1. Log in to SAM

- For new customers: Select SAM banner of SAM on the application’s home page to start using the application instantly.

- For existing customers: Select SAM banner on the application’s home page, or log-in to the application and then select “SAM” menu on main menu page

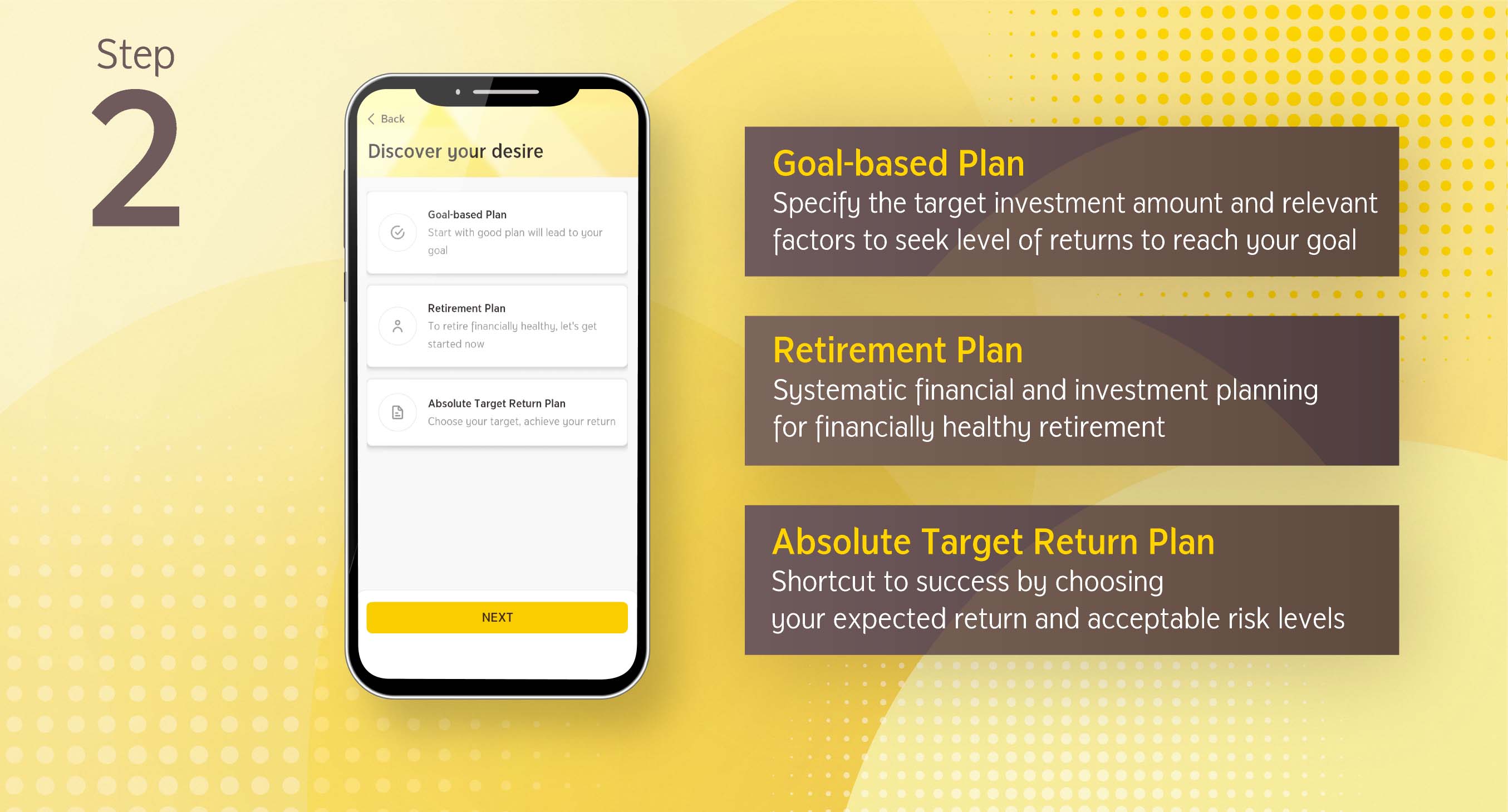

2. Assessing your investment goal

Select the desired type of investment plan. There are three types of investment plans in the system. Then, specify the information in order.

3. Viewing portfolio recommendation

3.1 Once completing the investment goal assessment, you can select “Recommended portfolio”. The The system will display the “Terms and Conditions for Use of SAM Service”, select “Agree” to proceed.

3.2 Now you will be asked to conduct investor risk profile assessment, then select “Next”

3.3 The system will display asset allocation recommendation according to your risk profile and the guidelines on asset allocation of SAM, if you accept such guidelines, select “Accept” to proceed

3.4 The system will display the recommended portfolio that is consistent with the level of return according to your investment target. You can select “Edit” to go back to the page specifying the information of investment plan or select the menu “Show investment growth chart” to view the forecast investment growth under such recommended portfolio.

Then, select “Open Account” to proceed to opening an account and starting investment. You can study how to proceed with online account opening by clicking here

4. Start investing

4.1 After the account opening is completed, the system will display the information of your planned investment portfolio. Select “Start Plan”. The system will display the list of funds under Investment Universe and transaction terms and conditions for your acknowledgement.

4.2 The system will take you to the “Subscribe” page, select “Single investment”. The system will display the investment details, then select “Next” and accept associated risks

4.3 Select the account for paying the subscription proceeds. (In this process, you have yet to link the account for paying the subscription proceeds, or you can study how to proceed by

clicking here. The system will then summarize the information on the “Confirmation” page, please select “Confirm”. The system will display the transaction result and save the transaction slip as evidence on your phone.

5. Rebalancing the Portfolio

Portfolio Rebalancing can happen when the asset allocation of your investment portfolio deviates from the recommended portfolio higher than the specified level, which may be due to:

- Changing market conditions

- Rebalancing of asset allocation according to the fund manager’s perspective on a quarterly basis review

The system will display a notification bar for your acknowledgement so that you can rebalance the investment portfolio as desired, select the notification bar to view the details and proceed further.

5.1 The system will display the portfolio information that falls under the criteria of portfolio rebalancing, then select “Detail” to proceed

5.2 The system will display all details for you to proceed and acknowledge associated risks and will summarize the information at the Confirmation page where you can select “Confirm” to get the transaction done.

This manual portfolio rebalancing can be proceeded only when you approve after your thorough consideration over the previous and new portfolio weights.