Seminar: Power of Dynamic Investing with Strategic Flexibility

.aspx) Krungsri Asset Management Company Limited

Krungsri Asset Management Company Limited (Krungsri Asset) held a special seminar on

"Power of Dynamic Investing with Strategic Flexibility”, inviting investment experts from Allianz Global Investors and Krungsri Asset to provide insights on the global economic outlook and investment landscape. The seminar also introduced a launch of

two new funds: KFGDB and KFGDA,

designed for investors seeking opportunities amidst market volatility. These funds do not only leverage a diversified asset allocation strategy and dynamic portfolio adjustments to seek an opportunity to generate superior returns, but also emphasize the sustainable asset selection, enabling investors to mitigate risks while achieving satisfactory returns.

The funds’ IPO will be launched from 19-25 September 2024.

At the seminar,

Mr. Kiattisak Preecha-Anusorn, Krungsri Asset’s Chief Alternative Investment Officer, stated

the global economy is facing uncertainty as interest rates are likely to decline from 5.5% to 3%, leading to a "3R" scenario: recession, rate cut, or rotation.

- A recession is unlikely, with only 20-30% probability1.

- A rate cut, however, is highly probable, benefiting stocks and bonds. Historically, a rate cut has resulted in a 50 - 70% increase in the S&P 500 stock performance within 1-2 years, depending on whether a recession occurs2.

- The rotation began on 11 July, due to declining inflation. This has positively impacted global bonds, while gold and REITs have also shown positive returns exceeding 10%. The ‘Magnificent Seven’ tech stocks are expected to see increased EPS. The rise in S&P 500 returns signifies an upward trend across the board3.

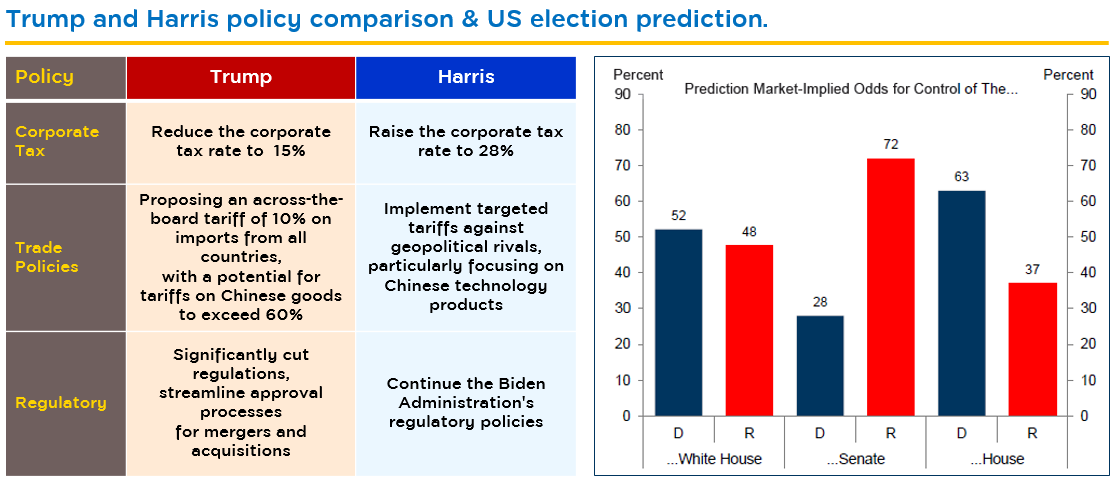

- Upcoming US elections will continue influencing investment decisions, causing market volatility until results provide clarity.

Sources:

1Goldman Sachs Global Investment Research, Bloomberg as of 17 Aug’24 |

2Bloomberg, BofAS, Kiatnakin Phatra Securities as of 2 Sep’24 |

3Bloomberg as of 9 Sep’24.

Sources: FirstCall, I/B/E/S, FactSet, and Goldman Sachs Global Investment Research as of 6 Sep'24 , and Goldman Sachs Global Investment Research as of 28 Aug'24

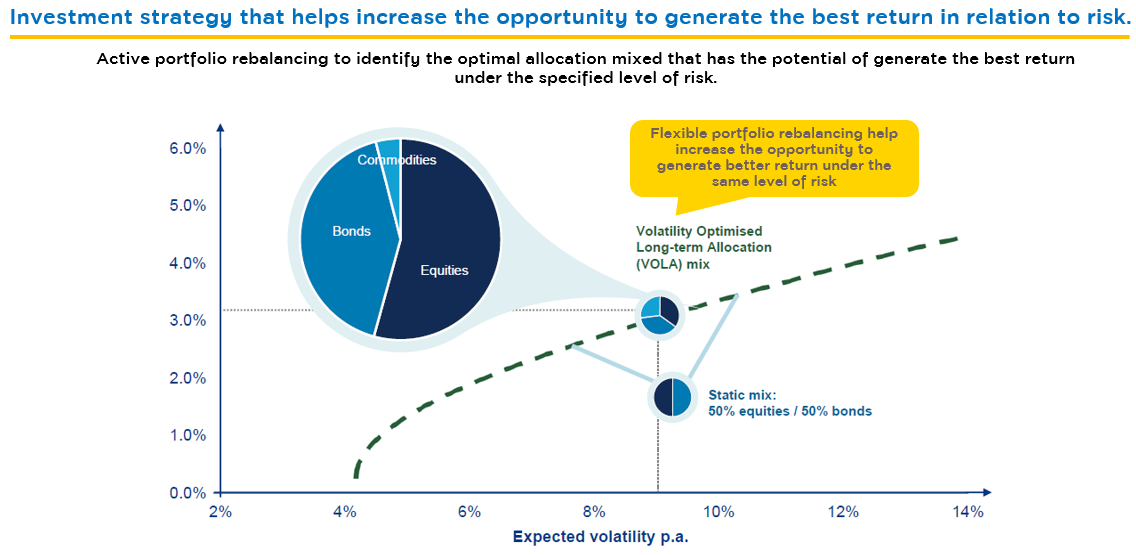

Therefore, a multi-asset allocation strategy is recommended to diversify risk in this volatile market environment. This approach involves monitoring market signals for each asset class and adapting investment strategies swiftly and proactively. This dynamic approach aims to seek an opportunity to generate consistent returns while effectively managing risk.

Krungsri Asset recognizes

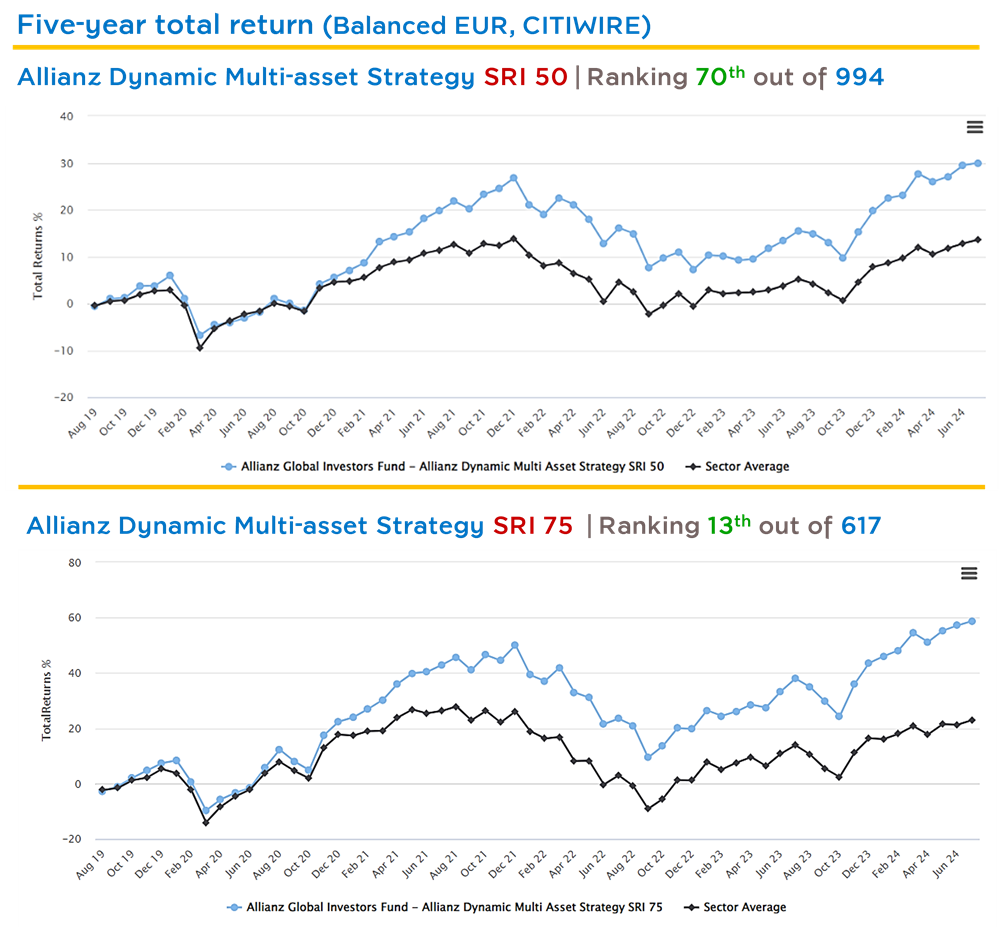

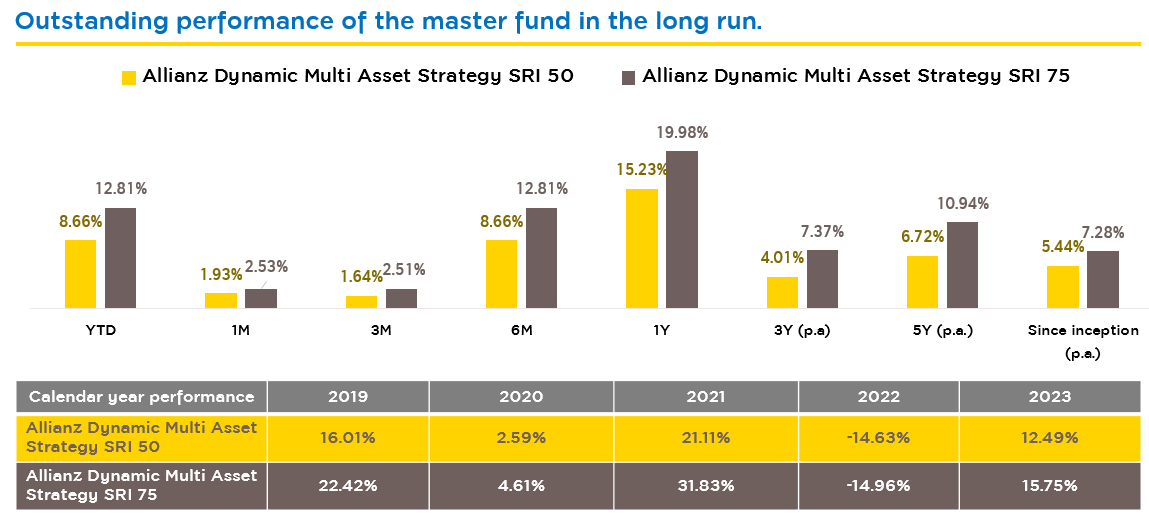

Allianz Global Investors as a fund manager that excels in implementing the multi-asset allocation approach. It consistently ranks among the top performers in the global multi-asset fund category, delivering superior returns over the past five years compared to the market. Furthermore, it has consistently maintained lower risk levels than the market. This exceptional performance is due to its unique investment process, asset selection, and risk management practices. Thus, Krungsri Asset has chosen this as a master fund, providing investors with two new investment options, namely

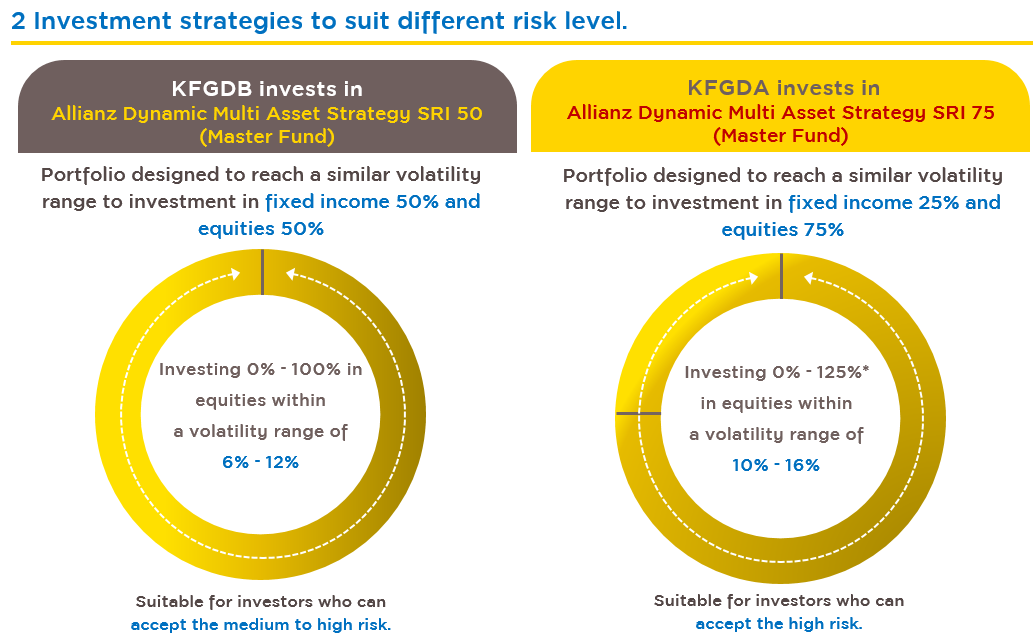

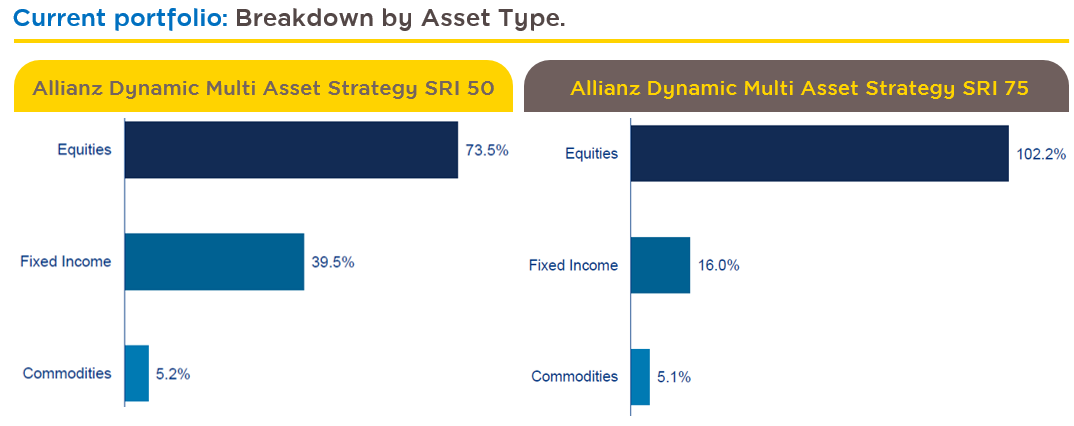

Krungsri Global Dynamic Balanced Allocation Fund (KFGDB) investing in the master fund - Allianz Dynamic Multi Asset Strategy SRI 50 and Krungsri Global Dynamic Aggressive Allocation Fund (KFGDA) investing in the master fund - Allianz Dynamic Multi Asset Strategy SRI 75. These two funds prioritize the sustainable assets within their portfolio, reflecting a commitment to responsible investing. Even though both funds employ an active investment strategy but differ in asset allocation to cater to varying risk profiles of investors.

- KFGDB: Portfolio with a similar volatility range to investment in 50% of fixed income and 50% of equities, having a target volatility range of 6% - 12%.

- KFGDA: Portfolio with a similar volatility range to investment in 25% of fixed income and 75% of equities, having a target volatility range of 10% - 16%.

Both funds might also invest in Derivative, ETF, or Futures to enhance portfolio adjustment.

Source: Allianz Global Investors as of May '24. | It does not guarantee the returns arising from this investment strategy, which may cause investors a loss. A team of fund managers will perform the annual reviews of investment ratio and volatility range. *The percentage of stocks in the investment portfolio of Allianz Dynamic Multi Asset Strategy SRI 75 may increase up to 125% using derivative instruments. The performance shown is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standard prescribed by the Association of Investment Management Companies (AIMC).

Michelle Lueng, an investment expert of Asia Pacific Allianz Global Investors, highlighted the fund’s key strengths. She emphasized

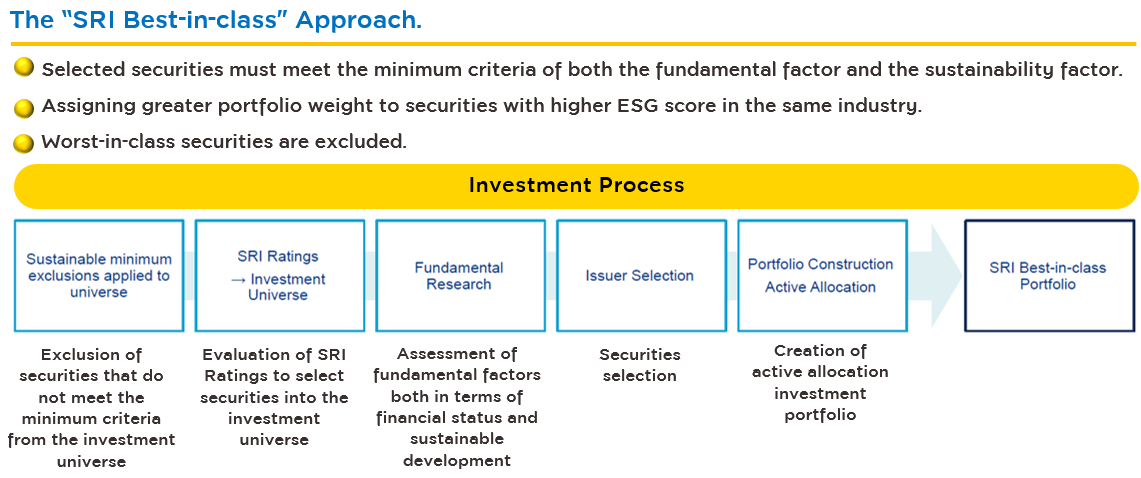

its active investment style, diversified asset allocation, and strategic flexibility, enabling swift portfolio adjustments in response to market dynamics. Furthermore, the fund prioritizes

sustainability as a core selection criterion. All assets in the portfolio must meet high Sustainable and Responsible Investing (SRI) scores, emphasizing climate change mitigation practices. This commitment ensures the fund holds only "Best in Class" assets aligning with responsible investment principles.

Source: Allianz Global Investors as of Apr'23. | The information is for illustrative purposes only. There is no guarantee that the investment strategy and process will be effective under every market condition.

The fund distinguishes itself from other multi-asset funds through its unique investment approach,

built on three core principles. First, it incorporates fundamental analysis, integrating SRI considerations and transparency into its asset selection criteria. However, what sets it apart is

its quantitative model for analyzing market signals, specifically for four key asset classes: global equities, government bonds, corporate bonds, and commodities. This approach provides early insight into the directions and trends of each asset class, allowing for timely portfolio adjustments. In high-risk market conditions, the fund promptly reduces investments in high-risk assets. This strategy has proven effective in various market cycles, including during the COVID-19 outbreak, where the fund swiftly reduced its exposure to risky assets. As the market improved, it increased investments in promising assets. These dynamic portfolio adjustments have enabled the fund to maintain strong returns. Another factor is Active Risk Management, adjusting the fund's risk levels according to market conditions. As a result of these strategies, the fund has increased its allocation of equities, gold, REITs, and commodities, driven by improving market trends.

Source: Allianz Global Investors as of 2024. | The information is for illustrative purposes only. It does not guarantee that the investment strategy and process will be effective under every market condition.

In periods of strong market growth, the equity allocation of KFDGA might exceed 100% but will not exceed 125%, while the fund aims to maintain lower volatility than the market while retaining a 25% allocation to bonds for risk management.

Sources: Allianz Global Investors, IDS GmbH as of 30 Jun’24. | The information is for illustrative purposes only. It cannot be used as a reference for a future investment portfolio and should neither be used as securities trading recommendations nor investment advice.

Mr. Kiattisak added that

the master fund, Allianz Global Investors fund also stands out as the top performer among multi-asset funds globally.

Source: Citiwire.com as of 31 Jul’24. | The performance shown is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standard prescribed by the Association of Investment Management Companies (AIMC).

Its 5-year track record demonstrates consistently high returns while maintaining a stable volatility level of 10%. This represents a lower risk compared to the market or individual investment strategies.

Source: Allianz Global Investors as of 30 Jun’24. | The figures of return demonstrated above are based on the Fund’s NAV after deduction of fees and excluding front-end and back-end fees. Dividends are included in price calculation. | The performance shown is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standard prescribed by the Association of Investment Management Companies (AIMC).

In terms of currency risk management for the funds, Krungsri Asset will invest in the master fund in Euro share class This decision stems from the lower hedging costs associated with the Euro compared to the US dollar, estimated at a 1% difference. This strategy also aligns with the current strong Thai Baht environment. Furthermore, the lower volatility between the Baht and Euro compared to the Baht and US dollar results in reduced hedging costs

For interested investors, Krungsri Asset has scheduled the IPO of the KFGDB and KFGDA during a period of 19-25 September, where investors can purchase the investment units directly through @ccess Online and @ccess Mobile Application. Minimum purchase is only 500 Baht.

To learn more about the funds, click here.

Fund policies and disclaimers:

- KFGDB invests on average at least 80% of NAV in an accounting period in Allianz Dynamic Multi Asset Strategy SRI 50, Class P (EUR) (Master Fund)

- KFGDA invests on average at least 80% of NAV in an accounting period in Allianz Dynamic Multi Asset Strategy SRI 75, Class P (EUR) (Master Fund)

- The master funds aim to invest in a broad range of asset classes, with a focus on global equity, fixed income and money market instruments to achieve over the medium-term a performance comparable to a balanced portfolio in accordance with the Sustainable and Responsible Investment (SRI) Strategy.

- Risk level 6: High risk. These funds are hedged against foreign exchange risk upon the fund managers' discretion. Thus, they are subject to high foreign exchange risk that may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

- This document is prepared based on the information obtained from reliable sources at the time of the presentation. However, the Management Company does not provide any warranty of the accuracy, reliability and completeness of all information. The Management Company reserves the right to make changes to all information without any prior notice.

- Investors should understand fund features, conditions of returns, and risk before making an investment decision. Past performance is no guarantee of future results.

To inquire more information or fund prospectus, please contact:

Krungsri Asset Management Company Limited | Tel. 0 2657 5757

For KFGDB-A details, click.

For KFGDA-A details, click.

Back