News/Announcement

Promotions/Fund Highlight

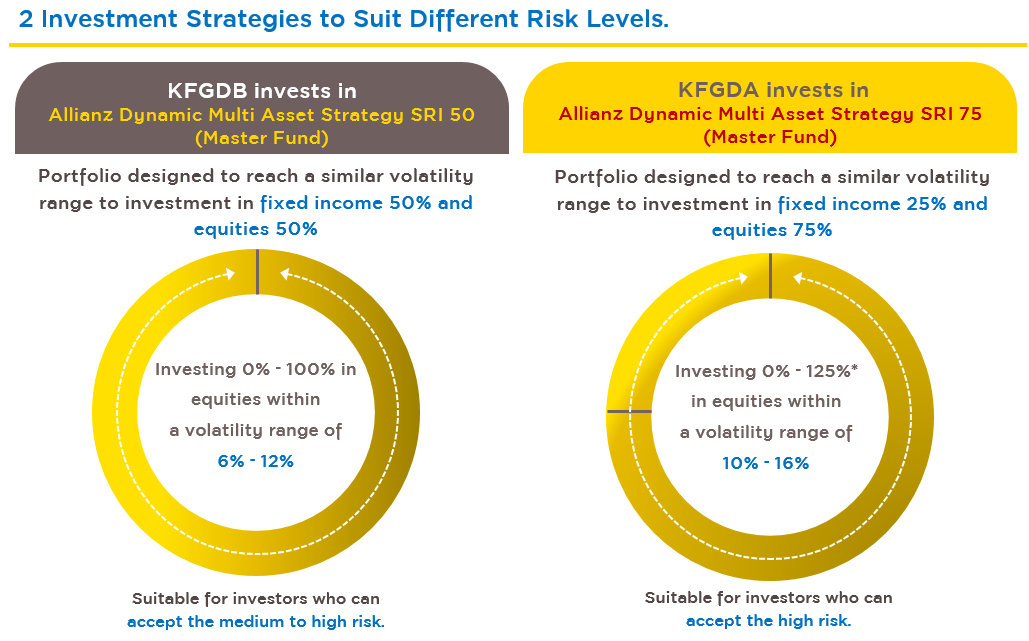

KFGDB / KFGDA ... Proven Asset Allocation Strategies with Flexible Portfolio Management

IPO: 19 - 25 September 2024.

2 new funds offering an access to portfolio diversification and sustainability using the Active Portfolio Strategies to ride the market waves successfully.

- Krungsri Global Dynamic Balance Allocation SRI Fund (KFGDB)

- Krungsri Global Dynamic Aggressive Allocation SRI Fund (KFGDA)

What makes KFGB and KFGDA interesting?

- Access a broad range of global asset classes such as stocks, fixed income instruments, and alternative assets through the top-performing master fund with a track record of outstanding past performance.

- Assets' selection is based on the assessment on fundamental factors, market trends, and SRI factors.

- Highly flexible portfolio under the predetermined volatility range and portfolio rebalancing to be back in line with each market condition.

- Suitable for investors who seek the investment diversification and can accept the medium to high volatility range for an opportunity to receive the attractive returns in the long run.

Source: Allianz Global Investors as of May '24• | It does not guarantee the returns arisen from this investment strategy, which may cause investors a loss. A team of fund managers will perform the annual reviews of investment ratio and volatility range. *The percentage of stocks in the investment portfolio of Allianz Dynamic Multi Asset Strategy SRI 75 may increase up to 125% using derivative instruments. • The performance shown is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standard prescribed by the Association of Investment Management Companies (AIMC).

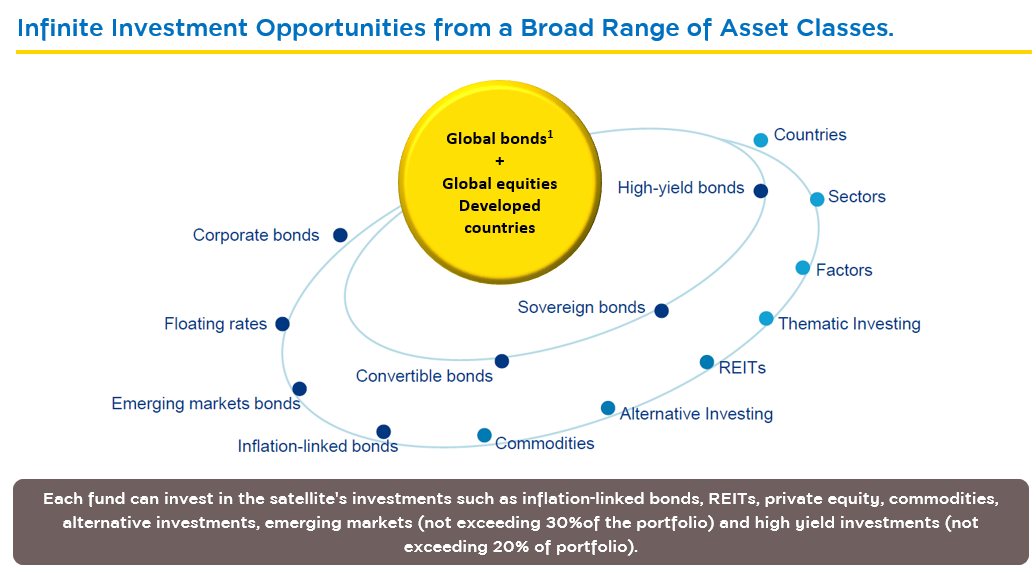

A Deep Dive into the Investment Strategies: Allianz Dynamic Multi Asset Strategy SRI

1. A flexible investment universe comprising a broad range of global asset classes to make the best of every investment opportunity with a highly flexible portfolio, which is divided into core portfolio and satellite portfolio.

Source: Allianz Global Investors as of 2024. • The information is for illustrative purposes only. The actual portfolio may deviate form the above-mentioned assets • 1 – Investments in global bonds are hedged against exchange risk in terms of Euro currency.

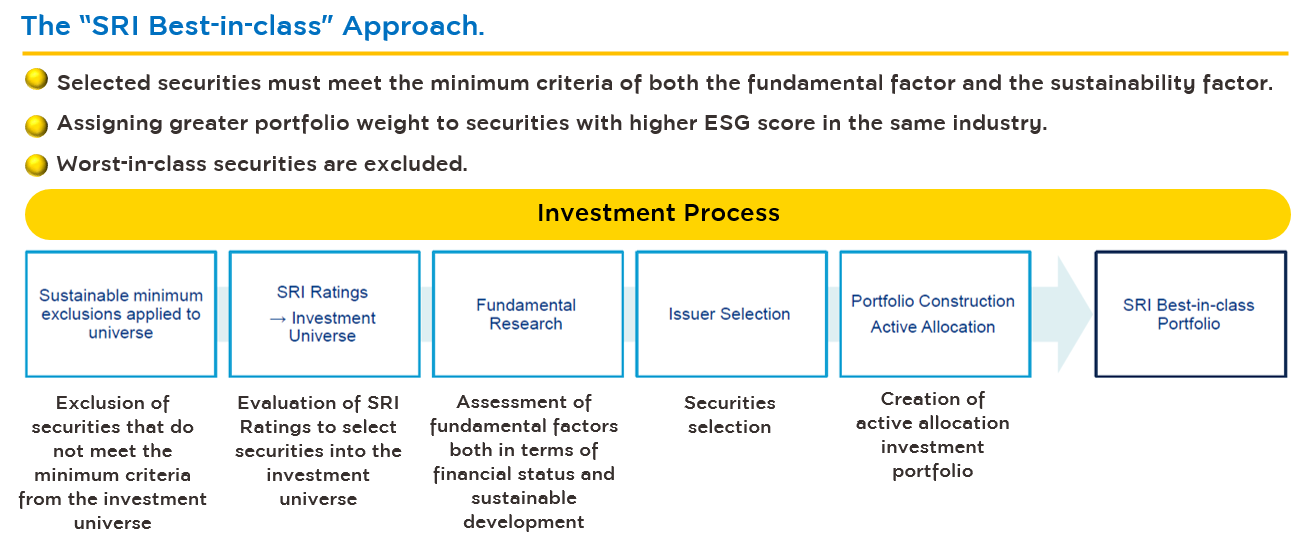

2. Enhancing strength by integrating the SRI Best-in-class approach into the whole investment process with an integration with 3 core elements leading to the construction of distinguished portfolio.

- Systematic analysis: Apply quantitative analysis technique in analyzing market conditions and asset trends.

- Focus on fundamental factors: A team of more than 80 experts (Fund managers and economists) to jointly analyze the fundamental factors of market and asset classes intensively to help strengthen the investment portfolio.

- Stringent risk control: Continuously control and monitor the volatility and risk levels to ensure that they are within the target range.

Source: Allianz Global Investors as of Apr '23 | The information is for illustrative purposes only. There is no guarantee that the investment strategy and process will be effective under every market condition.

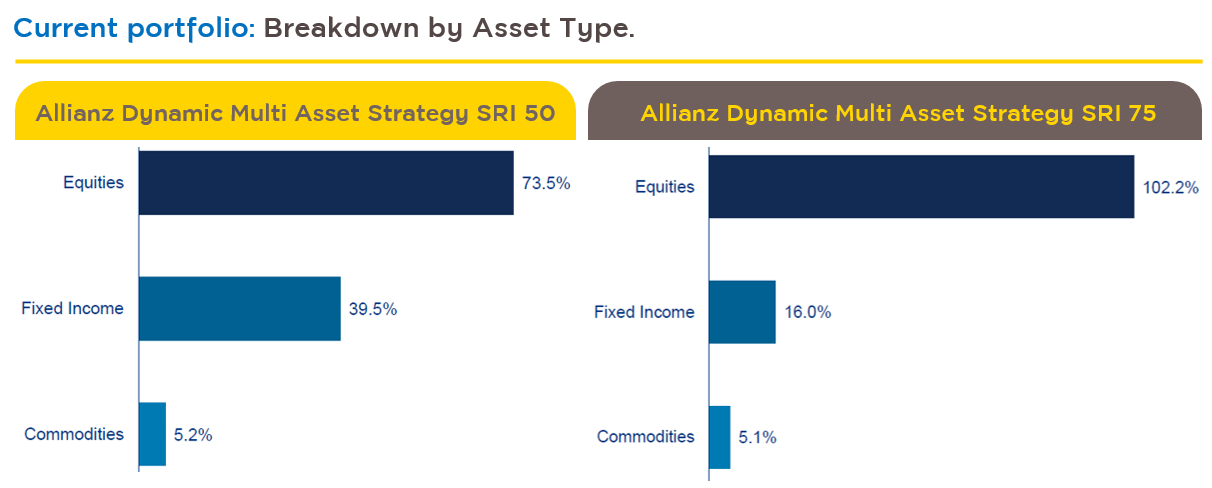

Source: Allianz Global Investors as of Apr '23 | The information is for illustrative purposes only. There is no guarantee that the investment strategy and process will be effective under every market condition.3. Portfolio of the master fund

Sources: Allianz Global Investors, IDS GmbH as of 30 Jun 2024. • The information is for illustrative purposes only. It cannot be used as a reference of future investment portfolio and should neither be used as securities trading recommendations nor investment advice.

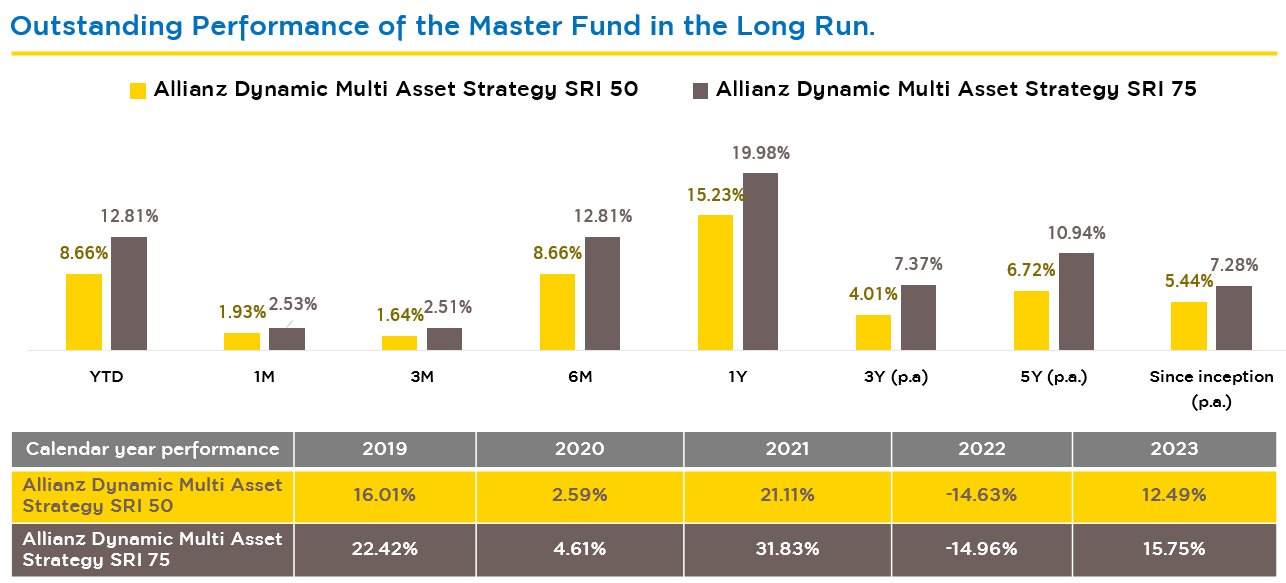

4. Outstanding Performance

Source: Allianz Global Investors as of 30 Jun 2024. • The figures of return demonstrated above are based on the Fund’s NAV after deduction of fees and excluding front-end and back-end fees. Dividends are included in price calculation. • The performance shown is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standard prescribed by the Association of Investment Management Companies (AIMC).

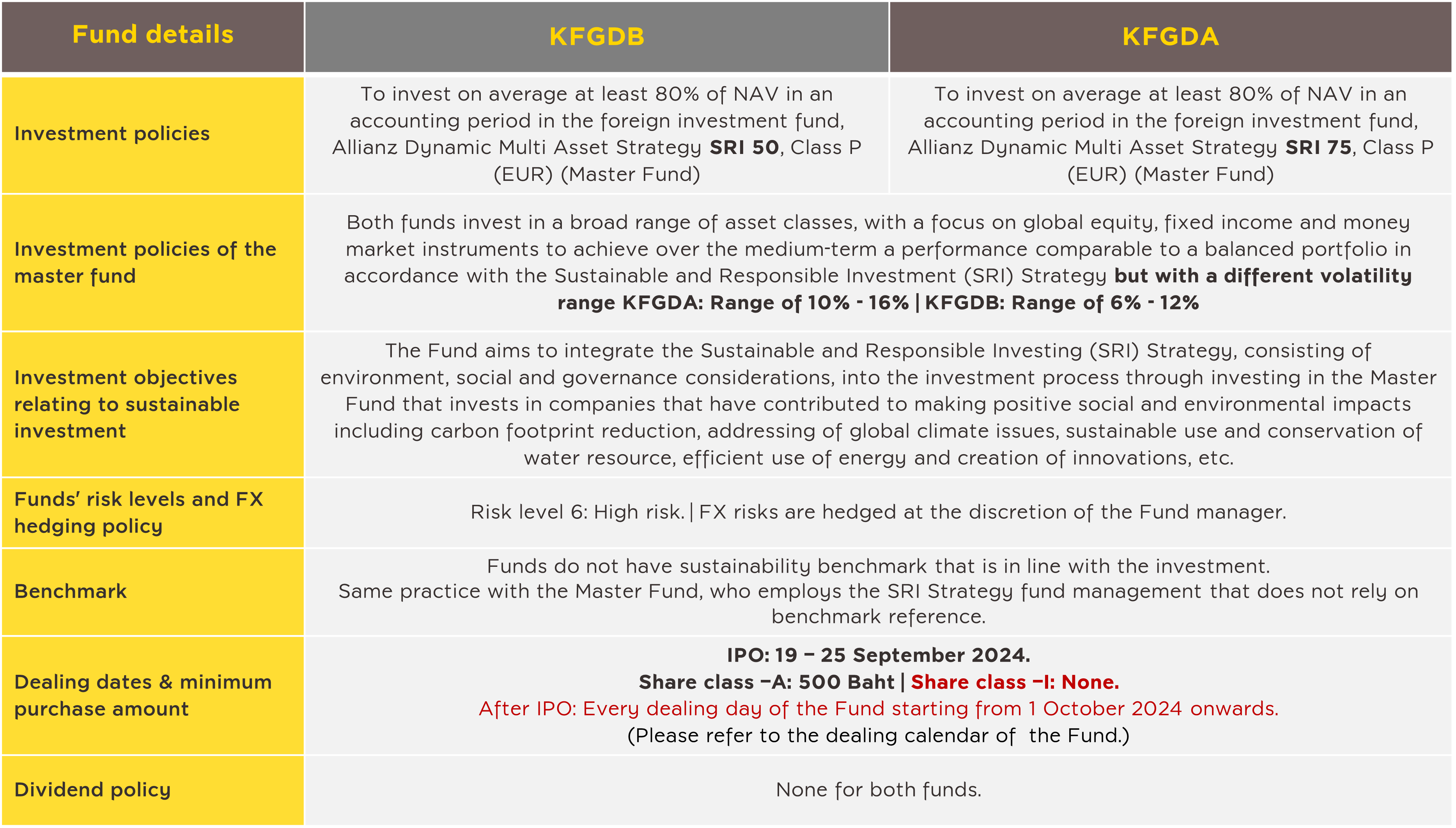

Important information of the funds

- Krungsri Global Dynamic Balanced Allocation SRI Fund (KFGDB)

- Krungsri Global Dynamic Aggressive Allocation SRI Fund (KFGDA)

Disclaimers

- This document is prepared based on the information obtained from reliable sources at the time of the presentation. However, the Management Company does not provide any warranty of the accuracy, reliability and completeness of all information. The Management Company reserves the right to make changes to all information without any prior notice.

- These funds are hedged against foreign exchange risk upon the fund managers' discretion. Thus, they are subject to high foreign exchange risk that may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

- Investors should understand fund features, conditions of returns, and risk, and study tax benefits from the investment manual before making an investment decision. Past performance is no guarantee of future results.

Krungsri Asset Management Company Limited. Tel 02-657-5757

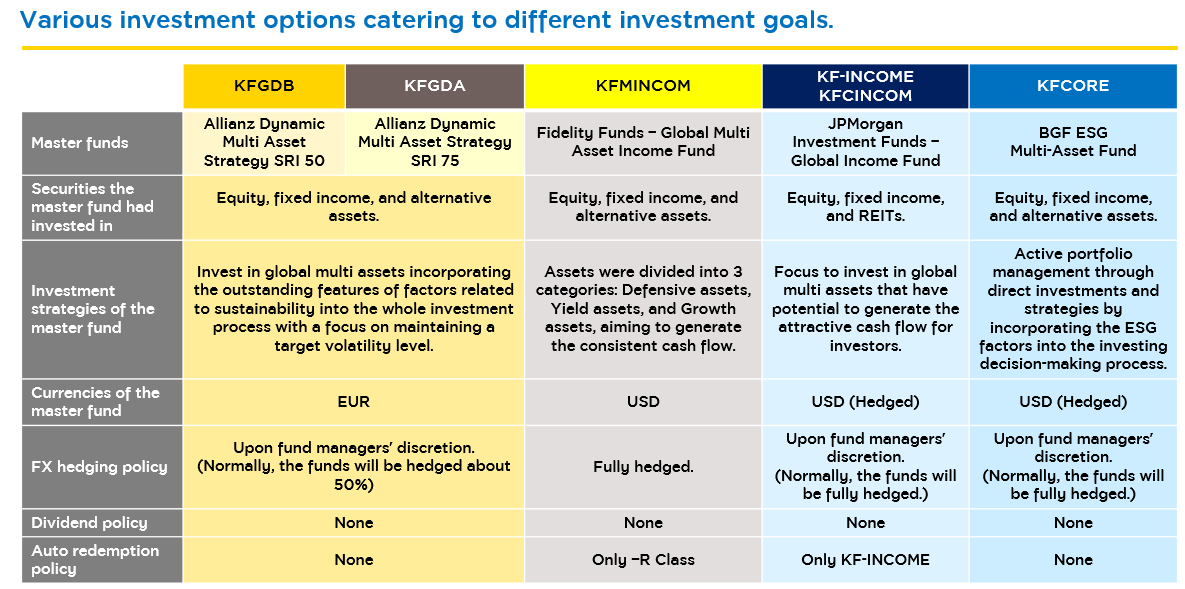

Comparison of Krungsri Global Multi Asset Funds

Source: Krungsri Asset Management. | KF-INCOME, KFCINCOM, KFCORE, KFGDB, and KFGDA are hedged against foreign exchange risk upon the fund managers' discretion. Thus, they are subject to a foreign exchange risk which may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

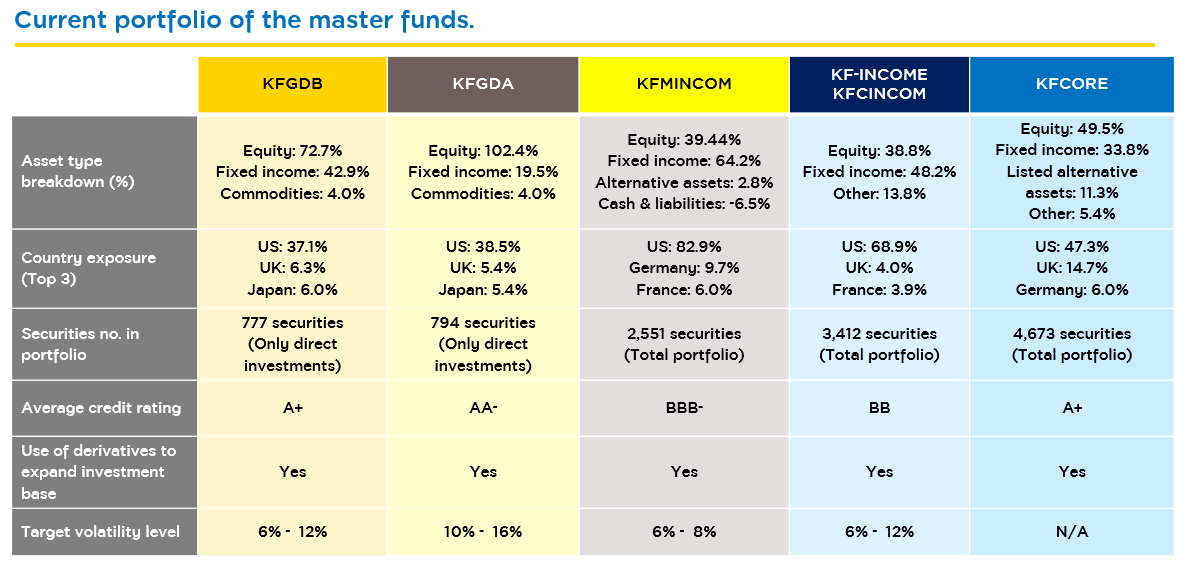

Source: Master Funds as of 31 Jul. '24 | KF-INCOME, KFCINCOM, KFCORE, KFGDB, and KFGDA are hedged against foreign exchange risk upon the fund managers' discretion. Thus, they are subject to a foreign exchange risk which may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

Risks Associated with Sustainable Investment.

Thai Funds

The Funds may be subject to concentration risk in line with the Sustainable and Responsible Investing (SRI) Strategy which prevents the Fund from investing in certain types of assets.

Master Funds

1. Sustainable Strategy Investment Risk

The Master Fund’s investment performance might be impacted and/or influenced by a Sustainability Risk since the execution of a Sustainable Investment Strategy may result in foregoing opportunities to buy certain securities when it might otherwise be advantageous to do so, and/or selling securities due to their characteristics when it might be disadvantageous to do so. The Master Fund which applies a Sustainable Investment Strategy may use one or more different third-party research data providers and/or internal analyses, and the way in which different funds will apply certain criteria may vary. In addition, the funds which follow a specific Sustainable Investment Strategy focus on Sustainable Investments and have a limited/reduced investment universe which results in limited risk diversification compared to broadly investing funds.

2. Sustainability Risk

This refers to an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment. There is systematic research evidence that sustainability risks may materialize as issuer specific extreme loss-risks. Such issuer specific sustainability risk events typically happen with low frequency and probability but may have high financial impact and may lead to significant financial loss. Sustainability Risks may have the potential to influence the investment performance of portfolios negatively. Allianz Global Investors considers Sustainability Risks to be potential drivers of financial risk factors in investments such as market price risk, credit risk, liquidity risk, and operational risk.

The Funds may be subject to concentration risk in line with the Sustainable and Responsible Investing (SRI) Strategy which prevents the Fund from investing in certain types of assets.

Master Funds

1. Sustainable Strategy Investment Risk

The Master Fund’s investment performance might be impacted and/or influenced by a Sustainability Risk since the execution of a Sustainable Investment Strategy may result in foregoing opportunities to buy certain securities when it might otherwise be advantageous to do so, and/or selling securities due to their characteristics when it might be disadvantageous to do so. The Master Fund which applies a Sustainable Investment Strategy may use one or more different third-party research data providers and/or internal analyses, and the way in which different funds will apply certain criteria may vary. In addition, the funds which follow a specific Sustainable Investment Strategy focus on Sustainable Investments and have a limited/reduced investment universe which results in limited risk diversification compared to broadly investing funds.

2. Sustainability Risk

This refers to an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment. There is systematic research evidence that sustainability risks may materialize as issuer specific extreme loss-risks. Such issuer specific sustainability risk events typically happen with low frequency and probability but may have high financial impact and may lead to significant financial loss. Sustainability Risks may have the potential to influence the investment performance of portfolios negatively. Allianz Global Investors considers Sustainability Risks to be potential drivers of financial risk factors in investments such as market price risk, credit risk, liquidity risk, and operational risk.