US Stock Investment Strategy for Superior Growth Opportunities

.aspx) Krungsri Asset Management Company Limited (KSAM), incorporation with J.P. Morgan Asset Management

Krungsri Asset Management Company Limited (KSAM), incorporation with J.P. Morgan Asset Management, the leading global fund house, recently held a special seminar on

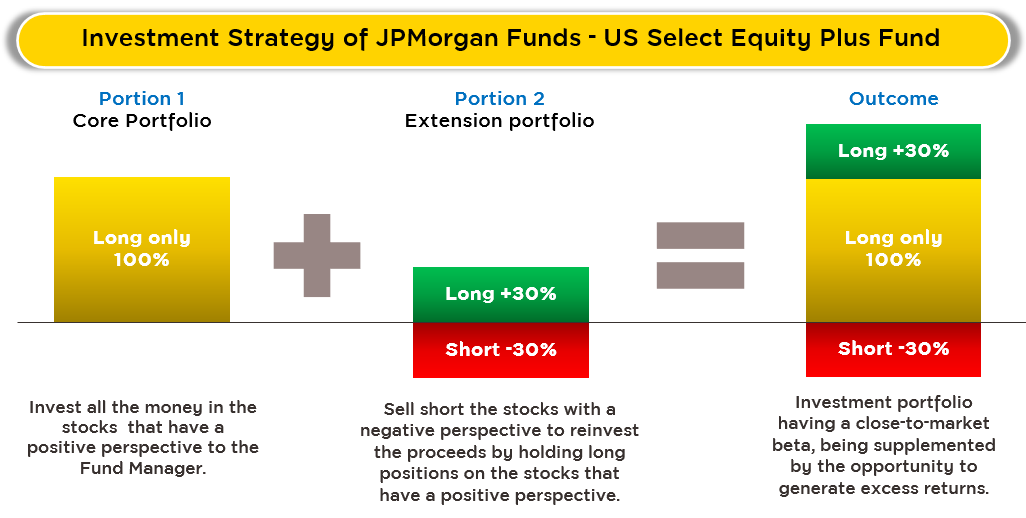

"Bridging the Gap: Passive Stability with Active Opportunity" to introduce the new fund, KF-US-PLUS (IPO 4 – 10 Feb’2025), which can be used as core portfolio option for investing in the US stock market and capitalizes on President Trump's trade policies which are expected to benefit business sectors and the S&P 500 index growth in the medium to long term. The fund also employs a unique investment strategy of

JPMorgan Funds - US Select Equity Plus Fund, the master fund managed by J.P. Morgan Asset Management. This strategy has a key strength in selecting individual stocks, combining Long and Short positions in stocks within the portfolio at different points in time with a goal is to maintain volatility close to the market level while still providing the potential to outperform the index. This fund has consistently ranked among the top-performing Active Funds in the U.S. stock market.

.aspx) Mr. Kiattisak Preecha-anusorn, KSAM’s Chief Alternative Investment Officer,

Mr. Kiattisak Preecha-anusorn, KSAM’s Chief Alternative Investment Officer, highlighted

the key strengths of KF-US-PLUS which is a fact that it is

the Active Fund consistently outperforming the S&P 500 index while maintaining a level of safety comparable to Passive Funds thanks to the fund’s dynamic strategy helping adjust the investment positions across different sectors to align with market conditions by carefully considering both opportunities and risks associated with individual stocks at each given period.

Mr. Kiattisak said the US stock market under President Trump

is poised for continued growth, citing its performance during his previous term. The US stock market is anticipated to deliver attractive returns driven by pro-growth policies such as promoting the overall economic growth of the country even though trade tensions and tariffs may cause global market volatility; but these trade conflicts may have short-term impacts. Meanwhile, easing financial regulations and industry support have lowered business costs, leading to relocation of manufacturing and improved corporate performance. Thus, the overall market outlook tends to improve, while the likelihood of a recession is low as estimated at only 15 - 20%*. In this respect, Trump’s policies are projected to add only 0.5 - 1% to US inflation**, with one-time pattern.

(*Sources: Bloomberg, 29 Jan’25 | **Goldman Sachs Global Investment Research 26 Jan’25.)

Mr. Christian Mariani, an investment specialist from J.P. Morgan Asset Management's US Equity Group

Mr. Christian Mariani, an investment specialist from J.P. Morgan Asset Management's US Equity Group, said that

the master fund, JPMorgan Funds - US Select Equity Plus Fund, is the fund that focuses on investing in stocks with a market cap similar to the S&P 500 index and employs an active investment strategy, aiming to outperform the index, aiming to outperform the index. Besides,

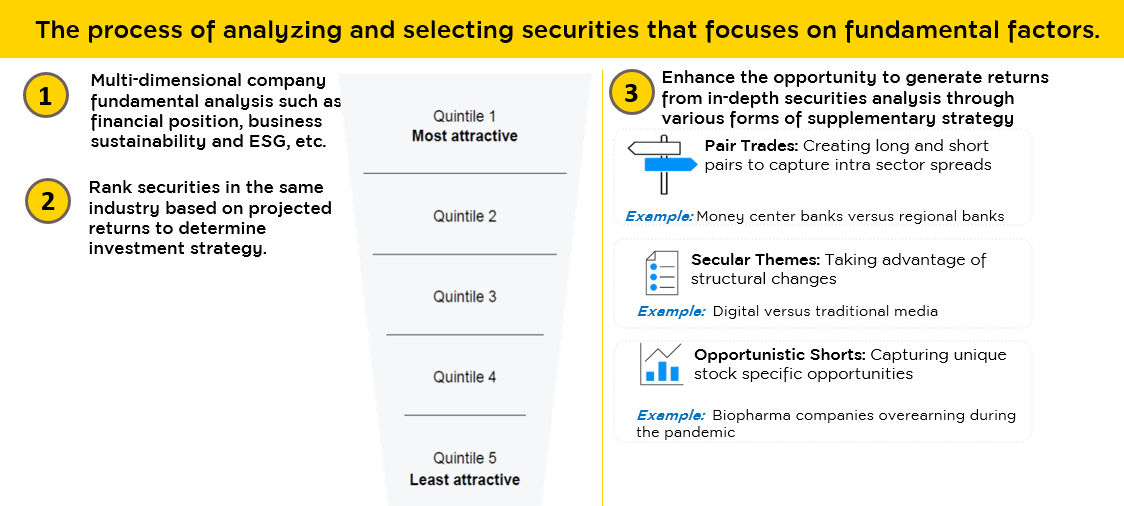

there are several factors setting this fund apart from others, such as a highly experienced team of researchers and analysts with over 20 years of industry expertise, allowing them to thoroughly analyze and select stocks with high growth potential, emphasizing companies with strong fundamentals, competitive advantages, and favorable growth prospects within each industry. They also had sophisticated ability to anticipate both opportunities and risks for individual stock over time, enabling the use of this information to generate alpha or increase investment returns. The primary proportion of the master fund’s investment portfolio focuses on investing in stocks that the fund manager is confident in, similar to general equity funds. However, there is an additional investment strategy by taking Long Positions when identifying stocks with long-term growth potential and Short Positions when stocks are likely to experience declining growth. This strategy enables the fund to fully leverage insights into each security, thereby increasing opportunities for more returns.

For the investment strategy in the Long-Short Portfolio, the fund manager will focus on selecting individual securities within the same industry. For example, in media industry, the fund managers hold the positive outlook for new-era media like Netflix, Amazon, or Walt Disney, while reducing exposure to traditional media companies. Besides, the fund managers may consider structural growth trends, such as Intel stocks, a computer hardware manufacturer with a declining growth. Another example is its strategy following the COVID-19 pandemic: the fund shorted Moderna after its stock surged, anticipating a decline as the pandemic eased. The proceeds were then reinvested in stocks with stronger growth potential. This dynamic approach has consistently helped the fund outperform the market.

Remark: The above information is provided as an example for explanatory purposes only and does not represent the actual investment allocation of the fund.

Remark: The above information is provided as an example for explanatory purposes only and does not represent the actual investment allocation of the fund.

Source: J.P. Morgan Asset Management. Remark: The above information is provided as an example for explanatory purposes only.

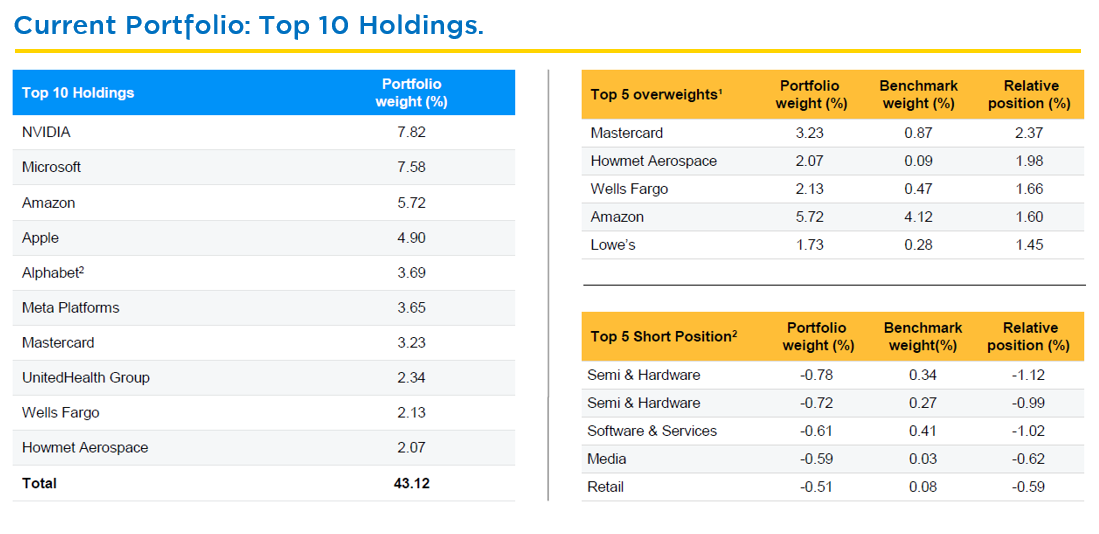

The master fund currently holds approximately 260 stocks across various industries. Its top 5 overweights are Mastercard, Hownet Aerospace, Wells Fargo, Amazon, and Lowe's, all of which are businesses known for their strong fundamentals, healthy cash flow, and high growth potential, while the top 5 Short positions are in the semiconductor, traditional media and retail companies that have not adapted to the digital age.

Source: J.P. Morgan Asset Management. Remark: The above information is provided as an example for explanatory purposes only.

The master fund currently holds approximately 260 stocks across various industries. Its top 5 overweights are Mastercard, Hownet Aerospace, Wells Fargo, Amazon, and Lowe's, all of which are businesses known for their strong fundamentals, healthy cash flow, and high growth potential, while the top 5 Short positions are in the semiconductor, traditional media and retail companies that have not adapted to the digital age.

Source: Wilshire. 1 Reflects relative position to the S&P 500 Index. 2 Based on sector classification of the stock. 3 Based on combining the positions of both Alphabet share classes (GOOGL and GOOG) which are listed in the S&P 500. The portfolio is actively managed. Holdings, sector weights, allocations and leverage, as applicable, are subject to change at the discretion of the investment manager without notice. Data as of 31 Dec’24.

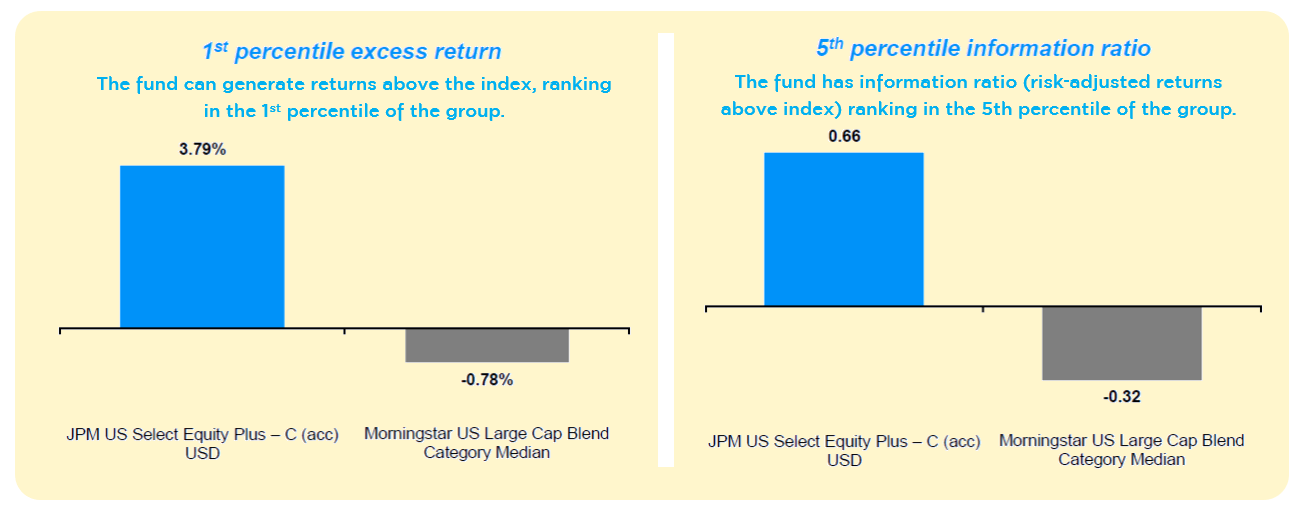

Over the past 5 years, the master fund has outperformed the S&P 500 index by an average of 3.25% while exhibiting lower volatility than other high-risk active funds that have underperformed the index. In this respect, the fund's strategy of shorting declining stocks and increasing exposure to high-growth companies has addressed the common issue of active funds delivering lower returns than the benchmark while carrying higher risk.

Source: Wilshire. 1 Reflects relative position to the S&P 500 Index. 2 Based on sector classification of the stock. 3 Based on combining the positions of both Alphabet share classes (GOOGL and GOOG) which are listed in the S&P 500. The portfolio is actively managed. Holdings, sector weights, allocations and leverage, as applicable, are subject to change at the discretion of the investment manager without notice. Data as of 31 Dec’24.

Over the past 5 years, the master fund has outperformed the S&P 500 index by an average of 3.25% while exhibiting lower volatility than other high-risk active funds that have underperformed the index. In this respect, the fund's strategy of shorting declining stocks and increasing exposure to high-growth companies has addressed the common issue of active funds delivering lower returns than the benchmark while carrying higher risk.

Source: J.P. Morgan Asset Management as of 31 Dec’24. | The data of peer group performance is based on 5-year average historical performance. | The performance displayed is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of AIMC. | The performance displayed is the performance of the investment units of Class C (acc) USD while KF-US-PLUS will invest in the investment units of Class I (acc) USD which has similar investment policy. | The performance displayed is calculated from the NAV where dividends (before deduction of tax) are reinvested which includes actual expenses but excludes front-end and back-end fees. | The benchmark is S&P 500 Net Total Return Index net of 30% withholding tax.

Lastly, KSAM and J.P. Morgan Asset Management are confident that the US stock market will continue to grow in the Trump era. Despite the current high valuations and market volatility,

Source: J.P. Morgan Asset Management as of 31 Dec’24. | The data of peer group performance is based on 5-year average historical performance. | The performance displayed is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of AIMC. | The performance displayed is the performance of the investment units of Class C (acc) USD while KF-US-PLUS will invest in the investment units of Class I (acc) USD which has similar investment policy. | The performance displayed is calculated from the NAV where dividends (before deduction of tax) are reinvested which includes actual expenses but excludes front-end and back-end fees. | The benchmark is S&P 500 Net Total Return Index net of 30% withholding tax.

Lastly, KSAM and J.P. Morgan Asset Management are confident that the US stock market will continue to grow in the Trump era. Despite the current high valuations and market volatility, they project an attractive return coming this year, driven by lower interest rates, which enable increased investment in high-quality stocks. Thus, the KF-US-PLUS fund will offer investors with full exposure to the US equity market while reducing the risk of over-exposure in any single sector.

For those interested, you can purchase the KF-US-PLUS fund through all channels, both online (Access Mobile or @ccess Online) and at offices (Krungsri Asset Management, Krungsri Bank branches, or authorized sales agents). The fund's IPO period is during 4 – 10 Feb’25; after the IPO, purchases can be made starting from 18 Feb’25. The minimum investment is only 500 Baht (no minimum investment requirement for Class I units).

Disclaimers/Investment Policies

- Investors should understand the fund features, conditions of returns and risks before making an investment decision. Past performance is not a guarantee of future results.

- KF-US-PLUS is hedged against foreign exchange risk at the Fund Manager’s discretion. Hence, they are subject to foreign exchange risk that may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

- This document is prepared based on the information compiled from various reliable sources as of the date of publication. However, Krungsri Asset Management cannot guarantee the accuracy, reliability, and completeness of all information. The Company reserves the right to change the information without any prior notice.

To require additional information or request a prospectus,

Please contact Krungsri Asset Management Co Ltd. | Tel. 2657 5757

For KF-US-PLUS info/highlights, click

Back