Promotions/Fund Highlight

KF-US-PLUS: Pushing the Boundaries to Maximize Potential Gains.

IPO 4 - 10 February 2025.

KF-US-PLUS ensures you will not miss the opportunity to generate robust returns from the U.S. stock market as it moves in line with the overall market trend while offering the potential for superior returns with comparable volatility. Unlike typical active funds, the fund stands out with its unique strategy, combining a Core Portfolio focusing on high-conviction stocks and Extension Portfolio employing both long and short strategies on selected stocks in each sector.

KF-US-PLUS: 4 - 10 February 20258 | Minum purchase 500 Baht.

The Golden Opportunity of the U.S. Stock Market

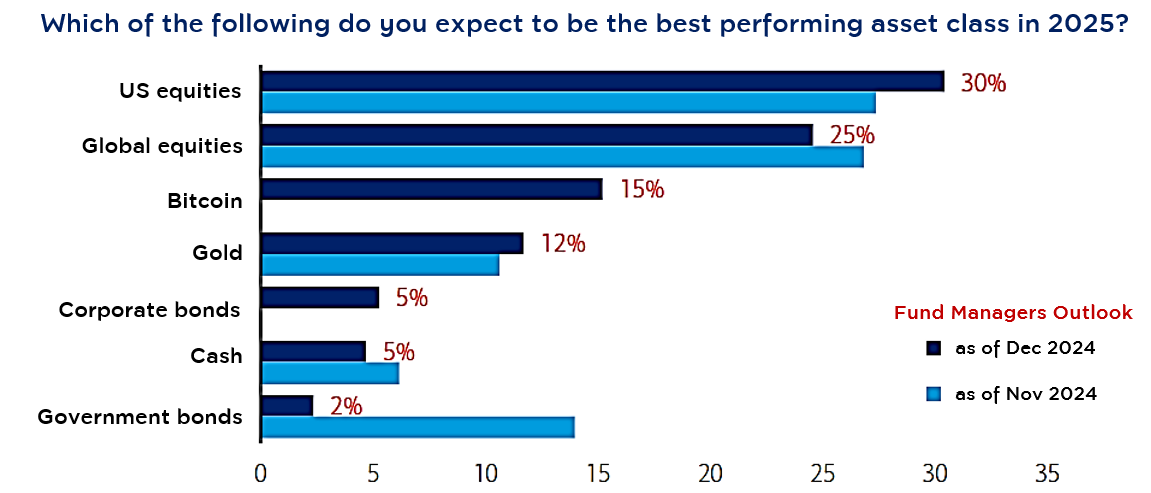

- Fund managers worldwide expect U.S. stocks to be the best-performing asset in 2025.

Source: BofA Global Fund Manager Survey as of 17 Dec’24

- Macroeconomic factors supporting the growth of the U.S. stock market include the downward trend in interest rates, continued solid GDP growth, and a low likelihood of an economic recession. (Source: Bloomberg, as of 27 Dec’24)

- The growth of net profit remaining at a high level is a supporting factor for the market's upward adjustment. (Source: Goldman Sachs, as of 16 Dec’24)

- Growth-supporting factors from Trump 2.0 policies.

Deep Dive into the Key Features of KF-US-PLUS

- Investing in the master fund named JPMorgan Funds - US Select Equity Plus Fund, the U.S. equity fund that has been rated 5 stars by Morningstar* with a strong track record of outstanding returns.

- Distinguished investment strategy combing the investing in trusted stocks (Part 1: Core Portfolio) and supplementary strategies (Part 2: Extension Portfolio), using both Long and Short strategies on selected stocks in each sector to enhance the potential for superior returns.

Remark: The above information is provided as an example for explanatory purposes only and does not reflect the actual investment proportion of the fund. | *Source: Morningstar as of 30 Nov’24. This ranking is not related to the ranking by AIMC in any way.

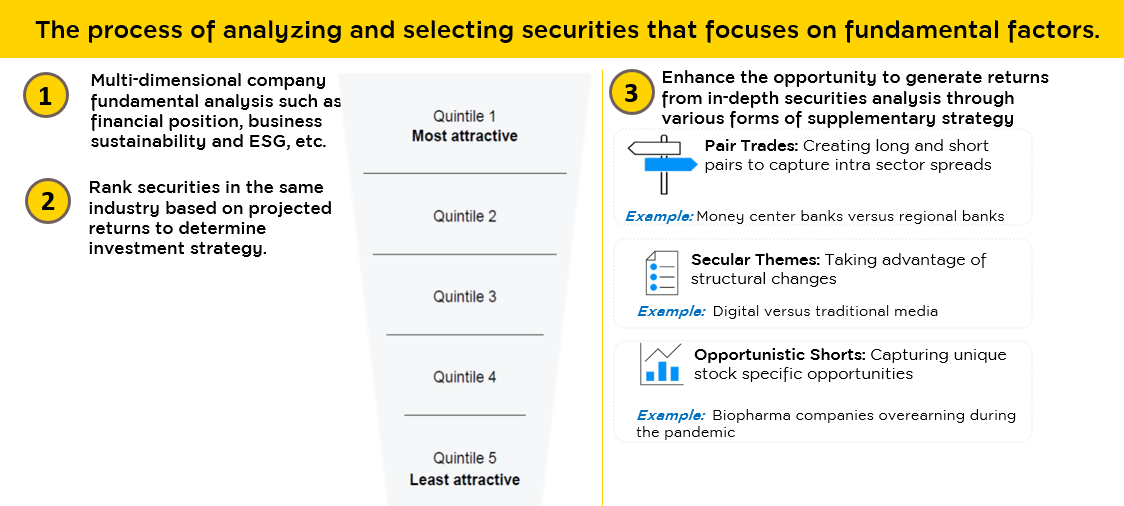

- The master fund employs the intensive process of securities analysis to identify the highest potential securities.

Source: J.P. Morgan Asset Management | Remark: Provided for information only to illustrate investment process.

The master fund believes that the grouping of securities by the analyst team helps generate alpha. Currently, the core fund holds approximately 74% of its allocation in stocks within Quintile 1 and 2, compared to the S&P 500 index, which has only 36% (Source: Wilshire J.P. Morgan Asset Management as of 31 Oct’24. | Benchmark: S&P 500 Index | The investment portfolio may change over time.)

Portfolio and performance of the master fund

Source: Factset, J.P. Morgan Asset Management as of 31 Oct’24. | The benchmark is S&P 500 Index. | The investment portfolio is subject to change from time to time 1 – Based on the figure of normalized earnings projected by JPM | 2 – Weighted average | 3 – JPM 12-month forward.

The proven results from a track record of outstanding performance outperforming the index in the long term.

Differentiated strategy leads to a track record of superior performance versus peers

Source: J.P. Morgan Asset Management as of 31 Oct’24. | The data of peer group performance is based on 5-year average historical performance. | The performance displayed is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of AIMC. | The performance displayed is the performance of the investment units of Class C (acc) USD while KF-US-PLUS will invest in the investment units of Class I (acc) USD which has similar investment policy. | The performance displayed is calculated from the NAV where dividends (before deduction of tax) are reinvested which includes actual expenses but excludes front-end and back-end fees. | The benchmark is S&P 500 Net Total Return Index net of 30% withholding tax.

Source: Citywire as of 30 Nov’24 | The performance displayed is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of AIMC, same as Citywire’s ranking.

Comparison of Krungsri Funds: KFUSINDX / KF-US-PLUS / KF-US

Source: Krungsri Asset Management’s forecast, aiming to compare the differences between funds, based on the historical return data of the main funds over the past 3 years up to December 31, 2024. This does not guarantee the actual returns that investors will receive. | KFUSINDFX does not hedge against exchange rate risks, therefore it carries high risks from exchange rates. KF-US-PLUS and KFUS hedge against exchange rate risks at the discretion of the fund manager, thus there is a risk from exchange rates, which may result in investors losing money or receiving a return lower than their initial investment.

Important information of KF-US-PLUS

- Investors should understand the fund features, conditions of returns and risks before making an investment decision. Past performance is not a guarantee of future results.

- The Funds are hedged against foreign exchange risk at the Fund Manager’s discretion. Hence, they are subject to foreign exchange risk that may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

- This document is prepared based on the information compiled from various reliable sources as of the date of publication. However, Krungsri Asset Management cannot guarantee the accuracy, reliability, and completeness of all information. The Company reserves the right to change the information without any prior notice.

To require additional information or request a prospectus,

Please contact Krungsri Asset Management Co Ltd. | Tel. 2657 5757

Summary of Krungsri’s US Equity Funds Summary table of Krungsri’s US Equity Funds

Source: Fact sheet of the master fund and Krungsri Asset Management | Information of KFUSINDX, KFUSINDFX, and KFNDQ are as of 31 Dec’24 | Information of KF-US-PLUS, KFUS, and KF-HSMUS are as of 30 Nov’24. | KFNDQ, KF-US-PLUS, and KFUS hedged against foreign exchange risk at the Fund Manager’s discretion. Hence, it is subject to foreign exchange risk that may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount. | Since KFUSINDFX is not hedged against foreign exchange risk, it is subject to a high foreign exchange risk that may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

For KF-US-PLUS-I details, click

Back