Ms. Pornchanok Rattanarujikorn, Assistant Vice President for Alternative Investment, Krungsri Asset Management said that there are several channels for investing in Private Equity. Of which, Primary Fund Investment means that the fund invests in other private equity fund from the initial period of a project. Next is Secondary Fund Investment which requires other investors to sell their investment in the Private Equity fund before the project ends. The last is Co-investment that is direct investment with other Private Equity funds which have strong connections or specialized in specific business sectors. Regarding the investment of KFGPE-UI’s master fund, it will diversify its investment in these styles of investment with the largest weight on Co-investment with a mix of the Primary and Secondary investment as to diversify risks.

Regarding the investment strategies, the fund will deploy different strategies for each region. In the United States and Europe, the fund will focus on Small-Mid Buyouts, investing in small-mid firms which may be family businesses with widely accepted products and services, and co-developing, growing them via technology or innovations for higher value-added, sales or market expansion. In growing Asia like China and India, the fund will apply Growth Capital strategy investing in companies which operate for a certain period. These companies are in the growth stage and require fund for business expansion. With these, the fund will make investment to expand markets for domestic consumption. These two types of investment strategies tend to gain popularity. The fund will opt to invest mainly in small- and medium-sized enterprises as an attempt to differ its strategy from investment in listed companies and other Private Equity funds.

The fund also focuses on diversification of investment into several industries, and overweighs on healthcare, technology, consumption-related, business services and manufacturing sectors. The fund’s current portfolio carries Buyouts of 73% and Growth Equity of 25%. The remaining 2% goes to Venture Capital or investing in small enterprises or early startups. By region, over 80% of the portfolio are in Europe and the United States, and the remainder in Asia. In this respect, the majority of capital is focused on co-investment in companies with growth potential and the fund can help improve or add value to their businesses, such as investing in Pete & Gerry's - an organic egg producer in the US, and co-invest in ]init[, a German company which has digital technologies to help transform businesses.

Source: Schroders Capital. Investment data as of 31 December 2021. 1 - Note that we present both direct and indirect exposure such as single asset funds. 2 - Listed equity owned as a result of an IPO.

So far, Schroders Capital, the specialist team in Private Equity investing under Schroders, has invested in 178 non-listed firms, and sold 47 of them for profit. Net IRR is 25% or 1.8 times and, if included those sold out, the rate is 31% or 3 times higher than initial investment capital.

Source: Schroders Capital, 2022. Number of investments closed is as of Q2 2021. Performance is net of underlying fees and carry and gross of Schroders Capital fees and carry. Overall performance as of Q3 2021 in €. Realized IRR and multiple is based on full realizations, partially realizations and IPOs as of 30 September 2021 (IPOs valued at last quarter end date).

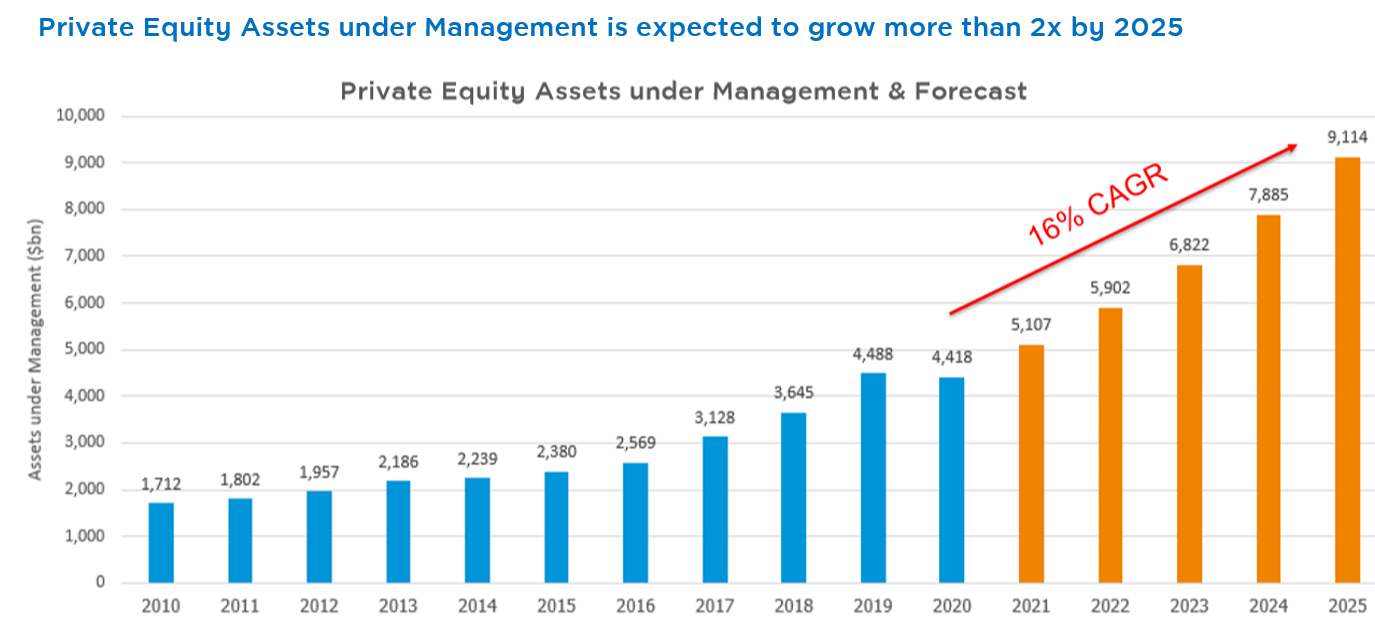

Ms. Pornchanok added that Private Equity is gaining more popularity and tends to see the most fund flowing in now, especially when stock markets are moving with high volatility. Private Equity is forecasted to grow 16% per annum or double its figure by 2025.

Source: Preqin, Nov 2020

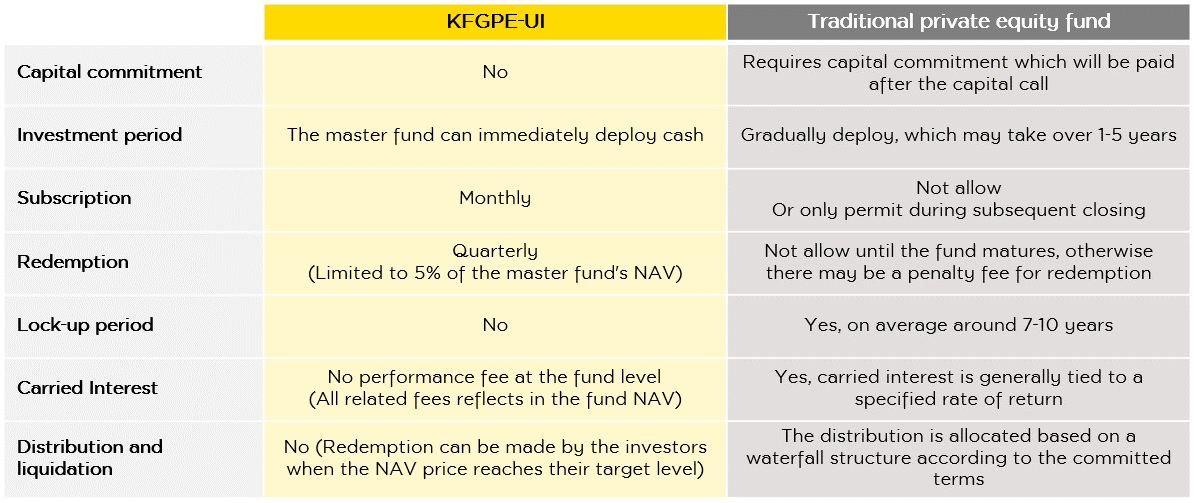

With Schroder GAIA II Global Private Equity Fund as its master fund, KFGPE-UI marks its difference from other typical Private Equity funds in several aspects. Unlike other funds, KFGPE-UI will not require specific capital commitment, while the subscription can be executed on a monthly basis and fund redemption can be done on a quarterly basis. Typical Private Equity funds will determine a period of investment without redemption before schedule. Besides, KFGPE-UI will not collect Carried Interest as all fees are included in net asset value (NAV). Thus, investors will be able to redeem fund units by themselves once NAV reaches their satisfactory levels. Given these conditions, KFGPE-UI carries more flexible investment conditions than typical private equity funds, which make the fund more attractive for investment.

Lastly, KFGPE-UI is scheduled for IPO during 1 – 14 March 2022 with minimum required purchase at one million Baht. After IPO, subscription order can be executed on monthly basis, and redemption order can be executed on quarterly basis by referring to the Fund’s calendar regarding the trade date. More specially, every 100,000 Baht investment amount in KFGPE-UI during IPO period will give investors investment units of KFCASH-A valued at 100 Baht (terms and conditions as specified by KSAM).

See fund/ promotion details, click here.

Fund policies & disclaimer (short version)

- Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, Schroder GAIA II Global Private Equity Fund, Class C Accumulation USD which managed by Schroder Investment Management (Europe) S.A.

- Schroder GAIA II Global Private Equity Fund (“Master Fund”): The Master Fund is regulated by Commission de Surveillance du Secteur Financier (CSSF) under the laws of Luxembourg and has a policy to invest in the equity interests of unlisted companies (private equity) worldwide. The Master Fund will invest in private equity strategies including venture capital, growth capital, and buyout. Besides, it may undertake both direct and indirect investments and may borrow up to 30% of its NAV to finance the investments.

- Risk level: 8+ Significantly high risk | Hedge against currency risk upon fund manager’s discretion. Generally, the Fund will enter into a forward contract to hedge against the exchange rate risk on average of 80% of the foreign investment value.

- Since the Thai Fund may enter into currency hedging agreement at the discretion of the Management Company, it may be exposed to FX risk, Investors may thus encounter FX gains or losses or receive a lower return than the initial investment amount.

- This mutual fund’s investment is highly concentrated in Europe and North America, therefore investors should consider diversify the risks in their portfolio.

- This document was made from accurate sources of information at the time of publication, but KSAM is does not provide any warranty of its accuracy.

- Before remitting in money, please carefully study fund features, performance, and risk. Past performance is not a guarantee of future results. This fund is a risky / complex fund, investor should seek an additional advice before investing.

For more information on fund, please contact

Krungsri Asset Management Co., Ltd. Tel. 02-657-5757 or any branch of Bank of Ayudhya