News/Announcement

Promotions/Fund Highlight

KFGPE-UI...Unlocking growth opportunities through Private Equity Investment

What is Private Equity and why now is the time to invest?

-

Private Equity refers to the capital investment made into companies which are not listed on the formal stock exchanges that stands out with its growth potential.

-

Private Equity will generate higher growth potential of investment principal through an investment in potential companies and active transformation of companies for better efficiency and growth.

Source: Schroders Capital, 2022

Currently, the Venture/Growth capital fundraising are considered to significantly grow above its long-term trend, while the Buyout fundraising tends to increase as well.

Opportunity to invest in Private Equity: KFGPE-UI

2. Investment strategy framework with well-diversified across multiple areas of Private equity investing plus investment in Providing capital to support medium and small businesses provide true differentiation to investments in listed companies and other Private Equity funds

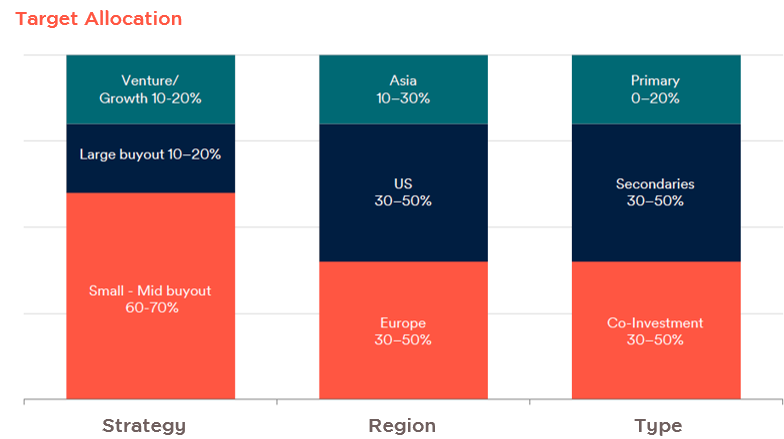

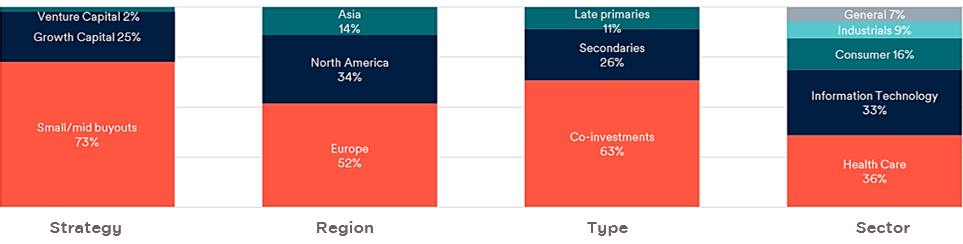

The master fund considers using the Buyout and Growth fundraising strategies that match each region with a focus on five business sectors.

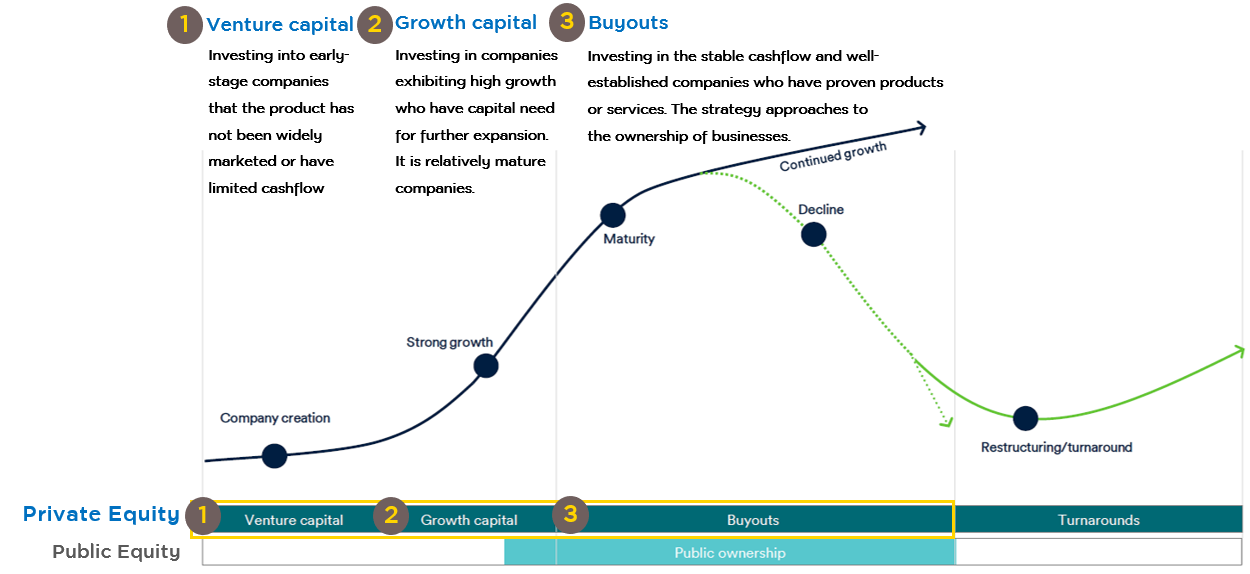

Access vehicles to Private Equity

- Primary fund investments: Investing in private equity funds during their initial fundraising which in turn invest in privately held companies

- Secondary fund investments: Acquiring existing fund investments from another private equity investor who wishes to exit their investment before the end of its life

- Co-investment: Holding in unlisted equities of companies. Mostly is direct investment.

Private equity investment strategies/ Different sources of capital according to company growth stage

Currently, the Venture/Growth capital fundraising are considered to significantly grow above its long-term trend, while the Buyout fundraising tends to increase as well.

Source: Preqin, Schroders Capital, 2022. Based on last 12 months data for every year as of end of November of each year.

Opportunity to invest in Private Equity: KFGPE-UI

Krungsri Global Private Equity fund - Not for Retail Investors

For fund details, click here.

The fund is for Institutional and Ultra High Net Worth Investors only. This fund is High Risk or Complex Fund which has no investment risk limit as general mutual funds, it is therefore suitable only for investors who can accept high level of loss.

The fund is for Institutional and Ultra High Net Worth Investors only. This fund is High Risk or Complex Fund which has no investment risk limit as general mutual funds, it is therefore suitable only for investors who can accept high level of loss.

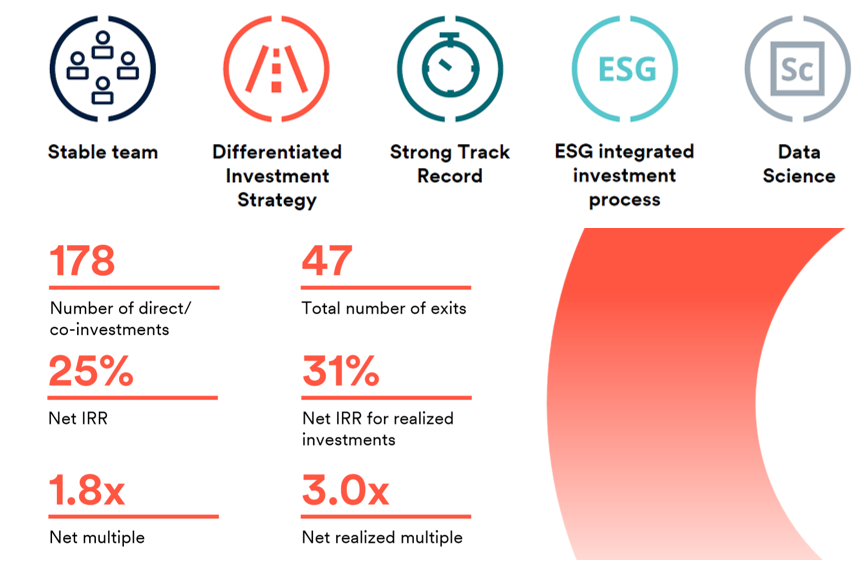

Strengths of the master fund: Schroder GAIA II Global Private Equity Fund

1. Schroders Capital’s Private Equity strengths in Private Equity investing and fund managers with proven track record of investment expertise

Source: Schroders Capital, 2022.The number of investments closed is as of Q2 2021. Performance is net of underlying fees and carry and gross of Schroders Capital fees and carry. Overall performance as of Q3 2021 in €. Realized IRR and multiple is based on full realizations, partially realizations and IPOs as of 30 September 2021 (IPOs valued at last quarter end date).

Source: Schroders Capital, 2022. | Small to Medium size enterprises defined as companies <€/$500m enterprise value

Source: Schroders Capital , 2022

3. The master fund selects the access vehicles to Private Equity that opportunities are most attractive and focuses on specialist and hard-to-access managers.

Portfolio holdings of the master fund

Source: Schroders Capital. Investment data as of 31 December 2021. 1 - Note that we present both direct and indirect exposure such as single asset funds. 2 - Listed equity owned as a result of an IPO.

The value of investments and past track record of the master fund

Source: Schroders Capital, as of 31 December 2021. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall. The performance shown belongs to IA share class, which is for institutional investors, while KFGPE-UI will be investing in C share class. Both share classes have the same investment policy. This shows the performance of the master fund, so it is not complied to AIMC’s standard.

Fund features: KFGPE-UI

| Investment policy |

|

| Risk level | 8+ Significantly high risk | Hedge against currency risk upon fund manager’s discretion. Generally, the Fund will enter into a forward contract to hedge against the exchange rate risk on average of 80% of the foreign investment value. |

| Dealing date | IPO: During 1 – 14 March 2022 After IPO: Subscription order can be executed on monthly basis, and Redemption order can be executed on quarterly basis. Please refer to Fund’s calendar regarding the trade date. |

| Minimum investment | Initial subscription 1 million baht, Subsequent 500 baht |

| Dividend policy | The fund has no dividend payment policy. |

Fund's Promotion

Every 100,000 Baht investment amount in

Krungsri Global Private Equity fund - Not for Retail Investors (KFGPE-UI)

during 1 - 14 March 2022

receive investment units of KFCASH-A valued at 100 Baht

Terms & conditions

- This promotion is applicable to the NET investment amount in KFGPE-UI during IPO period only. Net investment amount means purchase or switching in value less redemption or switching out value.

- Investors must hold units until 31 July 2022. The outstanding investment amount is based on the unit balance of the fund as of 14 March 2022. However, customers will not be eligible to join this promotion if they redeem and/or switch out investment units of the fund during 15 March – 31 July 2022 regardless of the amount of redemption.

- The date on which the advance order is placed will determine the redemption order. Even if the redemption order becomes effective after 31 July 2022 or if the redemption order is cancelled later after 31 July 2022, it will be considered a violation and not eligible for this promotion.

- Transferring investments units to different investor during 15 March– 31 July 2022, regardless of the amount of the transaction, is not eligible for this promotion. For transferring investments units from and/or to omnibus account, the investor must notify the management company and provide support documentation showing the transferor and transferee accounts belong to the same investor in order to be eligible for this promotion.

- The Management Company will calculate the total investment amount in KFGPE-UI based on each investor’s unitholder account number. In case an investor has more than 1 account, the Management Company will not consolidate the total investment amount from all accounts for this promotion.

- The total amount of investment amount, which is less than 100,000 Baht, will not be counted for the promotion.

- The Management Company will allocate the promotion units of KFCASH-A to the eligible investors within 31 August 2022. The units of KFCASH-A will be calculated at its NAV price on the allocation date.

- Subscription and switch-in order through unit-linked life insurance and provident fund are not eligible for this promotion.

- Other terms and conditions may apply for the transaction executed through an omnibus account. Investor should contact your representative selling agents for further information.

- The Management Company reserves the right to offer other equivalent reward as appropriate or change terms & conditions of this promotion without prior notice.

- This promotion expense is charged to the Management Company, not the fund.

Specific risk of the master fund

1. Risks arising from the nature of investments in Private Equity:

- Private equity investments typically display uncertainties which do not exist to the same extent in other investments (e.g. listed securities). Private equity investments may be in entities which have only existed for a short time, which have little business experience, whose products do not have an established market, or which are faced with restructuring etc. Any forecast of future growth in value may therefore often be encumbered with greater uncertainties than is the case with many other investments.

- While private equity investments offer potentially significant capital returns, funds and companies may face business and financial uncertainties. There can be no assurance that their use of the financing will be profitable to them or to any Fund. Investing in private equity and venture capital funds and unlisted companies entails a higher risk than investing in companies listed on a recognised stock exchange or on other regulated markets. This is in particular because of the following circumstances:

- The Fund may invest directly and indirectly in less established companies, which may subject it to a greater risk of loss. Such companies do not have any prior operating history. There can be no assurance that the managers of such companies will be able to meet their objectives. There can be no assurance that any such investment completed by the Fund will provide returns commensurate with the risk of investing in such companies.

- The Fund's co-investments may afford it only limited rights as a shareholder and, as a result, it may be unable to protect its interests in such investments. The Company may have little or no control over the structure or features of a co-investment, and as a result, will rely on the skills and capabilities of the (third party) investment managers selecting, evaluating, structuring, negotiating and monitoring the underlying (co) direct investment. In addition, in certain private equity funds in which the Fund may invest, other investors may be able to vote to cause a liquidation of such fund at a time when the Fund would not have so voted.

- Unlisted companies are often highly dependent on the skills of a small group of managers/directors. These companies often have limited resources. An investment in the Fund should be thought of as a long-term investment.

2. Investments in private equity funds and funds of private equity funds:

- The Fund is permitted to invest in private equity funds and fund of private equity funds established in jurisdictions where no or limited supervision is exercised on such funds by regulators. Further, the efficiency of any supervision may be affected by a lack of precision of investment and risk diversification guidelines applicable to, and the flexibility of the investment policies pursued by, such funds.

- This absence of supervision at both the level of the fund of funds and the underlying funds may result in a higher risk for the Shareholders.

- Shareholders in the Fund will bear indirectly the management and advisory fees charged by the investment managers of the various private equity funds, funds of private equity funds and listed private equity investments in which the Fund invests.

- It is possible that, even at times when the Fund has a negative or zero performance, the Fund will, indirectly, bear performance fees levied within individual Private Equity Funds, Funds of Private Equity Funds and Listed Private Equity Investments.

3. Redemption requests:

Investments in private equity interests companies can be difficult to sell quickly, which may affect the value of the Fund and its ability to meet redemption requests upon demand.

4. Liquidity risk:

Investments in private equity interests companies can be difficult to sell quickly, which may affect the value of the Fund and its ability to meet redemption requests upon demand.

4. Liquidity risk:

- Private equity investments are often illiquid long-term investments that do not display the liquidity or transparency characteristics often found in other investments (e.g. listed securities).

- Securities or other financial assets that the Fund may invest into may be difficult to sell. The eventual liquidity of all investments will depend on the success of any realisation strategy proposed. Such strategies could be adversely affected by a variety of factors. There is a risk that the Fund may be unable to realise its investment objectives by sale or other disposal at attractive prices or at the appropriate times or in response to changing market conditions, or will otherwise be unable to complete a favourable exit strategy. Losses may be realised before gains on disposals. The return of capital and the realisation of gains, if any, will generally occur only upon the partial or complete disposal of an investment.

- It may be difficult to dispose of investments made in unlisted companies. A realisation of investments in unlisted companies may be achieved by way of public offerings or sales to joint venture partners, strategic partners or other investors. However, any realisation of the investment of a Fund in a company may require the agreement of other shareholders in the company, or the consent of the board of directors of the company, or the approval of the relevant authorities. The timing and profitability of the exit strategy for direct investments can be negatively affected by external economic factors beyond the control of the Fund.

- There is no established market for secondary investments and although there has been an increasing volume of secondary investment opportunities in recent years, no liquid market has developed nor is one expected to develop.

5. Valuation risk

It may be difficult to find appropriate pricing references in respect of unlisted investments. This difficulty may have an impact on the valuation of the portfolio of investments. Certain investments are valued on the basis of estimated prices and therefore subject to potentially greater pricing uncertainties than listed securities.

6. Risk Factors Relating to Industry Sectors / Geographic Areas:

Funds that focus on a particular industry or geographic area are subject to the risk factors and market factors which affect this particular industry or geographic area, including legislative changes, changes in general economic conditions and increased competitive forces. This may result in a greater volatility of the Net Asset Value of the Shares of the relevant Fund. Additional risks may include greater social and political uncertainty and instability; and natural disasters.

7. Risk Factors Relating to concentration of investments risks:

Although it will be the policy of the Company to diversify its investment portfolio, a Fund may at certain times hold relatively few investments. The Fund could be subject to significant losses if it holds a large position in a particular investment that declines in value or is otherwise adversely affected, including default of the issuer.

It may be difficult to find appropriate pricing references in respect of unlisted investments. This difficulty may have an impact on the valuation of the portfolio of investments. Certain investments are valued on the basis of estimated prices and therefore subject to potentially greater pricing uncertainties than listed securities.

6. Risk Factors Relating to Industry Sectors / Geographic Areas:

Funds that focus on a particular industry or geographic area are subject to the risk factors and market factors which affect this particular industry or geographic area, including legislative changes, changes in general economic conditions and increased competitive forces. This may result in a greater volatility of the Net Asset Value of the Shares of the relevant Fund. Additional risks may include greater social and political uncertainty and instability; and natural disasters.

7. Risk Factors Relating to concentration of investments risks:

Although it will be the policy of the Company to diversify its investment portfolio, a Fund may at certain times hold relatively few investments. The Fund could be subject to significant losses if it holds a large position in a particular investment that declines in value or is otherwise adversely affected, including default of the issuer.

Important warning

- KFGPE-UI (“Thai Fund”) will invest mainly in the Master Fund named Schroder GAIA II Global Private Equity Fund which has a policy to invest in the equity interests of unlisted companies (private equity) worldwide without investment limits. It is different from and carries a higher degree of risk than general mutual funds as well as having low liquidity. Accordingly, investors may suffer losses of investment principals or may not receive the returns on investment as expected. This Fund is therefore suitable only for investors who have proper understanding about this type of assets and can accept high level of investment losses.

- The Thai Fund may invest in non-investment grade and/or unrated debt instruments and/or unlisted securities. The investors may have higher risks of not receiving the repayment of principals and interests.

- The Thai Fund may enter into currency hedging agreement at the discretion of the Management Company which may involve transaction costs, causing the overall returns of the Fund to decrease as a result of such transaction costs. And in the case where no currency hedging agreement is made, the investors may encounter foreign exchange gains or losses or receive a lower return than the initial investment amount.

- The Thai Fund may invest in or hold derivatives agreements for the purpose of efficient portfolio management and the Fund may invest in structured notes. Since investment in derivatives requires less money than direct investment in underlying securities and hence involves higher profits/losses from investment, the Fund is therefore exposed to higher investment risks than general mutual funds that invest directly in the underlying securities.

- The Thai Fund may at certain times concentrate investments in any one sector and/or any one region. Therefore, the performance of the Fund may fluctuate to a greater extent than general mutual funds that are well diversified. Investors are advised to carefully deliberate on the risk factors and risk diversification of their overall investment portfolio and the information contained in the prospectus before making decision to purchase the investment units.

- The Thai Fund has limited liquidity and accepts redemption of investment units on a quarterly basis by requiring advance notification by the 30th date of the ending month of the preceding quarter. The total period from the advance notification until receipt of the redemption proceeds will take more than 4 months which is consistent with the practical guideline of the Master Fund. Investors are advised to carry out their own liquidity planning to ensure consistency with the Fund’s liquidity before making investment decision.

- The Master Fund may have restrictions and reserves the right to close to new investors or stop accepting additional investment funds from existing investors if the Master Fund considers that such closing to new investors or additional investments of existing investors is for the best benefit of the unitholders. Circumstances that cause the Fund to consider closing to new investors or additional investment finds of existing investors include the case that the size of NAV of the Fund or any relevant share classes expand to the level that it may be difficult to manage the fund for maximum interests, or when the fresh or increased investment funds may adversely affect the Fund’s performance, etc. In addition, the Master Fund reserves the right to close to new investors and additional investments of existing investors, as well as closing to new investors and additional investments of existing investors in the future, without having to give any prior notices to the unitholders. Accordingly, such restrictions may result in the unitholders being unable to making regular investment on a monthly basis or unable to invest in the investment amount as desired.

- The Master Fund may impose a redemption gate which limits the total redemptions on any dealing day to not exceeding 5% of its NAV in the previous quarter. If total redemptions of the unitholders of the Master Fund on any dealing day exceed such limit, the Master Fund may process each redemption order on a prorate basis so that the total redemption value in respect of that dealing day is not more than the specified limit. Meanwhile, processing of the redemption portion exceeding the specified limit will be deferred until the redemption date of the subsequent quarter.

- The Master Fund may defer payment of the redemption proceeds for a maximum of 30 business days from the normal payment schedule under extraordinary circumstances, e.g., restrictions on inward/outward remittances, controls of relevant stock exchanges, or any other events resulting the Master Fund having insufficient liquidity to meet the obligation of redemption proceeds payment on a timely basis.

- Upon occurrence of extraordinary circumstances, for instance, the stock exchange in which the Master Fund invests cannot be open for normal trading, or the securities invested by the Master Fund are suspended from trading, or there is any unusual event beyond the control of the Master Fund, the Master Fund may temporarily suspend or defer the calculation of NAV, the offering for sale, the switching, and the redemption of investment units, which may result in the unitholders receiving the redemption proceeds later than the specified timeframe. In this regard, the Master Fund may not accept either the subscription or redemption of investment units or both transactions for a period of 12 months if the Fund Manager considers it to be the utmost benefit of the unitholders. During such period, there will be no calculation and announcement of the unit value.

- Since the Master Fund has the restrictions on sending advance subscription orders, and the date on which the NAV per unit of the Fund is calculated and announced as well as the payment date of the subscription proceeds require a longer period than other general mutual funds, such restrictions may result in the performance of the Thai Fund having greater deviation from that of the Master Fund than other general feeder funds.

- Since the Master Fund invests mainly in private equity, it may be subject to various types of risk associated with investment in the early-stage startup companies which may lack experience or expertise in management and have insufficient capital to cover the expenses for operations and research & development. Besides, the technologies adopted by such companies may have not undergone operational tests. These factors contribute to the possibility of failure in the operational and financial aspects of the securities issuers at the early stage which consequently have a negative impact on the business viability of such securities issuers both in the short and long-term.

- In the case where the Master Fund is unable to dispose of assets or withdraw from investments at the desired time or pricing to repay the principals and/or returns to the Thai Fund within an appropriate timeframe, it may result in the investors losing their principals and expected returns.

- The Thai Fund has a requirement of accepting the advance subscription and redemption orders for a long period before such orders are executed on the trade date which is the last business day of each month. Moreover, the calculation of the Fund’s NAV is made on a monthly basis as it will be calculated and announced within the following month or maybe at a later date. These requirements are stipulated in consistency with the practical guideline of the Master Fund which are different from the general mutual funds. Investors are advised to thoroughly study the notification of the Management Company regarding the trade dates before making investment decision.

- In sending subscription orders, investors shall submit the subscription orders together with the advance payment of subscription proceeds before the trade date of each month in accordance with the announcement of trade dates specified by the Management Company and are not able to cancel such transactions. The subscription orders will be processed on the last business day of each month (”Trade Date”) and investors will be allocated the investment units after the Thai Fund has calculated the NAV per unit of that particular month, which will be calculated and announced within the month next to the relevant trade date or maybe at a later date. Therefore, investors who have submitted the subscription orders together with the advance payments of subscription proceeds will not be allocated the additional investment units until the calculation and announcement of the NAV per unit is accomplished.

- This mutual fund’s investment is highly concentrated in Europe and North America, therefore investors should consider diversify the risks in their portfolio.

- Krungsri Asset Management Co., Ltd. (“The Management Company”) believes the information contained in this document is accurate at the time of publication but does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

- Before remitting in money, please carefully study fund features, performance, and risk. Past performance is not a guarantee of future results. This fund is a risky / complex fund, investor should seek an additional advice before investing.

.aspx)

.aspx)