KFCORE ... Your Core Portfolio for Every Investment Condition

.aspx)

Krungsri Asset Management Company Limited (Krungsri Asset Management) recently held a special seminar, “2023 Playbook: Strengthen Your Core Portfolio” to update economic outlook and investment strategies proven to help tackle the ongoing volatility and to introduce KFCORE, the fund being designed to be the core portfolio in every investment condition.

Ms. Pornchanok Rattanaruchikorn, Assistant Vice President of Alternative Investment Department, Krungsri Asset Management, talked about the economic changes and global investment pressures in the past year from the combined effects of rising interest rates, inflation, and war crisis between Russia and Ukraine, as well as the continued lockdown of China. All has contributed to risky assets around the globe, specifically, on the stocks and bonds that could not perform well. It is also expected that the market will continue to be volatile from these factors throughout this year. Therefore, investment must be made with caution. More emphasis will be placed on diversification to protect investment capital and to generate good returns.

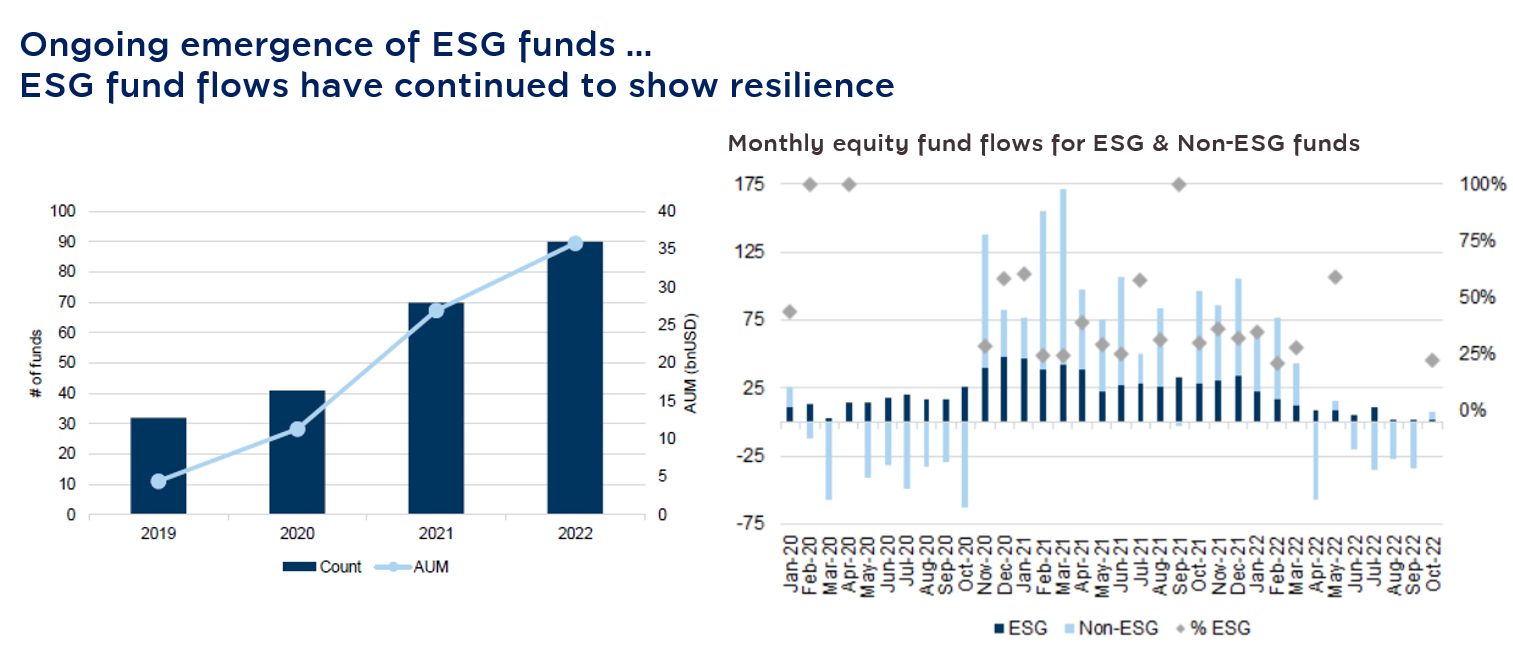

However, it is expected that 2023 will be an important turning point in which various assets will recover, but one must adjust the investment strategy by considering that there are three important investment trends that will increase the chances of generating good returns for the fund: (1) the fund must be highly flexible and dynamic and can be adjusted to suit market conditions, (2) Diversification of investments in a variety of assets is also required, and (3) Most importantly, the investment concept that considered integrating the ESG in the asset selection process. As we can see that ESG is an investment trend that is gaining global attention at a rapid rate; between the years 2019 - 2022, there had been an 8-time increase of fund flow into ESG-minded assets, and the trend continues to grow. Therefore, it is believed that investing in ESG will help the portfolio grow with total and sustainable returns from that concept.

Source: (left to right) Morningstar, Goldman Sachs Global Investment Research as of 15 Dec. and 30 Nov. 22

According to such investment concept, since December 2022, Krungsri Asset Management has adjusted the fund structure through adapting the BGF ESG Multi-Asset Fund as the master fund of KFCORE to respond to the new investment policy, which focuses on investing in accordance with Environmental, Social, and Governance (ESG) concept together with risk diversification in more assets instead of focusing only on investing in stocks and fixed income through ETFs. This new concept also broadens investment in alternative assets such as alternative energy, clean energy technology or investments in various high quality corporate bonds that are not affected by market volatility. The master fund also uses highly flexible investment policies with an aim to adjust the portfolio to keep up with the ongoing changing market situation.

Talking about the BGF ESG Multi-Asset fund, it has been the leading fund receiving 5-star overall ratings from Morningstar(1) and being managed by BlackRock, the world's largest asset management company(2). Therefore, Krungsri Asset Management believes that this fund will have a chance to generate an opportunity for satisfactory returns for investors amid market conditions that remain volatile from the recession, high interest rates, and inflation.

Source:

(1) Morningstar/Blackrock as of 31 Dec. 22 |

(2) Statista.com as of 31 Mar. 22 that is the latest updated info as of 31 Dec. 22 | Above rankings are not complied with AIMC standards.

Source: BlackRock as of 31 Dec. 22, for illustrative purposes only and subject to change.

Meanwhile,

Mr. Samuel Edgerley, BlackRock Investment Specialist, said

the BGF ESG Multi-Asset Fund put emphasis on investing in sustainability with more than 20 years of experience investing in ESG assets. Besides, the fund has the world's largest and fastest growing portfolio of sustainable assets with an expert team that helps select assets that are in line with the fund's asset selection criteria, including a team specifically for management of investment risks. In addition, the fund has a variety of investment tools both in direct investment in securities, derivatives, debentures, or others, with investment expertise under volatility allowing for returns to outperform the market and competitors at every opportunity. Impressively, even during the first quarter of 2020, when the world was affected by COVID-19, the fund was still less negative than other competitors and able to quickly turn around to beat the market.

Source: EAA Morningstar Moderate Allocation –Global Sector and BlackRock as of 30 Nov. 22, for illustrative purposes only and subject to change.

The concept of selecting assets for investment is an asset that must have tangible ESG performance with an ESG score above 75% and potentially generate high returns that remain at an attractive valuation. With this proactive strategy, the return of the fund in the past 10 years has always been among the top performers. This is from capital protection strategies and focusing on an opportunity to generate good returns along with appropriate risk management. When considering risk diversification, the fund invests through various securities with the proportion of the investment in each type of asset will not be unreasonably high. This reduces the risks and provides an opportunity to generate good returns consistently in all market cycles. Besides, the fund also has a team that monitors the factors that affect the investment so that it can quickly adjust the portfolio in accordance with a particular situation.

For 2023, BlackRock has a positive view on investment conditions. Although the market is still volatile from the direction of interest rate hikes, they believe that there are still good opportunities from other positive factors. For example, utilizing the developed countries' ESG policies have led to increased investment in this theme. Or when China fully reopens it will have a positive effect on Asian countries. Therefore, the fund may seek more investment opportunities in the region.

Lastly, we, Krungsri Asset Management, still would like to advise investors to keep their core investment in this fund due to the fact it is a well-diversified fund that can help protect investments with an opportunity to generate better returns than fixed income as we can see from the past performance of master fund, BGF ESG Multi-Asset, they have been able to generate average returns at least 5% per year. And, in the future, we have plans to set KFCORE up as SSF and RMF for investors who want to save tax and expect an opportunity for good returns with reasonable risk.

Source: BlackRock/Morningstar as at 31 December 2022. Performance shown above on NAV to NAV basis for the BlackRock Global Funds (BGF) ESG Multi-Asset Fund D2 (hedged to USD) accumulation share class shown net of 0.65% annual management fees in US Dollars (returns subject to rounding), formerly known as BGF Flexible Multi-Asset Fund prior to 25 March 2019. This shows the performance of the master fund, so it is not complied to AIMC’s standard.

Investment policy & disclaimer:

- Minimum 80% of NAV in average of fund accounting year are invested in the Master Fund named, BGF ESG Multi-Asset Fund, Class I2 Hedged USD which managed by BlackRock (Luxembourg) S.A. that follows an asset allocation policy that seeks to maximize total return potentials with investment principal ESG by investing globally in the equities, fixed income transferable securities (which may include some high yield fixed income transferable securities) units of undertakings for collective investment, cash, deposits and money market instruments. | 5 – Medium to high risk | Hedge against currency risk upon fund manager’s discretion.

- This document is prepared from the information obtained from various reliable sources as of the date of information. However, the Company does not provide any warranty of the accuracy, reliability and completeness of the information contained herein and reserves the right to amend the information without prior notice.

- KFCORE may enter into a currency swap within discretion of fund manager which may incur exchange rate risk and investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

For KFCORE details, click here

For further inquiries/ fund prospectus, please contact

Krungsri Asset Management Co., Ltd. at 02-657-5757 or our selling agent

Back