Seizing Investment Opportunities from Cyber Security ... the Backbone of Digital Era

.aspx)

Krungsri Asset Management Co., Ltd. recently held the online seminar, “Access Growth Opportunities in Cyber Security, the Backbone of Digital Era” , focusing on the theme of growth stocks with potential to follow the digital world and rising cloud usage widely expanded during the Covid-19 pandemic. While prices of tech stocks have been sinking, those of cyber security stocks were revised up on fundamentals and income growth after rising demand for cyber security systems across the world. There remains upside, while Cyber Security stocks had delivered income growth of about 20 - 30% per year in the past three years (Source: Allianz Global Investors as of 31 Dec. 2021). KSAM also took this opportunity to launch its “Krungsri Cyber Security (KFCYBER)” with Allianz Global Investors Fund - Allianz Cyber Security, which specializes in the cyber security business for more than 20 years, as the master fund. KSAM will make an initial public offering of KFCYBER during 7 - 15 February 2022.

At the seminar, Mr. Johannes Jacobi, Director, Senior Product Specialist, Allianz Global Investors and Mr. Kiattisak Preecha-anusorn, Vice President for Alternative Investment, Krungsri Asset Management provide information regarding threats to the digital world, importance of cyber security system in the cyber world, investment opportunities, details and strength of the fund, asset selection criteria, performance record and expectations that will make KFCYBER more attractive for investors.

Mr. Kiattisak said that cyber threats come in several forms, such as ransomware, a category of malware, started to spread from 2017, while the Covid-19 pandemic has increasingly pushed many across the world into the work-from-home situations through cloud services and online systems, making them become more vulnerable to cyber attacks. In 2020, estimated global losses are projected to hit 1% of the world’s gross domestic product (GDP). It is necessary for organizations to increase investment in cyber security systems. Therefore, cyber security becomes an interesting theme for investment in 2022.

.aspx)

Source: J.P. Morgan, FBI IC3 Internet Crime Annual Reports (LHS), CSIS "The Hidden Costs of Cybercrime“ (RHS), Sep. 2021

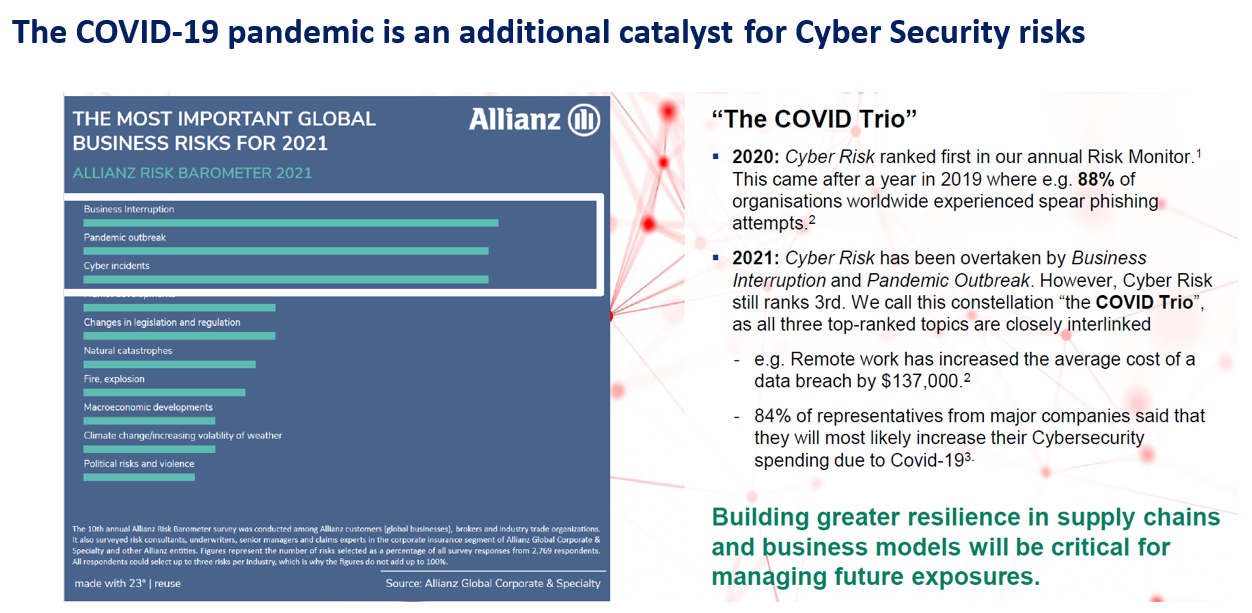

Mr. Jacobi said that, based on a United Nations Office on Drugs and Crime (UNODC) survey, cyber attacks last year soared over 60% across the world including Thailand. And, according to a survey of over 2,000 decision makers worldwide during a couple of years ago, cyber threat was one among the most concerns (after the pandemic and business disruption) because it could bring damages to organizations in several dimensions, spanning from financial, image to reputation. Besides, state’s regulatory requirements designate that organizations must show responsibility if they cannot have proper information protection. Thus, investment in cyber security is what organizations must pay more attention on urgently.

Source: 1Allianz Risk Monitor – Identifying the mayor business risks for 2021; 2,769 managers across 92 countries and 22 sectors are asked about their view on risks 2varonis: 134 Cybersecurity Statistics and Trends for 2021, February 2021. 3worldwide; HfS Research ; April 2020; 631 respondents; 18 years and older; Representatives from major enterprises; Online survey

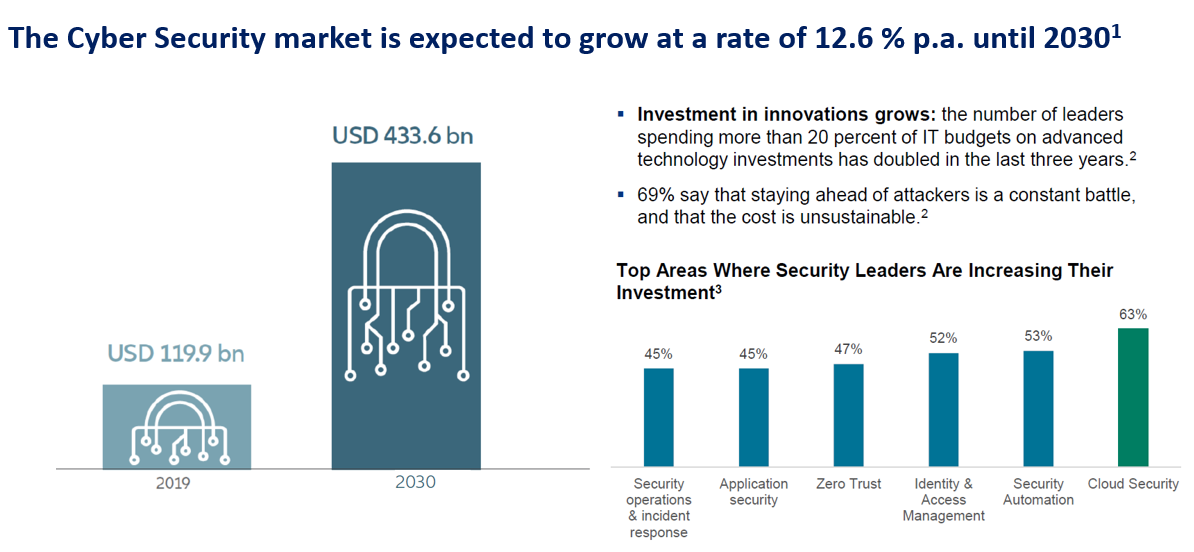

However, Mr. Kiattisak said that cyber security investment is now at a low level, accounting for only 1% of an organization’ IT investment and that is not sufficient to enhance cyber security. Appropriate cyber security expenses should be 5 - 10%. Given this urgency, organizations must strengthen their cyber security system. The cyber security market is expected to grow 12% per year from now to 2030. Such significant growth becomes a great opportunity for investment. Global analysts also revised up their forecast on net profit of cyber security stocks this year with an upside of 41%. This is very high for tech stocks despite of risks from higher interest rates and inflation for higher costs.

.aspx)

Source: IDC, Crowdstrike , Dec 21

Source: 1Businesswire: Global Cyber Security Market (2020 to 2030) - by Component, Security Type, Deployment, Enterprise, Use Case and Industry -ResearchAndMarkets.com, November 2020. 2Accenture security, Innovate for Cyber Resilience, Third Annual State of Cyber Resilience, 2020. 3Team8: 2021 Cybersecurity Brief

Allianz Global Investors Fund - Allianz Cyber Security KSAM picks takes advantage of being the solely fund that has expertise in Cyber Security and fund manager team with experience in cyber security-related assets for more than 20 years and ability to select leading Cyber Security stocks in the investment portfolio

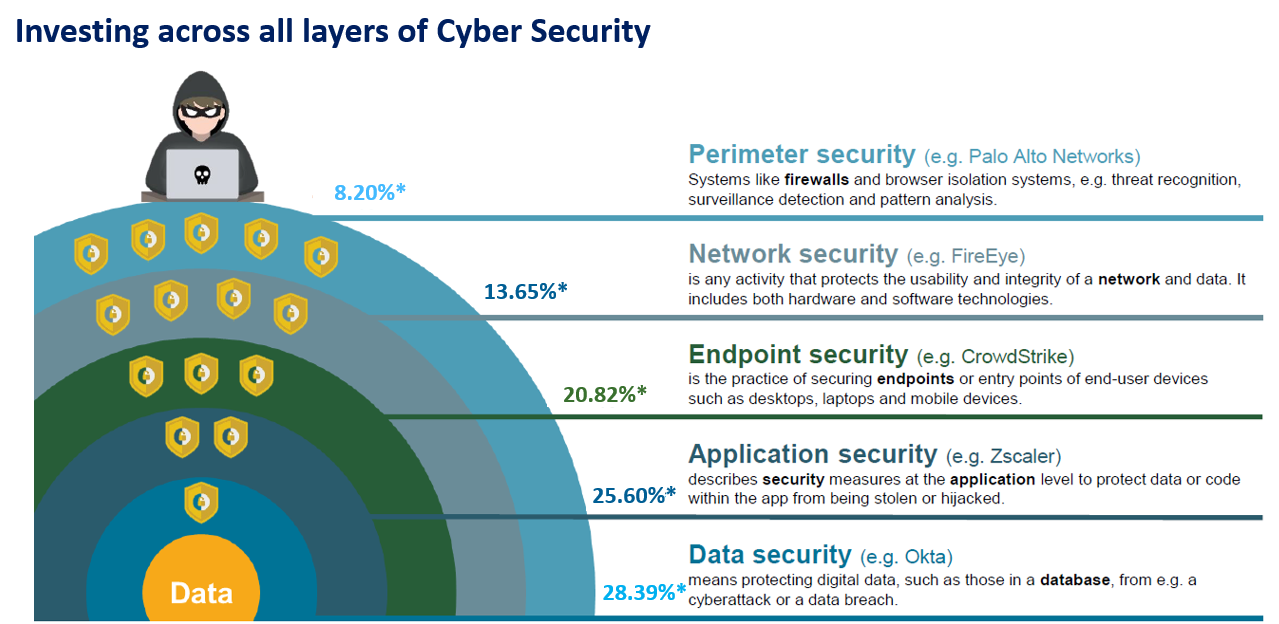

Mr. Jacobi also explained that Cyber Security assets are grouped by each company’s expertise. These groups are Perimeter Security - a firewall that prevents outer threats, Network Security - a system that prevents threats to network, Endpoint Security - a process that secures endpoints, Application Security - a system that prevents security issues within applications, and Data Security - a system that protect data from external attacks. The fund will select assets with Next-Gen technologies like artificial intelligence (AI) for proactive behavior inspection, swift protection against attacks with growth potential, leading positions and biggest market share in a market. The fund will invest in 30 - 60 stocks with a focus on small to mid-caps. It will mitigate risks by investing in big caps as well.

Source: Allianz Global Investors | *Allianz Cyber Security holdings by category as of 31 December 2021

One of key assets in its portfolio is ClowdStrike, a global cyber security leader for computers and mobile phones. ClowdStrike has the highest share in the endpoint security market now. Others include Zscaler - a leader in the application security group with mobile applications, Okta - a leader in the data security group with a system to prevent data breaches, and Pali Alto Networks - a leader in the perimeter security group with a system to trap and prevent firewall virus. Microsoft is also included with a cyber security system for its software. The fund invests 50% of its investment in high growth stocks, 30% in reasonable growth stocks and 15% in stocks with relatively low valuations. This is to reduce volatility. Earlier, the fund outperformed tech stocks, in general, with less volatility. (Source: Allianz Global Investors)

Mr. Kiattisak said that Cyber Security stocks had delivered income growth of about 20 - 30% per year in the past three years (Source: Allianz Global Investors as of 31 Dec. 2021), while Top-10 stocks are expected to see earnings per share (EPS) growth of 33% in the next three to five years, and 13 - 15% per year in a longer term. Amidst tech volatility now, this group still sees an upside of as high as 41% late this year, compared to their fundamentals. And this is very high upside. .

.aspx)

Source: Bloomberg as of 20 Jan. 2022

During the past one year, earnings estimates of Cyber Security stocks have been revised up consistently. Particularly in the previous three months, prices of growth stocks declined, while fair values of cyber security stocks have been revised up by 13% against decreases in their prices. Besides, inflation- an impact factor on tech stocks, started to ease. It is also believed that likely rises in interest rates have been already factored in markets. Thus, bond yields are not expected to rise sharply and risks to market plunge are relatively limited. Now is the right timing to invest in this group of stocks, given sharp drops in their prices during market fluctuations and their sound fundamentals.

Mr. Jacobi said that the fund was not concerned about risks from interest rates or inflation that arise from Quantitative Easing (QE) as stocks in its portfolio had sound fundamentals with healthy cash flow and there existed consistent market demand. These yield to long-term growth. In addition, the fund properly diversifies its investment portfolio. Therefore, it is believed that markets will gain only short-term impacts.

KFCYBER is divided into two share classes – Accumulation Class (KFCYBER-A) and Institutional Investor Class (KFCYBER-I). Fund’s IPO is scheduled during 7 – 15 February 2022 with required minimum purchase only at 500 Baht. Interested investors can purchase fund units at any branch of Bank of Ayudhya or selling agents, and Krungsri Asset Management (via @ccess Online and @ccess Mobile). Investors can also enjoy a special promotion during fund’s IPO where every 100,000 Baht investment in KFCYBER-A will give KFCYBER-A units valued at 100 Baht. (Terms & conditions as specified by KSAM)

For Fund Info/Promotion, click here

Investment policies & disclaimers

- KFCYBER invests in the master fund named Allianz Global Investors Fund - Allianz Cyber Security, Class RT (USD) (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV. The master fund invests in the global equity markets with a focus on companies whose business should benefit from or is currently related to the "cyber security" theme. Cyber security includes everything from computer security and disaster recovery to end user training.

- Risk level: 6 - High risk | Fully hedge against foreign exchange rate risk (Hedge against the exchange rate risk at a particular time for the value of at least 90% of the foreign investment value)

- This mutual fund concentrates its investment in Information Software industry. Therefore, the investors may incur a substantial loss of investment.

- Please carefully study fund features, performance, and risk. Past performance is not a guarantee of future results.

For more information on fund, please contact

Krungsri Asset Management Co., Ltd. Tel. 02-657-5757 or any branch of Bank of AyudhyaBack