Seminar: Unconstrained Investing: Unleashing Hidden Potential Returns

Krungsri Asset Management (KSAM) held a special seminar titled

“Unconstrained Investing: Unleashing Hidden Potential Returns” where

Mr. Brian Knowles, an investment expert from a leading fund firm BlackRock, along with Mr. Kiattisak Preecha-Anusorn, KSAM’s Chief Alternative Investment Officer were invited to offer an insight into the market outlook, investment directions, and trends in 2024. The top-notch fund

"BlackRock Global Unconstrained Equity Fund" was also introduced during the seminar. Being launched since 2020 during the ongoing Covid pandemic, the fund has outperformed the market outstandingly thanks to their

Unconstrained Approach strategy focusing on selecting the stocks with strong fundamentals and long-term growth potentials under benchmark-agnostic approach without constraints on types of invested sectors. Besides, more than 50% of the portfolio will be invested in Defensive Stocks to help reduce volatility during the bear market.

Thus, this fund has been selected as the master fund of KFGLOBAL, KSAM’s newly launched fund with IPO being made during 18 – 25 March 2024. The fund is believed to provide investors with an opportunity to invest in top picked global stocks from various industries that

will pave the path to attractively long-term sustainable returns. KSAM also suggested that investors use KFGLOBAL as their core investment portfolio.

Mr. Kiattisak said the US Federal Reserve (FED) will continue to play a crucial role in shaping the overall global economy and investment directions in 2024, particularly regarding interest rates. He believes that

starting from the middle of this year, interest rates are likely to be lowered due to decreasing inflation. The overall economy is exhibiting positive signs, as evidenced by companies in the S&P500 index performing 8% better than expected in the fourth quarter, confirming the strength of the US economy. The chance of an economic recession has decreased to only 40% from the original expectation of 70%. These developments are expected to help improve the equity market investment situation.

Source: Bloomberg ณ 28 ก.พ. 67

However,

Mr. Brian from BlackRock stated that investing in stocks at present is more challenging than before. Since 2010, stock investment has encountered numerous constraints, ranging from a gradual decrease in the timeframe for investment as analysts tend to prioritize short-term returns over the company's ability to sustain long-term growth. In addition,

the investment form is constrained by reliance on benchmarks. BlackRock considers all these factors as limitations on investment. By addressing these constraints, it will unleash investing opportunities to generate superior returns compared to the market and enable long-term investment.

BlackRock’s unconstrained approach is an approach designed to exploit the long-term alpha opportunity, which is the strategy their team of experts has used in selecting stocks to invest. This strategy involves disregarding constraints, such as benchmarks comparison or investment timeframe. Instead, the focus is on selecting "Great Businesses" with strong fundamentals and sustainable growth potential, and capability to maintain the market leadership. BlackRock also prioritizes consistent cash flow over current stock prices, seeking companies with excellent management committed to driving the business forward. Identified stocks meeting these criteria will be invested in for the long term, avoiding frequent trading to achieve stable and sustainable returns.

The three current portfolio themes consist of:

1st theme portraits the companies with strong brand perception and market leadership such as LVMH (Louis Vuitton) or luxury car brand like Ferrari whose Luxury Brand recognition has been very strong,

the 2nd theme is technology stocks; especially innovative firms like the Netherlands’ ASML - the world’s largest manufacturer of microelectronic circuits, or Microsoft as distinguished by its innovative AI and consistent recurring income model, and

the 3rd theme is companies with unique characteristics like Novo Nordisk as recognized for weight loss medicine and diabetes treatment demonstrating significant the growth potential in the long run.

Thus, as the master fund’s diversified portfolio comprises not only growth and tech stocks but also Defensive Stocks, it will also help reduce volatility.

Source: BlackRock as of 31 Dec 2023. | The information is for illustration purposes only. | The investment portfolio and perspectives may be subject to changes in the future.

Source: BlackRock as of 31 Dec 2023. | The information is for illustration purposes only. | The above investment approach does not give any guarantee that the investment return will always be positive throughout the investment period. | Although the above investment approach has an objective to control risks, the Fund may still involve risks. | The investment process may be changed without any prior notice.

Currently, the fund's portfolio consists of 21 stocks, focusing on global companies in the United States and Europe. In this respect, the fund prioritizes investing in a small number of carefully selected stocks while overweighting investments in those selected stocks as determined by a team of analysts and experts.

The top 10 current holdings in the portfolio include global stocks with share common characteristics: a strong brand presence, market leadership, high growth rates, and consistent delivery of potentially high returns. During times of crisis, however, they have demonstrated remarkable growth and cash flow stability.

Source: Bloomberg as of 27 Feb. 2024 | The figures shown above belong to individual stocks’ returns that do not relate to the performance of the fund. | Information shown above is for illustrative purposes only and should not interpreted as investment advice or recommendation. | The specific companies identified and described above do not represent all the companies in which the fund has invested, and no assumption should be made that these companies were or will be profitable.

From the past performance, the fund was able to notably outperform the market. In 2020, it generated returns as high as 25%, compared to the market's 13%. In 2021, returns reached 33%, while only 2022 saw declining operating results due to various negative factors, including rising interest rates, high inflation, and a fluctuating economy. Despite this, the portfolio was not adjusted due to confidence in the companies.

In 2023, positive performance resumed, recording 34%, outperforming the market by 10%. As a result, the fund's overall performance has consistently surpassed that of the market.

Source: BlackRock as of 31 Dec. 2023. | Index performance does not reflect any management fees, transaction costs or expenses. | Fund inception: 21 Jan. 2020. | Returns are shown net of fees for an investment in the USD D class accumulating. | The fund performance displayed above is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of AIMC.

Aside from an opportunity to generate high earnings during market uptrends, the fund also excels at mitigating portfolio losses during downtrends, outperforming the market thanks to their strategic portfolio with more than 50% being allocated in Defensive Stocks to help reduce volatility.

However, despite the fund's focus on long-term investments, it also employs a trading sell strategy. Factors considered include changes in a company's fundamentals that may impact long-term performance, identification of superior stocks likely to generate higher returns, and recognition of when a stock's value significantly surpasses its fundamentals.

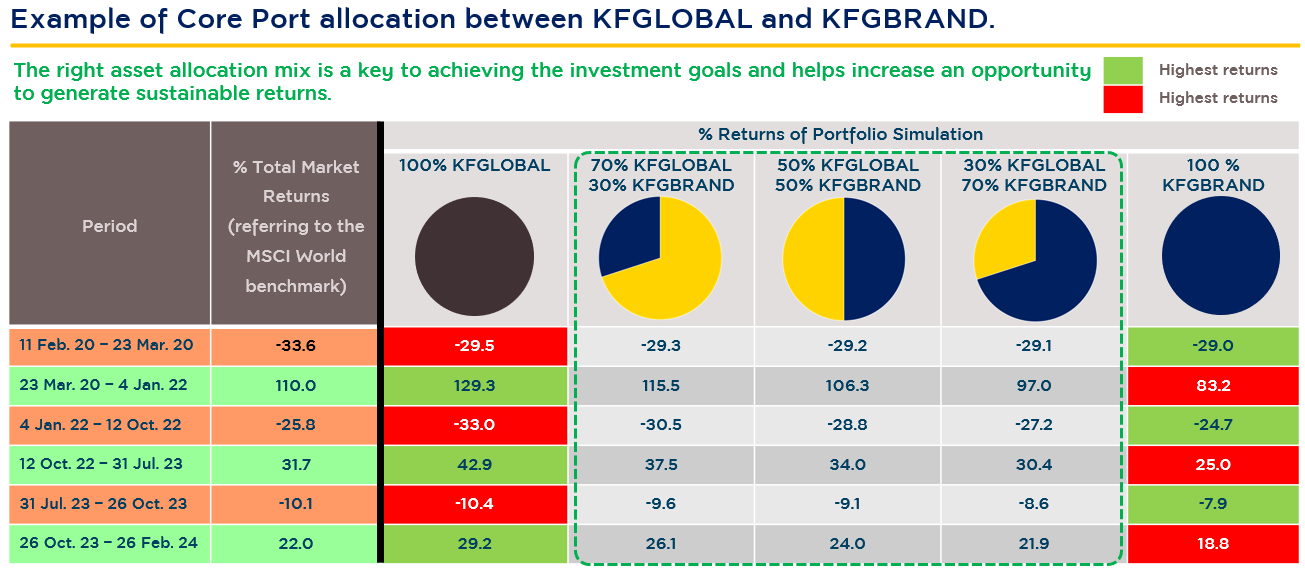

Mr. Kiattisak emphasized that now is a good time to invest in KFGLOBAL, given the global economic uptrend which has also become the key factor driving the growth of global stocks. In KSAM’s perspective, KFGLOBAL is suitable for investors seeking higher returns’ opportunity from investment. They can also invest alongside KFGBRAND with portfolio allocation based on their return expectations and risk tolerance.

Source: Bloomberg as of 28 Feb. 2024 with reference to the returns of the master funds according to specified periods described above. | The information shown above aims to explain the returns’ characteristics of asset allocation only, which does not guarantee the future returns and does not comply with the AIMC’s performance measurements in any way. | KFGLOBAL and KFGBRAND are hedged against foreign exchange risk at the fund manager’s discretion and therefore involves currency risk which may cause investors to experience foreign exchange losses or gains/or receive lower return than the initial investment amount.

KFGLOBAL’s IPO will be made during 18 – 25 March 2024 with a minimum purchase starting at only 500 Baht for KFGLOBAL-A plus a special promotion offered during the fund’s IPO where every 100,000 Baht of investment in KFGLOBAL-A will give investors 100 Baht of KFGLOBAL-A units. (when investing according to terms and conditions*)

Disclaimers:

- Should understand the fund features, conditions of returns, and risk before making investment decisions. Past performance is no guarantee of future results.

- Since the fund is hedged against foreign exchange risk at the fund manager’s discretion and therefore involves currency risk which may cause investors to experience foreign exchange losses or gains/or receive lower return than the initial investment amount.

- This document is prepared based on the information obtained from reliable sources at the time of the presentation. However, the Management Company does not provide any warranty of the accuracy, reliability, and completeness of all information. The Management Company reserves the right to make changes to all information without any prior notice.

To inquire more information or the fund’s prospectus, please contact

Krungsri Asset Management at tel. 02-657-5757 or Bank of Ayudhya or Selling Agents.

*For KFGLOBAL Info & Promotion, click.

Back