Defensive Investment Strategies in a Volatile Market

Krungsri Asset Management urges investors to make investment portfolio adjustment to cope with market volatility amid the economic slowdown.

27 September 2019 - Krungsri Asset Management Co., Ltd. held a seminar on "Defensive Investment Strategies in a Volatile Market”, advising investors on investment strategies to keep good returns amid the likely economic slowdown.

Invited to join the seminar included Ms. Laura Bottega, one of Morgan Stanley Investment Funds - Global Brands Fund management team, Ms. Ladawan Arunyingmongkol, Senior Sales Manager, Wholesale Distribution (Southeast Asia), Janus Henderson Investors and Mr. Kiattisak Preecha-anusorn, Vice President for Alternative Investment Department at Krungsri Asset Management, to provide an overview of the global economy, attractive industries for investment, detailed fund information, asset selection strategies, risk management, past performance and expected returns.

Mr. Kiattisak mentioned the global economy, saying that it has followed three characteristics: lower growth rate; lower interest rates; and high market volatility and all of these have signaled the economic slowdown. Although the impacts do not arise in this period but began to be factored in the overall investment picture. Therefore, investors should consider portfolio adjustment with the 3D strategy: Diversify; Defensive; and Dividend. Krungsri Asset Management selects two funds to match the strategy. They are KFGBRAND which invests through Morgan Stanley Investment Funds – Global Brands Fund (Class Z) and KFGPROP which invests through Janus Henderson – Global Real Estate Fund (Class I $ Inc).

Ms. Laura said that the strength of Morgan Stanley Investment Funds – Global Brands Fund lies in its defensive strategy against risks with selection of quality assets. In this regard, the master fund picks companies with globally recognized, famous brands that must stand as No. 1 or No. 2 in markets with competitive advantages and staple products or products with demand amid economic slowdowns. These companies include Unilever, L’Oréal, Heineken and Visa. Those with recurring income are included. Examples are software business and network systems like Microsoft which are intangible assets with annual service fees for use. Besides, these companies must have good management with stable profitability. Importantly, the master fund considers proper stock prices for investment in order to reduce risks and keep good returns.

Source: MS INVF Global Brands Fund (as of 30 June 2019)

Presently, the master fund diversifies its investment in quality assets across the world. Of Morgan Stanley Investment Funds’s portfolio, 39% are in consumer products, 29% in IT, 17% in health care and the rest in others. The fund’s assets under management total more than 47 billion US dollar (Source: Morgan Stanley Investment Management / AUM as of June 30, 2019). In the past 18 years, the fund has given stable return in the upward market trend and has outperformed the market in the downward trend. Compared to MSCI World with its negative yields for six times in 18 years, the fund recorded negative returns only twice and less negative figures than the market’s, while making fast recoveries. The fund performance has reflected its good risk management.

Source: : MS INVF Global Brands Fund (as of 31 Aug 2019)

Past performance is not an indicative of future performance

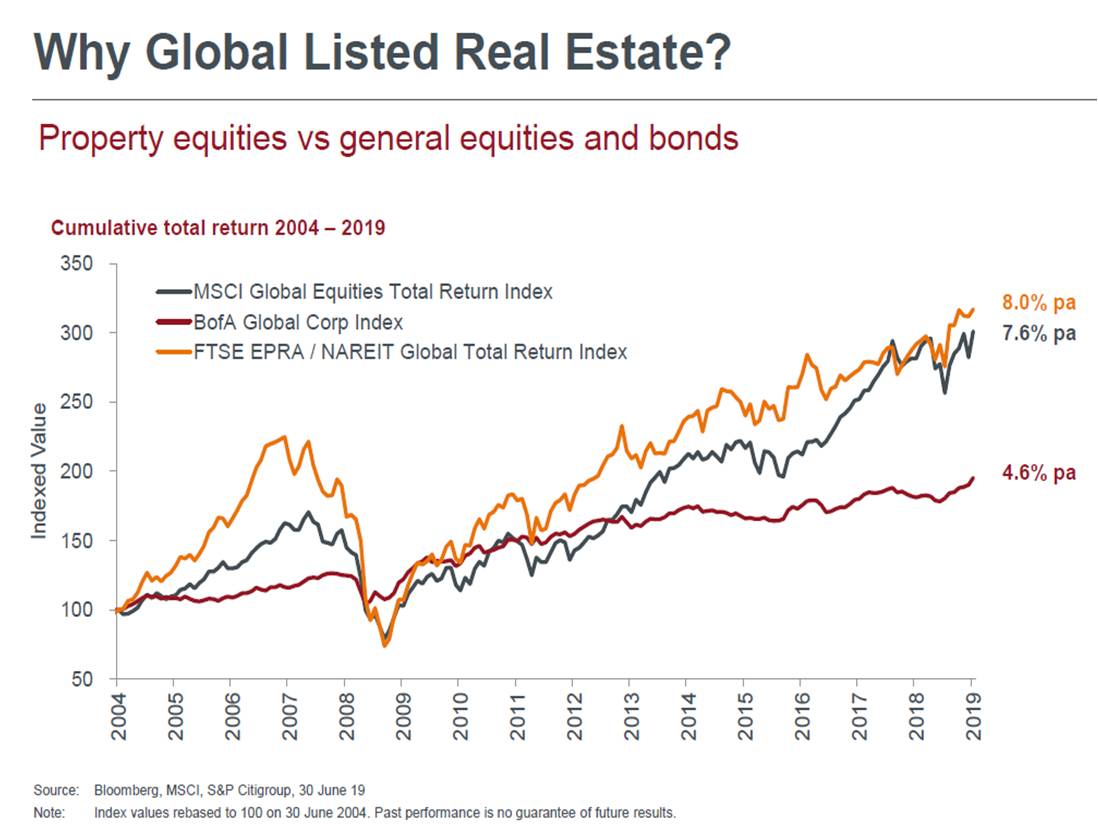

To KFGPROP, the fund invests in REITs investing in global real estates through Janus Henderson – Global Real Estate Fund. Ms. Ladawan said that, the fund manager views REITs as proper alternative assets for current investment as the real estate sector across the world has strong fundamentals with attractive prices. Listed real estate companies are cheaper than those unlisted. Besides, REITs have more diversity of assets after technological changes and that could allow the fund be able to diversify its investment to more types of assets, have high liquidity, register recurring income from rent with annual rent rises and chances for gains from a rise in real estate prices. Therefore, the master fund keeps its return stable in the long term with less risks. The average 15-year return of REITs is about 8%, compared to that of equities at 7.6% and that of fixed income at 4.6%.

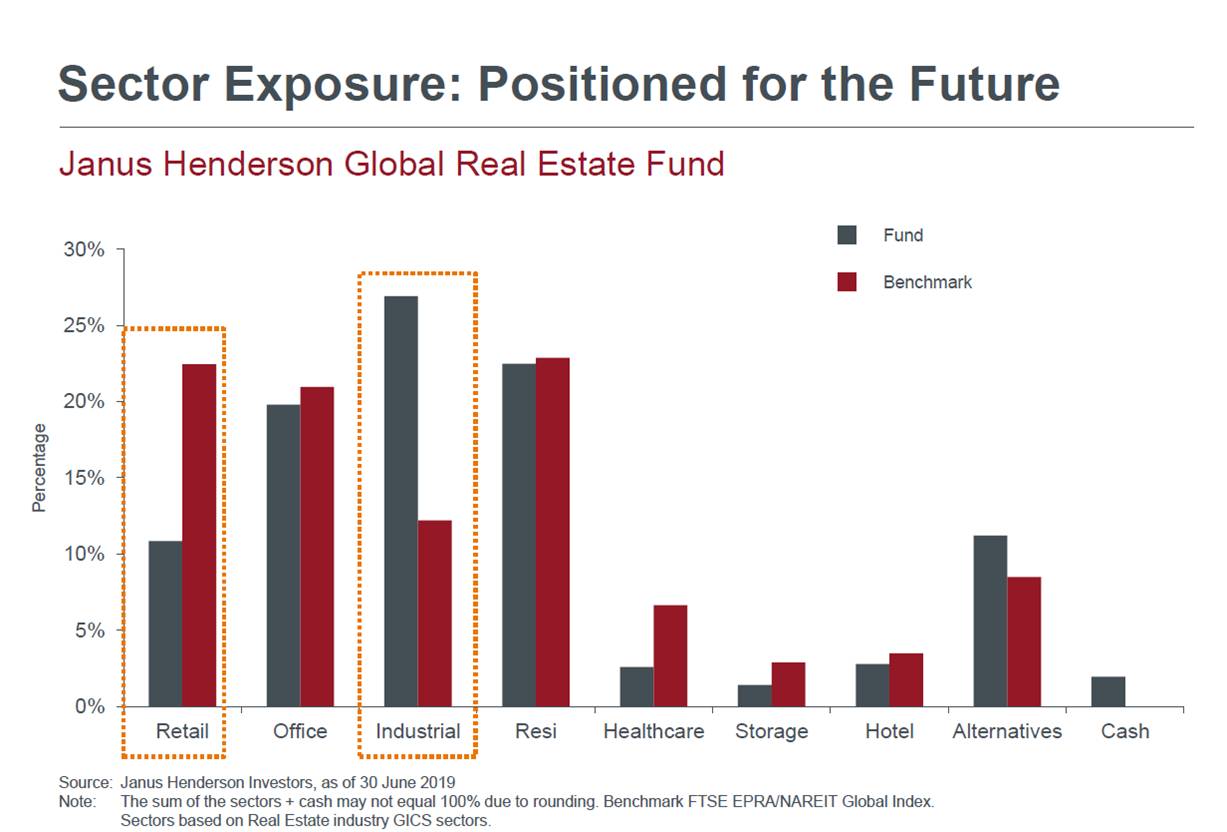

The master fund also has regional real estate specialists seeking and selecting quality assets with growth potential. Currently, the master fund weighs its investment in logistics, warehouse and data center businesses which are expected to grow in response with the technological changes giving impacts to retail business. Thus, consumers turn to shop more online, while service providers need more rental space for storage. The master fund is still searching for investment opportunities in assets which have been recovering in regions. Examples are residential projects in Australia, and offices for rent in Singapore, Sweden and Paris. The master fund will reduce its investment weight in businesses with likely less growth such as residential projects in Singapore where the Singaporean government has a tax measure to limit foreigners' holding of properties, and offices for rent in England where receives impacts from Britain exit (Brexit). So far, the master fund has 50-60 outstanding assets worldwide in its investment portfolio.

Mr. Kiattisak added that both fund normally hedges fully against exchange rate risk. From 1 October 2019 onward, both funds will have Class A: no dividend payment; and Class D: dividend payment. Investors will be able to make unit switching of these funds without fee.

Disclaimer

-

This document is produced for general information based on the trustworthy source of information, but the Management Company does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

-

Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance. Investors should seek advice before making an investment decision.

-

KFGPROP and KFGBRAND may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal.

-

KFGPROP and KFGBRAND may enter into a currency swap within discretion of fund manager which may incur transaction costs. The increased costs will reduce overall return. In absence

of a currency swap, investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

-

KFGBRAND concentrates its investment in specific industry section. Therefore, the investors may incur a substantial loss of investment.

For more information or request for fund prospectus, please contact:

Krungsri Asset Management Company Limited

Tel 0 2657 5757 | www.krungsriasset.com

or Bank of Ayudhya PCL. / Selling agents

Back