Promotions/Fund Highlight

KFPCD-UI Unlock Opportunity for Superior Returns in Private Credit.

IPO: 2 - 9 July 2024.

KFPCD-UI ... Access the superior opportunity of Private Credit.

Unveil an alternative offering of returns that does not rely only on traditional fixed income options.

For Ultra High Net Worth (UHNW) investors, investing in traditional fixed income instruments might not enhance an opportunity to achieve the higher returns. Private Credit, the private asset - fixed income category, can be the answer since it has been the alternative source of private funding for private companies that tends to generate higher returns with better risk diversification of total portfolio.

KFPCD-UI invests in BlackRock Private Credit Fund.

- The master fund has delivered the outstanding historical returns over the long term on lower volatility, as managed by BlackRock, the long-established private credit market leader for more than 23 years.

- The fund has sought to deliver higher returns than other fixed-income instruments listed on market and generate consistent cash flow for investors.

- Focus investing on secured instruments holding the first lien on debts and having restrictive financial requirements.

- Focus on transactions carrying floating interest rates, resulting in restricted impacts arisen from changes in interest rates.

KFPCD-UI IPO during 2 – 9 July 2024.

Minimum initial subscription: 100,000 Baht | Minimum subsequent subscription: 500 Baht .

Not for retail investors. Mutual fund for institutional investors and ultra high net worth Investors only. High risk or complex fund. This Fund has no investment risk limit as general mutual funds; therefore it is suitable only for investors who can accept high degree of loss.

Why Private Credit and why now?

1. Opportunity to generate higher returns than traditional fixed income instruments.

Private Credit is an alternative source of private funding provided by non-bank investors. Lenders will likely get the higher interest rates than the ones offered by traditional banks and can ask for secured collaterals and set conditions for risk protection.

2. Opportunity to diversify portfolio risk especially during the period of high volatility in Public Market (Equities Market and Fixed Income Instruments)

Private Credit has an opportunity to generate steady income stream through interest payments and has been shown to have a low correlation to public markets, both equities and fixed income instruments. Thus, returns from Private Credit will likely be more resilient than equities or fixed income markets, helping create more balance in investment portfolio.

3. Direct Lending: The most popular strategy.

Direct Lending is typically a form of senior debt financing to small and mid sized companies (with enterprise values between$100million and $2.5billion) that focuses on investing in secured instruments carrying floating interest rates with a preference for first lien loans with some second and Emphasis on loans structured with real covenants. Key advantages of Direct Lending can be described below:

- Opportunity for the higher yield than that in the public credit market due to increased risk premiums.

- Negotiating power and resiliency help create a better protective shield for investors.

- An opportunity to diversify portfolio risk especially during the period of high market volatility.

- Outstanding historical returns over the long term on lower volatility.

Source: Morningstar, Cliffwater Direct Lending Index, St. Louis Fed, Blackrock as of 30 Sep. 23. | Performance shown for illustrative purposes only and does not reflect the related fees or expenses. | Chosen period in the left aims to display the performance after volatility during Covid period. | 1 - Bank Loans referred to the S&P/LSTA Leveraged Loan Total Return Index. | 2 - High Yield referred to the Bloomberg US Corporate High Yield Total Return Index . | 3 - Direct Lending referred to the Cliffwater Direct Lending Index. | Index inception of Cliffwater Direct Lending Index is 30 Sep. 2004.

Why KFPCD-UI?

1. Quality of master fund managed by BlackRock

Source: Morningstar, Cliffwater Direct Lending Index, St. Louis Fed, Blackrock as of 30 Sep. 23. | Performance shown for illustrative purposes only and does not reflect the related fees or expenses. | Chosen period in the left aims to display the performance after volatility during Covid period. | 1 - Bank Loans referred to the S&P/LSTA Leveraged Loan Total Return Index. | 2 - High Yield referred to the Bloomberg US Corporate High Yield Total Return Index . | 3 - Direct Lending referred to the Cliffwater Direct Lending Index. | Index inception of Cliffwater Direct Lending Index is 30 Sep. 2004.

Why KFPCD-UI?

1. Quality of master fund managed by BlackRock

- One of experienced leaders in Private Credit market with more than 23 years of experience with more than US$ 40,000 million of deployed in the market with over 1,012 deals..

- BlackRock's Direct Lending strategy has a proven track record of generating solid returns.

- A popular investment partner in the area of strategic source of funds with a power of expansive private markets team and network to access and seek the high-potential deals.

Source: Blackrock as of 31 Dec 2023. | The number of deals and investment value are information from 21 Jun 2000 to 31 Dec 2023 which include all transactions in various funds and accounts managed by Tennenbaum Capital Partners, LLC (TCP) (acquired by BlackRock in 2018) and the investment management team in BlackRock’s U.S. Private Capital group.

2. Outstanding Characteristics of BlackRock Private Credit Fund

Remark: 1 – Yield to maturity information referred to the investment of BlackRock Capital Investment Advisors (“BCIA”) made into BDEBT as of 31 Dec. 23. | 2 – Source: BlackRock as of 31 Mar. 24. Senior secured investments are typically secured by real assets, intangible assets, and enterprise value, and consist of 1st and 2nd lien positions provide repayment priority in the event of default. | 3 - Floating rate investments typically provide adjustable coupons that increase when interest rates rise and provide floors when they decline. Investment proportion figures referred to BlackRock as of 31 Mar. 24. | The figures shown relate to current information of the fund and does not guarantee the future portfolio.

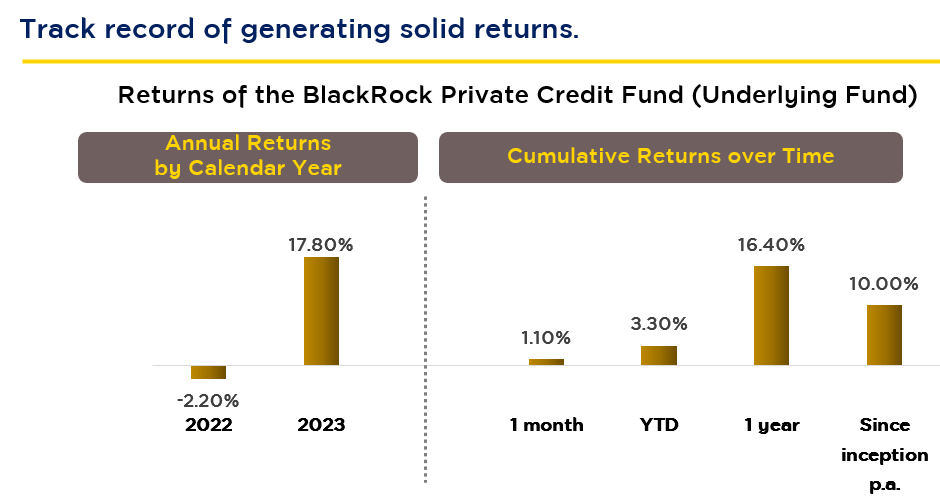

3. Performance of the Underlying Fund

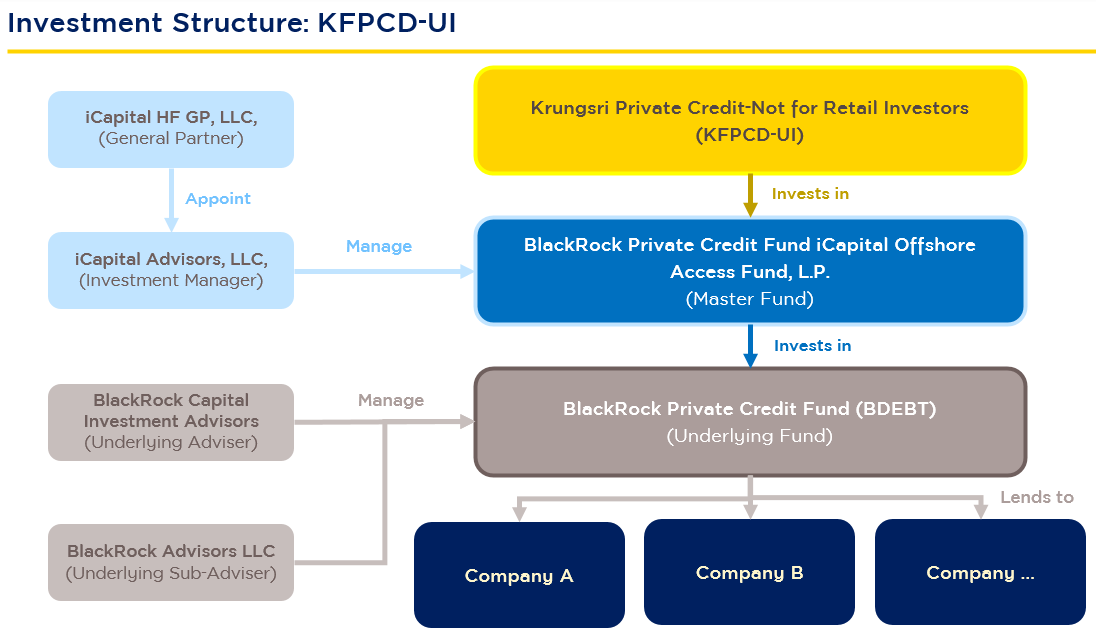

KFPCD-UI will invest in the BlackRock Private Credit Fund (Underlying Fund) and through BlackRock Private Credit Fund iCapital Offshore Access Fund, L.P. (Master Fund)

Source: BlackRock as of 31 Mar 24. | The information displayed is the net returns that are calculated from the changes in price of the investment unit during the specified period plus the dividend per share and divided by the net price of investment unit per share at the beginning of the period. | The returns displayed herein are based on the financial statements pending certification of the auditor and are net of the total expenses of the Underlying Fund which include general administrative expenses, transaction related expenses, management fee, performance-based fee, and specific fees of each share class, but excluding the impacts of redemption of investment units with less than 1 year of holding period. | The Fund was launched on 1 Jun 22. | The returns for a period of less than 1 year are time-weighted returns. | KFPCD-UI will invest in BlackRock Private Credit Fund (the Underlying Fund) through BlackRock Private Credit Fund iCapital Offshore Access Fund, L.P. (the Master Fund). | Although almost all of the Master Fund’s returns depend on the returns on investment in the Underlying Fund, the returns of the Master Fund do not equal the returns of the Underlying Fund. The costs and expenses of investment of the Master Fund (including various fees) will result in the returns of the Master Fund being lower than those of the Underlying Fund. Besides, there are also a number of other factors that may cause a deviation between the returns of the Master Fund and the Underlying Fund. | The fund performance displayed above is the performance of the Underlying Fund which is not in accordance with the mutual fund performance measurement standards of AIMC.

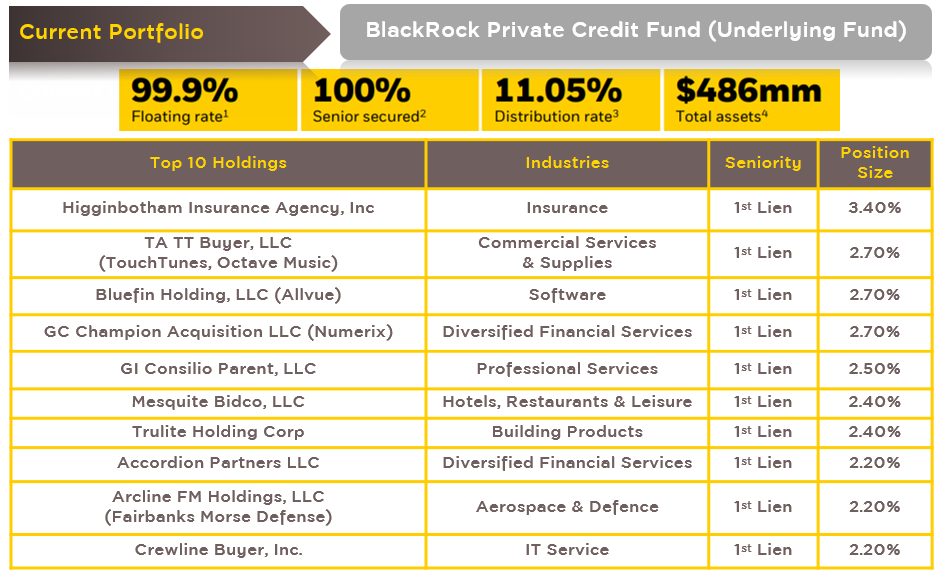

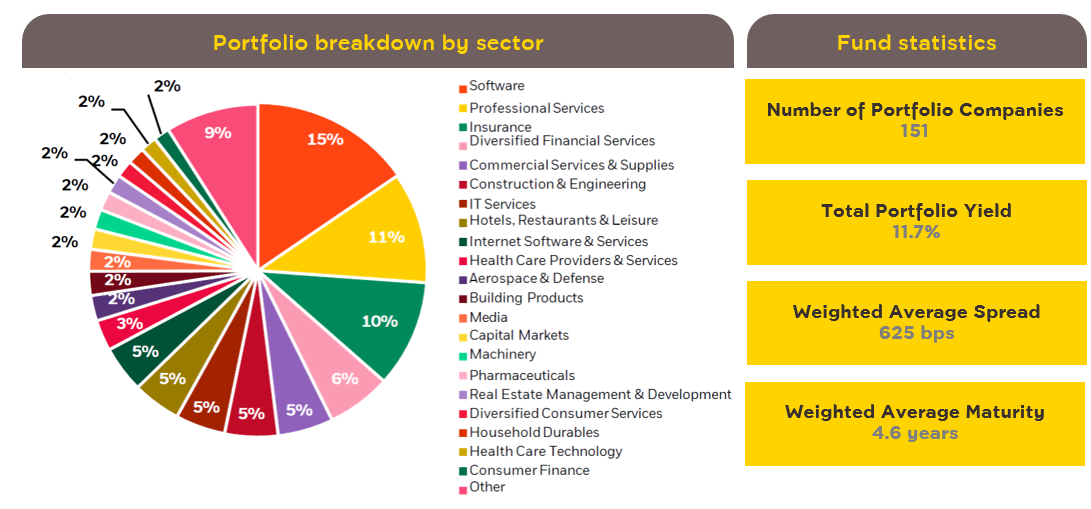

Portfolio of the BlackRock Private Credit Fund (Underlying Fund)

Source: BlackRock as of 31 Mar 24. | The information displayed is the net returns that are calculated from the changes in price of the investment unit during the specified period plus the dividend per share and divided by the net price of investment unit per share at the beginning of the period. | The returns displayed herein are based on the financial statements pending certification of the auditor and are net of the total expenses of the Underlying Fund which include general administrative expenses, transaction related expenses, management fee, performance-based fee, and specific fees of each share class, but excluding the impacts of redemption of investment units with less than 1 year of holding period. | The Fund was launched on 1 Jun 22. | The returns for a period of less than 1 year are time-weighted returns. | KFPCD-UI will invest in BlackRock Private Credit Fund (the Underlying Fund) through BlackRock Private Credit Fund iCapital Offshore Access Fund, L.P. (the Master Fund). | Although almost all of the Master Fund’s returns depend on the returns on investment in the Underlying Fund, the returns of the Master Fund do not equal the returns of the Underlying Fund. The costs and expenses of investment of the Master Fund (including various fees) will result in the returns of the Master Fund being lower than those of the Underlying Fund. Besides, there are also a number of other factors that may cause a deviation between the returns of the Master Fund and the Underlying Fund. | The fund performance displayed above is the performance of the Underlying Fund which is not in accordance with the mutual fund performance measurement standards of AIMC.

Portfolio of the BlackRock Private Credit Fund (Underlying Fund)

- Invest mainly in Core Middle Market companies which are mid-cap companies with many interesting aspects: Lender has higher negotiating power and can consequently stipulate the provisions that better protect investors, higher spread premium than large companies, lower debt ratio than large companies, and a track record of higher returns comparing to risks

Source: BlackRock as of 31 Mar. 2024 ● All$ are in U.S.Dollars.

- Diversify portfolios across different companies and industries by focusing on sectors that (1) Are Non-cyclical or the companies whose underlying businesses are slightly disrupted by economic cycles, (2) Achieve recurring earnings that focus investing on senior-lien secured instruments.

Source: BlackRock as of 31 Mar. 24.

1 Investing in floating rate instruments will cause the coupon rates to vary according to changes in interest rates.

2 Investments in non-subordinated instruments are usually secured by tangible assets, intangible assets and business value, which consist of first.

3 Distribution rate is calculated based on the latest average annual dividend rate per share divided by total asset value. It is not a guarantee for future performance and there may be sources of funds other than the cash flows received from investments. However, from the inception date of the Fund to the present date, all dividends of the Fund are derived from the cash flows received from investments.

4 Asset value calculated at fair price according to the GAAP standards based on the valuation guidelines as specified in the Prospectus.

The information of top 10 holdings is based on the highest fair value securities in the investment portfolio of BDEBT. | The above information is for illustrative purposes only. It is not intended to serve as investment advice and does not guarantee that the investment will generate profits. | The information displayed herein does not represent all securities or transactions of the Fund.

Source: BlackRock as of 31 Mar. 24.

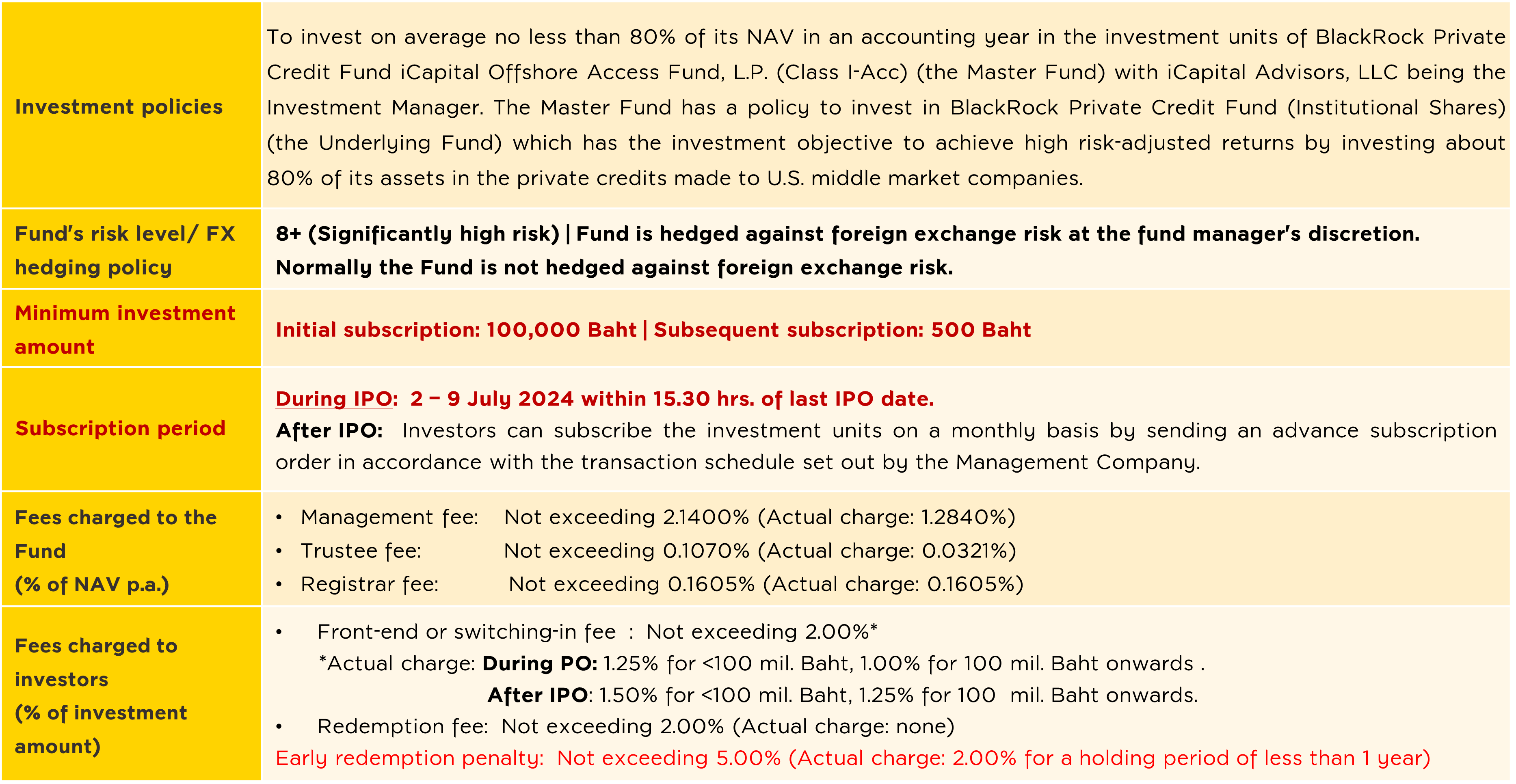

Fund Information: KFPCD-UI

For more information or a request for Fund Prospectus, please contact :

Krungsri Asset Management Company Limited | Tel. 02-657-5757 press 02.

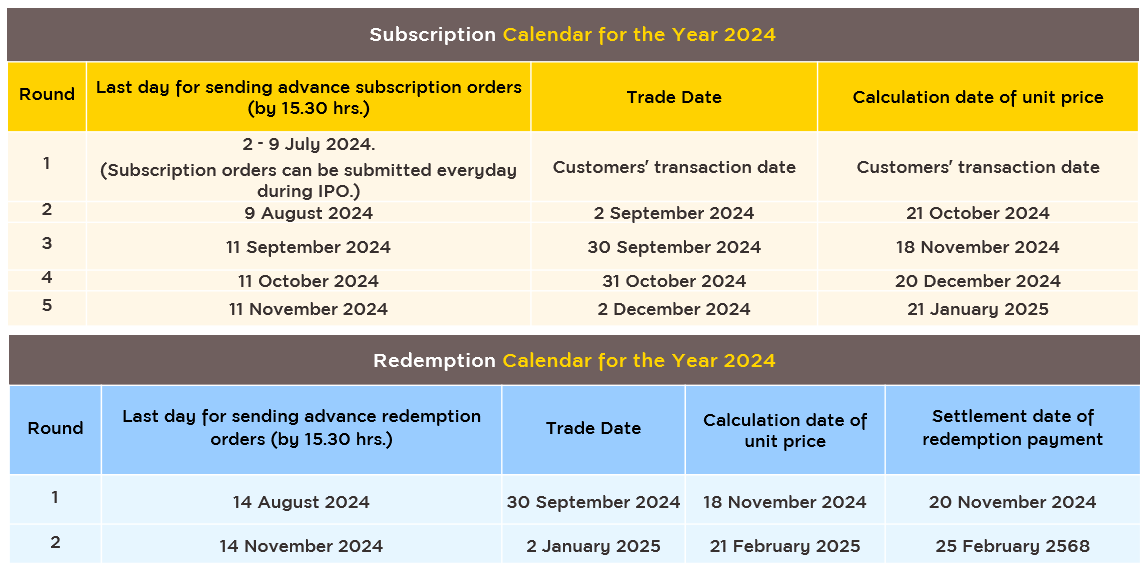

Fund's Dealing Calendar for Year 2024  The Management Company reserves the right to change the above schedule in the future at its discretion, for example, when the Master Fund changes the dealing date and/or time of investment units, etc. In this regard, the Management Company shall give an advance notice to investors via the website of the Management Company.

The Management Company reserves the right to change the above schedule in the future at its discretion, for example, when the Master Fund changes the dealing date and/or time of investment units, etc. In this regard, the Management Company shall give an advance notice to investors via the website of the Management Company.Who are Ultra High Net Worth (UHNW)? Ultra High Net Worth (UHNW) are investors that have knowledge or experience in investment and carry a financial position is in accordance with the regulations to thrive in high risks and volatility from investments. This type of investor is able to invest in the significantly high-risk product such as UI fund (Ultra Accredited Investor Mutual Fund) and non-rated Thai Perpetual Bond, etc.

Financial Status Requirements

(either one qualified) |

Knowledge or Experience Requirements*

(either one qualified) |

Individual investors

- Annual income of > Baht 6 million.

- Investments* when excluding deposits of > Baht 15 million or > Baht 30

million when including deposits.

- Net assets** of > Baht 60 million.

Juristic Investors

- Shareholder’s equity shall be of > Baht 150 million/ year.

- Investments*when excluding deposits of > Baht 30 million or investments including deposits of > Baht 60 million.

*Direct investments in securities or futures

**Excluding the value of any property used as the main residence of such person. |

- Have past experience in investment in Risk Assets on a regular and continuous basis.

- Have experience in working in financial and investment management.

- Have sufficient knowledge and understanding on the securities to be invested.

- Be an Investment Consultant or an Investment Planner approved by the Office of the SEC.

- Possess certificate of one of the following courses: CFA, CISA, CAIA, CFP or any course stipulated by

the Office of the SEC

*หลักเกณฑ์ความรู้หรือประสบการณ์จะเป็นไปตามดุลพินิจของผู้ให้บริการแต่ละราย |

Source: Translation of the original source as shown below:

https://www.smarttoinvest.com/Pages/Investment%20Knowledge/infog_investors_definition.aspx Important Disclaimers of the Fund

- Krungsri Private Credit Fund-Not for Retail Investors (KFPCD-UI) invests primarily in BlackRock Private Credit Fund iCapital Offshore Access Fund, L.P. (the Master Fund) which has a policy to invest in BlackRock Private Credit Fund (Institutional Shares) (the Underlying Fund), under the management of BlackRock Capital Investment Advisors, LLC (Investment Advisor) and BlackRock Advisors, LLC (Sub-Advisor), which has an investment policy to generate high risk-adjusted returns by investing approximately 80% of its asset value in private credits in the form of originated loans, syndicated loans, senior secured or unsecured loans, subordinated loans, mezzanine loans or any other loans extended to non-listed U.S. middle market companies, with a preference for floating-rate debt which provides flexibility to adapt to changing market conditions.. The Underlying Fund may also invest in equity or equity related instruments including common shares and preferred share, convertible securities and share warrants. Such investment policy involves greater risks than general mutual funds and has low liquidity, which may cause investors to lose their investment principal or fail to receive the investment returns as expected. This Fund is therefore suitable for investors who have good understanding in this type of securities and can accept high level of risk.

- The Master Fund was established as a Cayman Islands exempted limited partnership and was categorized as a private fund under the private fund regulations of the Cayman Island which do not provide protection for retail investors. The Fund is therefore suitable only for high net worth investors or institutional investors who can accept very high level of risk.

- The Underlying Fund is a Delaware statutory trust under the laws of the State of Delaware, USA and is regulated as a business development company (“BDC”) under the Investment Company Act of 1940. It is suitable only for institutional investors or high net worth investors who have high level of investment knowledge and experience.

- The Master Fund was launched on 2 August 2022 and the Underlying Fund was launched on 23 December 2021. Both funds have a relatively short history of operations and therefore provide limited information of historical performance to support the making of investment decision.

- Although almost all of the Master Fund’s returns depend on the returns on investment in the Underlying Fund, the returns of the Master Fund do not equal the returns of the Underlying Fund. The costs and expenses of investment of the Master Fund (including various fees) will result in the returns of the Master Fund being lower than the Underlying Fund. Besides, there are also a number of other factors that may cause a deviation between the returns of the Master Fund and the Underlying Fund.

- The personnel of the Master Fund and the Underlying Fund may not spend all of their time managing the Master Fund and the Underlying Fund. Some of the time may be allocated to manage other parts of the business as assigned that may be related or unrelated to the Master Fund and the Underlying Fund, resulting in a conflict of interest in terms of management time and the provision of services of the Master Fund and the Underlying Fund to investors in the Master Fund and the Underlying Fund.

- The General Partner, Investment Manager, Investment Advisor and affiliated companies may assume the responsibility of a general partner, investment manager, investment advisor or commodity pool operator or any other responsibility for other clients or funds that may have similar or different investment policy to the Master Fund and/or the Underlying Fund. In addition, other funds that are managed or advised by the General Partner, Investment Manager, Investment Advisor and affiliated companies may invest in the Master Fund and/or the Underlying Fund or any other funds managed or advised by the Investment Advisor of the Underlying Fund. The investment policies or conditions of such funds may be similar to or different from those of the Master Fund, resulting in competition in the investment of the Master Fund and/or the Underlying Fund from other funds or clients of the General Partner, Investment Managers, Investment Advisors and affiliated companies.

- Conflicts of Interest Arising from the Underlying Fund and the Investment Manager of the Underlying Fund:

- BlackRock, the Investment Advisor of the Underlying Fund, and affiliated companies (collectively referred to as “BlackRock Entities”) provide the services of investment management, risk management and investment advisory to retail investors and institutional investors around the world and therefore involve in a number of activities related to investment in multiple asset classes. Although these activities under the BlackRock Entities provide good investment opportunities and services to clients, they may also cause conflicts of interest between clients and the Underlying Fund or the Master Fund.

BlackRock Entities manage investment for a wide range of clients around the world whose investment portfolios may have similar or different investment policies as the Master Fund and the Underlying Fund. Allocating investments to each client may create a conflict of interest, especially when the investment opportunities are limited.

The calculation of fair value of the Master Fund is mainly based on the monthly NAV of the Underlying Fund. The securities invested by the Underlying Fund will be valued by the Investment Advisor of the Underlying Fund. Such actions may create a conflict of interest with inflated valuations to facilitate higher management fees and performance-based compensations.

- In order to ensure fair and equitable investment allocation and expense allocation in each client's investment portfolio, BlackRock has established an Allocation Policy as a guideline for investment management.

- The Master Fund and the Underlying Fund have limited liquidity because they are investments in private securities which are less liquid than listed securities. In addition, the Underlying Fund is not listed on the stock exchange and has no plan to be listed on any stock exchange. Furthermore, the investment units of the Master Fund cannot be transferred freely without the prior consent of the General Partner, therefore, the Master Fund and the Underlying Fund are only suitable for long-term investors who do not urgently need to use the money from this investment.

- The Underlying Fund may borrow for investment purposes with a target leverage of about 100%-125% of the debt-to-equity ratio, while such transactions can be carried out at a maximum rate of 200% of the debt-to-equity ratio under the Investment Company Act of 1940. Such leverage has an objective to enhance the opportunity to generate good returns on investment, but at the same time also increases the risk of the Underlying Fund and may lead to an increase in losses.

- The Underlying Fund invests in non-investment grade debt instruments or unrated securities which will be rated below the investment grade if a credit rating is applied. In addition to the default risk, such securities also have low liquidity and the difficulty in assessing the fair value of the instrument.

- The Underlying Fund may invest in collateralized loan obligations (CLOs) which involve high default risk and is therefore riskier than investing directly in other debt instruments or securities.

- Although the Underlying Fund emphasizes the loans with higher collateral value, it is still at risk of loss. In addition, the Underlying Fund may invest in unsecured loans under some circumstances, resulting in the Underlying Fund being exposed to higher risk.

- The Underlying Fund has concentrated investment in the United States. Therefore, investors should also consider diversifying risks of their own investment portfolio. The Underlying Fund invests in private securities that are not traded on the stock exchange or in some cases, although trading of such securities are accommodated by private secondary market places, the prices obtained from secondary market cannot be instantly used to determine the fair value if no trading is taken place in the secondary market. Although there is a fair valuation policy as a practice guideline to ensure consistency of operations and an independent external appraiser is commissioned to support consideration, the final valuation and decision is made by the Advisor of the Underlying Fund who is assigned by the Board of Trustees. The fair valuation of securities depends on a number of factors, the Advisor of the Underlying Fund cannot give assurance that the information used in the valuation is complete, accurate and precise, which may cause the valuation of securities to be higher or lower than the reasonable value.

- The Underlying Fund charges the performance-based compensation in addition to the management fee for the Investment Advisor of the Underlying Fund. Such performance-based compensation may result in the Investment Advisor of the Underlying Fund choosing to invest in more risky assets than normal in the expectation of a larger amount of performance-based compensation. In addition, such performance-based compensation is calculated based on both realized and unrealized gains of the Underlying Fund at that time, the investors redeeming the investment units may redeem at a price derived from the calculation of an inflated performance-based compensation because the unrealized gains at that time are higher than the actual gains. In this regard, the Underlying Fund and the Master Fund will not make a compensation for any discrepancy to the investors who have already redeemed the investment units.

- The Master Fund and/or the Underlying Fund may not accept redemption of investment units in any quarter when the Underlying Fund has the available and undrawn leverage below 25% of its NAV in the previous quarter. Furthermore, the Master Fund and/or the Underlying Fund may in each quarter impose a redemption gate of not exceeding 5% of the NAV or outstanding number of investment units of the previous quarter, or may restrict the redemption of investment units for any reason whatsoever at the discretion of Master Fund and/or Underlying Fund without prior notice. The right to redeem the investment units is therefore subject to significant restrictions and there is no guarantee that the Master Fund and/or Underlying Fund will be able to process the redemption as per order.

- Although the Master Fund is an investor in the Underlying Fund, investor in the Master Fund is not an investor in the Underlying Fund and accordingly cannot exercise the enforcement right or make any claims against the Underlying Fund. Investor in the Master Fund can only exercise its rights according to the agreements stipulated in the Partnership Agreement and the Memorandum of the Master Fund.

- KFPCD-UI has limited liquidity because it is not open for daily trading like general open-ended funds. The Fund will accept redemption of investment units once a quarter and may be able to accept only partial redemption or refuse the redemption of all investment units in any or several consecutive quarters subject to the restrictions of the Master Fund and/or the Underlying Fund and or the discretion of the Fund Manager of KFPCD-UI. Investors should have an understanding before investing that the right to redeem their mutual fund units is subject to significant restrictions and there is no guarantee that the Master Fund or the Underlying Fund will be able to process the redemption as per order.

- KFPCD-UI charges an early redemption/early switch-out fee for redemption of investment units held less than 1 year based on a First-in, First-out (FIFO) method, from the trade date of subscription to the trade date of redemption, at the rate of 2% of the redemption value. In this connection, KFPCD-UI will pay the redemption proceeds at the rate of 98% of the redemption value to the unitholders sending the redemption order and allocate such penalty fees to KFPCD-UI. Such practice guideline is determined to ensure consistency with the Master Fund and the Underlying Fund and may discretionarily change without prior notice.

- KFPCD-UI is offered for subscription once a month and may be able to accept the subscription orders only partially or may refuse the total subscription amount or may change any of the conditions in accordance with the requirements and discretion of the Master Fund and/or the Underlying Fund and/or the discretion of the Fund Manager of KFPCD-UI. Investors or unitholders may not be able to invest in KFPCD-UI in the investment amount as desired or may not be able to make regular investment. In the case where the subscription transaction is totally rejected or processed partially, the Management Company shall return the subscription payment that is rejected by the Management Company or overpaid by the investors without paying any interest or compensation.

- In sending the subscription order, investors have to send the subscription orders together with the subscription payment in advance of the trade date of each round in accordance with the announcement of trade dates specified by the Management Company, and cannot cancel such transaction. The subscription orders will be processed on the trade date which is the last day of each month and investors will be allocated the investment units after the Fund has calculated the NAV for that round which will be calculated and announced within 62 days from the last dealing day of the month or later depending on the Master Fund and the Underlying Fund. Accordingly, the period from sending of the subscription order together with payment to the calculation of the NAV per unit, investors will not be allocated the additional investment units until the NAV per unit of the Fund has been calculated and announced.

- KFPCD-UI has a requirement of receiving advance subscription and redemption orders for a long period before the actual trade date. The trade date for redemption is the last dealing day of each quarter while the trade date for subscription is the last dealing day of each month. Such trade dates may change at the discretion of the Master Fund and the Underlying Fund. Furthermore, KFPCD-UI calculate its NAV on a monthly basis by calculating and announcing the NAV within 62 days from the last dealing day of each month or later than that depending on the decision of the Master Fund and the Underlying Fund. These requirements are determined according to the practice guidelines of the Master Fund which are different from general mutual funds. Investors should study the announcement of the trading date of investment units as specified by the Management Company in detail before making investment decision.

- Sending an advance transaction order for a long period where the investors or unitholders cannot know the NAV of the Fund on the date of sending such transaction order will cause these investors or unitholders to bear the risk that the Fund’s NAV may fluctuate significantly during the period between the date of submission of the transaction order and the trade date for processing the purchase or redemption of investment units as per order.

- KFPCD-UI may execute automatic redemption of investment units based on the discretion of the Fund Manager without prior notice. The automatic redemption will result in the decrease of remaining investment units of the unitholder.

- Normally the Master Fund will pay the redemption proceeds to investors in cash payment. However, under some circumstances, the Master Fund may make redemption payment in the form of investment units of the Underlying Fund or any other securities to KFPCD-UI in lieu of cash payment which causes KFPCD-UI to incur expenses arising from receiving the investment units or any other securities from the Master Fund or the Underlying Fund and may also result in the unitholders of KFPCD-UI being unable to receive cash from the redemption payment. The in-kind payment for the redemption of investment units may have restrictions on transfer or resale of assets especially the illiquid securities of companies in which the Underlying Fund invests, which may cause a significant burden on operations. Additionally, direct ownership of certain types of assets may subject the holder to compliance with the litigation guidelines or tax laws of the state in which those assets are located.

- The Master Fund may request the personal information and documents of the investors in KFPCD-UI to verify their identity in compliance with the regulations on anti-money laundering or any other regulations of the Master Fund. The Master Fund has the right to refuse to accept or cancel the subscription orders received and return the investment amount without any interest or compensation to any investor who refuses to cooperate in providing the information and documents as requested by the Master Fund. In addition, the Master Fund may refuse or delay the payment of the redemption of investment units or the dividends allocated to KFPD-UI or any unitholder in KFPCD-UI where the Master Fund has reason to believe that the payment to such investors may cause the Master Fund to commit a violation of the Anti-Money Laundering Law or any other relevant regulations.

- KFPCD-UI has an unlimited duration but it may terminate the Mutual Fund Project or take any of the actions in accordance with the terms and conditions of the Mutual Fund Project if the Master Fund requests a mandatory redemption of some or all of the investment units held by KFPCD-UI, based on the discretion of the Master Fund and the Underlying Fund. In this connection, KFPCD-UI as an investor cannot make any claims.

- The Master Fund has full rights and power under the relevant laws to make changes, amendments or additions to the provisions of the Master Fund without having to seek prior consent of the investors, similar to the Underlying Fund which has full rights and power under the relevant laws to make changes, amendments or additions to the terms and conditions of the Underlying Fund without having to seek prior consent of the Master Fund. Accordingly, such changes, amendments or additions, whether from the Master Fund or the Underlying Fund, may inevitably affect KFPCD-UI and unitholders.

- BlackRock Private Credit Fund iCapital Offshore Access Fund, L.P. (the Master Fund), iCapital HF GP, LLC (General Partner of the Master Fund) iCapital Advisors, LLC (Investment Manager of the Master Fund), collectively referred to as "iCapital Parties"; BlackRock Private Credit Fund (the Underlying Fund), BlackRock Capital Investment Advisors, LLC and BlackRock Advisors, LLC, collectively referred to as "Underlying Fund Parties"; or any related affiliated companies are not the sponsor, manager or representative of KFPCD-UI and are not responsible for the contents contained in the fund documents of KFPCD-UI, be it the Fund’s Fact Section of the Prospectus, the Mutual Fund Project and the Fund’s Commitment, Factsheet, Sales Sheet, and any other documents of KFPCD-UI. Investors in KFPCD-UI are not deemed as investors in the Master Fund or the Underlying Fund and therefore do not have the rights or direct obligations in the Master Fund or the Underlying Fund or related parties.

- This document is prepared based on the information compiled from various reliable sources as of the displaying date. However, the Management Company cannot guarantee the accuracy, credibility, and completion of all information.

- Investors should inquire additional details from the salesperson or study the details from the Sales Sheet of the Fund.

- The Fund is hedged against foreign exchange risk at the fund manager’s discretion and therefore involves currency risk which may cause investors to experience foreign exchange losses or gains/or receive lower return than the initial investment amount.

- Investors should understand the fund features, conditions of returns and risks, before making investment decision. Past performance is no guarantee of future results.

- This Fund is a high risk or complex mutual fund, investors should seek additional advice before investing.

Back