Promotions/Fund Highlight

New RMF: Maximizing Growth Opportunities from 2 Rising-Star Stock Indexes

IPO: 21 - 27 November 2024.

New RMF to maximize growth opportunities by investing in two rising-star stock indexes.

Nasdaq-100 and Emerging Markets ex China Indexes.

KFNDQRMF: Krungsri NDQ Index RMF

- Opportunity to grow with Nasdaq-100 , a rising-star index of a decade of technologies and innovations.

KFEMXCNRMF : Krungsri Emerging Markets ex China Index RMF

- Access the leading holdings in MSCI Emerging Markets ex China where immense growth potential of emerging markets ex China are set to unleash.

IPO: 21 – 27 November 2024.

Promotion: Receive KFCASH-A units valued at 100 Baht for every 50,000 Baht investment in participating Krungsri funds in SSF/ RMF/ Thai ESG funds. (When investing according to terms and conditions only/ Please study more details at the below button*)

KFNDQRMF: Krungsri NDQ Index RMF

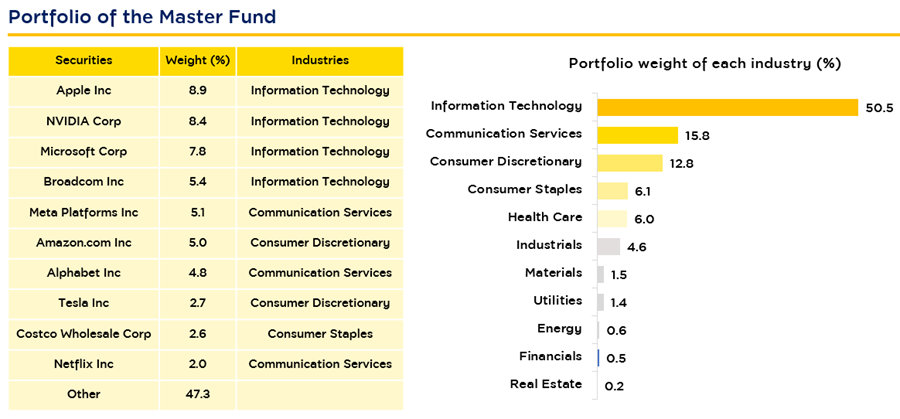

- The master fund, Invesco NASDAQ 100 ETF aims to track the performance of Nasdaq-100 index and has a high liquidity with low fees. The fund was managed by the global investment management company.

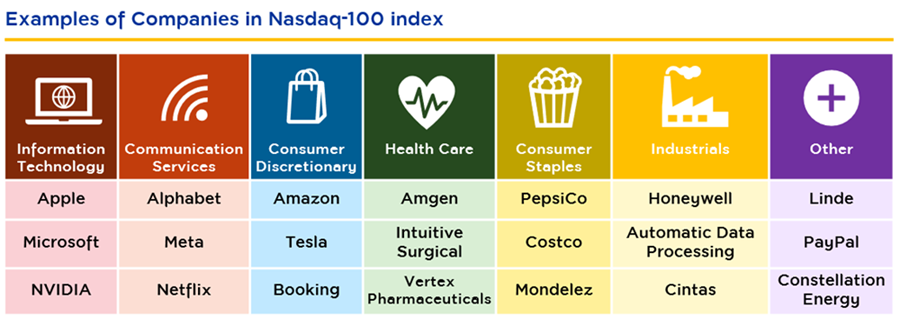

- Nasdaq-100 index has been the rising-star index in an era where technologies and innovations have become an essential factor for enhancing the efficiency and capability to generate profits in various industries, leading to tremendous investment opportunities.

What makes Nasdaq-100 Index interesting?

1. Rising stars of the future with outstanding growth potential.

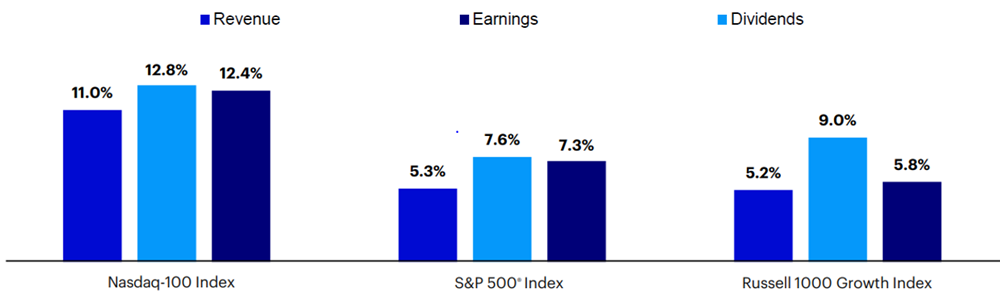

Over the past 10 years, constituent companies in Nasdaq-100 index (NDX) have been able to generate significantly higher growth in terms of revenue, net profits and dividend yields than other U.S. equity indices.

Source: Nasdaq, Invesco as of 31 Dec'23.

2. An index that represents businesses of the new world and shows a continuous growth.

EPS of the Mag 7 and non- mag 7 stocks have continued to grow boosted by increased spending by businesses on Generative AI.

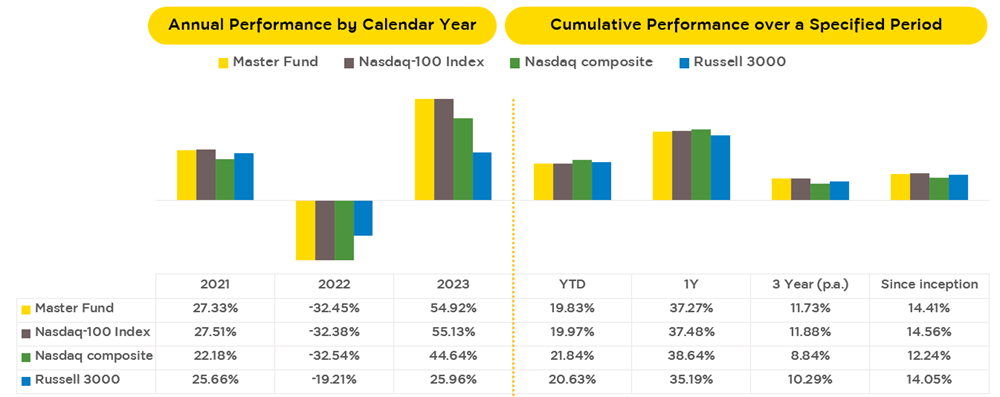

The master fund: Invesco NASDAQ 100 ETF

EPS of the Mag 7 and non- mag 7 stocks have continued to grow boosted by increased spending by businesses on Generative AI.

The master fund: Invesco NASDAQ 100 ETF

Source: Invesco as of 16 Oct'24.

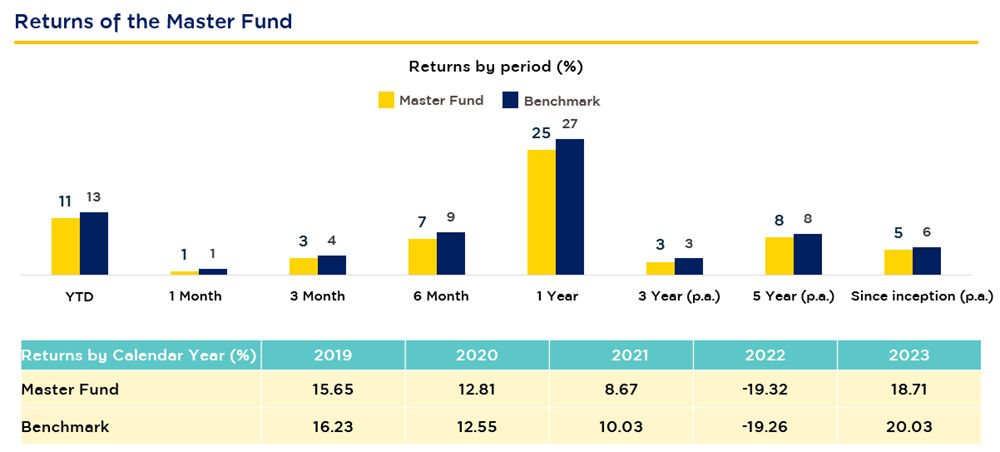

- The performance reflects the performance of the Nasdaq-100 index.

Source: Invesco, as of 30 Sep'24. | The Fund’s inception date is 13 Oct'20. | Performance of the Master Fund is based on NAV prices. | The performance displayed is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by the Association of Investment Management Companies (AIMC).

KFEMXCNRMF: Krungsri Emerging Markets ex China Index RMF

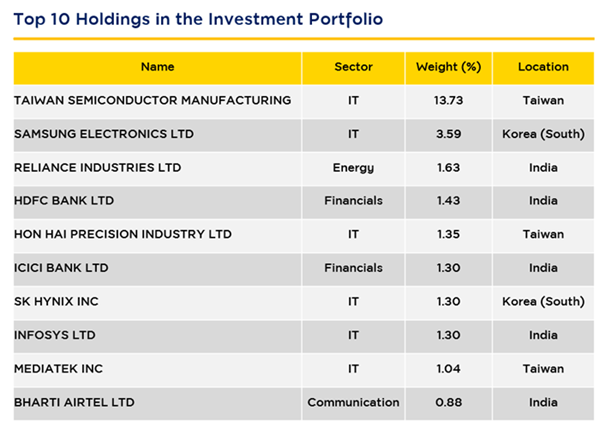

- The Master Fund, iShares MSCI Emerging Markets ex China ETF is one of the top ranked ETFs in the emerging markets in terms of fund size and trading volume.* (*With reference to https://etfdb.com/index/egai-emerging-markets-ex-china-index/ As of 16 Oct'24.)

- An investment portfolio mainly accounts for large and medium-sized stocks of emerging markets excluding China, such as India, Taiwan, South Korea, and Brazil; this helps diversifying risks and reducing the volatility stemming from investing in China’s stocks.

- Various growth potentials of each country from economic expansions:

- India: Most population are in the working age and young age group which will help enhance the growth potential of the economy as a result of premiumization. Besides, EPS growth of Indian stock market is higher than historical averages and tends to grow continuously.

- Taiwan & South Korea: A significant proportion of GDP linked with demands for AI and technologies will combine to be the driving force for Taiwan and South Korea to grow significantly in the long run. Furthermore, Taiwan is one of the major chip producers of the world.

- Brazil: As a major producer of agricultural products, Brazil is likely to benefit from the trend of deglobalization and geopolitical conflicts between great powers.

What makes Emerging Markets interesting?

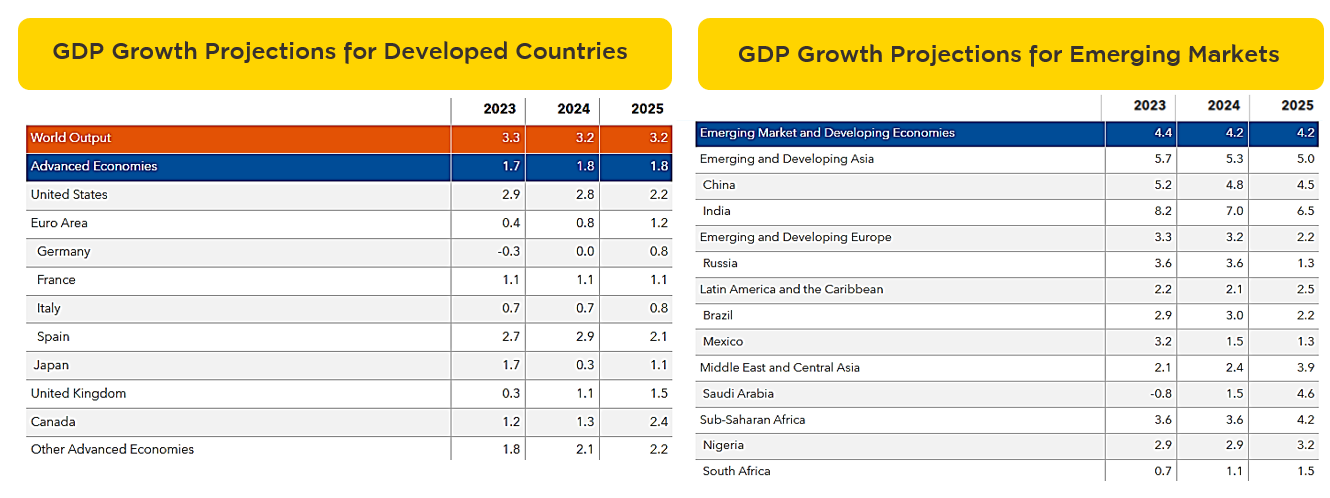

1. Emerging markets have a high level of economic expansion compared to developed countries from structural changes with respect to demographics, economic growth and the position of key production bases for AI-related and technological industries such as semiconductors, datacenters, etc.

Source: IMF as of 22 Oct'24.

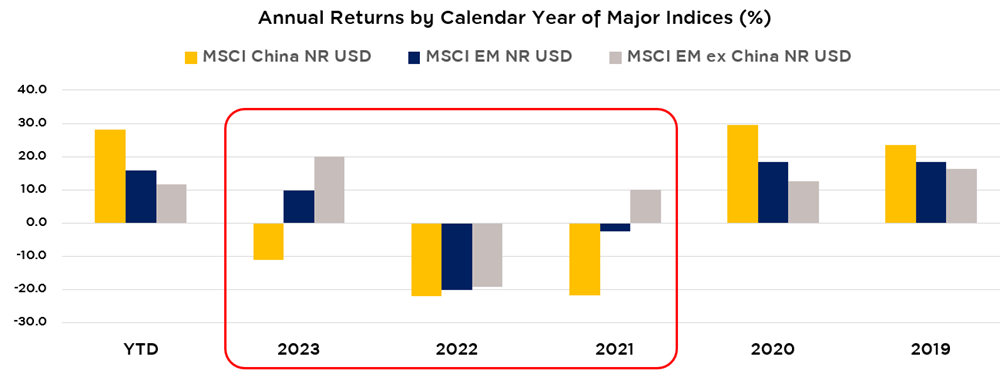

2. Valuations of stocks in emerging markets excluding China remain inexpensive compared to global stock markets and have been able to generate good returns during the period when the Chinese stock market is under pressure. Such returns reflect that other countries in the emerging markets still have potential to generate positive returns.

Source: Morningstar as of 14 Oct'24.

The master fund: iShares MSCI Emerging Markets ex China ETF

Source: iShares as of 16 Oct'24.

Source: iShares as of 30 Sep'24. | The inception date is 18 Jul'17. | The benchmark is MSCI Emerging Markets ex China Index. | The performance displayed is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of the Association of Investment Management Companies (AIMC).

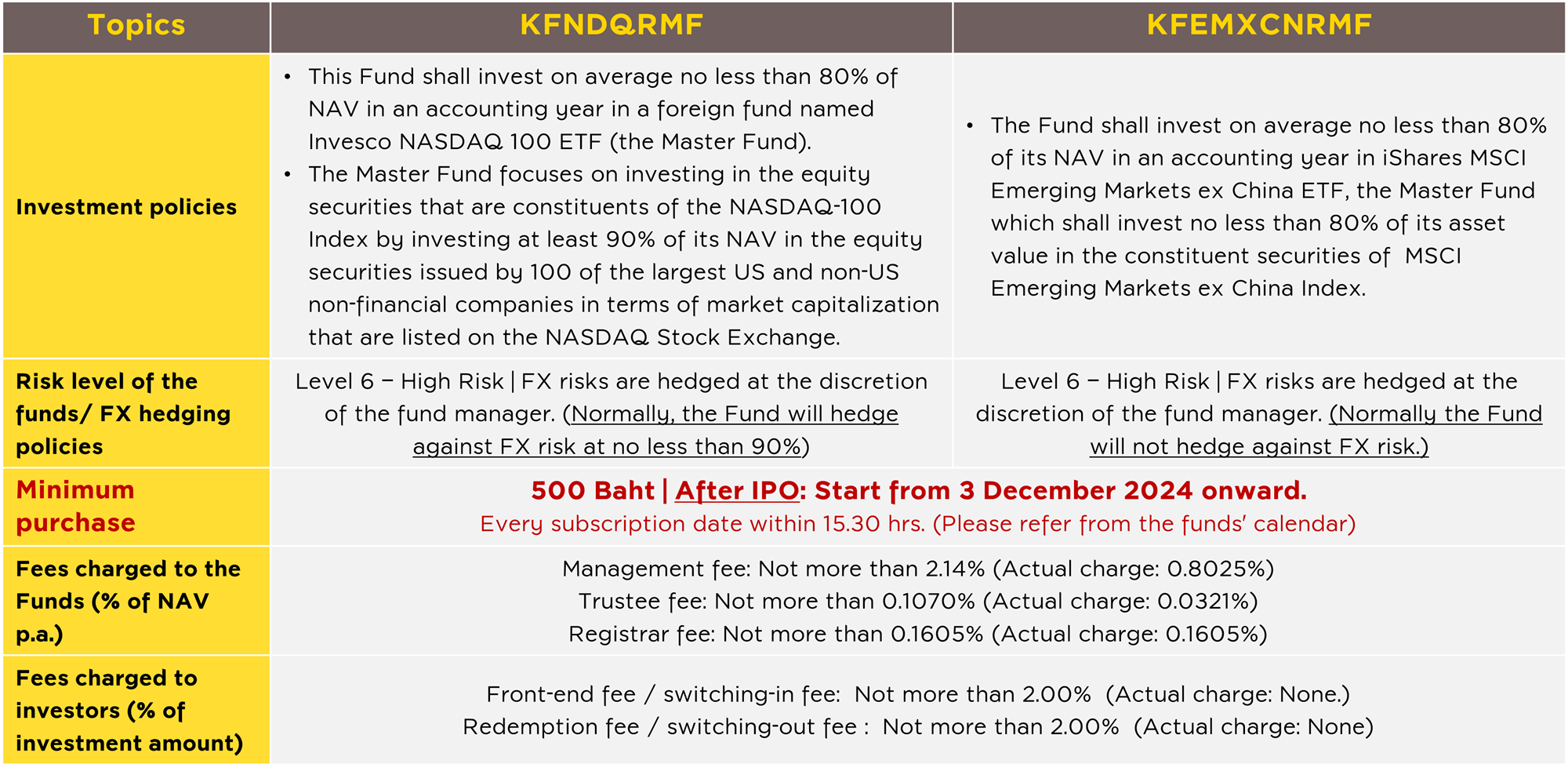

Summary of funds information: KFNDQRMF & KFEMXCNRMF

The fees charged to the Fund and/or investors are inclusive of value added tax or specific business tax or any other taxes.

For more information / request for fund prospectus, please contact Krungsri Asset Management Company Limited at tel. 0 2657 5757 | Email: krungsriasset.mktg@krungsri.com

The fees charged to the Fund and/or investors are inclusive of value added tax or specific business tax or any other taxes.

For more information / request for fund prospectus, please contact Krungsri Asset Management Company Limited at tel. 0 2657 5757 | Email: krungsriasset.mktg@krungsri.com

Disclaimer

- The RMF aims to promote long-term investment for retirement. Investors should understand the fund features, conditions of returns and risks; and study the tax benefits in the Investment Manual, before making investment decision. Past performance is no guarantee of future results. Investors should study the tax benefits stated in the Investment Manual. Unitholders in breach of investment conditions shall not be entitled to the tax benefits and must return all the tax benefits received earlier within the specified timeframe, otherwise they will be liable to a surcharge and/or fine in accordance with the Revenue Code.

- This document is prepared based on information obtained from reliable sources at the time of presentation. However, the Management Company does not provide any warranty of the accuracy, reliability and completeness of all information. The Management Company reserves the right to make changes to all information without prior notice.

- KFNDQRMF and KFEMXCNRMF have the policy to hedge against currency risk at the Fund Manager’s discretion. Therefore, they are exposed to foreign exchange risk which may cause investors to experience foreign exchange losses or gains/or receive lower return than the initial investment amount.

*Terms & Conditions for SSF/ RMF / Thai ESG 2024 Promotion

- This promotional campaign does apply only to individual investors who invest in SSF/ RMF/ Thai ESG funds managed by Krungsri Asset Management Co., Ltd. (“the Company”), except KFCASHSSF/ KFCASHRMF and any other SSF/ RMF/ Thai ESG funds 2024 according to the Company's announcement for exemption. The eligible accumulated investment amount must be proceeded during 2 Jan. - 30 Dec. 2024.

- Investors must hold investment units invested during this promotion period until 29 Mar. 2025, which is the date the Management Company will calculate the net accumulated investment for KFCASH-A units’ entitlement.

- The net accumulated investment amount consists of (1) a total investment amount of subscription and switch-in transactions from other non-SSF, non-RMF, non-Thai ESG of the Management Company and (2) transfers of SSF/ RMF/ Thai ESG from other management companies, excluding the transfers from PVD to RMF, being deducted with the total investment amount of redemption, switch-out transactions to SSF/ RMF/ Thai ESG not participating in this promotion or other fund of the Management Company, and transfers from SSF/ RMF/ Thai ESG units of the Management Company to other companies. The exception will be allowed only when the redemption, switch-out and transfer are made from the outstanding balances on 28 Dec. 2023 calculated with FIFO basis by the Management Company, according to tax benefit conditions specified by the Revenue Department.

- For investors having more than one fund account, the Management Company will count the net accumulated investment amount from all their accounts by considering the ID Card number.

- The Management Company will transfer KFCASH-A units according to the investment and entitlement conditions to investors within 30 Apr. 2025. KFCASH-A units will be calculated at its NAV price on the allocation date.

- Net eligible investment units from SSF/ RMF/ Thai ESG Regular Investment Promotion for 12 consecutive months from Jan. – Dec. 2024 will not be considered for this above-mentioned promotion.

- RMF units transferred from PVD will be eligible only for RMF-for-PVD promotion, but not for this promotion mentioned above.

- This promotional campaign is not applicable to the investments made by juristic/ institutional investors and provident funds.

- The Management Company reserves the rights to change the promotional conditions without giving prior notice. In case of any dispute, the Management Company’s decision shall be deemed final.

Conditions for subscription through credit cards

- Investors can use Krungsri participating credit cards, namely Krungsri Private Banking, Krungsri Exclusive Signature, Krungsri Signature, Krungsri Platinum Visa/ Master, Krungsri Visa/ Master, HomePro Visa Platinum Credit Card, Krungsri Lady Titanium, Krungsri Manchester United, Krungsri Doctor Card, AIA Visa, Krungsri JCB Platinum, Siam Takashimaya (all types), Krungsri NOW, Central The 1 Credit Card, Simple Visa Card, Krungsri First Choice, and Lotus's Credit Card to purchase SSF/ RMF/ Thai ESG. (except KFCASHSSF, KFAFIXSSF, KFCASHRMF, KFAFIXRMF, KFGOVRMF, KFLTGOVRMF, KFMTFIRMF, and KFGBTHAIESG, and any other SSF/ RMF/ Thai ESG in 2024 according to the Company’s announcement for exemption.)

- Any investment units from subscription will not join the credit card promotion and reward points accumulation.

- Terms and conditions in using credit cards will be as set forth by the Management Company and the Credit Card Companies.

- The Management Company reserves the right to change the conditions in subscribing the funds through credit cards without giving prior notice. In case of any dispute, the Company’s decision shall be deemed final.

- SSF is the fund to promote savings. | RMF is the fund promoting long-term investment for retirement. | Thai ESG Fund aims to promote long-term savings and encourage Thailand’s sustainable investment Investors should understand fund features, returns, risks and study tax benefits in the investment manual before making an investment decision. | Investors will not be eligible for tax benefits in an absence of compliance with investment conditions.

For KFCASH-A info, click here

For SSF/ RMF/ Thai ESG investment manuals, click here

For KFEMXCNRMF info, click

For other recommended RMF, click

For Thai ESG funds info, click

Back