Promotions/Fund Highlight

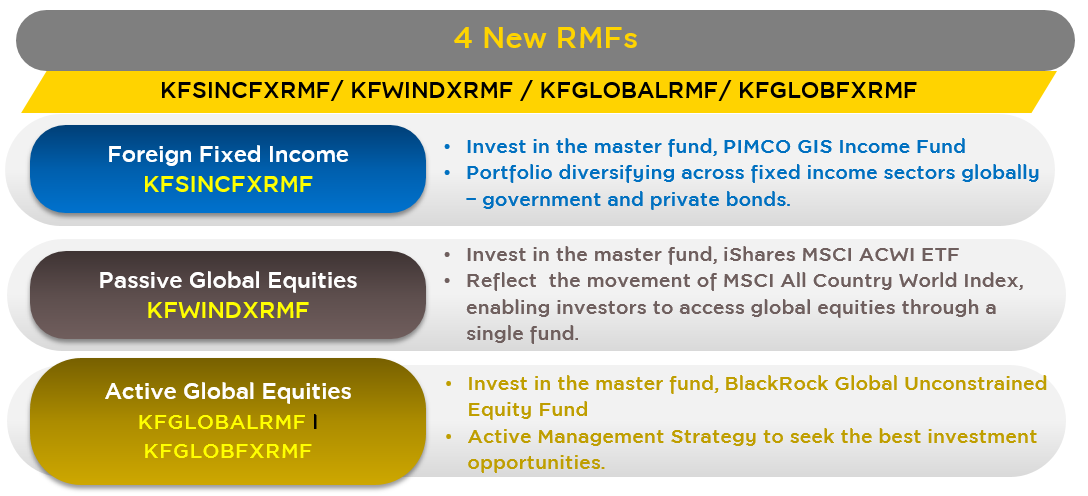

4 New Global RMF Themes: Global Fixed Income/World Index/Leading Equity Funds.

IPO: 15 - 22 Oct. 2024 with special promotion applied*

Krungsri Asset Management is offering 4 new RMFs accessing the global investment portfolios, from which investors can have a wide range of investment products to choose. These four new funds represent the three foreign investing themes: fixed income, world index, and leading equities.

IPO: 15 - 22 Oct. 2024.

Minimum purchase: 500 Baht for all funds and can be purchased through Krungsri’s participating cards.

(Purchased units will be not eligible for promotional campaigns & point accumulcation.)

More specially,

investors can enjoy tax deduction privileges and investment promotion:

Receive KFCASH-A units valued at 100 Baht for every 50,000 Baht investment in participating Krungsri funds in SSF/ RMF/ Thai ESG funds. (When investing according to terms and conditions only, please study more at the below button*)

The fund codes for KFSINCFXRMF and KFWINDXRMF have been changed to KF-SINCOME-FXRMF and KF-WORLD-INDXRMF, respectively, effective from 4 Mar'25, onwards.

KFSINCFXRMF (Krungsri Global Smart Income FX RMF)

The perfect fixed income investment solution for an opportunity to generate the higher and consistent yields.

- The current interest rate cut is the factor that enhances an opportunity to generate an excess returns from investing in fixed income fund.

- Effective fund management of the master fund: PIMCO GIS Income Fund, the Morningstar 5-star rated* master fund managed by PIMCO, the global asset management company with over 50 years of reputation and expertise in active management of fixed income investments, including a proven strong track record of performance amidst the changing market conditions. (Source: PIMCO as of 31 Jul’24. | Percentage of bond exposure is measured based on market value. | Morningstar’s rating has no connection to the rating of AIMC in any respect.)

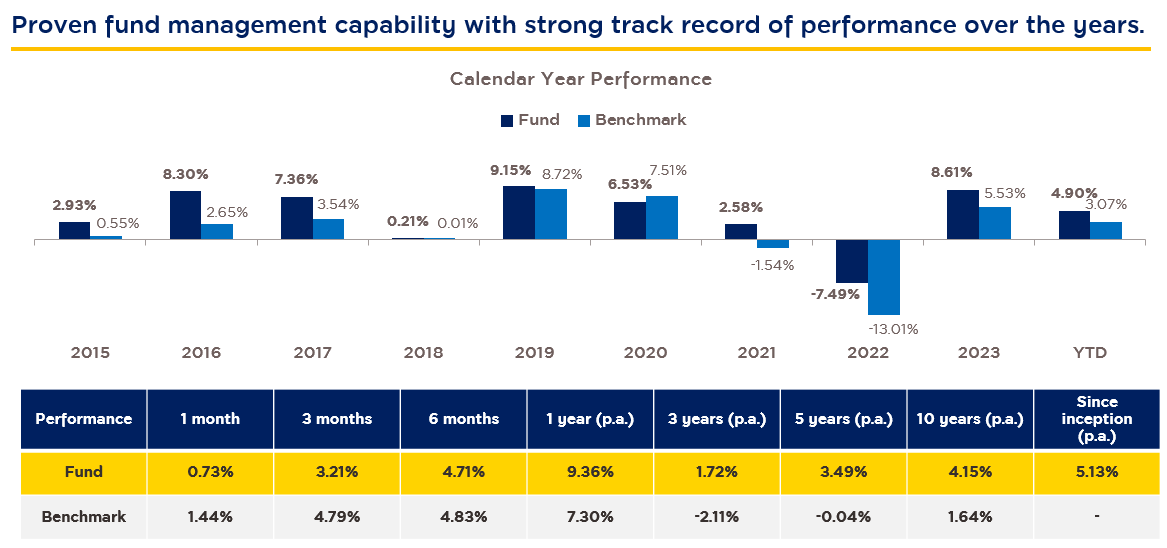

1. The master fund has the past performance that was able to continuously beat the market through adjusting portfolio exposures to fixed income investments dynamically to ensure consistency with changing market conditions.

Source: PIMCO as of 31Aug’24. | Benchmark: Bloomberg US Aggregate Index. The Fund’s inception date is 30 Nov 2012. The performance shown is the performance of the Master Fund net of management fee and is denominated in USD. The performance shown is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by AIMC.

2. Well-balanced current portfolio to maintain quality and opportunity to create returns proven with distinguished long-term performance.

Source: PIMCO as of 31 Jul'24. “Government related” excludes any interest rate linked derivatives used to manage our duration exposure in U.S, Japan, United Kingdom, Australia, Canada and European Union (ex-peripheral countries mean Italy, Spain, Cyprus, Malta, Portugal, and Greece.)

KFWINDXRMF (Krungsri World Equity Index RMF)

Access global equities with opportunity to grow supported by a declining trend of policy interest rate through the master fund, iShares MSCI ACWI ETF, whose portfolio diversifying in both developed and emerging markets.

- Investment portfolio to achieve an opportunity of long-term growth.

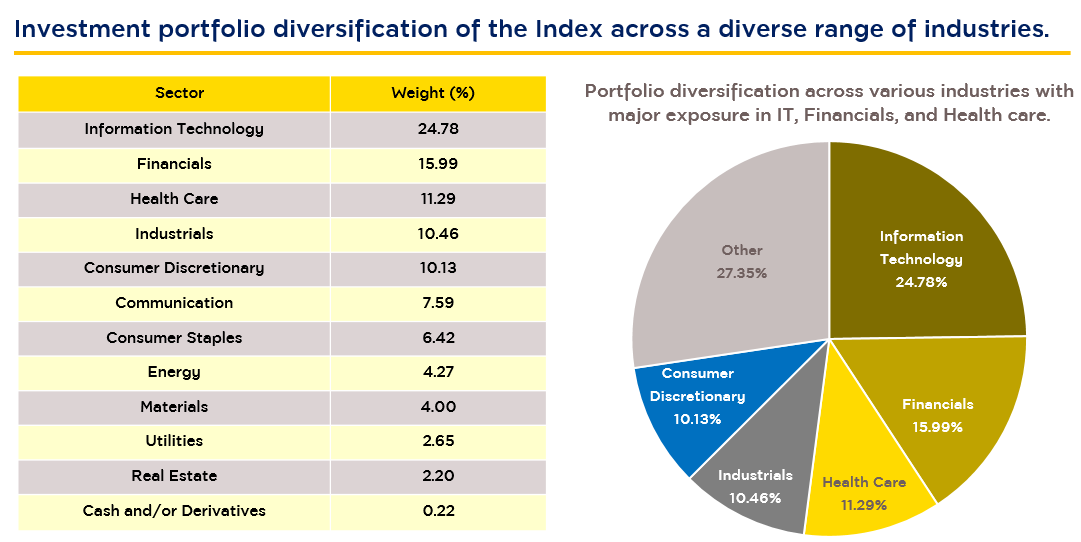

- The master fund: iShares MSCI ACWI ETF is based on the MSCI ACWI Index and gained the most popularity with its world’s largest asset size at more than 18,800 million USD, while the investment portfolio diversification across a diverse range of industries and regions around the world made the fund’s volatility not too dependent on the growth of any particular sector.

- The master fund expense ratio is as low as 0.32% that supports their efficiency to reflect the movement of index and opportunity to generate the long-term attractive returns. (Source: Factsheet of the master fund as of 30 Jun'24. (data being reviewed quarterly). | The ranking of fund size is from https://www.justetf.com/en/how-to/msci-acwi-etfs.html as of 2 Sep’24, which is not in accordance with the ranking standards measurement as prescribed by AIMC.)

- Opportunity to diversify investment portfolio into more than 2,000 companies of varying sizes in both developed and emerging markets and across a diverse range of industries; this helps the fund to enhance their risk diversification efficiency.

Source: iShares as of 26 Aug'24.

.aspx)

Source: iShares as of 30 Jun’24. The Fund’s inception date is 26 Mar’08. The underlying index is MSCI ACWI Index. Performance of the Master Fund is based on NAV prices including the returns from dividends. The performance displayed is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by AIMC.

KFGLOBALRMF / KFGLOBFXRMF

- Krungsri Global Unconstrained Equity RMF (KFGLOBALRMF)

- Krungsri Global Unconstrained Equity FX RMF (KFGLOBFXRMF)

Time to seize the best investment opportunities to ride on the up and down economic cycles by investing in global quality stocks that are being not limited to any specific type, industry, or benchmark, thanks to the Unconstrained Approach, investment strategy of Global Unconstrained Equity Fund managed by BlackRock, the world's asset manager.

Source: BlackRock as of 31 Aug’24. | The Morningstar rating is not associated with AIMC’s rating in any respect.

The master fund: BlackRock Global Unconstrained Equity Fund

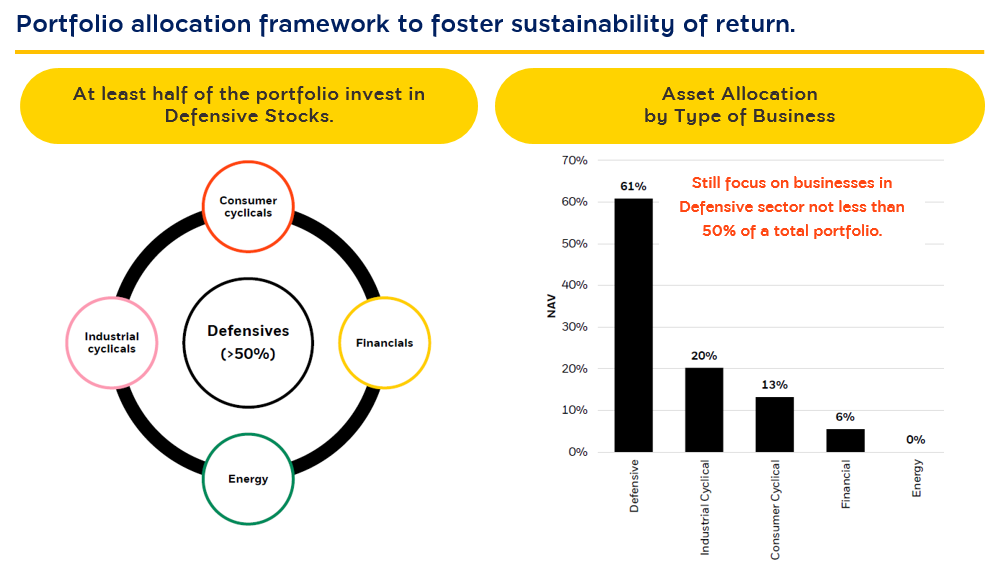

- Allocating the balanced portfolio to foster sustainability of return: More than 50% of a total portfolio being invested in defensive stocks, while the remaining investment portion will be diversified among various types of businesses having high potential to generate excessive returns such as financials, energy, industrials, and consumption.

Source: BlackRock as of 31 Aug’24. | The information is for illustration purposes only. | The above investment approach does not give any guarantee that the investment return will always be positive throughout the investment period. | Although the above investment approach has an objective to control risks, the Fund may still involve risks. | The investment process may be changed without any prior notice.

- 3 Major investment themes of the current portfolio: The master fund focuses on investing in stocks with consistent growth potentials to achieve an opportunity of long-term growth such as long-established brands, innovative technologies, and retail businesses that own unique characteristics.

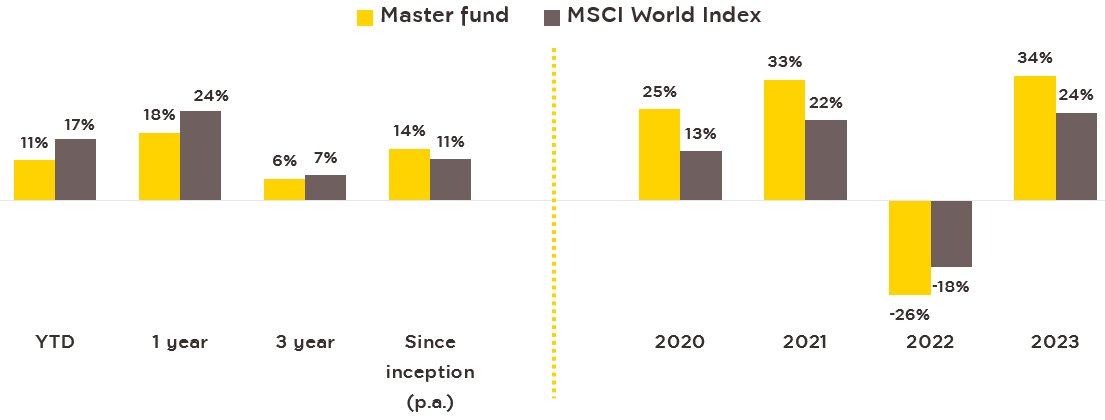

- Amidst changing market conditions, the master fund can deliver distinguished returns that can beat the market in long run.

Source: BlackRock as of 31 Aug’24. The index performance does not reflect any management fees, transaction costs, or expenses. Returns are shown net of fees for an investment in the USD D class accumulating. | The shown fund performance belongs to the Master Fund that is not in accordance with the mutual fund performance measurement standards of AIMC.

Disclaimers

- Investors should understand the fund features, conditions of returns and risks, and study the tax benefits in the investment manual before making an investment decision. Past performance is not a guarantee of future results.

- RMF is a fund that promotes long-term investment for retirement, investors will not be eligible for tax benefits in the case of non-compliance with the investment conditions.

- This document is prepared based on the information obtained from reliable sources at the time of the presentation. However, the Management Company does not provide any warranty of the accuracy, reliability and completeness of all information. The Management Company reserves the right to make changes to all information without any prior notice.

- Since KFGLOBFXRMF is not hedged against foreign exchange risk, it is thus exposed to a high foreign exchange rate risk, which may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

- For KFSINCFXRMF, KFWINDXRMF, and KFGLOBALRMF, they are hedged against a foreign exchange risk upon the discretion of fund managers. Thus, they are subject to a foreign exchange risk which may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

*SSF/ RMF/ ThaiESG 2025 Promotion details

KF-SINCOME-FXRMF details

KF-WORLD-INDXRMF details

KFGLOBALRMF details

KFGLOBFXRMF details

Back