Krungsri Asset Management Company Limited held a webinar on “Shield Your Portfolio from Uncertainties with the Golden Goose Strategy,” inviting investors to mitigate risks from uncertainties of Covid-19 shocks and introducing Fidelity Funds – Global Dividend Fund that is more suitable for investors who seek an opportunity to receive constant returns and higher yields than interest rates. The fund focuses on sound-fundamentals, less-volatility defensive stocks which are survivors from crises and have ability to generate income and make profits from investment globally, as well as have growth potential. Interested investors can invest through the open-ended Krungsri Global Dividend Hedged FX Fund (KFGDIV). The fund's IPO is scheduled during 15 - 22 June 2020.

At the webinar, Mr. Christopher Wong, Client Portfolio Strategist from Fidelity Funds – Global Dividend Fund, FIL Investment Managerment (Singapore) Limited and Mr. Kiattisak Preecha-Anusorn, Vice President for Alternative Investment Department at Krungsri Asset Management, were invited to share information concerning the overall outlook of global stock-market investment amid the COVID-19 crisis, the golden goose strategy in light of 2020 market challenges, investment opportunity for dividend stocks, portfolio management strategy, risk management and investment portfolio that will provide steady yields in the long term.

Mr. Kiattisak said that stock markets worldwide plunged sharply early this year due to the COVID-19 crisis. Global stocks including those with sound fundamentals also sank. Now is the right time to return to stocks again on improving situations. However, there remain concerns looming the market for fears of a second wave of COVID-19 infections. Therefore, stock investment should be made with caution. However, stocks are still interesting investment alternatives as interest rates are expected to stay low for a long period. The proper investment strategy for now goes to the golden goose strategy. KSAM, therefore, introduces KFGDIV as another option.

Mr. Kiattisak said that amid this current situation, an investment portfolio should be consisted of three types of assets. The first type, stocks, helps grow investment. While the second is for income which comprises dividend stocks, debt instruments, high-interest credit, REITs, and multi-assets/income mutual funds. The third is government bonds which will help reduce fluctuations and mitigate risks.

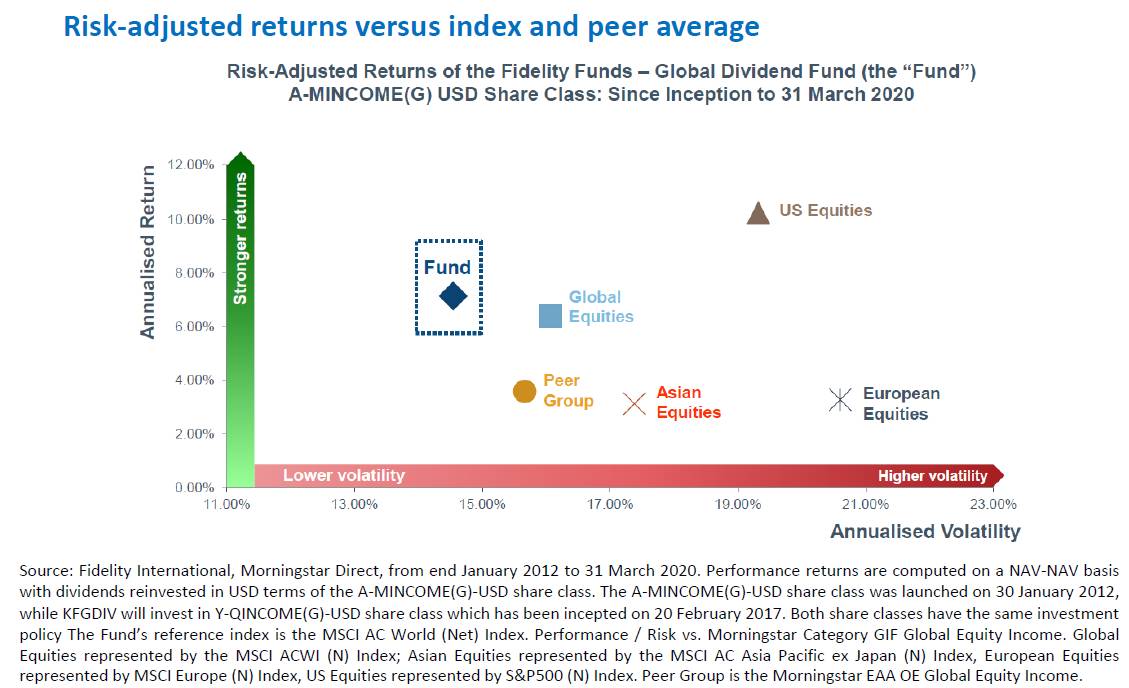

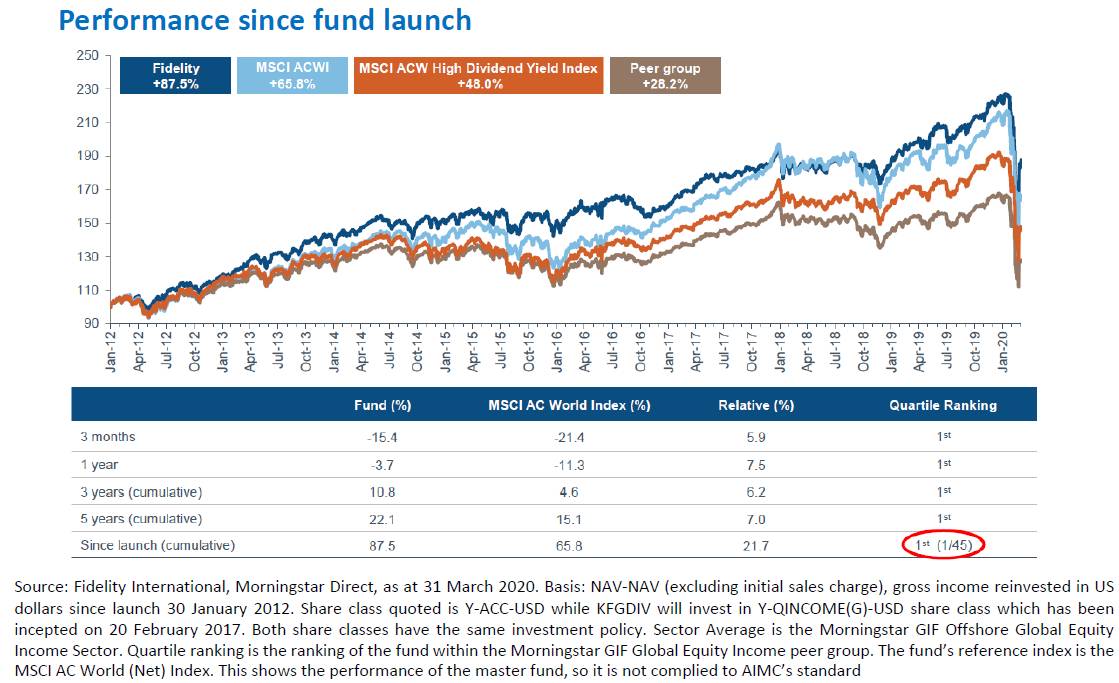

KFGDIV, whose master fund is Fidelity Funds – Global Dividend Fund, meets demand for investment now, thanks to three sets of its strength. The fund invests in dividend stocks in several regions across the world and continuously grows its portfolio via its outperformed position against other stock markets. Its volatility is low and, hence, its risks are less.

During this March when the COVID-19 has been spreading all over the world, Fidelity Funds – Global Dividend Fund has also dropped but still outperformed global markets, drawing down less than MSCI All Countries. Compared to its competitors in the global equity income industry, the fund outperformed in every period, while maintaining its average dividend of 3-3.3% per annum and dividend rises every year. Meanwhile, the fund’s standard deviation is also lower than all other equity funds and global stock markets.

Mr. Wong added that dividend yields are currently more attractive than investment-grade bond yields. Given economic crises, central banks have announced cuts in their benchmark rates with money injection, prompting declines in bond yields and increased returns on dividend stocks. In the long-term perspective, dividend of value stocks makes up a large part of total return. Over the past ten years, dividend makes up 40% of global stock’s total return. In even longer term since 2000, dividend makes up almost 70% of total return. Earlier, most funds held less proportion of dividend stocks, compared to growth stocks. Dividend stocks have a pro helping adjust portfolios for investment risk mitigation. This year, prices of dividend stocks are attractive after drops during the COVID-19 pandemic.

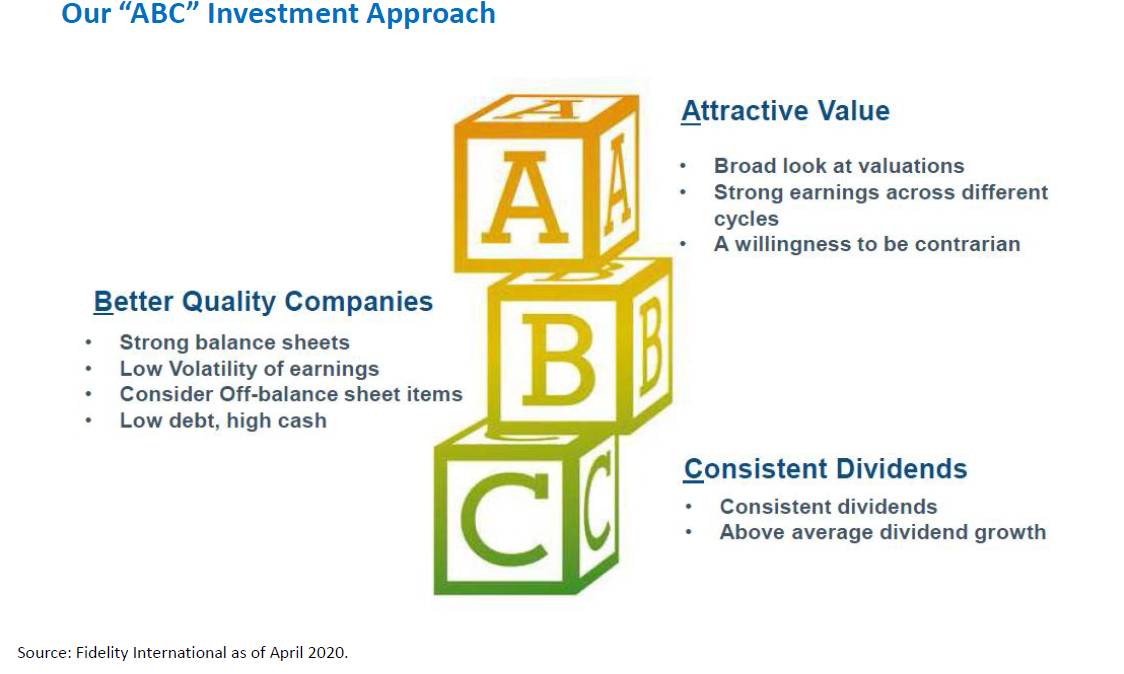

Mr. Wong said that the fund uses the ABC strategy to select stocks. The ABC strategy means attractive value, better quality companies for sound fundamentals, robust financial status and low debt burden, and consistent dividend despite crisis.

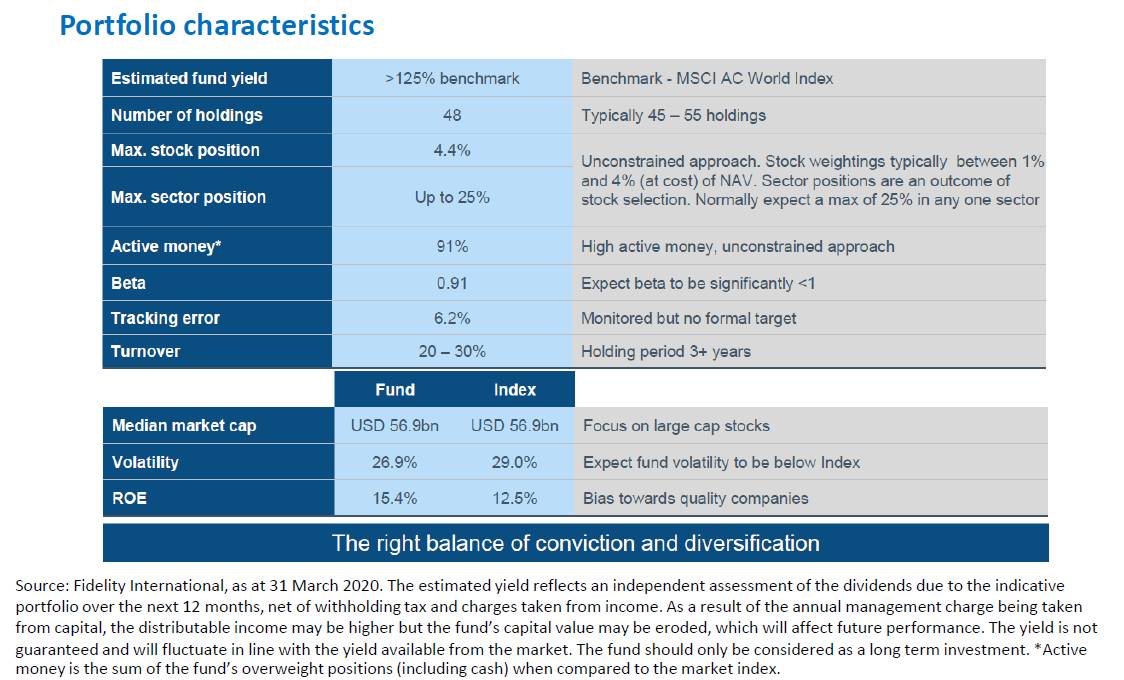

Presently, the fund holds 49 securities in several regions spanning from the Europe, the United States to the United Kingdom. Giants firms in these countries generate income from other countries all over the world, particularly emerging markets. The fund also diversifies its investment into several industries, focusing on defensive sectors with certain profits. These sectors are consumer products such as Tesco Lotus and Unilever; and healthcare like Pfizer. Cyclical stocks like semi-conductors are also invested. Semi-conductor sector has a chance to grow in the future together with the IT industry and technology like Internet of Things (IoT) and Cloud Computing.

The fund’s active style of investment allows it to adjust its portfolio timely and properly. During the pandemic, the fund reduced its weight in some industries like energy due to its increased risks. The fund overweighs in consumer staples and healthcare for drops in prices, good profitability, ability to pay dividend and growth potential. Returns on these stocks can be estimated more correctly.

Mr. Kiattisak said KFGDIV can satisfy investors in growth potential and dividend expectations simultaneously. The fund’s average return from dividends was 3.3% per annum, higher than current interest rates and bond yields. Its yield is estimated to rise in a longer term. Previously, the master fund has an objective to generate the dividend yield at least 25% over the market , while they were able to previously generate the dividend yield over the global stock markets by 30% - 40%.

Interesting investors can invest through Krungsri Asset Management every business day. KFGDIV is divided up into two share classes, KFGDIV-A has no dividend policy and KFGDIV-D is with dividend payment policy. Moreover, for every 100,000 Baht investment amount in KFGDIV during IPO period (15-22 June), investors will receive investment units of KFGDIV-A or KFGDIV-D value 100 Baht, in compliance with the holding terms and conditions.

For promotion details, click here

Disclaimer

-

Before remitting in money, please carefully study fund features, performance, and risk. Past performance is not a guarantee of future results.

-

Krungsri Asset Management Co., Ltd. (“The Management Company”) believes the information contained in this document is accurate at the time of publication, but does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

-

KFGDIV invests in the master Fund named Fidelity Funds - Global Dividend Fund Y-QINCOME(G)-USD (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV. | Fund level is 6 – High risk.

-

The fund may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal.

-

The funds will enter into a forward contract to fully hedge against the exchange rate risk, in which case, it may incur costs for risk hedging transaction and the increased costs may reduce overall return.

For more information or request for fund prospectus, please contact:

Krungsri Asset Management Company Limited

Tel 0 2657 5757 or Bank of Ayudhya PCL. / Selling agents