The fund’s success stems from clever strategies focusing on stocks that grow in accordance with China’s new economy driven by two important factors namely, consumption upgrade of the middle-class population and technology development. Vivien said that China is currently experiencing an explosive growth of the middle-class population which rose from 38,000 in 2010 to 4.4 million in 2019. As this class population increases their income and spending power, they become more willing to improve their life quality. Technological changes such as the rapid growth of e-commerce, investment in research and technologies’ development like 6G network, are the major driving forces behind China’s New Economy growth.

In relation to stock selection strategies, Vivien also added that the fund will select stocks whose businesses serve the four changing trends of China’s new economy in the next decade, which include consuming, urbanizing, innovating and automating, as well as aging society. The fund will then select the stocks which have strong fundamentals and have a strong investment component in technology and human resources development which will ensure a competitive advantages and long-term market leadership.

.aspx)

At present, the fund has around 20 stocks in its portfolio. Some of the most interesting stocks include Jiangsu Hengrui, China’s largest drug company which invests heavily in R&D and human resources development and has the potential to be the one of the global companies with the largest market capitalization; Kweichow Moutai, China’s No.1 premium liquor company; and Ping An Insurance, one of the leading insurance companies that hugely invested in technology development and will pave the way in the insurance industry. Furthermore, the penetration rate of life insurance in China is still very low with only 4.2% thus, companies like Ping An have greater chances to grow along with China’s new economy.

Source : Factset, UBS Asset Management as of 23 Sep. 2019

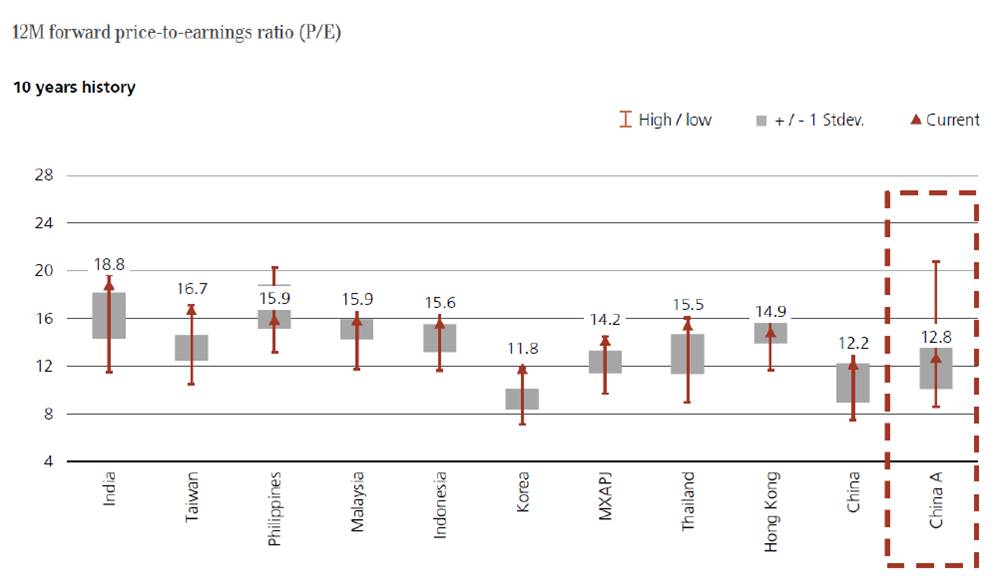

Kiattisak added that beside the outstanding stock performance, investment in China’s A Share stock markets is also attractive due to high growth opportunities. Although last year the market had P/E ratio of 9 times and has increased to 13 times this year, the valuation is still very low thus have upside potential. And as investors may want to make profits in the short term, but there is still strong growth potential in the long term.

Source : Factset, MSCI, UBS Asset Management as of 30 Dec. 2019

One of the important factors showing A Share potential is MSCI’s inclusion of China stocks in the MSCI China and MSCI Emerging Market indices. This would mark the increased significance of China’s A Share to the global stock market as the move will lift up the market creditability, create transparency and internationalize China stocks. It is also expected that such decisions will attract more foreign fund flows which currently accounts only to 7-8% of the China A Share stock markets.

A Share investment has a further peculiarity: 86% are retail investors who mostly focus on short-term investment for profits. This becomes a good opportunity for the master fund to buy strong fundamental stocks when the retail investors got panic from market situation. This will result in profits for investors in the long term.

Those who are interested in investing in China’s A Share market can do it through Krungsri China A Shares Equity Fund - Accumulative (KFACHINA-A) which are traded at every working day. Available channels range from Krungsri Asset Management head office, any branch of Bank of Ayudhya, selling agents, and online channels that are @access Mobile and @ccess Online Service system.

Disclaimer

-

This document is produced for general information based on the trustworthy source of information, but the Management Company does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

-

Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

-

KACHINA-A invests not less than 80% of NAV in average of fund accounting year in the foreign investment fund titled UBS (Lux) Investment SICAV - China A Opportunity (USD) (Class P - acc) (master fund). | The fund has risk level at 6 – high risk.

-

KFACHINA-A may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal.

-

KFACHINA-A may enter into a currency swap within discretion of fund manager which may incur transaction costs. The increased costs will reduce overall return. In absence of a currency swap, investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

For more information or request for fund prospectus, please contact:

Krungsri Asset Management Company Limited

Tel 0 2657 5757 | www.krungsriasset.com

or Bank of Ayudhya PCL. / Selling agents