Four new SSFs – RMFs Duo to acสรุปสาระสำคัญจากงานสัมมนาออนไลน์hieve tax-saving and retirement planni

A summary on the seminar

"Four new SSFs – RMFs Duo to achieve tax-saving

and retirement planning goals"

Krungsri Asset Management Co., Ltd. (KSAM) recently held an online seminar on "Four new SSFs – RMFs Duo to achieve tax-saving and retirement planning goals", introducing 4 SSFs and 4 RMFs for tax privileges - Super Savings Funds (SSFs) and Retirement Mutual Funds (RMFs) - with a focus on foreign stocks with high growth potential to build up investment portfolios. These funds are made fit for investors wanting tax benefit and long-term investment or preparing themselves for retirement.

At the seminar, Krungsri Asset Management had invited Mr. Chakkrapong Mekphan, known as Coach Noom, a financial planning expert from The Money Coach, and Mr. Kiattisak Preecha-anusorn, Vice President for Alternative Investment at KSAM, to address the importance of financial planning in order to achieve happy retirement, together with guidelines to SSF and RMF investment and fund details were also elaborated so that investors can select funds they prefer and plan target-focused investment to reap expected returns.

Coach Noom said that financial planning was highly necessary for working people and should be done early. Presently, there existed several investment alternatives, such as tax-privilege SSFs and RMFs that were set as long-term investment. Therefore, funds investing in assets with sound fundamentals and high growth potentials in the long term are likely to generate attractive returns as targeted.

SSFs and RMFs that KSAM is offering now are the funds focusing on the long term growth through an investment in the global companies stocks through the master funds managed by the top fund houses. Their fund performances were outstanding with higher returns than market averages. Their stocks’ selection strategies included sound fundamentals, leading positions in industries and good cash flows, and a chance to highly grow, following the global future trends, ranging from consumers’ demand driven by technology and innovation, global warming issue being clearly supported by the government policies, and the next generation infrastructures. These mega trends were expected to grow consistently for the next five to 10 years.

Investors, who were interested to invest in high-growth stocks with higher long-term returns and could tolerate risks of market volatility, may pick KFGGRMF / KFGGSSF or KFUSRMF / KFUSSSF. Both funds are invested in Morningstar's five-star* master funds managed by Ballie Gifford, an investment expert in US equity investment. (*Source: Baillie Gifford as of 30 Jun 21. The above Morningstar rankings are not relevant to the AIMC.)

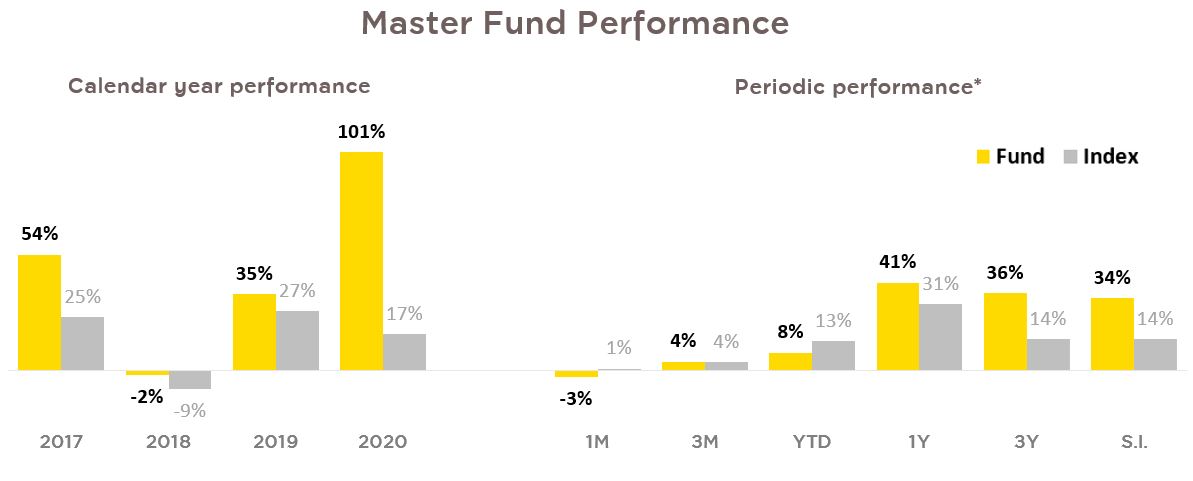

KFGGRMF and KFGGSSF’s master fund was Ballie Gifford Worldwide Long-Term Global Growth Fund emphasizing on firms from several industries worldwide and with estimates to grow several folds from now. Investment themes that stood out were digital, e-commerce, software and healthcare. Previously, the master fund’s average growth was 28% per year. Last year, it recorded over 100% in growth, outperforming the world’s stock market index which increased only 17%. Of total investment portfolio, 55% were in the US stocks, 20% in Chinese tech stocks and the remainder in those of the Europe and other regions. Top assets were Amazon, Tesla, Moderna, Alibaba and Tencent.

*Returns in period less than one year are not annualized | Source: Baillie Gifford as of 31 Jul. 2021 | US dollars. Net of fees | Index: MSCI ACWI Index | Share Class Inception date: 10 August 2016 | This shows the performance of the master fund, so it is not complied to AIMC’s standard.

KFUSRMF / KFUSSSF concentrated on US stocks with high growth potential through Ballie Gifford Worldwide US Equity Growth Fund. This master fund had the long-term investment policy of over five years in high-growth US companies. It overweighed on securities the fund had high confidence, while paying no much attention on indicators. Their assets included consumer discretionary, healthcare and IT. As both Ballie Gifford funds’ investment themes were similar, about 35% of their portfolio assets were the same. They were Amazon, Tesla, Alphabet, Moderna, Shopify, Netflix, Zoom, Nvidia, and Illumina. (Source: Baillie Gifford & Co as of 30 Jun. 2021 | Remark: Master Fund information are updated quarterly.)

Meanwhile, for those seeking to deal with less fluctuations, there still are two other choices to consider - KFCLIMARMF/ KFCLIMASSF and KFINFRARMF/ KFINFRASSF. Both themes saw growth potential from the government’s policy support.

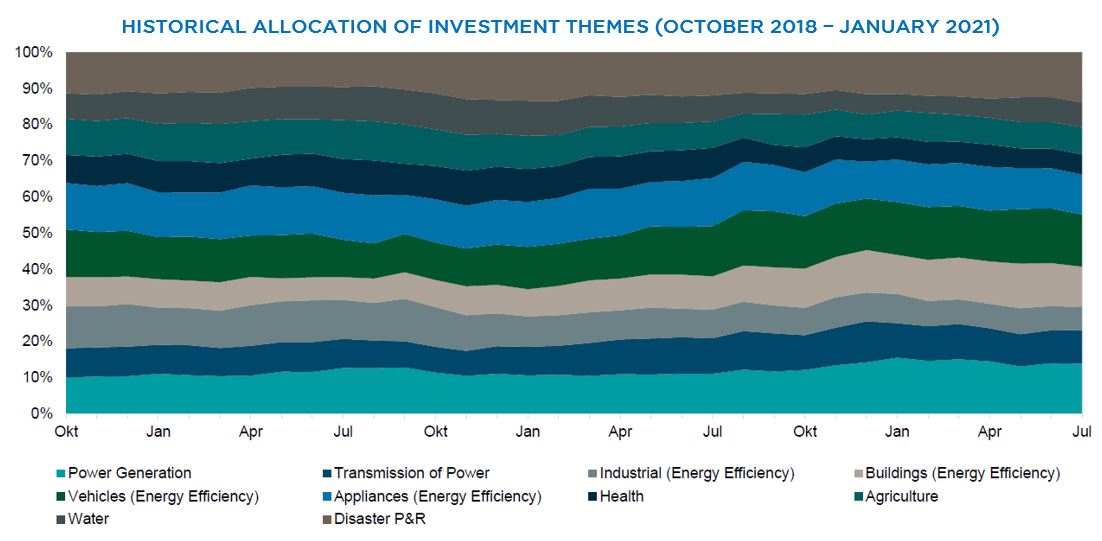

KFCLIMARMF/ KFCLIMASSF invests in DWS Invest ESG Climate Tech Fund whose expertise lied in ESG businesses. Of its investment portfolio, 66% were in businesses with technology for global warming reduction. These firms involve in several industries like electric vehicles, alternative energy, and smart buildings with energy saving. The remaining 34% were in businesses that alleviated impacts and provide solutions for climate changes. These were in water management, waste management and smart farming among others. This portfolio focused on big caps, weighing mainly in the US and European markets. The rest was in other regions. This industry has received policy support and begin to regulate in many countries and, thus, has a chance to grow in the long term.

Source: DWS Investment GmbH as of 30 Jul. 2021

KFINFRARMF and KFINFRASSF invest in Credit Suisse (Lux) Infrastructure Equity Fund which has an investment mix. One of its investments was traditional, large infrastructure stocks whose main income derive from utilities business, transportation and telecommunications- airports, ports, expressways and energy. This acted like investment buffer for less market volatility. The other investment mix was new infrastructure in the new world- 5G, Internet of Things and data centers. The master fund emphasized on firms with certain strategies for long-term growth. Currently, its portfolio overweighs the United States most with 44%. The rest lies in other developed countries in North America, the Europe, Japan as well as China

Source: Credit Suisse as of 30 July 2021

Regarding differences of RMFs and SSFs, Coach Noom explained that RMFs fit those wanting a sum of money for retirement. Investment was required every year and the whole amount could be redeemed when investors aged 55 years old. Investors could invest the maximum of not more than 30% of taxable income and not more than 500,000 Baht, which must include investments in Provident Funds, Government Pension Funds, annuity insurance premiums, private teacher aid fund contributions, national savings fund, and SSF.

Meanwhile, SSFs was for those needing long-term savings of at least 10 years with the maximum investment of no more than 200,000 baht per year but it does not require to invest every year in this fund. Deciding to invest in RMFs or SSFs should depend on income levels and an investment amount that affects tax privileges. Investors must understand and follow investment conditions, and make investment as scheduled firmly. Importantly, investors should know that the fund they invest in uses the proceeds in what types of businesses. Monitoring should be made for the fund’s annual performance and its target achievement so that investors can rebalance their holdings properly.

Minimum purchase amount for these new SSFs | RMFs is only 500 Baht, while every SSF has dividend payment policy. Interested investors can purchase funds through participating Krungsri credit cards (Fund subscription will be not eligible for promotional programs and reward points accumulation). More specially, when investing according to terms and conditions of annual SSF – RMF promotion 2021, receive KFCASH-A units valued at 100 Baht for every investment of 50,000 Baht (For more details of funds and promotion, please click here)

Investment policy

| Funds |

Investment policies |

FX heding policies |

KFCLIMASSF/

KFCLIMARMF |

≥ 80% of NAV in average of fund accounting year

are invested in the foreign investment fund named,

DWS Invest ESG Climate Tech, Class USD TFC. V |

Hedge against currency

risk upon fund manager’s

discretion |

| KFINFRASSF/ KFINFRARMF |

≥ 80% of NAV in average of fund accounting year are invested in the foreign investment fund named Credit Suisse (Lux) Infrastructure Equity Fund, Class IB USD |

Fully hedge against

foreign exchange rate risk |

| KFGGSSF/ KFGGRMF |

≥ 80% of NAV in average of fund accounting year are invested in the foreign investment fund named Baillie Gifford Worldwide Long Term Global Growth Fund, Class B USD Acc. |

Fully hedge against

foreign exchange rate risk |

| KFUSSSF/ KFUSRMF |

≥ 80% of NAV in average of fund accounting year

are invested in the foreign investment fund named, Merian Baillie Gifford Worldwide US Equity Growth Fund, Class B Acc (USD). |

Hedge against currency

risk upon fund manager’s discretion |

| Risk level: Every fund has level at 6 – High risk |

Disclaimer

- SSF are the funds aimed to promote savings. | RMF are for retirement investment.

- Investors will be not entitled to any tax privileges if they do not comply with the investment conditions.

- Investors should understand fund feature, returns, risk, and tax privileges in the investment manual before making investment decision.

- KFCLIMASSF / KFCLIMARMF / KFUSSSF / KFUSRMF are exposed to exchange rate risk, which may cause investors to lose or gain lower return than the amount initially invested.

For more information, please contact

Krungsri Asset Management Co., Ltd. tel. 02-657-5757 or any branch of Bank of Ayudhya PLC.

Back