Capturing investment opportunities from Millennials shaping global economies with KFGMIL

.aspx)

Krungsri Asset Management Company Limited (KSAM) recently held an online seminar on “Capturing investment trends from Millennials Gen” introducing a new theme of a fund, KFGMIL or Krungsri Global Millennial Equity Fund which trails millennials’ lifestyles and seeks opportunities to invest in various types of businesses across the world that capture demand of working people – the majority of the world’s population – with high purchasing power and a key driver for the global growth. KFGMIL invests in the five-star Morningstar master fund, Goldman Sachs Global Millennials Equity Portfolio (Source: Goldman Sachs Asset Management as of 30 Jun 2021. The above awards and rankings are not relevant to the AIMC.) that has searched for firms doing businesses serving needs and consumption of millennials consumers, including their modern lifestyles, tech using together with a selection of sustainable products and services for quality of life.

At the seminar, Krungsri Asset Management had invited

Ms. Akanksha Ganju – an investment expert from Goldman Sachs Asset Management and Ms. Pornchanok Rattanarujikorn, Assistant Vice President for Alternative Investment, Krungsri Asset Management to discuss and exchange information involving the Millennials and opportunities to invest in businesses that potentially grow from this group’s consumption demands and spending potentials. Details concerning the fund’s rationale, stock selection strategies, classification of investment themes, risks and opportunities, risk management and past performance were also elaborated.

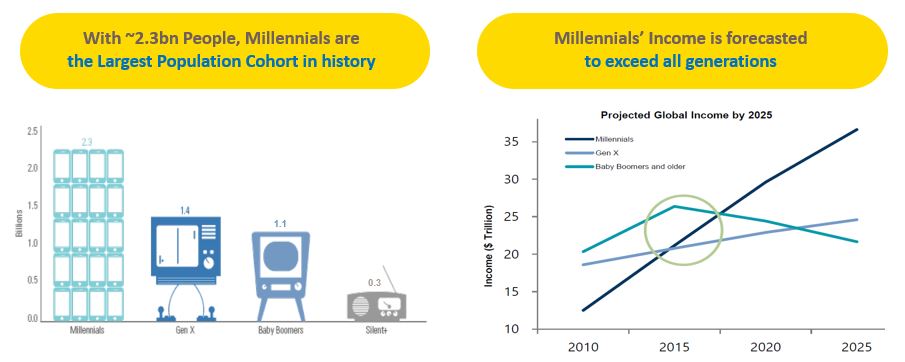

Ms. Pornchanok said that the Millennial group meant those who were born during 1980 - 1999 or aged 22 - 41 years old in 2021. This is the interesting population group considering their number reaching 2.3 billion worldwide*, accounting for 30% of the world’s population. Given the region, the majority of this group resided in emerging-market countries, particularly India and China combined, there existed more than 800 million millennials. (Source: Goldman Sachs Asset Management/ Statista, Outlook India, World Finance, as of 2020) These millennials were working people with wealth and high purchasing power, being ready to spend money for the right products and services for them. Millennials were also forecast to earn higher income than those of other groups, and to spend the most in the next five years*. Therefore, products and services directing to them were estimated to grow.

*Source: Goldman Sachs Asset Management. Left - World Population Survey, United Nations, 2019. Right - BofAMerrill Lynch, Javelin Research, Generation Y: Why They’re Worth a Second Look, 2015. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved.

Ms. Akanksha of Goldman Sachs said that what differs the millennials from their predecessors are technologies. The millennials were born and grown up at the time technology started playing a role in all dimensions of living, prompting them to demand products and services that satisfy them with speed. As the first generation of the digital world, the millennials owned outstanding characteristics – use of technology as a part of living, ranging from data consumption, communication via social media, online entertainment enjoyment, product purchase, food delivery ordering, and online working. At the same time, the Millennials are also interested in living with lifestyles and value their surroundings like communities, society, and environment. Besides, they pay attention on healthcare and development of quality of life and are willing to pay more if that can bring sustainability.

Source: Goldman Sachs Asset Management

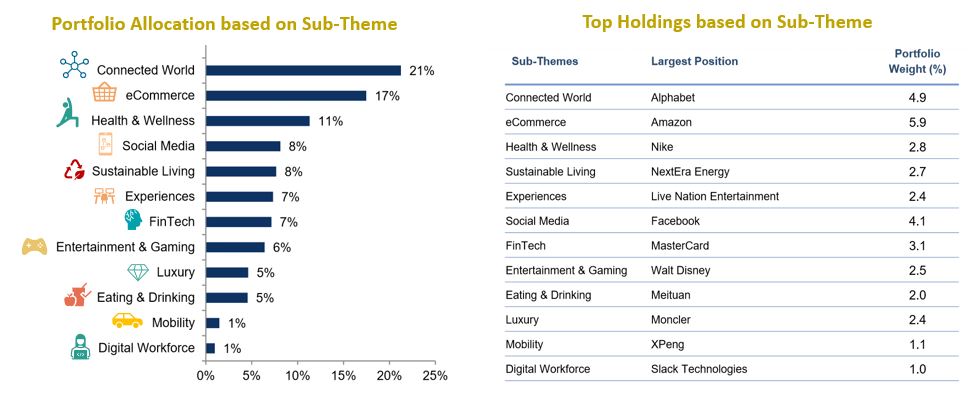

Given such distinguished characteristics of the millennials, Goldman Sachs viewed that as the investment opportunity starting from 2016, where Goldman Sachs Global Millennials Equity Portfolio Fund was launched with two major factors determined from millennials’ behaviors. One was Tech-enabled Consumptions like social media, games and entertainment, Fintech, and travel-related services like electric vehicles, and online working. The other factor is called Lifestyle and Value, involving products and services that correspond to ways of living. Examples were sustainable consumption, healthy food, experiences, travel, and childcare. In this regard, being aware of consumption in things would shift following ranges of ages, making millennial-related businesses to have a broader range.

.aspx)

Source: Goldman Sachs Asset Management. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved.

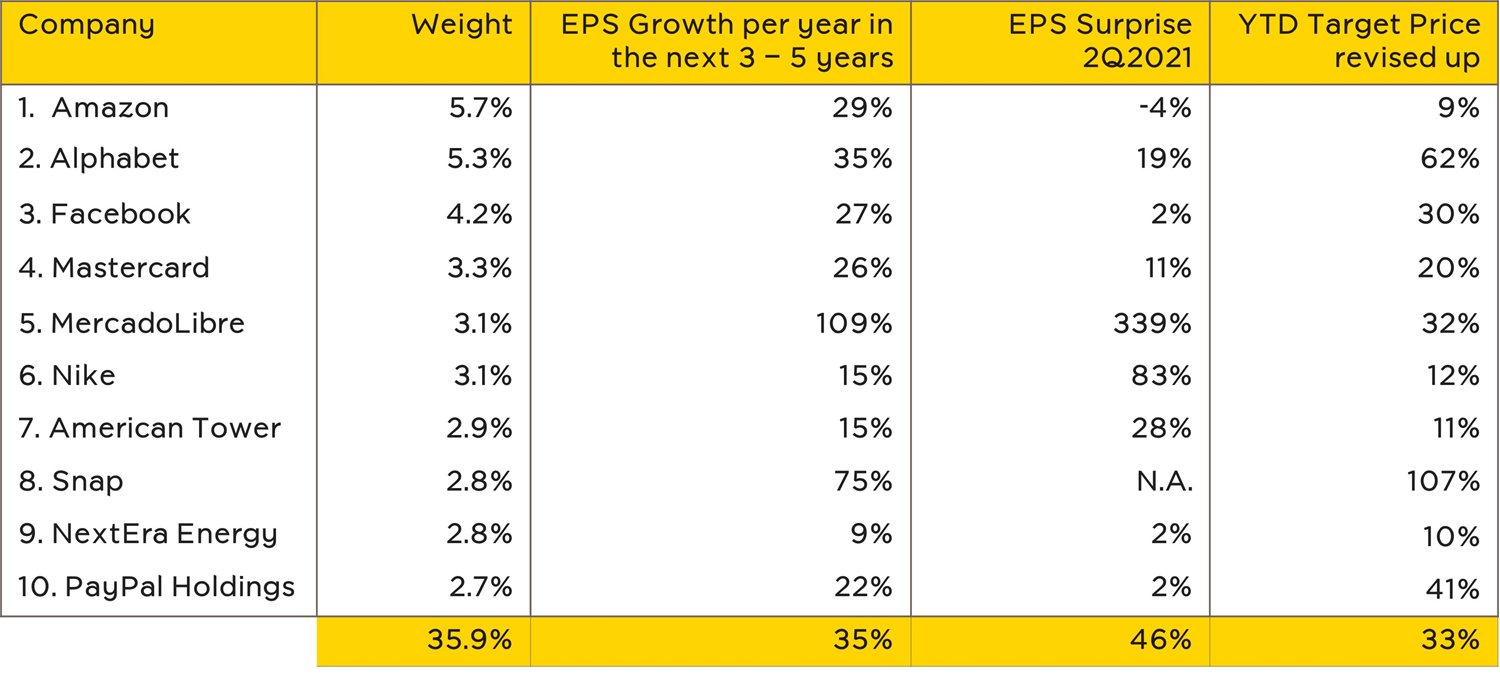

Goldman Sachs’s stock selection procedures started from screening worldwide firms doing businesses that serve needs of the Millennials and following the two main investment themes. About over 400 firms were screened and analyzed, based on their fundamentals and long-term growth potentials. And once a team of analysts from each country completed their full stock screening, the fund would wait for reasonable prices to invest. Presently, the fund’s investment portfolio comprises of 46 firms worldwide who are both the world’s leaders – Amazon, Nike, Walt Disney, Alphabet, and those with high growth at regional level – Argentina’s e-commerce giant MercadoLibre, for example. The fund puts its efforts to balance the tech-focused and the lifestyle-related, while monitoring their performances. At the same time, it also looked for new opportunities to invest in new assets or did portfolio rebalancing to keep pace with situations. This is to maintain its portfolio’s growth at all situations.

Source: Source: Goldman Sachs Asset Management, FactSet, as of 30-Jun-2021. The theme chart might not total to 100% due to weight of cash in the portfolio. For illustrative purposes only. Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the portfolio's investments. Future investments may or may not be profitable.

Ms. Akanksha gave an example at the time of the Covid-19 crisis when most of businesses were adversely affected. About 60% of the fund’s assets could adjust their businesses and surviving the crisis. In a case that Walt Disney’s theme parks were shut down due to the coronavirus pandemic, Disney turned itself into online content builder and earned income from the business transformation. With that, the fund continued its holding of this stock.

At present, other major assets in the fund’s portfolio were Beyond Meat - the US maker of plant-based meat which was gaining the popularity in the health-conscious millennials; and Farfetch - the online fashion platform of over 700 global luxury brands for the Millennials, which has recently joined force with Alibaba, targeting customers in China where existed very high chance for growth in the future. The other one was PayPal – the online payment platform with over 400 million users worldwide, having a chance to grow together with the rising popularity of e-commerce and cryptocurrencies.

Regarding the past performance, the master fund outperformed the global stock index in the past years. In the second quarter of this year in particular, the return of the fund’s top-10 combined was 46% higher than market expectations. The analyst consensus is expected that its top-10 holdings would maintain profit growth of 35% per year in the next three to five years. This is very high growth rate whilethe global stock index is estimated to grow at a normal rate of only 7%, indicating that the stock fundamentals remain robust. Thus, now is the right timing for investment as there was market volatility as a result of sector rotation and global cash flow movement.

Source: Bloomberg, Sep 26, 2021. Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments.

Ms. Pornchanok said that KFGMIL is different from other thematic equity funds because it primarily focuses on the Millennials and is flexible for portfolio adjustmentto cope with changes of consumer behavior. This is the interesting theme for investors to have this fund in their investment portfolio for the long-term growth.

KFGMIL is divided into two share classes –Accumulation Class (KFGMIL-A) and Institutional Investor Class (KFGMIL-I). Fund’s IPO is scheduled during 20-27 October 2021 with required minimum purchase only at 500 Baht. Interested investors can purchase fund units at any branch of Bank of Ayudhya or selling agents, and Krungsri Asset Management (via @ccess Online and @ccess Mobile). Investors can also enjoy a special promotion during fund’s IPO where every 100,000 Baht investment in KFGMIL-A will give KFKGMIL-A units valued at 100 Baht. (Terms and conditions as specified by KSAM) | For Fund Info/Promotion, click here

Investment policy & Disclaimers

- KFGMIL invests in the master fund named Goldman Sachs Global Millennials Equity Portfolio, Class I Shares (Acc.), on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has the policy to invest in equity which provide exposure to companies that are domiciled anywhere in the world which are beneficiaries from the behavior of the Millennials generation, defined as individuals born between 1980 and 1999.

- Risk level: 6 – High risk | Fully hedge against foreign exchange rate risk

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

For more information on fund, please contact

Krungsri Asset Management Co., Ltd. Tel. 02-657-5757 or any branch of Bank of Ayudhya

Back