Look Beyond Local Property, Seize the Global Opportunities

Krungsri Asset Management suggests investors to diversify investment from local property to real estate stocks across the world to increase opportunities for higher return amidst volatile global economy and stock market slowdown.

22 August 2019 - Krungsri Asset Management Co., Ltd has organized a seminar "Look Beyond Local Property, Seize the Global Opportunities", suggesting Thai investors to diversify risks from investing in local stocks and local REITS, whose prices have risen beyond fundamentals, to invest more in global REITs, which invest in property stocks with strong growth potential around the world. It said global REITs have opportunities to generate better returns in the long run amidst low interest and inflation rates and high volatility of the global economy.

At the seminar, Mr. Xin Yang Low, Associate Portfolio Manager of Janus Henderson Property Equities which manages Janus Henderson Global Real Estate Fund and Mr. Kiattisak Preecha-anusorn, Vice President of Alternative Investment Department, Krungsri Asset Management Co., Ltd. were invited to talk about the investment alternative amidst the low growth of global economy. Key topics include the situation of global real estate market, attractiveness, risks and opportunities of REITs which invest in global property, strategies and stock selection processes, fund’s portfolio, past performance and future direction for global property.

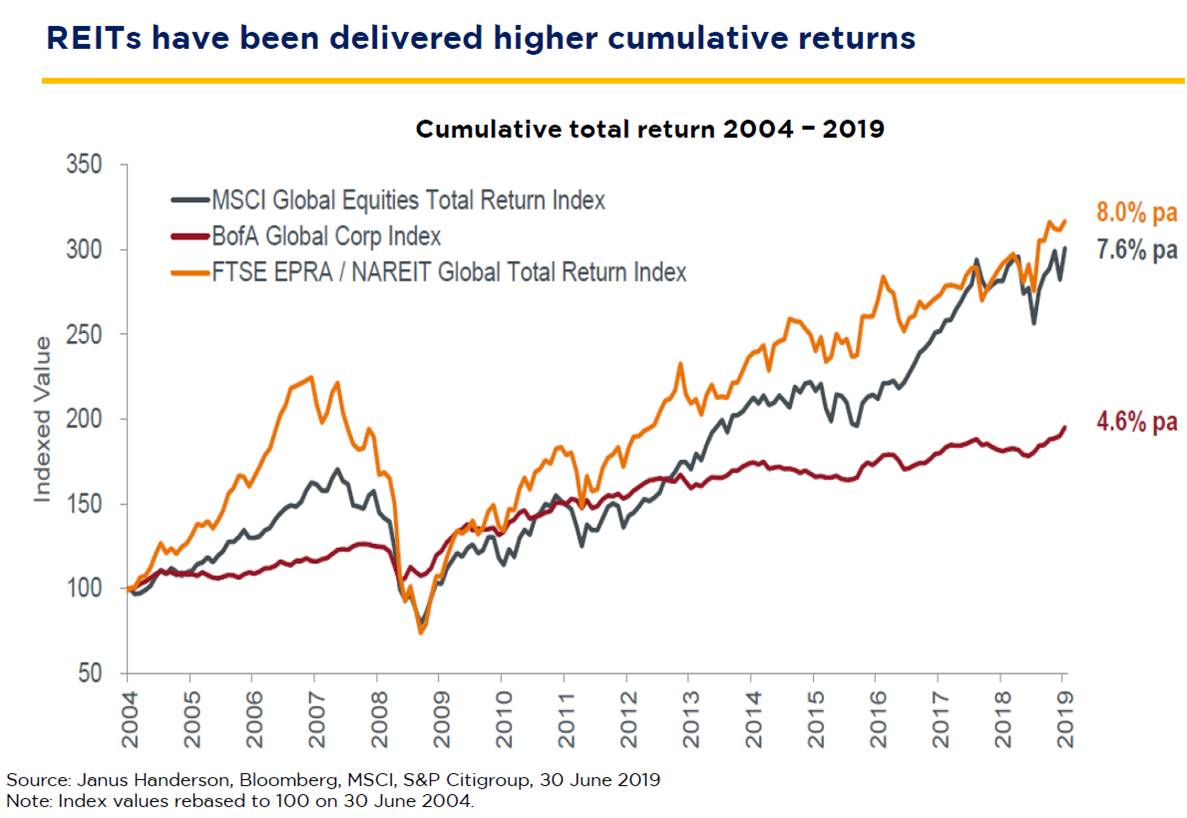

Mr. Kiattisak said currently the global economy has high volatility due to the rapid change in monetary policy. The central banks of several countries have announced to lower interest rates which result in lower return from bonds. Therefore, investors should adjust their portfolios with 3D strategies: Diversify, Defensive, and Dividend. Investing in REITs can offer the alternative to investors as it can deliver better return when compared to stocks and bonds, which are being affected by fluctuations of the economy and investment. According to the cumulative total return, REITs investing in real estate across the globe has recently reached an average return of 8% per year. About two-thirds of the return is derived from the fund’s dividends. The stock market gives negative returns, while bonds offers low return.

Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance. Investors should seek advice before making an investment decision.

For this reason,

Xin Yang Low has suggested investors to consider allocating assets to invest in REITs to diversify the risks arising from the volatile global economy. The real estate stocks yield higher dividend with tendency to grow further in the long term. She said this is the right timing to increase investment in the global REITs due to its fair valuation and high liquidity.

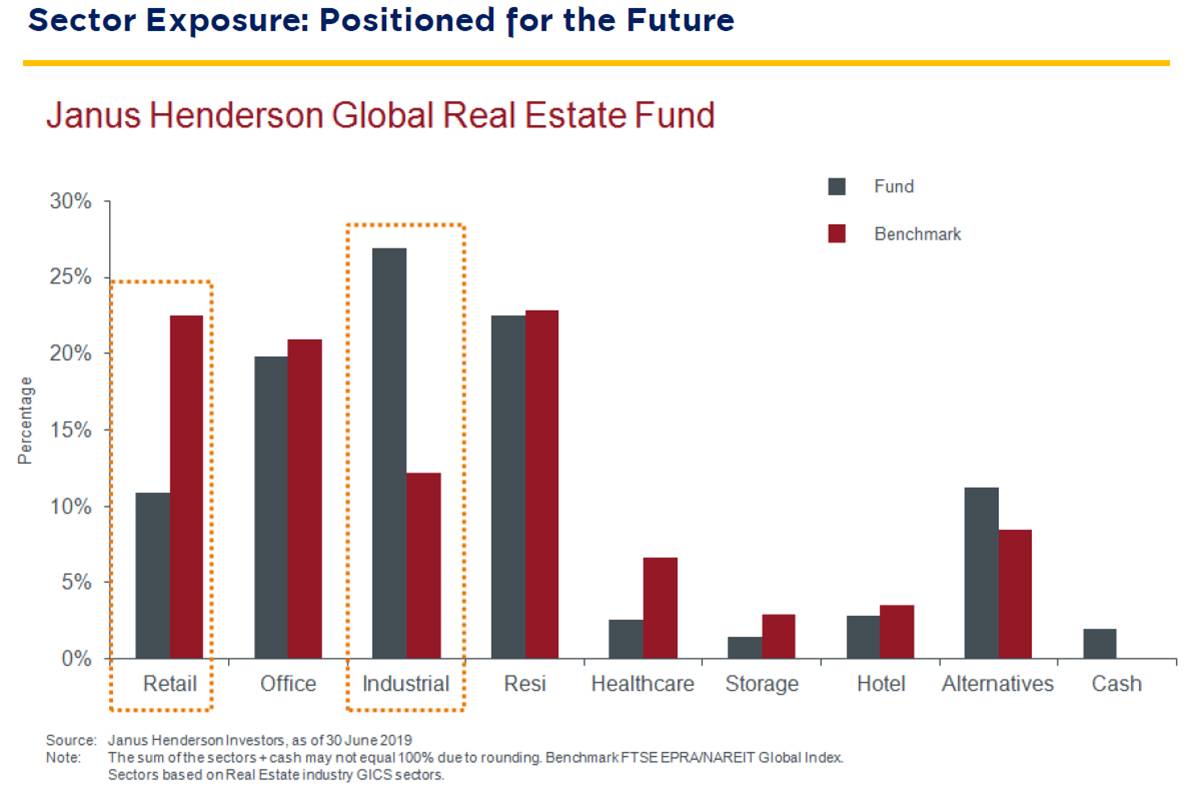

Mr. Kiattisak said global REITs have quite strong fundamentals. Investment in global property has increased continuously since 2013. Last year, investment has reached the highest record as high-quality property usually has a high rental fee and the rents tend to increase every year. Meanwhile, the market situation is unlikely to have an oversupply, resulting in consistent profits from real estate stocks. However, global REITs are quite different from local REITs which still invest in traditional real estate projects. Global REITs will invest in new asset types such as the businesses that grow from technology disruption as data center, logistics, self-storage, office for rent, co-working spaces which are upcoming business trends with promising future growth. The fund therefore has a chance to make profits and minimize risks in the long run.

While REITs in Thailand have delivered returns higher than 20%, the upside gain has exceeded fundamental and this makes it more difficult to maintain such the high growth rate. Currently, local REITs are traded relatively high prices but have low liquidity because most investors are institutions which hold quite long.

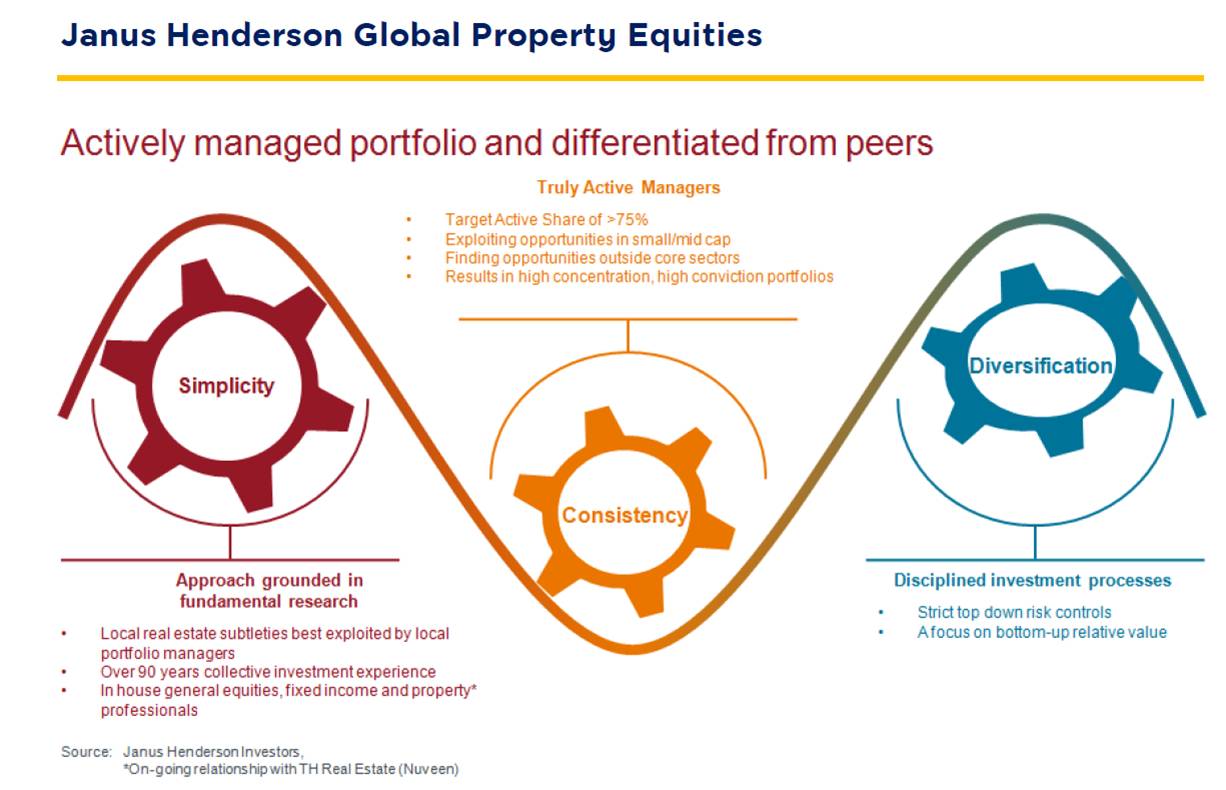

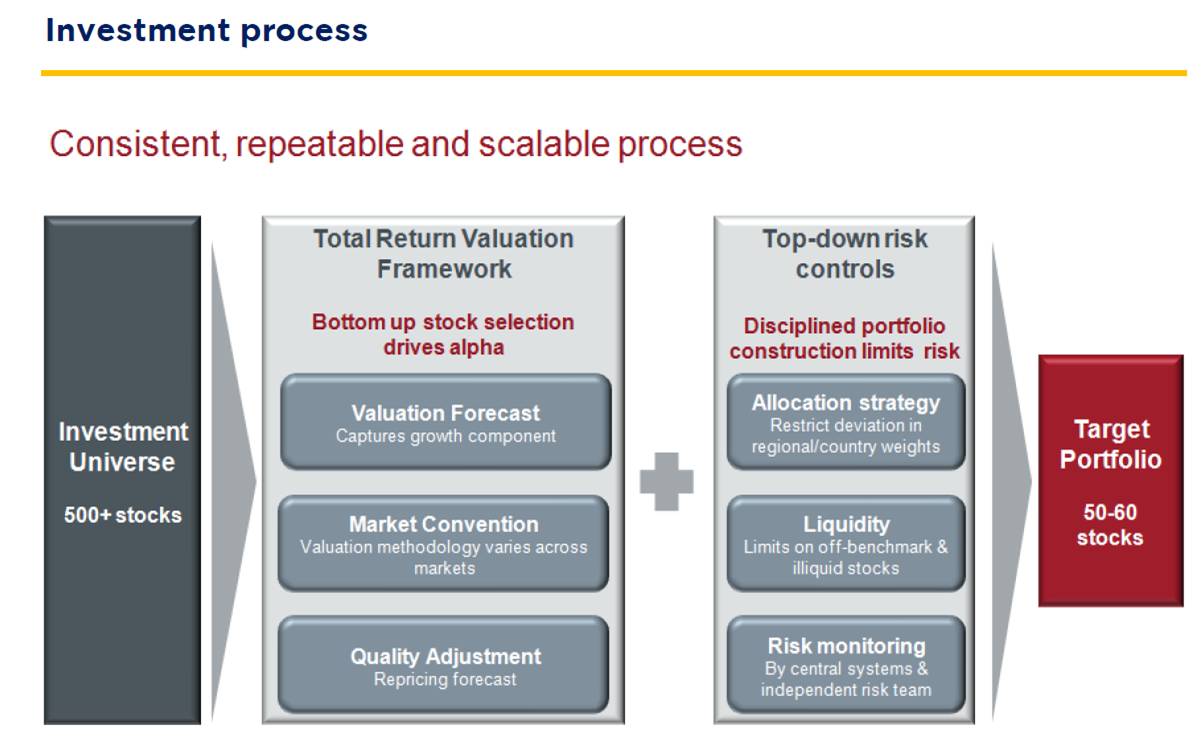

However, investors should understand that not all property stocks will generate good returns, so investors should look for the fund which has a smart investment strategy and an expert team to select high-quality assets that can generate good returns continuously. Janus Henderson Global Real Estate Fund that has been selected as master fund of the Krungsri Global Property Dividend Fund (KF-GPROPD) is a global fund with outstanding performances. The fund is particularly specializing in global property investment with a strong team of experienced fund managers. In addition, the fund also has selection processes that are different from other funds. Based on the buttom-up approach, the fund carefully analyzes individual stocks and selects the ones with strong fundamentals and high growth potential. The fund also adopts active investment style, allowing it to adjust portfolios constantly to keep up with changing market conditions. It also diversifies investment by having selected 50-60 real estate stocks from over 500 stocks worldwide. Such investment strategies enable the fund to consistently outperform the market during the past several years.

Xin Yang Low added that the fund weights its investment in assets that have high growth potential from the use of technology. The fund also looks for the niche market segment which has high growth potential such as co-working space or office for rent. The outstanding asset in its current portfolio is Alexandria, a leading US-based office for rent which target to particularly serve the companies which have research and development (R&D) and have bright prospect in the future. Therefore, the fund overweighs its highest investment in this stock. Or another promising sector is the real estate that was served as baby boomers, so it makes investment in the stock Sun Communities in the US.

With these positive factors, there is a potential that investment in REITs around the globe will yield an average of 5-7% per year, which is considered quite a good return and realistic.

Click here fore more details of KF-GPROPD

Disclaimer

-

Investors should study fund features, performance, and risk before investing. Past performance is not an indicative of future performance. Investors should seek advice before making an investment decision.

-

KF-GPROPD concentrates its investment in property sector. Therefore, the investors may incur a substantial loss of investment. The fund has risk level at 7.

-

The fund invests in a foreign investment fund titled Janus Henderson - Global Real Estate Fund (Class I $ Inc) (Master Fund) on average in an accounting year, of not less than 80% of the fund’s NAV.

-

The fund may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal.

-

The fund may enter into a currency swap within discretion of fund manager which may incur exchange rate risk. Investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

For more details or to request for the Fund Prospectus, please contact:

Krungsri Asset Management Co., Ltd.

Tel: 02-657-5757 | www.krungsriasset.com

Or Bank of Ayudhya Public Company Limited/ Selling Agents

Back