Plan Your Investment

Krungsri Asset urges investors to keep an eye on global economy & seek opportunities of the year

A discussion on global economic trends and direction, including risk factors affecting investment in asset classes - Thai and foreign equities, and fixed income from the fund managers’ team of Krungsri Asset Management, namely Mr. Jaturun Sornvai, Chief Global Investment Officer, Mr. Thalit Choktippattana, Chief Equity Investment Officer, and Ms. Porntipa Nungnamjai, Chief Fixed Income Investment Officer.

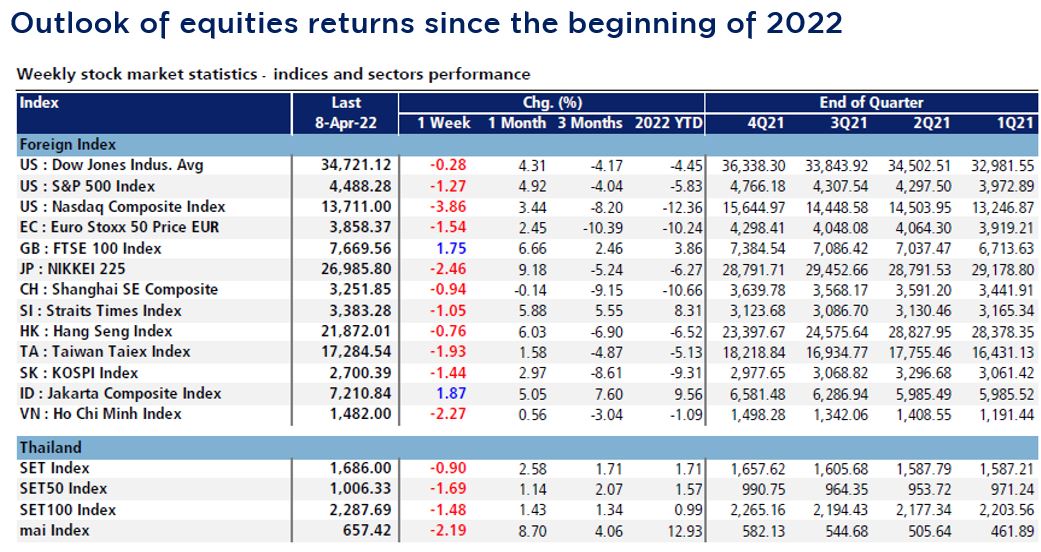

- In 2022, global economic developments came with risks that could affect all types of risky assets and lead to lower returns than those in the previous year. However, there remained investment opportunities in some asset classes. In this respect, investing in both Thai and overseas stock markets continued to yield good returns despite of fluctuations from risk factors. The Thai stock market has specific, positive factors and was estimated to yield 7 - 10% returns at this year-end. Regarding foreign equity funds, a focus should be defensive stocks with benefits from economic slowdowns and shifts in state policies. Even though fixed income investment continued to see risks from all sides, possibly paying yields that were not as good as expected, it could be safe haven in the medium to long term.

Global Equities

by Mr. Jaturun Sornvai

- Several factors for this year’s global investments are derived from major causes as follows:

- US monetary shift after the ease of Covid-19 crisis and an overheating economic growth which resulting in estimated high inflation of 8.5%. Thus, the Federal Reserve hiked the interest rate and also announced the US Quantitative Tightening (QT) policy aiming to reduce financial liquidity and tackle inflation. These factors adversely affected stock markets worldwide, especially growth and tech stocks in particular. Regarding fixed income, the rise in the US benchmark rate resulted in the Inverted Yield Curve where short-term treasury yield was higher than the long-term one. Such factors could lead to economic recession in the next 12 - 18 months. Given concerns on these situations, stock markets have previously seen sharp corrections.

- The World Bank and the International Monetary Fund revised down their estimates for this year’s GDP growth to 3.6%, which could prompt the global economic slowdown.

- Conflict between Russia and Ukraine would likely be prolonged on expectations for an oil crisis.

Such uncertainties were forecasted to stay until the end of 2022 or the beginning of 2023 with more fluctuations of all risky assets.

- However, there remained a chance for investment after such factors were priced in, while the previous profit taking released cash waiting for investment and this could recover stock markets in the short term. Investors who were interested in foreign stock markets should look for defensive assets or those expected to yield returns amid economic slowdowns. Interesting themes include healthcare and alternative energy. China's stock market will also likely bounce back from an ease of policies lockdowns in property and tech sectors. Besides, the government has roll outed the continued support for the Chinese economy from now on.

Thai Stock Market

by Mr. Thalit Choktippattana

- Despite of being affected from the said factors, the Thai bourse had specific, positive factors in the country. From the beginning of 2022, foreign investors staged a comeback into Thai stocks consistently. So far, net foreign purchase of Thai stocks was worth as much as 100 billion Baht, marking the return of foreign investors after their continued sell-offs of Thai stocks over the past five years.

- Major reason why Thai stocks are attractive again is thanks to the fact that the Thai government has gradually opened the country after over 70% vaccine rollout. Also, Thailand’s listed companies were, thus, projected to see their earnings increase QoQ and YoY. In this respect, there was a chance to see more foreign fund inflows. As a result, Krungsri Asset Management remained its positive view toward the SET Index with upside risks and estimated that the SET Index was targeted to 1,782 points at this year-end, based on an average return of 7-10% or PE of 18 times.

Fixed Income Market

by Ms. Porntipa Nungnamjai

- Even though Thai fixed income was not hit by the government’s policy on interest rate as the domestic economy remained gloomy. It was thus believed that the Thai policy rate would stay at 0.5% throughout this year. In the meantime, the Thai fixed income would likely receive impacts from the Federal Reserve’s expected rate hiking, causing the overall fixed income market to face sell-offs. Possible economic slowdown was also expected to happen soon. Even though investing in fixed income could be volatile, it still can be a safe haven in the minimum holding period according to investment policies.

Recommended Funds

Domestic Equity Funds

- KFTSTAR-D which would invest in 40 securities, and KFDYNAMIC, a more concentrated portfolio, which would invest in fewer securities, or about 25 ones. Both funds have no restrictions on investment themes, open to investments in big caps, growth stocks, and dividend plays upon investment opportunities. Compared to KFTSTAR-D, KFDYNAMIC contained higher risks with more volatility since it focuses to invest in smaller number of securities.

Foreign Investment Funds

Een though there have not been positive factors in the long run, investment must be made to catch up with market situations to gain from short-term rebounds. What we see from the current economic situation is that Fed is quickly reducing the liquidity in the financial system and shows continued hikes in interest rates. These two factors will have negative impacts on the risky assets. However, looking back at the situation in 2018 where the similar situation had happened, we will see that defensive stocks like healthcare, utilities, and infrastructure are able to yield outstandingly compared to other stock types.- The irst recommended fund is KFHHCARE, managed by JP Morgan, the Morningstar 5-star rated master fund that invested 80% in the US healthcare group (pharmaceutical, MedTech and Biotech). During the Inverted Yield Curve, the funds related to healthcare group normally made higher profit than S&P500’s. (Source: JPMorgan Funds - Global Healthcare Fund as of 28 Feb. 2022 | The above awards and rankings are not relevant to the AIMC.) )

- Next, KFACHINA-A, under UBS management, has recovered from the Chinese government’s easing measures. This fund was attractive, given its investment mainly in the healthcare and consumer staples groups.

- Another fund was KFINFRA which invested in the climate change theme including alternative energy. In the past 10 years, investment in clean energy tripled with last year’s investment of 750 billion baht, (Source: Credit Suisse), while a sharp increase in investment was expected this year.

Fixed Income Funds

- KFSMART is still our most recommended fund because it is likely to yield attractively from recent upward interest rate trend, despite its higher returns and some fluctuations. This fund suits an investment of no less than three months. KFAFIX was a medium-to-long-term fixed income fund proper for those who were able to make long-term investment of at least one year. It was not proper to increase investment now, but existing investment could continue. For KFSPLUS, it contained low fluctuations and could be invested to save initial investment and maintain liquidity. However, this fund will not gain from the short-term upward trend of interest rates.

For Krungsri Asset’s fund details, click:

Foreign Investment Funds | Domestic Equity Funds | Fixed Income Funds

Disclaimers

- This document was made from accurate sources of information at the time of publication, but KSAM is does not provide any warranty of its accuracy. KSAM reserved the rights to change any part of information without prior notice.

- KFSPLUS focuses on domestic investment particularly debt instruments of government sector, financial institutions, private companies or bank deposits and partially invests in debt instruments in foreign countries. | Risk Level 4: Medium to Low Risk | Fully hedge against FX risk.

- KFSMART and KFAFIX-A invest on onshore and/or offshore in debt instruments and/or deposits or deposits equivalent issued. The fund may also invest in non-investment grade debt securities or unrated securities at its discretion of the Fund Management. | Risk Level 4: Medium to Low Risk | Fully hedge against FX risk.

- KFHHCARE-A and KFHHCARE-D invest in JPMorgan Funds - Global Healthcare Fund, Class C (acc) – USD (master fund) ≥ 80% of NAV in average of the fund accounting year. | Risk level 7: high risk | Fully hedge against foreign exchange rate risk. | This mutual fund concentrates its investment in Technology Sector. Therefore, the investors may incur a substantial loss of investment. Investors should seek additional advice before investing.

- KFACHINA-A invests in UBS (Lux) Investment SICAV - China A Opportunity Fund (“The Master Fund”) with not less than 80% o NAV | Risk level: 6 – high risk | Hedge against currency risk upon fund manager’s discretion, thus, it is exposed to exchange rate risk, which may cause investors to lose or gain lower return than the amount initially invested. (Generally, the Fund will enter into a forward contract to hedge against the exchange rate risk on average of ≥ 90% of the foreign investment value.)

- KFINFRA-A invests in Credit Suisse (Lux) Infrastructure Equity Fund, Class IB USD (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV. | Risk level: 6 – high risk | Fully hedge against foreign exchange rate risk.

- Investors should carefully study fund features, performance, and risk before making investment decision. Past performance is not a guarantee of future results.

For more information on fund, please contact

Krungsri Asset Management Co., Ltd. Tel. 02-657-5757 or any branch of Bank of Ayudhya

.aspx)