On 16 February 2016, Bank of Ayudhya Public Company Limited (BAY) in cooperation with Krungsri Asset Management Public Company Limited (KSAM) and Krungsri Securities Public Company Limited organized an economic and financial seminar “Riding Out Global Storms” in the first half of the year at Siam Kempinski Hotel, Bangkok. Global investment experts were invited to indicate the global economy’s directions and trends, challenges, risks and opportunities as well as recommendations on investment strategies as a means to cope with global economic uncertainties in 2016. This set out a guideline for investors to make decision and adjust their investment strategies for the year to come.

At the seminar, the organizer was greatly honored to have Morgan Stanley Research to present the overall picture of the global economy in 2016 and Schroder Investment Management to lecture about Asian economic outlook and investment opportunities. For the investment directions in Thailand, executives at Krungsri Asset Management Company Limited and Bank of Ayudhya Public Company Limited jointly shared their views at a discussion forum.

At the seminar, the organizer was greatly honored to have Morgan Stanley Research to present the overall picture of the global economy in 2016 and Schroder Investment Management to lecture about Asian economic outlook and investment opportunities. For the investment directions in Thailand, executives at Krungsri Asset Management Company Limited and Bank of Ayudhya Public Company Limited jointly shared their views at a discussion forum.

Ms. Deyi Tan, Executive Director from Morgan Stanley Research

Ms. Deyi Tan, Executive Director from Morgan Stanley Research, presented an analysis on global financial markets, stating that the year of 2016 continued to be another challenging year for the global economy, particularly for developed markets such as the United States, Europe and Japan, and emerging markets like China. These countries differ in challenges. In the United States, the US economic growth could be lower than most people expected, given the US manufacturing's shortage of investment capital and low labor market penetration.

Caution must be taken for more appreciation of the US dollar or the FED's rate hikes. Thus, the US risk to an economic downturn is still unclear now. In Europe, key challenges exist with the monetary policy and political conflicts on the refugee issue. However, the Europe's economic figures continue expanding and its monetary easing are expected to prop up the region to expand 1.5% this year.

China continued to face an economic slowdown, while taking on challenges in the country. Its high debts, upward demographic trend for aging people and deflation will still fuel pressure on the Chinese economy and affect emerging countries. Japan's economy has been recovering gradually from the government policy. Global crude prices will still remain weak on the back of lower demand, oil oversupply and US dollar appreciation. For the investment diversification, in the view of the global market, cash is more preferable than stock markets which, however, are more preferable than bond markets. In case of stocks, we overweight stocks in developed- country markets than those in emerging-country markets.

For Asia,

Mr. Showbhik Kalra, Head of Product, Asia Pacific at Schroder Investment Management, said that what happened in the global markets could affect Asian region, however, a severe impact is not expected to drag down the markets. Although China's economic slowdown remains a worrying issue, it is believed to be under control as expansion in tourism will lead to higher spending and, thus, sustain the economy.

Meanwhile, Asia is facing challenges extending from decline in exports, appreciation of the US dollar and low domestic demand. What will happen is that the heavy sales of stocks, which could bring a sharp drop in prices. In addition, new financial technology that will arise seems like an entry into the second era of the industrial revolution. However, amid great challenges, plenty of opportunities exist. Schroder Investment Management still overweighs bonds and stocks of robust-growth companies particularly those producing globally-known goods or globally-branded goods. Investment opportunities still occur in Hong Kong's office buildings where are in high demand from markets, Indian markets where the economy is expected to grow satisfactorily, especially in the growing banking sector.

Let's move back to Thailand's economic and investment situations. Dr. Somprawin Manprasert, Associate Dean -The Faculty of Economics Chulalongkorn University and Chief Economist and Head of Research Department, Bank of Ayudhya Public Company Limited said that the Thai economy in 2016 was forecast to grow from last year. It is believed to rock the bottom already. The country's GDP is expected to rise from 2.8% to 3.2% this year. The following factors will mainly promote Thailand's economic expansion:

1) The growth of service sector, especially tourism which remained resilient to any unrest. During the past 10 years, income from the service sector accounted for 13% of the country's total income. In addition, the number of tourists continued its rise every year. Therefore, we believe that the service sector will be the main economic driver this year.

2) Thailand's domestic consumption started to improve as household debt, arising from the first-car scheme, is expected to decline this year, which could leave ample room for people's spending.

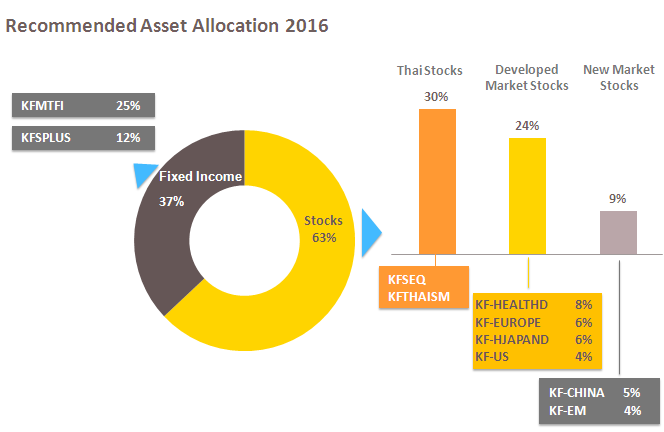

On the investment aspect, Ms. Siriporn Sinacharoen, Managing Director at Krungsri Asset Management Company Limited, said that the Company will continue its positive outlook on Thailand's overall economic and investment situation in 2016. The country's economy is expected to improve from 2015 with more investment from the private sector, given low interest rates which lead to low borrowing costs and the government's economic stimulus measures. Tourism, hotel, airline, e-Commerce and commercial banking sectors are forecast to record high growth rates. This year's investment strategy focuses on investment in short and medium terms. Of the investment portfolio, 37% should be placed in debt instruments and 63% in capital instruments. Of the capital instruments, 30% should be put into Thai stocks, 24% in stocks in developed-country markets and healthcare stocks, and 9% in emerging markets like China and ASEAN.On the investment aspect, Ms. Siriporn Sinacharoen, Managing Director at Krungsri Asset Management Company Limited, said that the Company will continue its positive outlook on Thailand's overall economic and investment situation in 2016. The country's economy is expected to improve from 2015 with more investment from the private sector, given low interest rates which lead to low borrowing costs and the government's economic stimulus measures. Tourism, hotel, airline, e-Commerce and commercial banking sectors are forecast to record high growth rates. This year's investment strategy focuses on investment in short and medium terms. Of the investment portfolio, 37% should be placed in debt instruments and 63% in capital instruments. Of the capital instruments, 30% should be put into Thai stocks, 24% in stocks in developed-country markets and healthcare stocks, and 9% in emerging markets like China and ASEAN.

At the moment, KSAM is offering Krungsri Thai Small - Mid Cap Equity Fund (KFTHAISM) which focuses on Thai mid and small caps in industries with growth potential. The fund will achieve returns on mid and small caps with outstanding performances that find the opportunity to outperform the overall stock market. KFTHAISM's initial public offering is scheduled during February 15 – 24, 2016, with the minimum investment of 2,000 baht.

Investors can ask for more details on the Fund at Krungsri Asset Management, call 02-657-5757 or www.krungsriasset.com or any branch of Bank of Ayudhya (as a distributor of investment units on behalf of Krungsri Asset Management Co., Ltd. only)

Disclaimers

1. Investment contains risks. Investors must study and understand the nature of the products, conditions of return, and risks before making investment decision.

2. Past performance is not a guarantee of future results.