Promotions/Fund Highlight

Krungsri Top SSF / RMF / Thai ESG for Your Tax Planning

Special promotion applies when investing according to T&C*

Krungsri Asset Management selects top SSF / RMF / Thai ESG funds accessing complete range of assets for the opportunity to receive long-term good returns with tax deduction benefits and special promotions being offered when investing according to terms and conditions*

*Receive: KFCASH-A units valued at 100 Baht for every 50,000 Baht of investment in Krungsri Asset's participating SSF/ RMF/ Thai ESG according to terms and conditions. (Please study more details at the below part.)

Fixed Income Funds

Mid-term fixed income

Krungsri Active Fixed Income-SSF (KFAFIXSSF)

Krungsri Active Fixed Income-SSF (KFAFIXSSF)

Krungsri Active Fixed Income RMF (KFAFIXRMF)

- Invest in mid-term debt instruments with a focus on quality private debt instruments through the Active Investing strategy that has flexible portfolio management.

- Opportunity to generate attractive excess returns to reduce portfolio volatility after the overall policy interest rate in many countries around the world, led by developed countries, have entered a downward interest rate cycle and become a force for the trend of capital movement into emerging markets.

- Suitable for investors looking for opportunities to generate better returns than short-term fixed income and can tolerate moderate volatility

Source: Krungsri Asset Management as of Oc’24.

Global fixed income

Krungsri Global Smart Income RMF (KFSINCRMF)

Krungsri Global Smart Income RMF (KFSINCRMF)

Krungsri Global Smart Income FX RMF (KFSINCFXRMF)

- Invest in the master fund titled PIMCO GIS Income Fund that focuses on generating the consistent income from multiple sources of income through a diversification into a combination of high quality and high yielding instruments, including government bonds, private bonds (Investment Grade private and High Yield), and Mortgage-Backed Securities (MBS)/ Asset-Backed Security (ABS) in order to enhance the ability to generate high and consistent return and reduce the volatility stemming from changes of economic conditions and interest rates.

- Suitable for investors seeking more investment diversification into fixed income portfolio and those looking for potential to enhance returns volume for their overall portfolio.

- KFSINCRMF is fully hedged against a foreign exchange risk.

KFSINCFXRMF is hedged against a foreign exchange risk upon the discretion of fund managers.

Thai Equity Funds

Krungsri SET100-SSF (KFS100SSF)

Krungsri SET100 RMF (KFS100RMF)

- Invest in top Thai stocks ranking top 100 in SET’s market capital.

Aim to track the investment returns of SET100 Total Return Index with targeted tracking error (TE) of the Fund and the benchmark to be not greater than 1.00% per annum.

Opportunity to achieve growth in tandem with the recovery of Thai stock market backed with the supporting factors from the capitals of the Vayupak Fund and political issues that are clearer, including the potentials of implementing economic stimulus policies.

Source: Krungsri Asset Management as of Oc’24.

For fund details, click: KFS100SSF | KFS100RMF

Equity Funds Investing in Global Leading Brands

Krungsri Global Brands Equity Dividend SSF (KFGBRANSSF)

Krungsri Global Brands Equity Dividend RMF (KFGBRANRMF)

- Invest in stocks of leading brand owners with customers base around the world and potential to have a consistent income from the high brand loyalty of their customers.

- These stocks are defensive stocks that are resistant to the economic cycle. Most of them are brands of products used in daily life, such as consumer goods which customers have to buy no matter how the economy turns out.

- The master fund, Morgan Stanley Investment Funds – Global Brands Fund has performed exceptionally well with an ability to find the companies with high profitability, who have the potential to generate stable returns during the bull market and can protect the risk of investment during the bear market

- Examples of stocks: Microsoft, SAP, Visa, Accenture, Aon, etc. (Source: Morgan Stanley Investment Management as of 31 Aug’24.)

For fund details, click: KFGBRANSSF | KFGBRANRMF

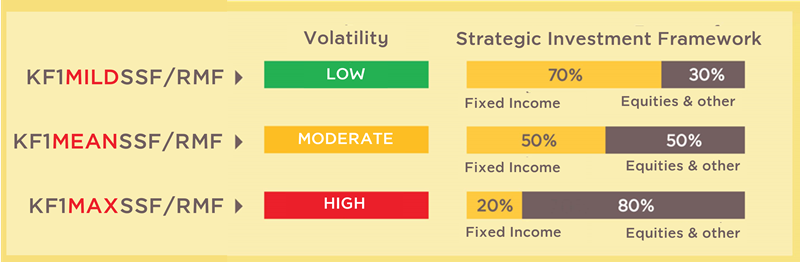

Mixed Funds with Comprehensive Range of Asset Allocation

Krungsri The One Mild SSF/RMF (KF1MILDSSF/RMF)

Krungsri The One Mild SSF/RMF (KF1MILDSSF/RMF)

Krungsri The One Mean SSF/RMF (KF1MEANSSF/RMF)

Krungsri The One Max SSF/RMF (KF1MAXSSF/RMF)

- The three fund series investing in a variety of assets through selected mutual funds, including fixed income funds, Thai equity funds, and alternative assets through the Krungsri Group's views of allocating investment weights to suit different targets and risk levels while flexibly adjusting the funds’ portfolios proactively to keep up with the situation:

Source: Krungsri Asset Management as of Aug’24. Remark: The above information is just an investment framework which can be changed and divert from the actual investment portfolio.

For fund details, click:

KF1MILDSSF | KF1MILDRMF

KF1MEANSSF | KF1MEANRMF

KF1MAXSSF | KF1MAXRMF

Krungsri Thai ESG Funds

- KFTHAIESG: Grow with ESG stocks with an opportunity to generate higher returns than the index.

- KFGBTHAIESG : Opportunity of resilient growth with ESG Government bond

Every fund has a minimum purchase of 500 Baht only.

- Can use Krungsri participating credit cards to purchase SSF/ RMF/ Thai ESG (except KFCASHSSF, KFAFIXSSF, KFCASHRMF, KFAFIXRMF, KFGOVRMF, KFLTGOVRMF, KFMTFIRMF, KFGBTHAIESG, and any new SSF/ RMF/ Thai ESG in 2024 according to the Company’s announcement for exemption. Please see more details on the terms and conditions stated below. / Any investment units from subscription will not join the credit card promotion and reward points accumulation.)

- Can redeem your credit card points of all Krungsri credit card types (except Krungsri Corporate Card) to invest in any SSF/ RMF/ Thai ESG through @ccess Mobile Application and @ccess Online Service on a condition that 1,000 points = 100 Baht of fund units. | See terms and conditions, click here.

Disclaimers

- SSF is the fund to promote savings. RMF is the fund promoting long-term investment for retirement. Investors will not be eligible for tax benefits in an absence of compliance with investment conditions. Investors should understand fund features, returns, risks and study tax benefits in the investment manual before making an investment decision. Past performance does not guarantee future results.

- KF1MILDSSF/RMF KF1MEANSSF/RMF KF1MAXSSF/RMF KFSINCFXRMF / KFGBRANSSF/RMF are hedged against a foreign exchange risk upon the discretion of fund managers. Thus, they involve a currency risk which may cause investors to experience foreign exchange losses or gains/or receive a lower return than the initial investment amount.

For additional inquiries or request for fund prospectus, please contact

Krungsri Asset Management Company Limited at tel. 02-657-5757

For details of KFCASH-A, click here

For SSF/RMF investment manuals, click here

*Terms & conditions for SSF/ RMF/ Thai ESG Promotion 2024

- This promotional campaign does apply only to individual investors who invest in SSF/ RMF/ Thai ESG funds managed by Krungsri Asset Management Co., Ltd. (“the Company”), except KFCASHSSF/ KFCASHRMF and any other SSF/ RMF/ Thai ESG funds 2024 according to the Company's announcement for exemption. The eligible accumulated investment amount must be proceeded during 2 Jan. - 30 Dec. 2024.

- Investors must hold investment units invested during this promotion period until 29 Mar. 2025, which is the date the Management Company will calculate the net accumulated investment for KFCASH-A units’ entitlement.

- The net accumulated investment amount consists of (1) a total investment amount of subscription and switch-in transactions from other non-SSF, non-RMF, non-Thai ESG of the Management Company and (2) transfers of SSF/ RMF/ Thai ESG from other management companies, excluding the transfers from PVD to RMF, being deducted with the total investment amount of redemption, switch-out transactions to SSF/ RMF/ Thai ESG not participating in this promotion or other fund of the Management Company, and transfers from SSF/ RMF/ Thai ESG units of the Management Company to other companies. The exception will be allowed only when the redemption, switch-out and transfer are made from the outstanding balances on 28 Dec. 2023 calculated with FIFO basis by the Management Company, according to tax benefit conditions specified by the Revenue Department.

- For investors having more than one fund account, the Management Company will count the net accumulated investment amount from all their accounts by considering the ID Card number.

- The Management Company will transfer KFCASH-A units according to the investment and entitlement conditions to investors within 30 Apr. 2025. KFCASH-A units will be calculated at its NAV price on the allocation date.

- Net eligible investment units from SSF/ RMF/ Thai ESG Regular Investment Promotion for 12 consecutive months from Jan. – Dec. 2024 will not be considered for this above-mentioned promotion.

- RMF units transferred from PVD will be eligible only for RMF-for-PVD promotion, but not for this promotion mentioned above.

- This promotional campaign is not applicable to the investments made by juristic/ institutional investors and provident funds.

- The Management Company reserves the rights to change the promotional conditions without giving prior notice. In case of any dispute, the Management Company’s decision shall be deemed final.

Conditions for subscription through credit cards.

- Investors can use Krungsri participating credit cards, namely Krungsri Private Banking, Krungsri Exclusive Signature, Krungsri Signature, Krungsri Platinum Visa/ Master, Krungsri Visa/ Master, HomePro Visa Platinum Credit Card, Krungsri Lady Titanium, Krungsri Manchester United, Krungsri Doctor Card, AIA Visa, Krungsri JCB Platinum, Siam Takashimaya (all types), Krungsri NOW, Central The 1 Credit Card, Simple Visa Card, Krungsri First Choice, and Lotus's Credit Card to purchase SSF/ RMF/ Thai ESG. (except KFCASHSSF, KFAFIXSSF, KFCASHRMF, KFAFIXRMF, KFGOVRMF, KFLTGOVRMF, KFMTFIRMF, and KFGBTHAIESG, and any other SSF/ RMF/ Thai ESG in 2024 according to the Company’s announcement for exemption.)

- Any investment units from subscription will not join the credit card promotion and reward points accumulation.

- Terms and conditions in using credit cards will be as set forth by the Management Company and the Credit Card Companies.

- The Management Company reserves the right to change the conditions in subscribing the funds through credit cards without giving prior notice. In case of any dispute, the Company’s decision shall be deemed final

- SSF is the fund to promote savings. | RMF is the fund promoting long-term investment for retirement. | Thai ESG Fund aims to promote long-term savings and encourage Thailand’s sustainable investment Investors should understand fund features, returns, risks and study tax benefits in the investment manual before making an investment decision. | Investors will not be eligible for tax benefits in an absence of compliance with investment conditions.

Thai ESG Funds Info click

Krungsri SSF info click

Krungsri RMF info, click.

Back