Promotions/Fund Highlight

Build Passive Income in each market condition with quality Fixed Income Funds

Investing in PIMCO GIS Income Fund.

4 Fixed Income funds for an opportunity to generate attractive returns when it comes to rate cuts through the global master fund, PIMCO GIS Income Fund, being ideal for those looking to generate the consistent returns and reduce their portfolio’s volatility.

Outstanding Characteristics of PIMCO GIS Income Fund

The Morningstar 5-star rated* master fund managed by PIMCO, the global asset management company with over 50 years of reputation and expertise in active management of fixed income investments.

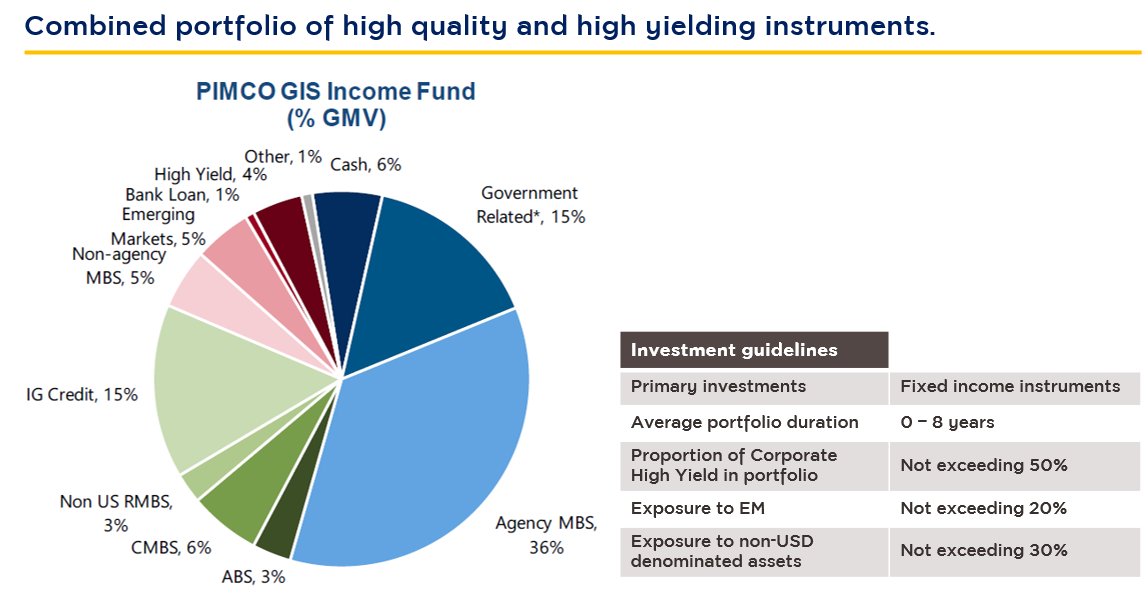

- Diversified portfolio into a combination of global high quality and high yielding instruments, including government bonds, private bonds, Investment Grade private and High Yield, and Mortgage-Backed Securities (MBS)/ Asset-Backed Security (ABS)

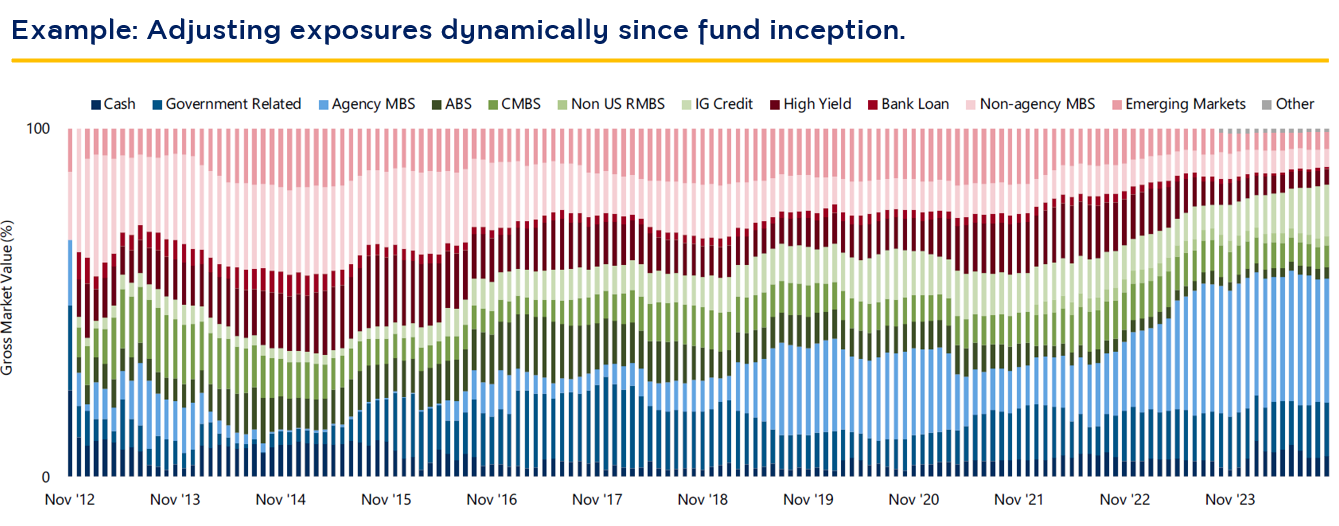

- Flexible active portfolio rebalancing with a focus on various fixed income investments and tactical management of the average duration of fixed income instruments in the portfolio to ensure consistency with changing market conditions and interest rates.

Source: PIMCO as of 31 Oct’24. | Percentage of bond exposure is measured based on market value. | Morningstar’s rating has no connection to the rating of AIMC in any respect.

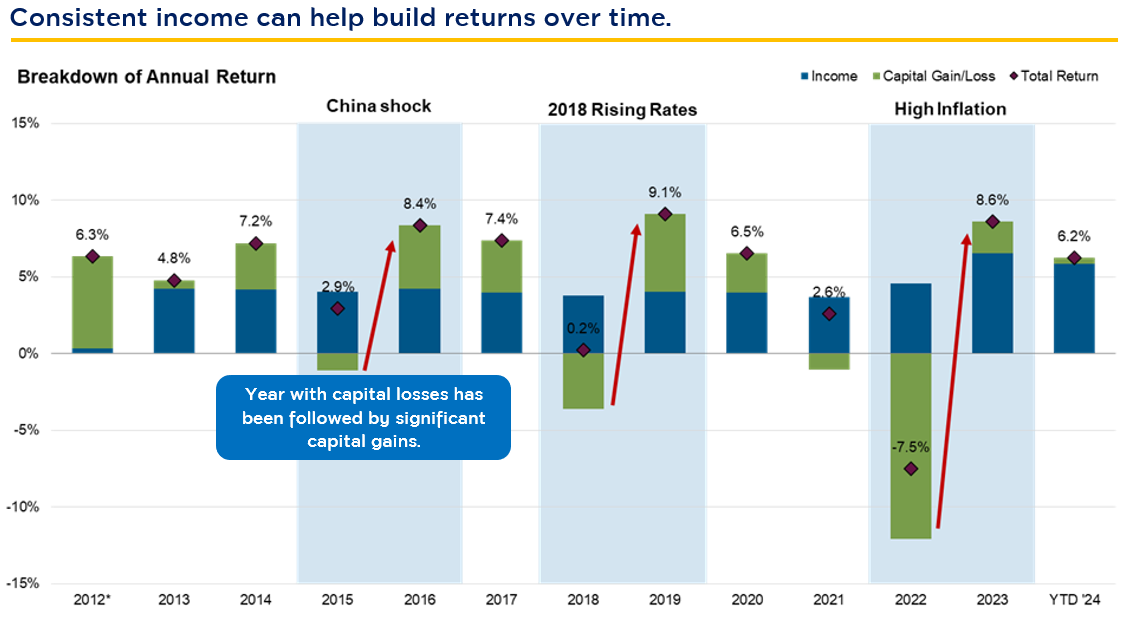

- Focus on cash flow from investing as a major driver of the total return and risk compensation when a price of invested fixed income falls.

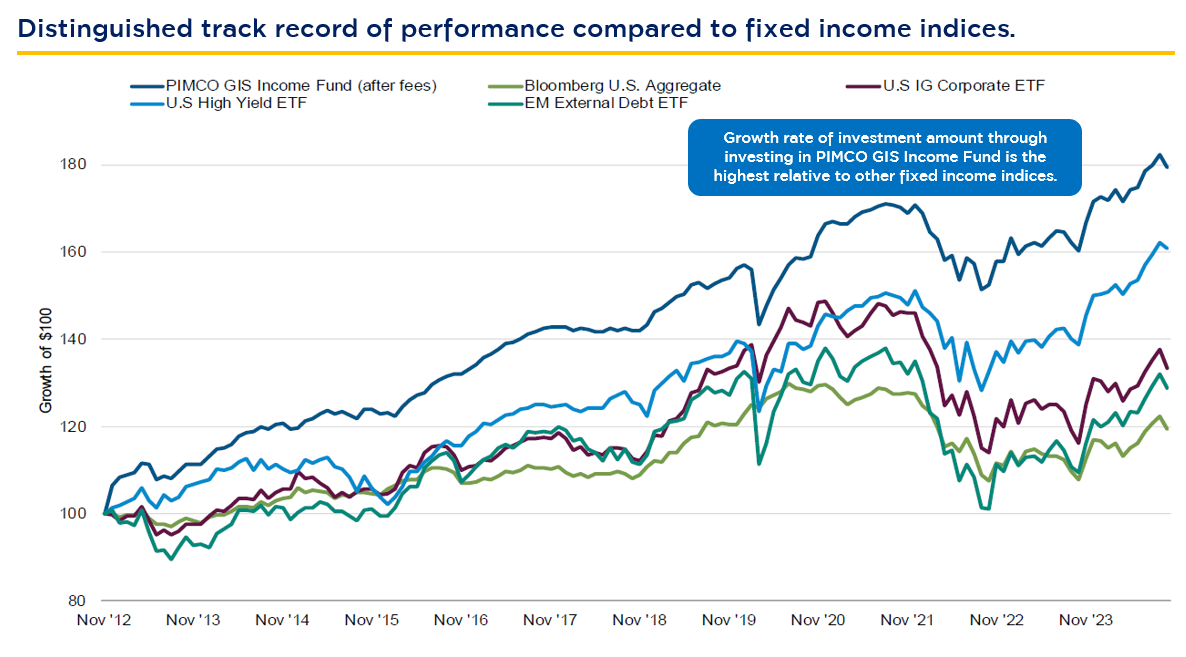

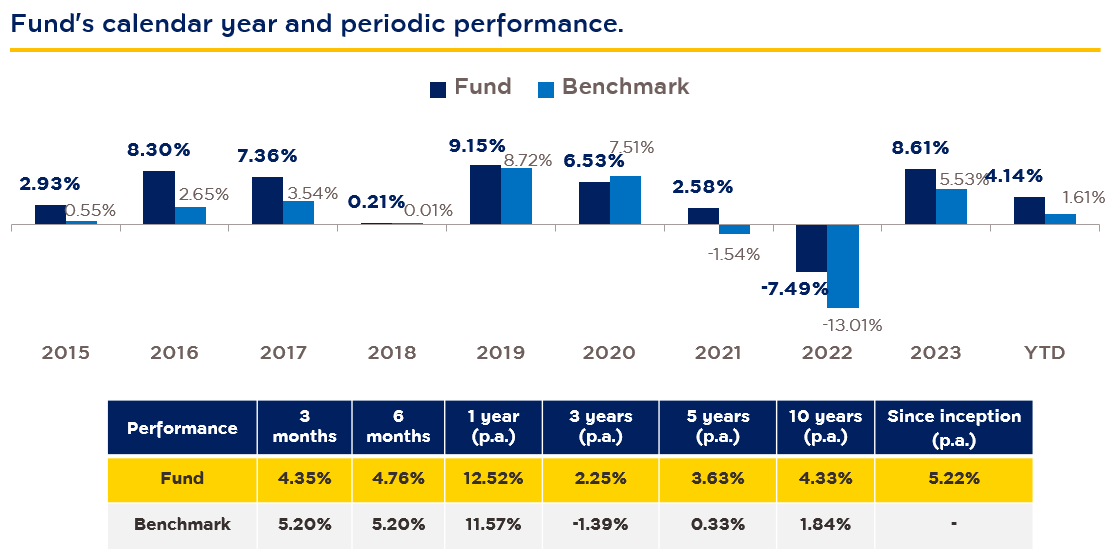

Sources: Bloomberg, PIMCO as of 30 Nov’24. | *Performance shown since the GIS Income Fund’s inception on 30 November 2012. | Performance is shown for the USD institutional class, accumulation shares, net of fees. Performance for periods less than one year is cumulative. | The performance shown is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by AIMC.

- Portfolio and track record of the past performance

Sources: PIMCO as of 31 Oct’24. | *”Government related” and “Non-U.S developed”: excludes any interest rate linked derivatives used to manage our duration exposure in the following countries: U.S, Japan, United Kingdom, Australia, Canada and European Union (ex-peripheral countries). Derivative instruments may include interest rate swaps, futures and swap options. All other government related and non-U.S government related securities such as government bonds, Treasury inflation protected securities, FDIC-guaranteed and government guaranteed corporate securities are included. Index shown: Bloomberg U.S. Aggregate Index. | Fund inception: 30 Nov’12. | The performance shown is net of management fee and is denominated in USD. | The performance shown is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by AIMC.

- Proven fund management capability with strong track record of performance over the years.

Source: PIMCO as of 30 Sep’24. | Benchmark: Bloomberg US Aggregate Index. | Fund inception: 30 Nov’12. | The performance shown is the performance of the Master Fund net of management fee and is denominated in USD. | The performance shown is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by AIMC.

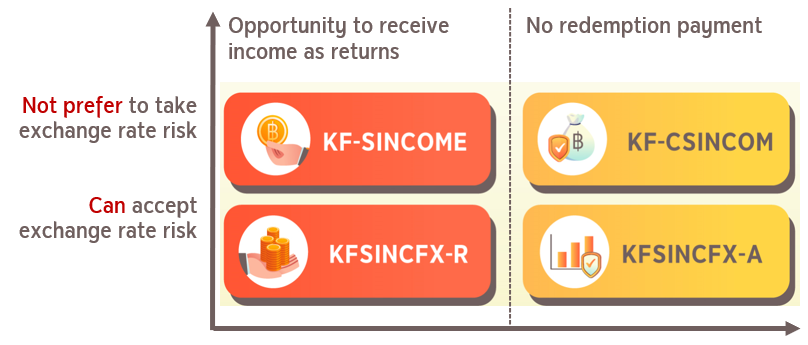

4 Krungsri’s Recommended Fixed Income Funds investing in PIMCO GIS Income Fund

Source: Krungsri Asset Management as of 31 Oct'24.

In addition, there are Fixed Income funds under RMF category, KFSINCRMF and KFSINCFXRMF for those who want to invest and use tax deductions, both of which are participating in the promotion of the Company's 2024 tax deduction fund group (please learn more details at button below*).

Fore more information or funds' prospectus, please contact:

Krungsri Asset Management Company Limited. Tel. 0 2657 5757

Disclaimers

- Should carefully study the fund features, conditions of returns, and risks before making an investment decision. Past performance is not a guarantee of future results.

- Since KFSINCFX is hedged against the foreign exchange rate risk, it may be exposed to the currency risk, which may cause investors the losses or gains on foreign exchange or cause them to receive lower return than the amount initially invested

- For KF-SINCOME & KFSINCFX-R, payment of returns depends on the master fund’s performance, which may sometimes cause investors to not receive the returns at some periods of time.

- This document has been prepared based on information obtained from reliable sources at the time of the presentation, but the Management Company does not provide any warranty of the accuracy, reliability, and completeness of all information. The Management Company reserves the right to change all information without any prior notice.

For KFSINCFX-A details, click

For KFSINCFX-R, click

For KF-CSINCOM, click

For KF-SINCOME, click

*Krungsri Tax Saving Funds Promotion, click

Back