Promotions/Fund Highlight

KFYENJAI-A ... Staying resilient & fueling potential higher returns

KRUNGSRI YENJAI FUND (KFYENJAI)

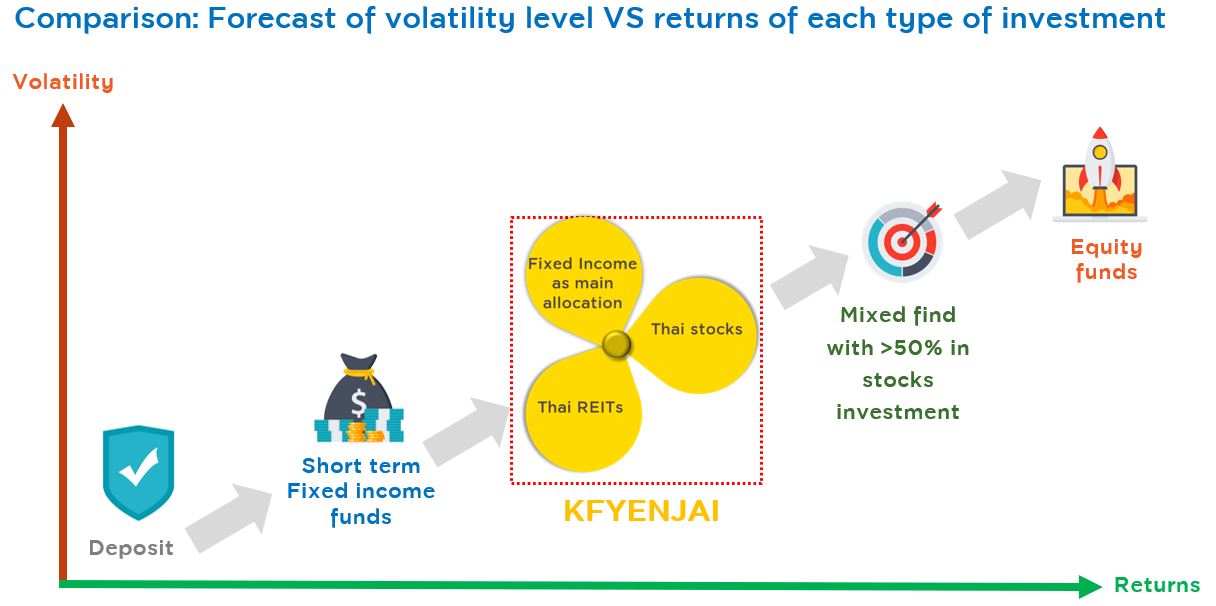

Through a diversified portfolio allocation across asset classes ranging from fixed income, stocks, to REITs, this ideal fund provides an opportunity to achieve better returns than deposit and manage to lower volatility and responds to the needs of investors who seek the source to generate better returns than deposit as for their resilient investment and moderate risk acceptance.

Remark: Above asset allocation is only the forecasted one that may change upon fund managers’ discretion. Above information is intended to be only an example to help describe the goals of the investment strategy. It does not guarantee the actual performance.

Forecasted portfolio of KFYENJAI and its investment strategy

- Investment strategy in fixed income to achieve sustainable investing: Focus to invest in fixed income as core allocation that diversifies across onshore debt instruments issued by the government and state enterprise, including offshore instruments with forecasted average credit ratings ranging from A to A+.

- Investment strategy in stocks and REITs to enhance returns: Diversifying investment in stocks and REITs at 5% each for an opportunity to generate additional returns and manage investment risk on portfolio.

Source: Krungsri Asset Management as of May 2022 | Above information is only the forecasted portfolio, which may differ from the actual one. And, once the fund size is larger, fund managers may consider direct investment instead of mutual fund investing according to their discretion.

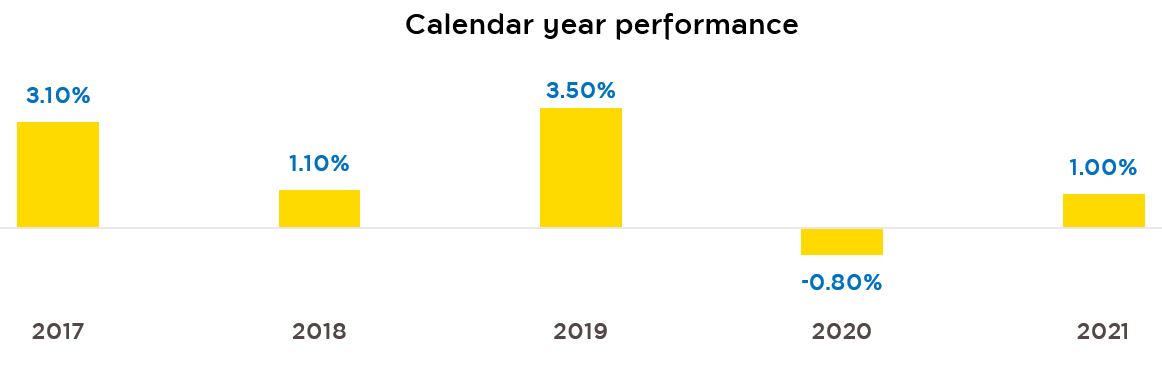

Past performance of model portfolio

being calculated from investment proportion in fixed income 90%, stocks 5%, and REITs 5% (not representing an actual performance of the fund)

Source: Morningstar, Krungsri Asset Management as of 30 Apr. 2022 | Model portfolio has investment proportion - Fixed income 90%, stocks 5%, and REIT 5%, which represents the proportion of model portfolio. The fund/ reference assets index consists of 1) Reference fixed income data from KFAFIX-A 40.5%, KFSMART 40.5%, and 6-month ZRR index 9% 2) Reference stocks data based on SET50 TRI at about 5.00% of portfolio 3) Reference REIT data based on PE & REIT Total Return Index at about 5.00% of portfolio. Investment proportion will be rebalanced monthly. | Above investment proportion was referred from forecasted long-term investment strategies of the fund. | Above shown returns are the ones after deduction of management fee of KFYENJAI at 0.7490% per year | Above shown returns include the rebate fee from KFSMART at 0.081% per year and KFAFIX-A at 0.1215% per year. These rates were calculated from management fee of KFSMART at 0.20% per year and KFAFIX-A at 0.30% per year multiplying investment proportion of KFSMART and KFAFIX-A at 40.5% each. | Shown performance is the forecasted performance of model portfolio, which does not represent the actual performance of the fund.

Fund facts

KFYENJAI-A: Krungsri Yenjai Fund – A

| Investment policy |

Investing in one or several securities or assets as follow:

1. Domestic and/or international bonds, deposits or deposits equivalent bonds, including CIS units of fixed income funds

2. Average stocks listed on the Stock Exchange, including stocks during IPO in the fiscal year of not exceeding 15% of the fund's net asset value

3. Average investment units of real estate investment trusts (REIT) and/or investment units of property mutual funds in the fiscal year of not exceeding 15% of the Fund's net asset value

4. Investment units of other mutual funds, which are under the management of the management company, with the average proportion in the fiscal year of not exceeding 79% of the Fund's net asset value. |

| Risk level |

5 – Moderate to high | Fully hedge against the exchange rate risk |

| Dividend payment policy |

None |

| Dealing date |

Daily (Please refer to the fund’s non-dealing calendar) |

| Minimum purchase |

500 Baht |

| IPO |

21 - 27 June 2022 (After IPO: 1 July 2022) |

- The Fund will enter into a forward contract to fully hedge against the exchange rate risk, in which case, it may incur costs for risk hedging transaction and the increased costs may reduce overall return.

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

Back