Promotions/Fund Highlight

KFUS: Investing in US Quality Performing Stocks

Responding to the strength of US stocks by proactively investing in high-quality stocks with the potential to generate superior returns with 3 funds:

- Krungsri US Equity Fund (KFUS)

- Krungsri US Equity SSF (KFUSSSF)

- Krungsri US Equity RMF (KFUSRMF)

All these funds invest through GQG Partners US Equity Fund*, the Master Fund, which is a Morningstar 5-star rated fund** with an investment philosophy to focus primarily on forward-looking “quality” and the investment process to select top quality stocks.

*The new Master Fund effective form 1 Nov'24. | **Source: GQG Partners as of 30 Sep'24 and Morningstar rating from Morningstar, which has no association with the performance assessment of the Association of Investment Companies (AIMC) in any respect.

KFUSSSF and KFUSRMF participate in 2024 tax saving campaign. (Please see further details below.)

Highlights of the master fund: GQG Partners US Equity Fund

1. Focus on forward-looking “quality” when selecting companies to invest in:

- Less reliant on historical data and instead place heavy emphasis on qualitative assessments barriers to market entry, sustainability, and industry insight, as well as the resulting valuation implications

- Target clarity on longer term targeted earnings to become comfortable with the durability of a company’s competitive advantage

- Focus on long-term compound growth

.aspx)

Source: GQG Partners as of 30 Sep'24

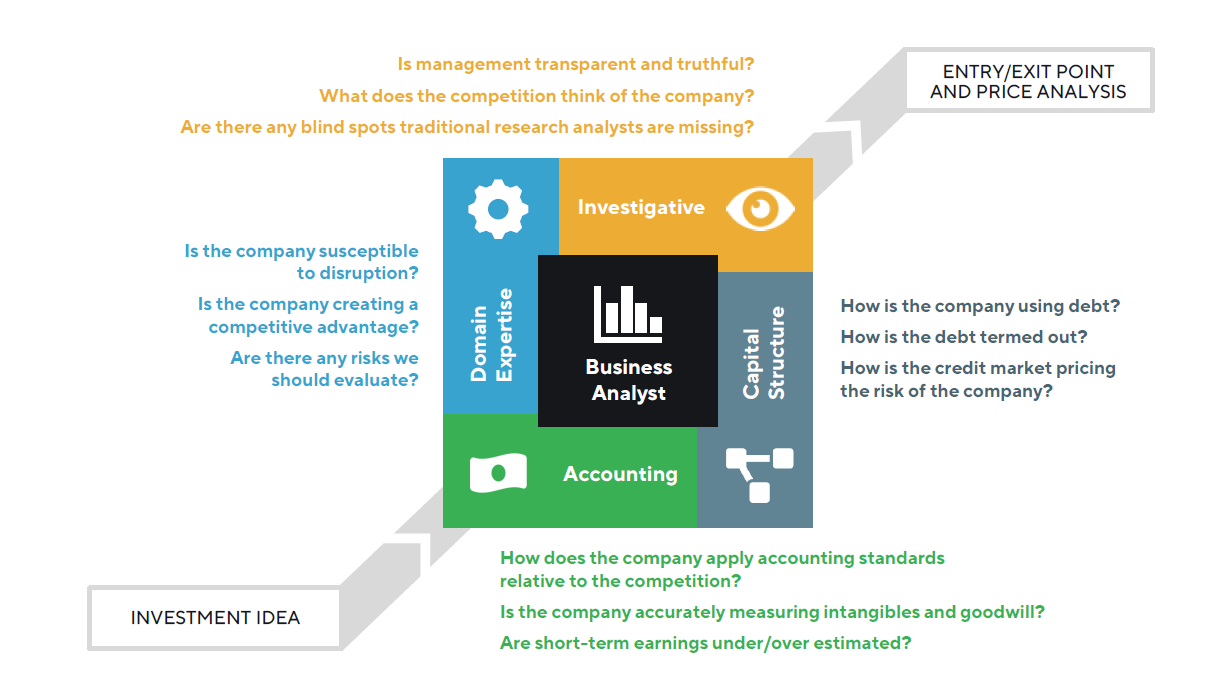

2. A “Research Mosaic” that brings together the following 4 key elements: Investigative / Capital Structure / Domain Expertise / Accounting

Source: GQG Partners as of 30 Sep'24

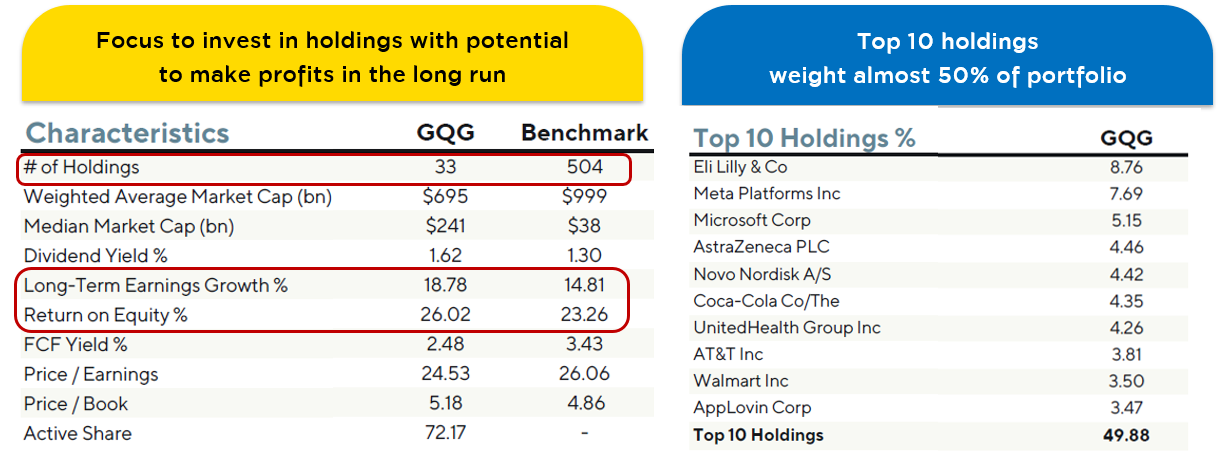

3. Investment strategy framework that focuses on finding the potential of securities without adhering to the benchmark

3.1) Investment Universe

- The Fund does not focus on cash holdings. Under normal market condition, the Fund will invest fully in stocks, accounting for 15-40 securities.

- The Fund has no restrictions on sector diversification and the capitalization size of the companies in which it invests, but it usually focuses on investing in large-cap stocks.

3.2) Portfolio Guidelines

- Seek reasonably priced companies.

- Focus on long-term perspective and disciplined investing.

Analyze company fundamentals in terms of durability, valuation, management, and earnings.

- Diversify across risk factors impacting portfolio companies.

- Agile portfolio rebalancing in alignment with changing market condition.

Source: GQG Partners as of 30 Sep'24. | The information is provided for illustrative purposes only. The actual portfolio may differ from the above investment universe and therefore cannot be used as reference for forward-looking investing of the Fund.

Investment Portfolio of the Master Fund

- A portfolio that assigns higher weights to high-conviction securities while diversifying investments across countries and sectors as a result of individual securities selection.

Currently the Fund has overweighed the most in the sectors of Healthcare, Utilities and Communication Services and allocates modest weights to non-listed US companies.

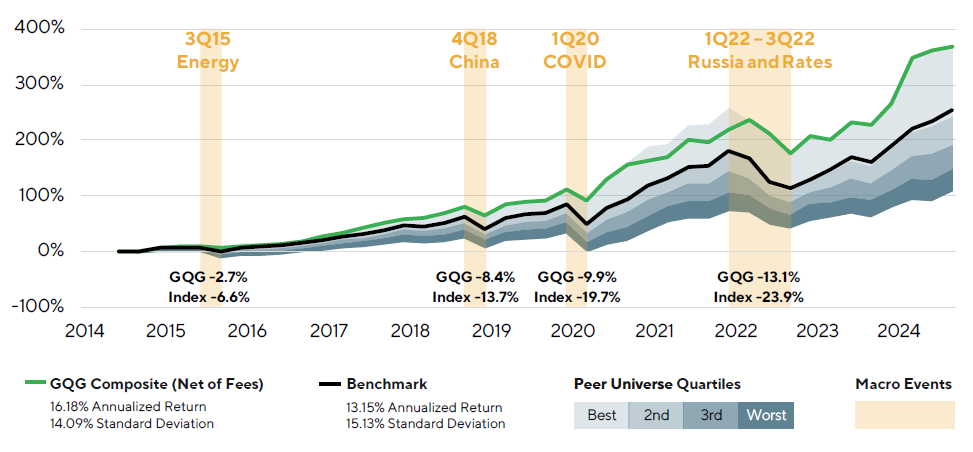

- Durability amidst Volatility Caused by Macroeconomic Challenges

Source: GQG Partners as of 30 Sep'24. The Fund’s inception date is 1 Jul'14. | Peer fund comparison is based on Morningstar Peer Universe: US Large Cap (597 strategies). | The performance data presented is based on the compilation of performance of the funds investing in such strategies. | The performance displayed is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of the Association of Investment Management Companies (AIMC).

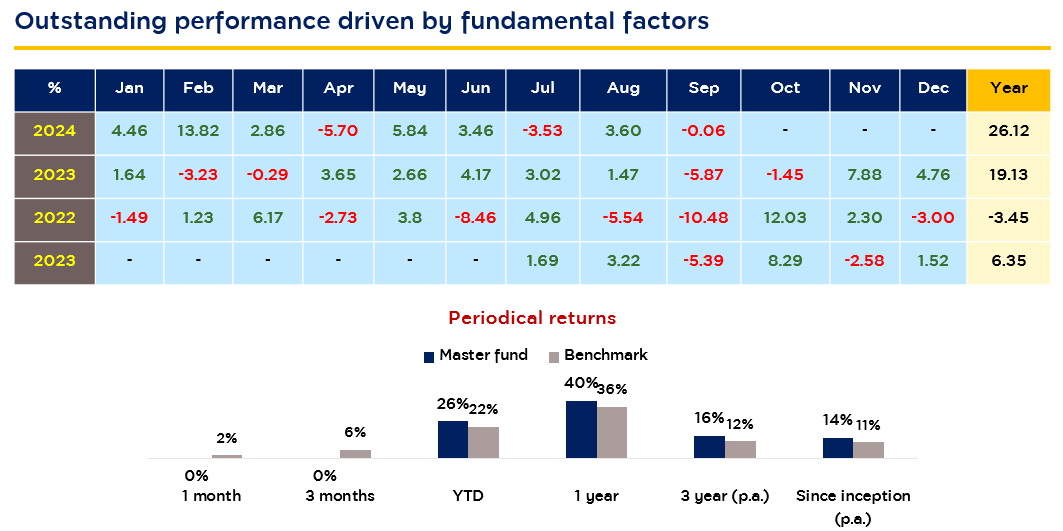

Performance of the Master Fund

Source: GQG Partners as of 30 Sep'24. The Fund’s inception date is 1 Jul'14. | Peer fund comparison is based on Morningstar Peer Universe: US Large Cap. | The performance displayed is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of the Association of Investment Management Companies (AIMC).

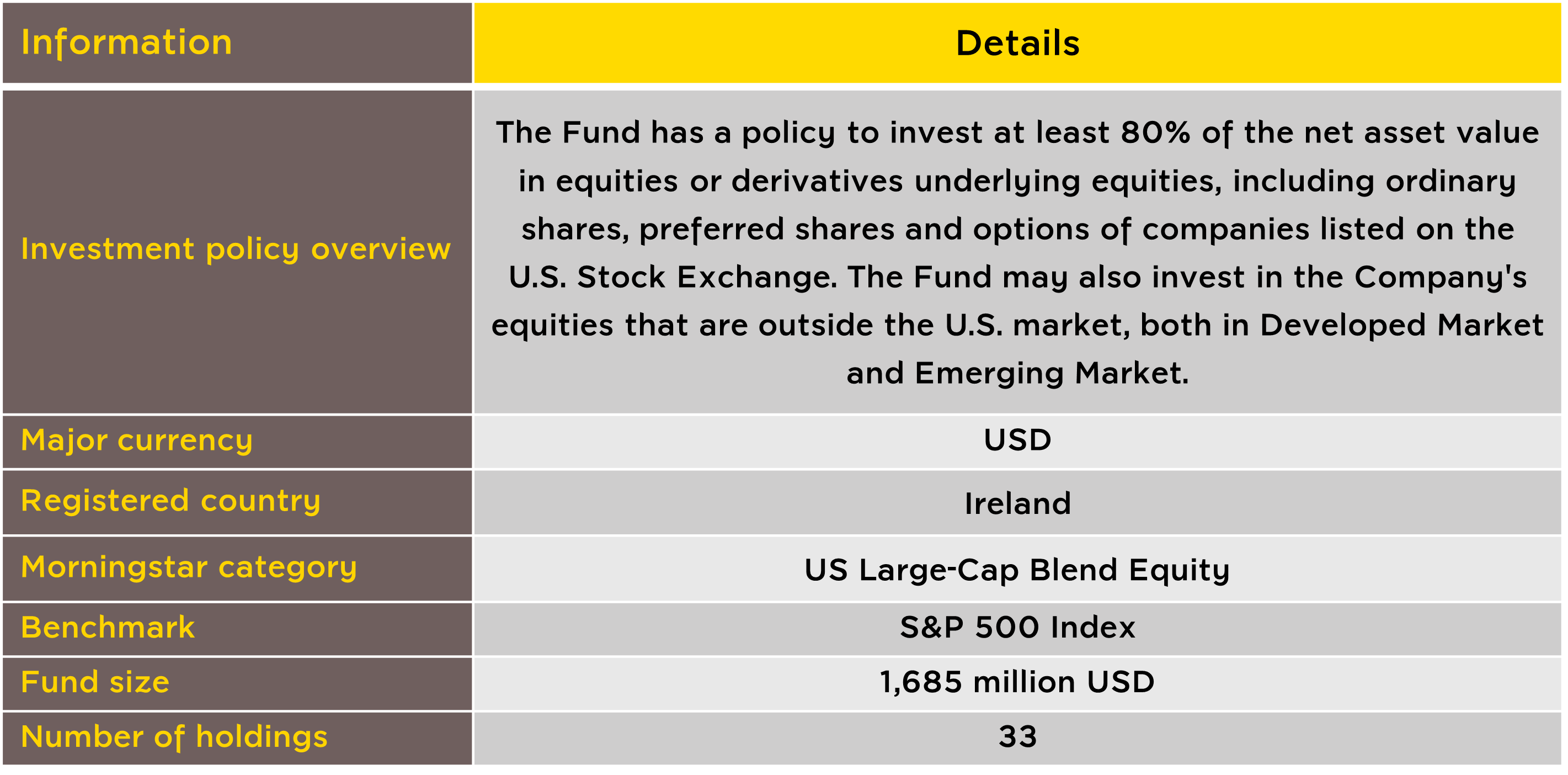

Brief Summary of the Master Fund: GQG Partners US Equity Fund

Source: GQG Partners as of 30 Sep'24. The Fund’s inception date is 1 Jul'14. | Peer fund comparison is based on Morningstar Peer Universe: US Large Cap. | The performance displayed is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of the Association of Investment Management Companies (AIMC).

Brief Summary of the Master Fund: GQG Partners US Equity Fund

Source: Fact sheer of the master fund as of 30 Sep'24.

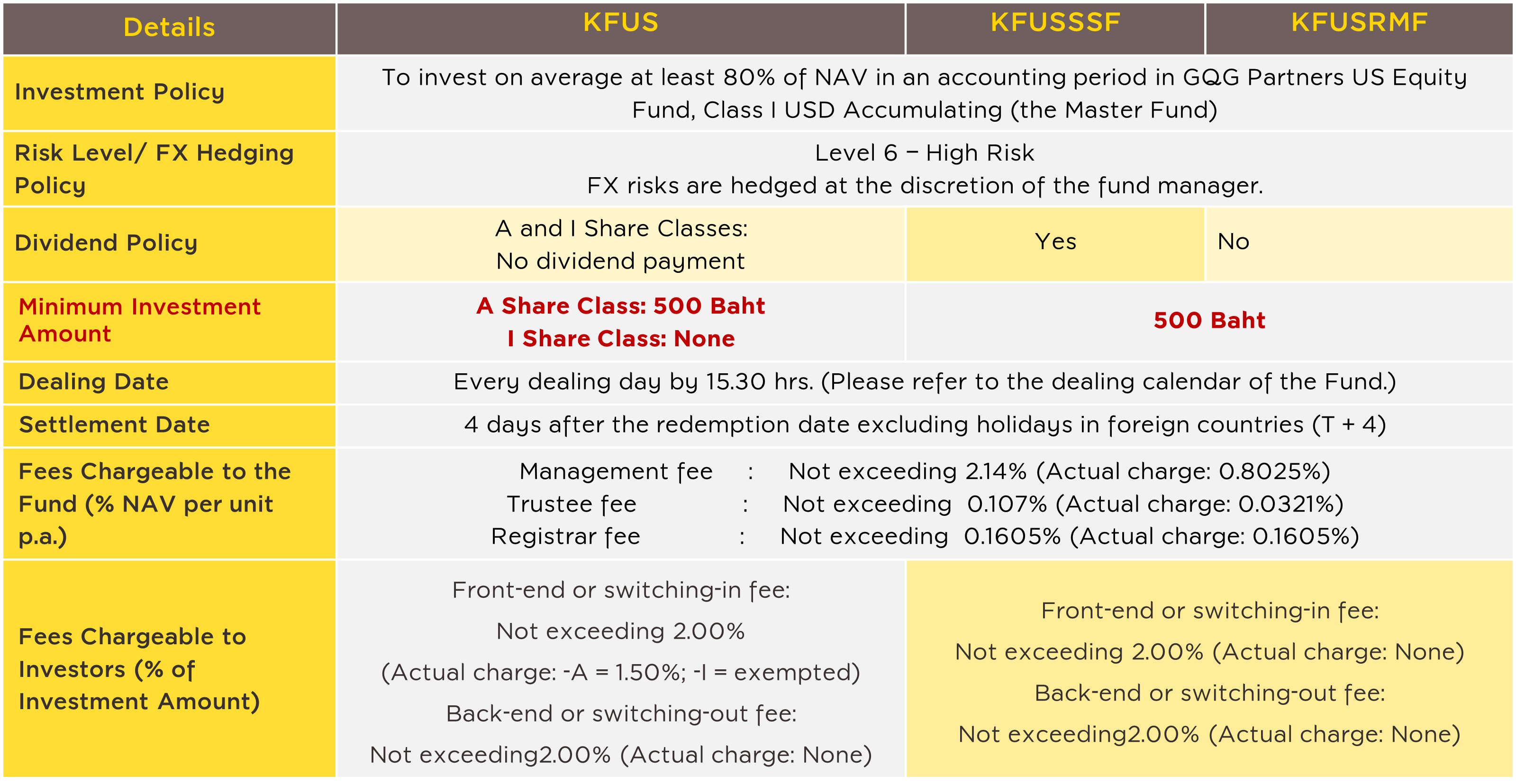

Brief Summary of Krungsri Funds and Special Promotion*

Remark: The fees chargeable to the Fund and/or investors are inclusive of value added tax or specific business tax or any other taxes. Switching fees between different share class of the same fund are waived.

*For KFUSSSF and KFUSRMF

- Enjoy tax deduction and promotional privileges: Receive investment units of KFCASH-A worth 100 Baht per every cumulated investment amount of 50,000 Baht in any of the participating SSF/ RMF/ Thai ESG funds of Krungsri Asset Management. (Upon investing in accordance with the conditions only. Please see further details below.)

- The Funds can be purchased with a Krungsri participating credit card. (Purchases of investment units will not participate in the sales promotion and point accumulation program of the relevant credit card.)

Disclaimers

- SSF is the fund that promotes savings and RMF is the fund that promotes long-term investment for retirement. Investors should have an understanding of the product feature, conditions of investment return and risks, and study the tax benefits in the investment manual before making investment decision. Investors will be not eligible for tax benefits in an absence of compliance with the investment conditions. Past performance is not a guarantee of future results.

- This document is prepared based on information obtained from reliable sources as of the date of publication. However, the Management Company does not provide any warranty of the accuracy, reliability and completeness of all information. The Management Company reserves the right to make changes to all information without prior notice.

- KFUS, KFUSSSF, and KFUSRMF are hedged against currency risk at the Fund Manager’s discretion and are therefore subject to foreign exchange risk which may cause investors to experience foreign exchange losses or gains/or receive lower return than the initial investment amount.

To inquire further information or request a prospectus, please contact Krungsri Asset Management Co., Ltd. Tel. 0 2657 5757 press 2 | E-mail: krungsriasset.mktg@krungsri.com

For KFUS-A details click

For KFUSSSF details click

For KFUSRMF details click

For SSF/RMF/Thai ESG promotion details click

Back