Promotions/Fund Highlight

KFSINCFX ... Accelerate Potential Returns from Global Fixed Income

The unmissable investment opportunity is in fixed income right now when it comes to a fact that Fed nearly ends the rate hike cycles, inflation in developed countries is likely to fall from its peak and yields of fixed income instruments in many categories are rising to attractive levels.

Krungsri Global Smart Income FX Fund (KFSINCFX)

- Invest in the master fund titled PIMCO GIS Income Fund, a Morningstar 5-star rated fund* with a proven track record of past performance riding through changing market conditions.

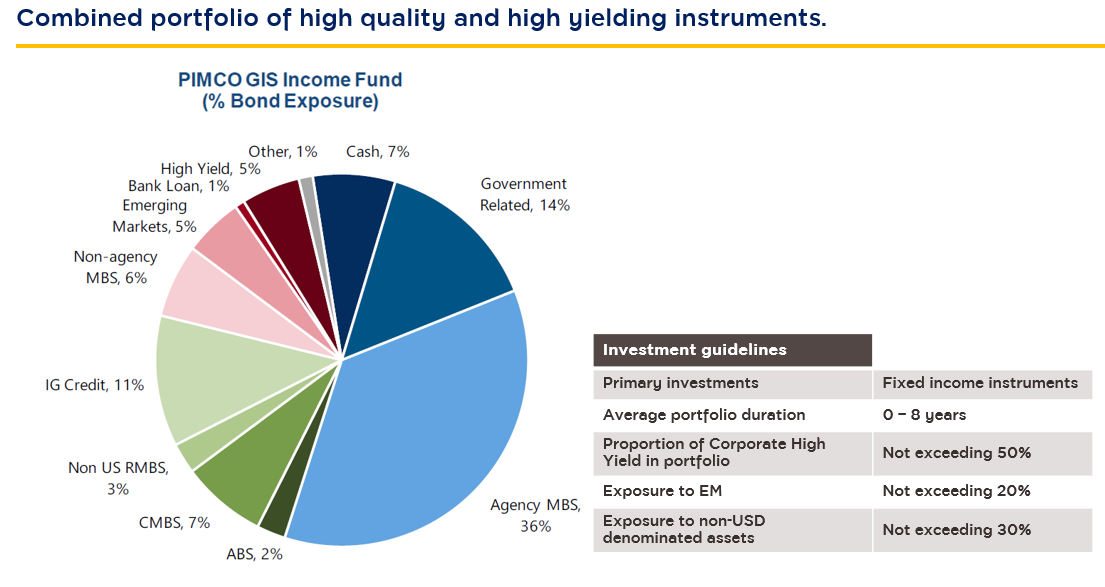

- Focus on achieving consistent income from multiple sources of income through a diversification into a combination of high quality and high yielding instruments, including government bonds, private bonds (Investment Grade private and High Yield), and Mortgage-Backed Securities (MBS)/ Asset-Backed Security (ABS) in order to enhance the ability to generate high and consistent return and reduce the volatility stemming from changes of economic conditions and interest rates.

- Suitable for investors seeking more investment diversification into fixed income portfolio and those looking for potential to enhance returns volume for their overall portfolio.

*Source: Morningstar rating from PIMCO as of 31 Mar. 2024. | Such rating has no connection to the rating of AIMC in any respect.

Outstanding Characteristics: PIMCO GIS Income Fund

1. Flexible active portfolio rebalancing with a focus on various fixed income investments and tactical management of the average duration of fixed income instruments in the portfolio to ensure consistency with changing market conditions and interest rates.

Source: PIMCO as of 30 Apr. 2024. | *”Government related” and “Non-U.S developed”: excludes any interest rate linked derivatives used to manage our duration exposure in the following countries: U.S, Japan, United Kingdom, Australia, Canada and European Union (ex-peripheral countries). Derivative instruments may include interest rate swaps, futures, and swap option. All other government related and non-U.S government related securities such as government bonds, Treasury inflation protected securities, FDIC-guaranteed and government guaranteed corporate securities are included.

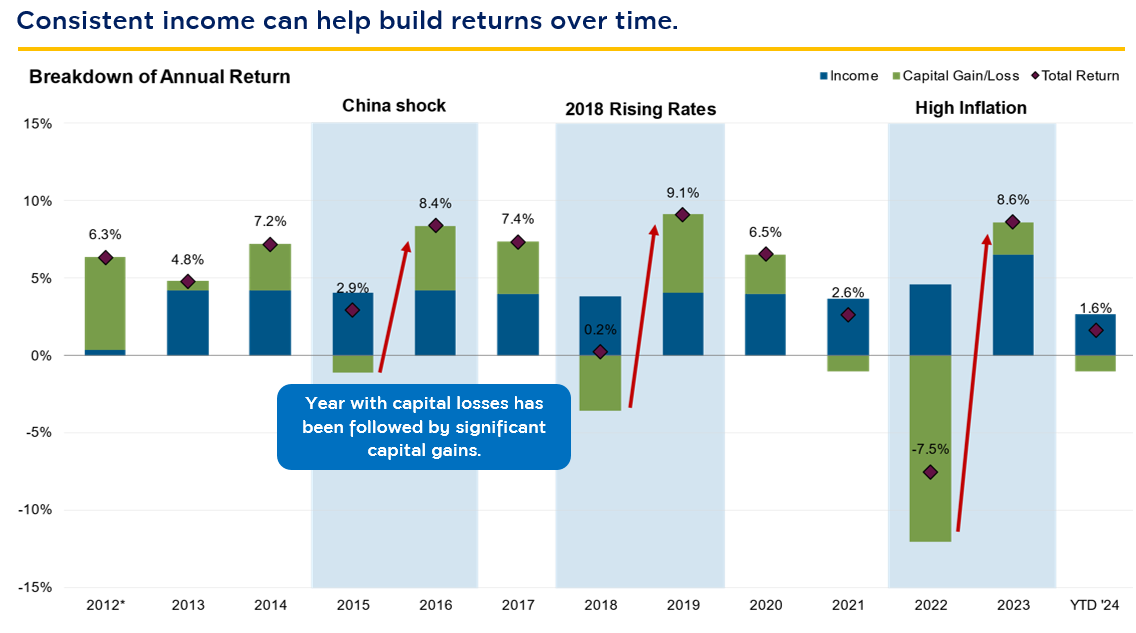

2. Focus on cash flow from investing as a major driver of the total return and risk compensation when a price of invested fixed income falls.

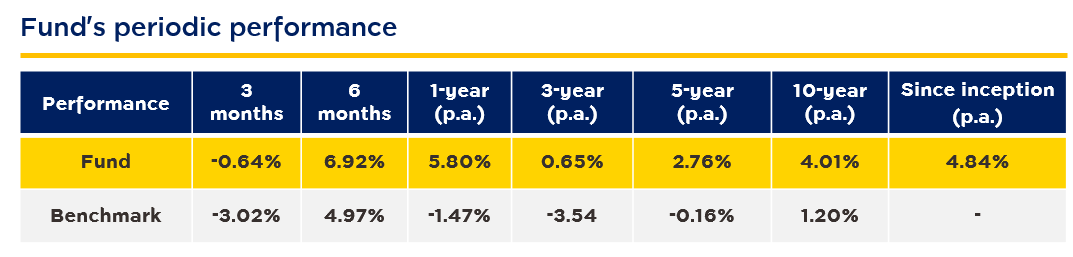

Source: Bloomberg, PIMCO as of 30 May 2024. | *Performance shown since the GIS Income Fund’s inception on 30 November 2012. | Performance is shown for the USD institutional class, accumulation shares, net of fees. Performance for periods less than one year is cumulative. | The performance shown is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by the Association of Investment Management Companies (AIMC).

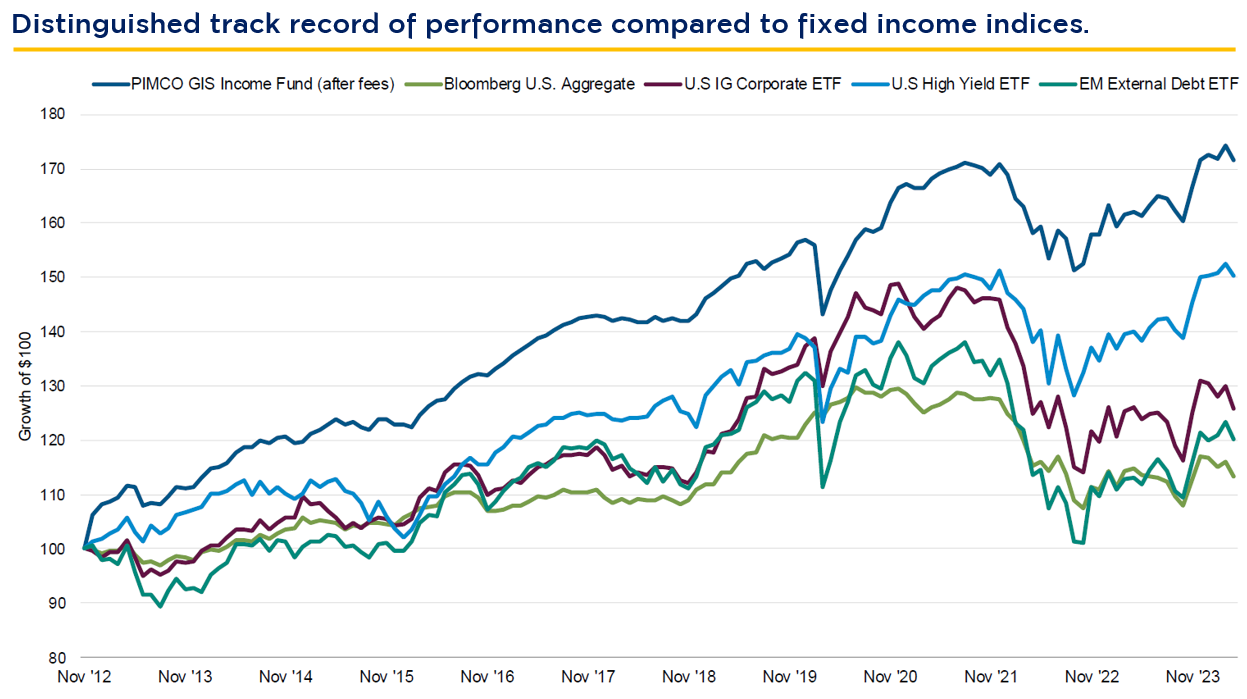

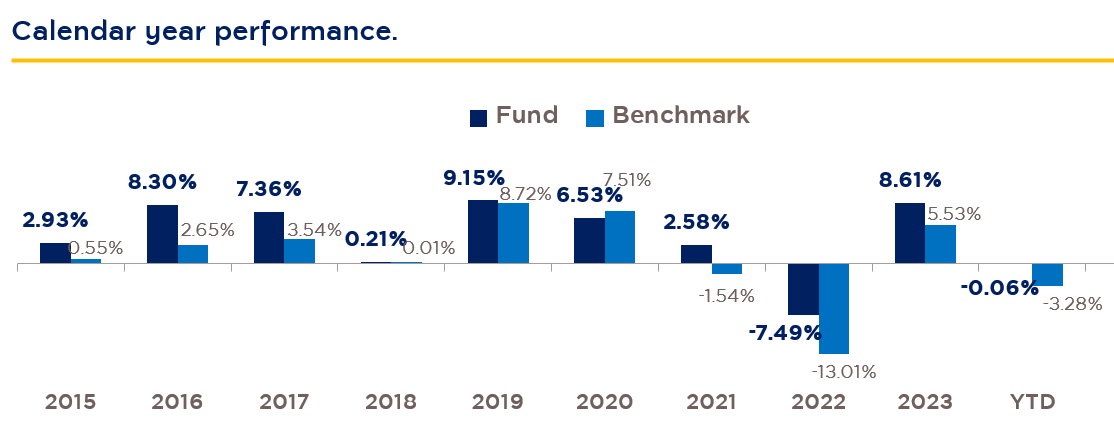

3. Proven fund management capability with strong track record of performance throughout the changing market environments.

Sources: PIMCO, Bloomberg as of30 Apr. 2024. | The chart's starting time period is since inception of the GIS Income Fund, which was incepted on 30 November 2012. |.Index and ETFs shown: U.S Agg = Bloomberg U.S. Aggregate Index, U.S High Yield ETF = iSharesiBoxx$ High Yield Corporate Bond ETF, U.S IG Corporate ETF = iSharesiBoxx$ Investment Grade Corporate Bond ETF. | The performance shown is net of management fee and is denominated in USD. The performance shown is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by AIMC.

Source: PIMCO as of 30 Apr. 2024. | Benchmark: Bloomberg US Aggregate Index. The fund is actively managed in reference to the Bloomberg US Aggregate Index as further outlined in the prospectus and key investor information document. The Fund’s inception date is 30 Nov 2012. The performance shown is the performance of the Master Fund net of management fee and is denominated in USD. The performance shown is the performance of the Master Fund which is not in accordance with the standards on mutual fund performance measurement as prescribed by AIMC.

Fund information

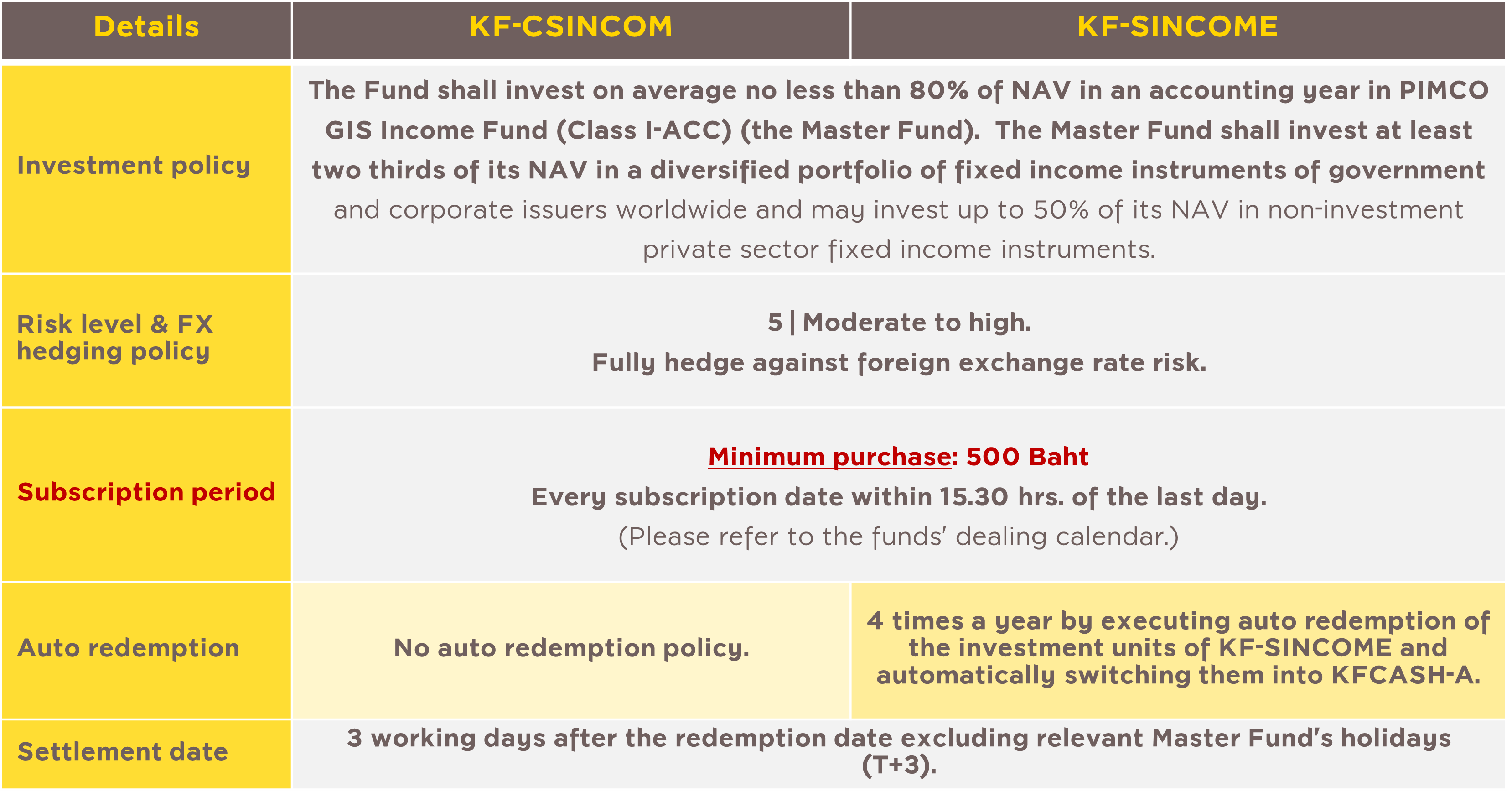

Krungsri Global Collective Smart Income Fund (KF-CSINCOM)

Krungsri Global Smart Income Fund (KF-SINCOME)

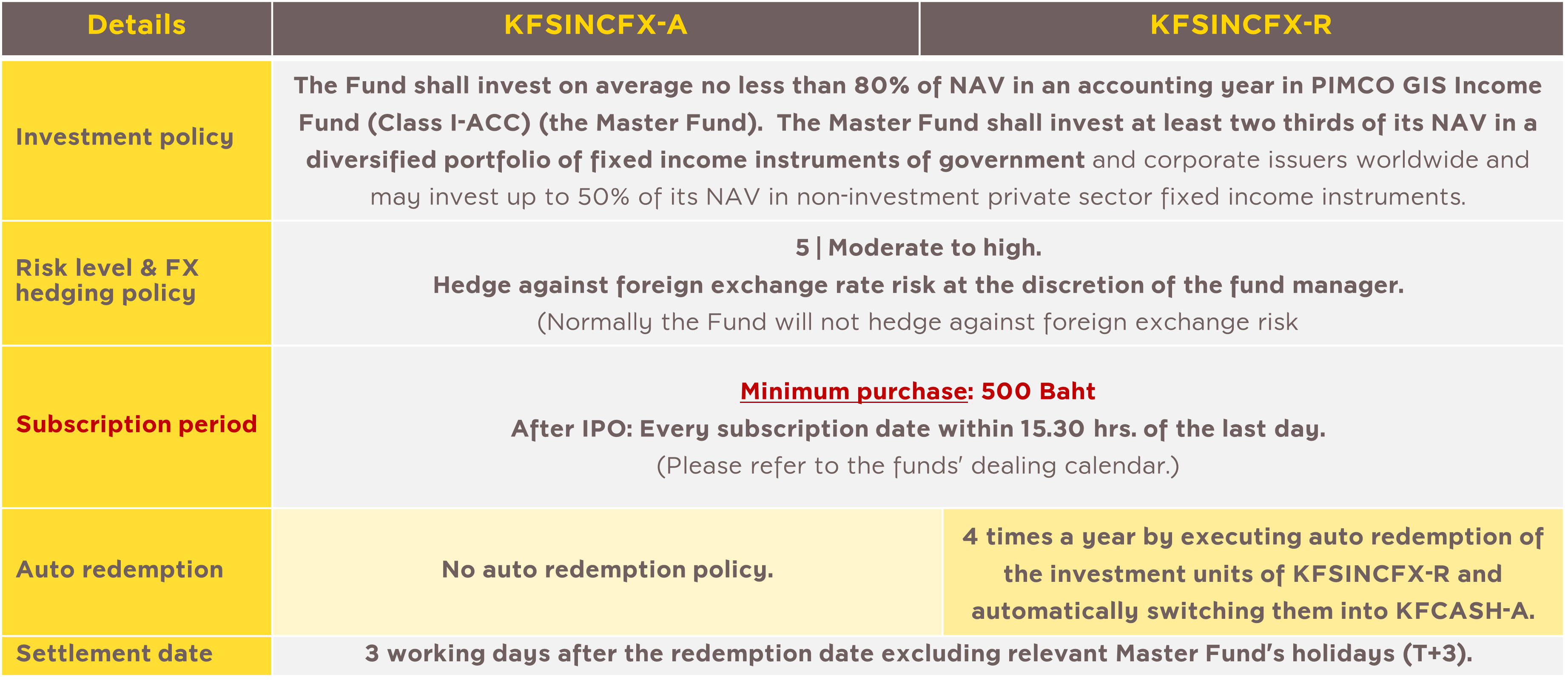

KFSINCFX was divided into two share classes:

KFSINCFX was divided into two share classes:

- Krungsri Global Smart Income FX Fund-A (KFSINCFX-A)

- Krungsri Global Smart Income FX Fund-R (KFSINCFX-R)

- This document has been prepared based on information obtained from reliable sources at the time of presentation, but the Management Company does not provide any warranty of the accuracy, reliability, and completeness of all information. The Management Company reserves the right to change all information without any prior notice.

- For KF-SINCOME & KFSINCFX-R, payment of returns depends on the master fund’s performance, which may sometimes cause investors to not receive the returns at some periods of time.

- KFGLOBAL and KFGLOBFX are subject to exchange rate risk which may result in losses or gains on foreign exchange or cause investors to receive lower return than the amount initially invested.

- Should carefully study the fund features, conditions of returns, and risks before making an investment decision. Past performance is not a guarantee of future results.

For more information or request for fund prospectus, please contact:

Krungsri Asset Management Company Limited. Tel. 02-657-5757.

For KFSINCFX-A details, click

For KFSINCFX-R details, click

For KF-CSINCOM details, click

For KF-SINCOME details, click

Back