Promotions/Fund Highlight

KFGLOBFX ... Seize the Boundless Opportunities in Global Top Stock Picks.

IPO: 23 - 29 April 2024.

KFGLOBFX truly provides an opportunity to invest in top picked global stocks being not limited to any specific type of stocks, industries, or benchmark to achieve the best opportunities in up-and-down economic cycles through investing in the Morningstar 5-Star rated* master fund under the management of BlackRock, the world's asset manager. The fund does not hedge against the exchange rate risk.

(Unlike KFGLOBAL that is hedged against the exchange rate risk at fund manager’s discretion normally at least 90% of foreign investment value.)

*Source: BlackRock as of 29 Feb. 2024. | The Morningstar fund rating is not associated with the AIMC’s fund performance measurement in any respect.

KFGLOBFX IPO: 23 - 29 April 2024. | Minimum purchase at 500 only.

During IPO, investors can switch from KFGLOBAL units to KFGLOBFX-A and KFGLOBFX-I during 23 - 24 April 2024.

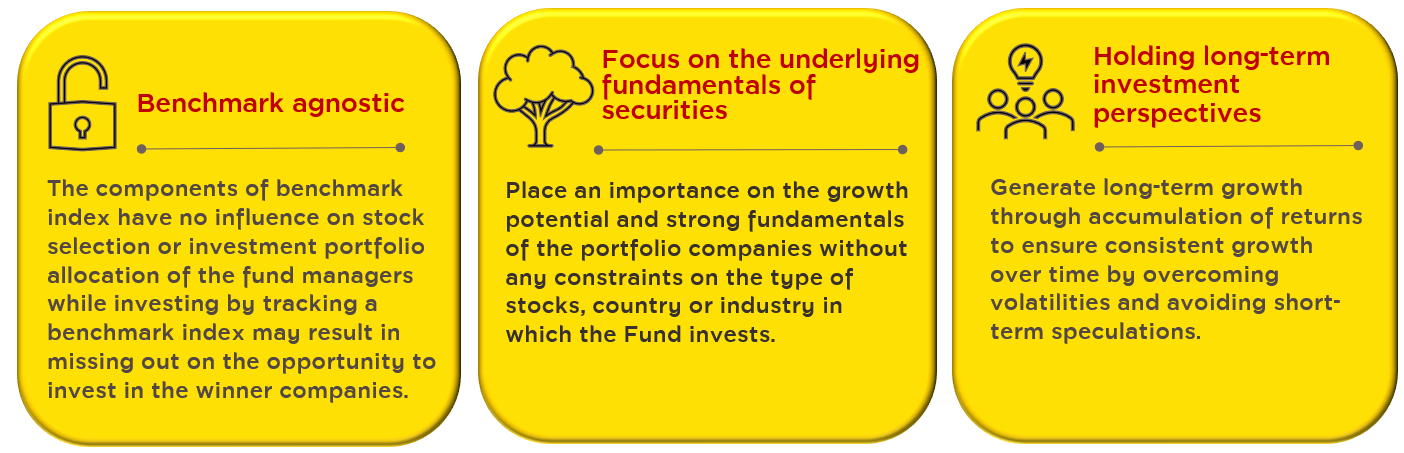

KFGLOBFX highlights the “Unconstrained approach” of fund investment.

Source: BlackRock as of 29 Feb. 2024. The investment process may be changed without any prior notice. The above investment approach does not give any guarantee that the investment return will always be positive throughout the investment period.

Strategies of the Master Fund: BlackRock Global Unconstrained Equity Fund

1. Place an importance on fundamentals and growth potentials of the companies to invest in by focusing to identify the companies with most outstanding characteristics of "the winner" and growth potentials

Source: BlackRock as of 31 Jan. 2024. | The information is for illustration purposes only. | The above investment approach does not give any guarantee that the investment return will always be positive throughout the investment period.

2. Allocating the balanced portfolio to foster sustainability of return

According to fund managers' team, business segmentation is based on cash flow generating and actual profits to help manage portfolio risk:

- >50% of portfolio will be invested in defensive stocks that are resilient to economic cycles to build a protective shield for the portfolio during economic downturns.

- The remaining investment portion will be diversified among various types of business having high potential to generate excessive returns.

Source: BlackRock as of 31 Jan. 2024. | The information is for illustration purposes only. | The above investment approach does not give any guarantee that the investment return will always be positive throughout the investment period. | Although the above investment approach has an objective to control risks, the Fund may still involve risks. | The investment process may be changed without any prior notice.

3. Stick to an investment discipline: Call themselves as a business owner, not speculator.

Trading or portfolio rebalance of the fund managers will be infrequent, mainly driven by:

- Stock fundamentals have changed and affected the investment supporting factors.

- Portfolio rebalance that tends to happen when it comes to the adjustment of portfolio holdings price that makes the fund allocation exposed to <50% of assets Defensive companies.

- Valuation extreme of portfolio holdings, particularly when it comes to heavy market adjustments.

- Superior businesses have been uncovered.

Source: BlackRock as of 31 Jan. 2024. | The above investment approach does not give any guarantee that the investment return will always be positive throughout the investment period.

Unique Features of the Master Fund:

Master Fund's Portfolio

The master fund has employed the investment strategy framework that focuses on the selection of individual stocks based on fundamental factor consideration of around 20 - 30 securities under three major investment themes. In this respect, the investment universe mainly focuses on the big companies in US and Europe, while the remaining investment portion will be diversified among medium and small companies.

Source: BlackRock as of 31 Jan. 2024. | The information is for illustration purposes only. | The investment portfolio and perspectives may be subject to changes in the future.

Source: BlackRock as of 29 Feb. 2024. | The company names displayed above do not refer to all securities in the Fund’s portfolio and should not be used as a reference for implying that investing in these companies will always generate profits. | The investment portfolio and perspective are subject to changes in the future.

Master Fund's Past Performance

The master fund has generated the returns that were able to beat the market outstandingly in the long run.

Source: BlackRock as of 29 Feb. 2024. | Index performance do not reflect any management fees, transaction costs or expenses. | Fund inception: 21 Jan. 2020. | Returns are shown net of fees for an investment in the USD D class accumulating. | The fund performance displayed above is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of AIMC.

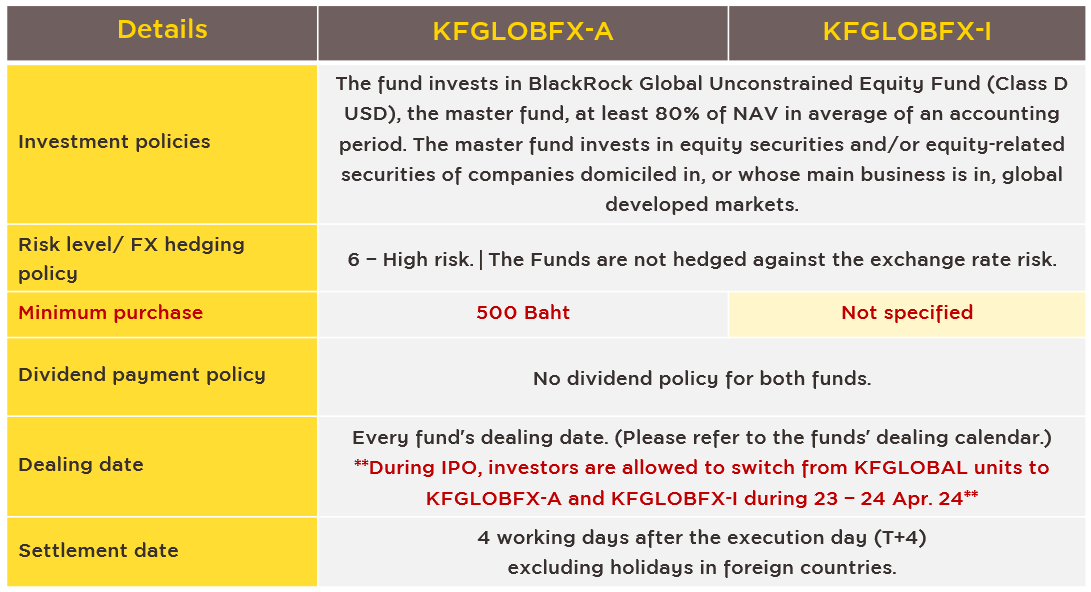

KFGLOBFX was divided into two share classes:

- Krungsri Global Unconstrained Equity FX-A (KFGLOBFX-A)

- Krungsri Global Unconstrained Equity FX-I (KFGLOBFX-I)

- Should understand the fund features, conditions of returns, and risk before making investment decision. Past performance is no guarantee of future results.

- Since KFGLOBFX is not hedged against the exchange rate risk, it therefore involves currency risk which may cause investors to experience foreign exchange losses or gains/or receive lower return than the initial investment amount.

- This document is prepared based on the information obtained from reliable sources at the time of presentation. However, the Management Company does not provide any warranty of the accuracy, reliability and completeness of all information. The Management Company reserves the right to make changes to all information without any prior notice.

For KFGLOBFX-I details, click.

Back