Promotions/Fund Highlight

KFGG ... Bringing you the portfolio of true global growth stocks

Krungsri Global Growth Fund (KFGG)

A concentrated global portfolio of true growth stocks backed with the best investment ideas from the totally bottom-up strategy with long-term investment horizon by Baillie Gifford, the fund manager of Baillie Gifford Worldwide Long Term Global Growth Fund, the five-stars rated one from Morningstar*

*Source: Baillie Gifford as of 30 June 2021 | The above awards and rankings are not relevant to the AIMC. The referenced performance belongs to the master fund, so it is not complied to AIMC’s standard.

Why should you invest in KFGG?

Master Fund: Baillie Gifford Worldwide Long Term Global Growth Fund

Fund Performance

*Returns in period less than one year are not annualized.

Source: Baillie Gifford as of 30 June 2021 | US dollars. Net of fees | Index: MSCI ACWI Index | Share Class Inception date: 10 August 2016 | This shows the performance of the master fund, so it is not complied to AIMC’s standard.

Growth investing strategy … Unique characteristic of Baillie Gifford

- Different perspectives lead to different strategies : The fund focuses on long-term investment rather than short-term trading with a current average holding period of each asset at nine years. The fund also stays open to investment opportunities around the world based on their different attitudes to optimism allowing them to grasp growth opportunities that others may dismiss.

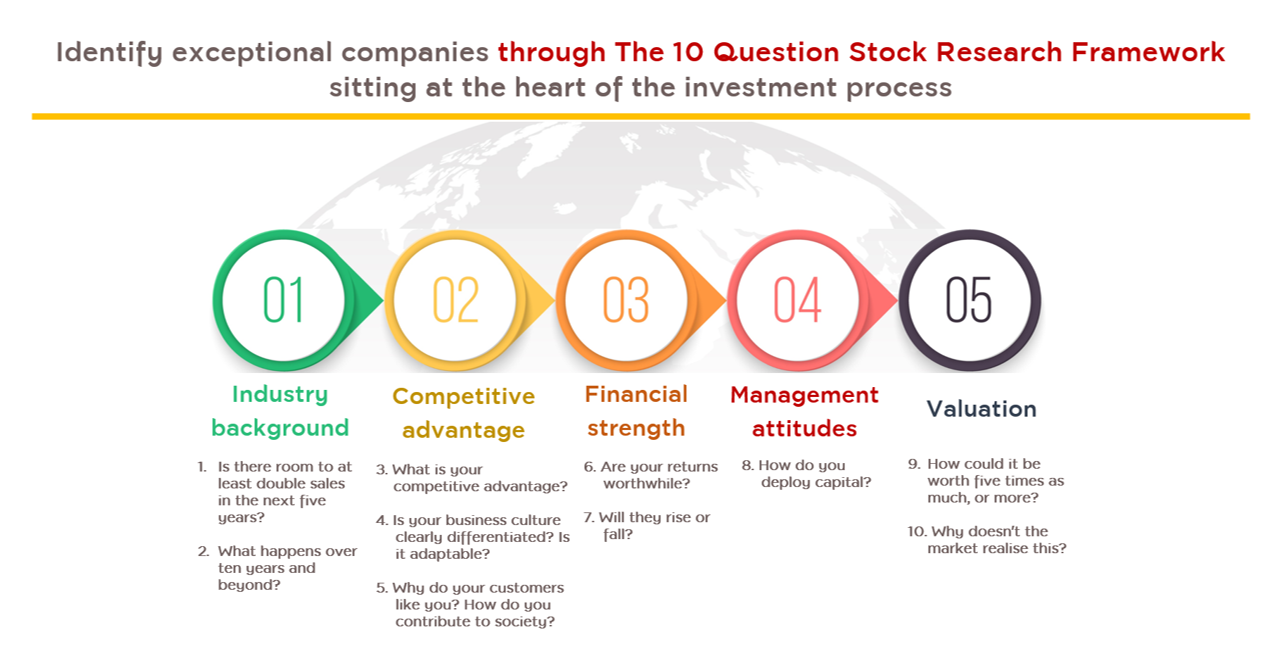

- Focus on a small number of holdings with potentials in which the fund has confidence and that will drive the long-term returns through identifying the exceptional companies based on an analysis of growth potentials that will drive the next decade of returns.

Source: Baillie Gifford as of 30 June 2021

Source: Baillie Gifford as of 30 June 2021

- Pay attention to stocks’ fundamental factors rather than macro ones or short-term volatility through a portfolio construction based on long-term growth trends rather than industrial sectors relying on indexes.

Source: Baillie Gifford as of 30 June 2021 | Size of circle = weight of assets | Stocks can span more than one circle

- A collection of true growth stocks worldwide in one portfolio

Samples of world famous securities

Source: Baillie Gifford as of 30 June 2021

About KFGG

The fund is divided into 2 share classes:

- Krungsri Global Growth Fund - Accumulation Class (KFGG-A)

- Krungsri Global Growth Fund - Institutional Investor Class (KFGG-I)

| Investment Policy |

Invest in the master fund named Baillie Gifford Worldwide Long-term Global Growth Fund, Class B USD Acc, on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has an objective to primarily invest in a concentrated but diversified portfolio of equity securities which shall principally be listed, traded, or dealt in on one or more of the Regulated Markets |

| Risk Level |

6 – High risk | Fully hedge against foreign exchange rate risk (Hedge against the exchange rate risk at a particular time for the value of at least 90% of the foreign investment value) |

| Dividend Payment Policy |

Both share classes have no dividend payment policy. |

| Dealing Date |

Daily (Please refer to Fund’s Non-Dealing Calendar) |

| Minimum Purchase |

500 Baht |

| IPO |

24 - 31 August 2021 (After IPO: 7 September 2021) |

Every 100,000 Baht investment amount in

Krungsri Global Growth Fund - A (KFGG-A)

during 24 - 31 August 2021

receive investment units of KFGG-A valued 100 Baht

Terms & conditions:

- This promotion is applicable to the net investment amount in Krungsri Global Growth-A (KFGG-A) during IPO period only. Net investment amount means purchase or switching in value less redemption or switching out value. Investment amount in Krungsri Global Growth-I (KFGG-I) is not eligible for this promotion.

- Investors must hold units until 31 December 2021. The outstanding investment amount is based on the unit balance of the fund as of 31 August 2021. However, customers will not be eligible to join this promotion if they redeem and/or switch out investment units of the fund during 1 September – 31 December 2021 regardless of the amount of redemption.

- The Management Company will calculate the total investment amount in KFGG-A based on each investor’s unitholder account number. In case an investor has more than 1 account, the Management Company will not consolidate the total investment amount from all accounts for this promotion.

- The total amount of investment amount, which is less than 100,000 Baht, will not be counted for the promotion.

- The Management Company will allocate the promotion units of KGG-A to the eligible investors within 28 February 2022. The units of KFGG-A will be calculated at its NAV price on the allocation date. Front-end fee is waived for the units of KFGG-A received from this promotion.

- Subscription and switch-in order through unit-linked life insurance and provident fund are not eligible for this promotion.

- Other terms and conditions may apply for the transaction executed through an omnibus account. Investor should contact your representative selling agents for further information.

- Transferring units, either to the same or different investor, is not eligible for this promotion.

- The Management Company reserves the right to offer other equivalent reward as appropriate or change terms & conditions of this promotion without prior notice.

- This promotion expense is charged to the Management Company, not the fund.

- The Fund will enter into a forward contract to fully hedge against the exchange rate risk, in which case, it may incur costs for risk hedging transaction and the increased costs may reduce overall return.

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

KFGG-I

Back