Promotions/Fund Highlight

KFGBTHAIESG: ESG Government Bond Investment for Tax Saving.

Special promotion applied*

Krungsri Government Bond Thailand ESG Fund (KFGBTHAIESG)

New! Save your tax to a maximum of 300,000 Baht with special promotion applied* (

Click here for details and introduction to the new Thai ESG investing criteria | Investing criteria of new Thai ESG fund is based on the Cabinet resolution as of 30 Jul. 2024.)

IPO: 1 – 6 August 2024. | Minimum purchase amount: 500 Baht.

*Receive KFCASH-A units valued at 100 Baht for every 50,000 Baht of investment in participating SSF/ RMF/ Thai ESG funds according to terms and conditions (please study more details below)

KFGBTHAIESG allows you to claim tax deduction through investing in ESG Government Bond instruments that focus on sustainability with lower risk and help reduce volatility in the overall portfolio in order to offer investors an opportunity to achieve sustainable returns and promote social developments and environmental conservation in parallel.

What makes KFGBTHAIESG interesting KFGBTHAIESG

Source: Krungsri Asset Management as of June 2024. | The above investment strategy framework may differ from the actual investment portfolio and may change in accordance with market condition, the instruments offered for sale in the market, and the fund manager’s discretion.

Getting to Know ESG Bonds

Source: Partial translation of https://www.sec.or.th/TH/Pages/LawandRegulations/ResourceCenter.aspx as of 26 Jun. 2024

Why should we invest in ESG Bonds?

1. ESG bonds in Thailand have an ample room for growth.

As the issuance of global ESG bonds has grown substantially over the past 2-3 years. Particularly, Thailand’s ESG bond issuance is the second highest in ASEAN next from Singapore). Compared to Europe, the proportion of ESG bonds in Thailand thus have a lot of opportunities to grow.

Source: ThaiBMA ‘s document on the issuance of ESG bonds in Thailand published on 17 Jul. 2023

2. ESG bonds have a track record of generating good returns.

2.1 Globally, ESG bond indices have a track record of generating better returns than the general debt instrument market.

- Bloomberg’s Global Aggregate Green, Social and Sustainability Index (the white line) which is an index representing ESG bonds generated a return of as high as 9.94% in 2023.

- Bloomberg’s Global Aggregate Total Return Index (the orange line) which is an index representing overall debt instrument market generated a return of only 5.72% in 2023.

Source: Bloomberg’s article on “Green bonds reached new heights in 2023” published on 8 Feb. 2024

2.2 Track record of generating good returns during market upturns and offering risk protection during market downturns.

Source: J.P. Morgan Asset Management’s article on “Green bonds: Is doing good compatible with doing well in fixed income?” published on 22 Feb. 2024 based on the information as of 31 Jan. 2024. | The information displayed is based on the constituent securities of Bloomberg Global Aggregate Index and Bloomberg MSCI Global Green Bond Index with similar characteristics in terms of issuer, capital structure, currency denomination, credit rating and issue term.

3. Key factors that drive investing in Thai fixed income instruments.

- Thailand’s policy interest rate is staying at a 10-year high, and the current rate-hiking cycle is expected to have come to an end. (Source: Krungsri Asset Management and Bank of Thailand as of 12 Jun. 2024)

- Market starts to lower expectations of a policy interest rate cut by the Bank of Thailand this year. (Source: Bloomberg, HSBC as of Jun. 2024)

Source: Krungsri Asset Management as of Jun. 2024.

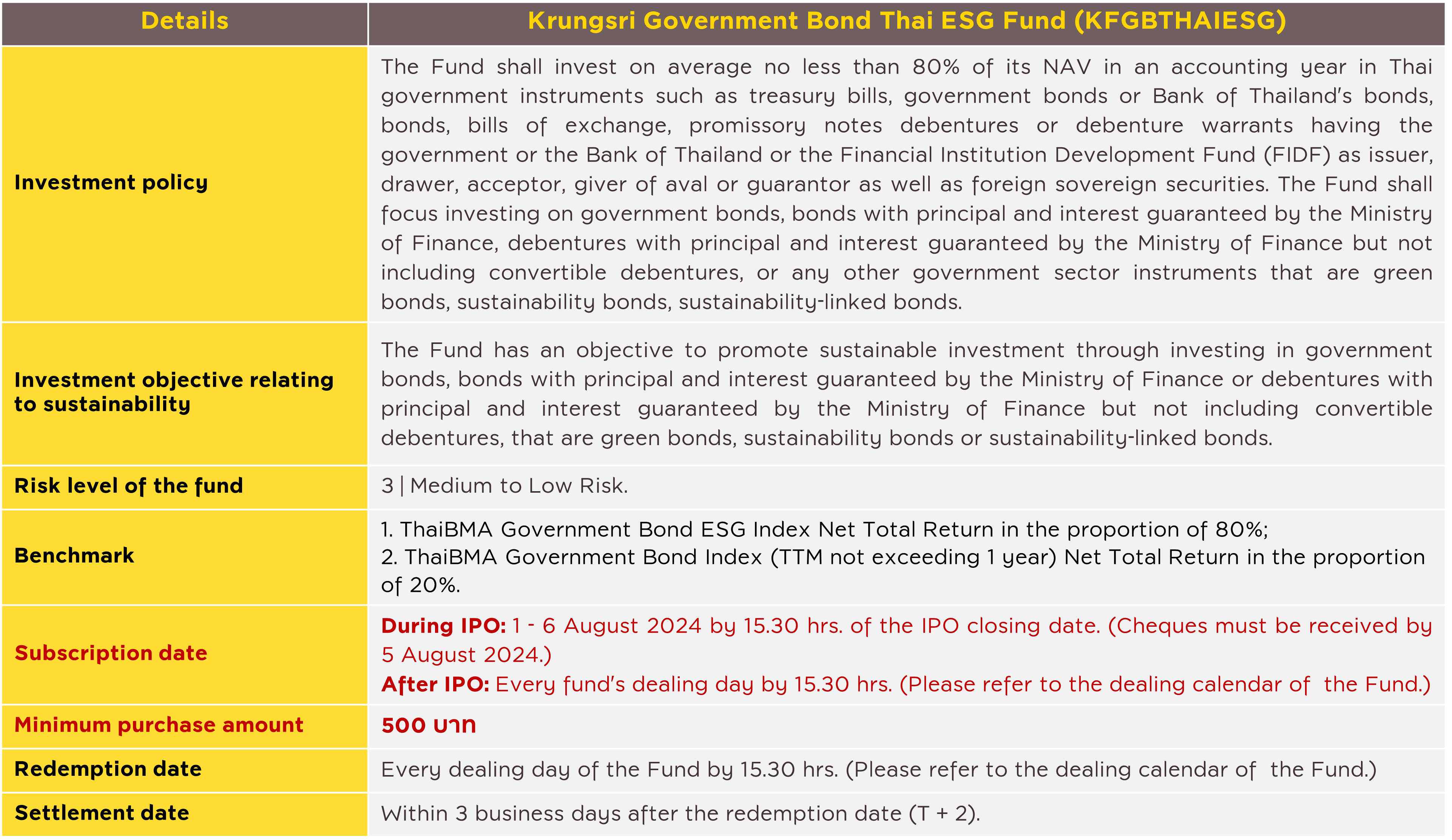

Fund information: KFGBTHAIESG

- The Thai ESG Fund aims to promote long-term savings and encourage Thailand’s sustainable investment. Investors should understand the fund features, conditions of returns and risks; and study the tax benefits in the Investment Manual, before making an investment decision. Past performance is no guarantee of future results.

- This document is prepared based on information obtained from reliable sources at the time the information is displayed. However, the Management Company does not provide any warranty of the accuracy, reliability and completeness of all information. The Management Company reserves the right to make changes to all information without prior notice.

- Investors should study the tax benefits stated in the Investment Manual. Unitholders in breach of investment conditions shall not be entitled to the tax benefits and must return all the tax benefits received earlier within the specified timeframe, otherwise they will be liable to a surcharge and/or fine in accordance with the Revenue Code.

To inquire further information or request a prospectus, please contact:

Krungsri Asset Management Company Limited. Tel. 0 2657 5757

Investment restrictions & risks associated Investment restrictions

Since the investment framework of the Fund focuses investing in government bonds, bonds with principal and interest guaranteed by the Ministry of Finance or debentures with principal and interest guaranteed by the Ministry of Finance but not including convertible debentures, that are green bonds, sustainability bonds or sustainability-linked bonds, the scope of investment of the Fund is therefore limited.

Risks associated with investment of an ESG fund

- The risk arises from investing mainly in government bonds, bonds with principal and interest guaranteed by the Ministry of Finance or debentures with principal and interest guaranteed by the Ministry of Finance but not including convertible debentures, that are green bonds, sustainability bonds or sustainability-linked bonds, which causes the fund to lose the opportunity to invest in general debt instruments that may offer better returns.

- The risk arises from relying the ESG data on third party’s sources for analyzing and selecting the securities which may be incomplete or inaccurate. In this regard, the Management Company will search for additional data from various sources to ensure more accuracy of the data used in the analysis.

- The risk arises from investing in instruments that may not in accordance with the ESG investment framework as determined by the Fund. For example, investing in the instrument over which the issuer does not have controlling power or in the case where the counterparties of the issuer (such as venders, contractors and/or service providers) may not comply with the ESG investing framework that is beyond the recognition of the Management Company.

- Liquidity risk may arise from the Fund’s inability to buy or sell instruments at the appropriate prices or timing due to the ESG criteria conditions set by the Fund.

For details of KFGBTHAIESG-A, click

Back