Promotions/Fund Highlight

KFCLIMA-A ... Green investing opportunities benefiting from climate change

Climate change … A huge window of investment opportunity for the next decade

As we can see the global warming awareness among the government and private sectors, and people around the world uniting to take bold actions, this global agenda has also created the next decade’s investment theme with profitability from rising renewable energy businesses and growing state-of-art technologies full of solids supports.

- Rising global green energy investments

Source: Sources: International Energy Agency (2020), Bloomberg Finance L.P., DWS Investment GmbH as of Nov 20 | Green Energy Investments include capital spending on renewable energy generation technologies, investments into electric grid and storage, energy efficiency improvement projects across all end-use sectors and end-use applications for green electricity | Forecasts are not a reliable indicator of future returns.

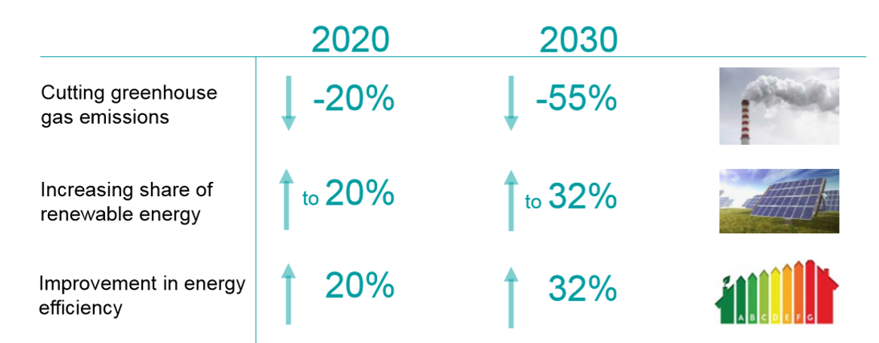

Besides, one of the most promising EU missions is to improve climate quality according to their 2030 climate and energy framework setting three key targets to ensure the EU meets its climate and energy targets for the year 2030.

Source: European Commission, DWS as of 20 Dec 2020

Source: European Commission, DWS as of 20 Dec 2020

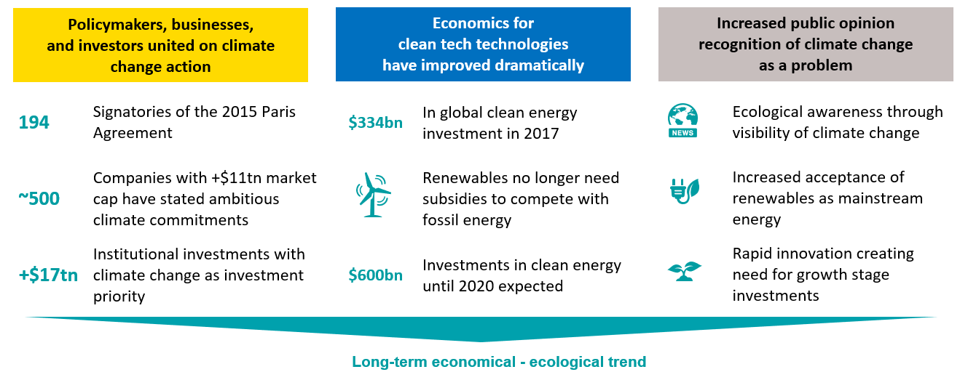

- Technological advancements have improved dramatically and accelerating innovation to address climate change problem

- Increased public opinion recognition of climate change as a problem supports long-term growth for climate-friendly businesses

Sources: We Mean Business Coalition; Ceres Investor Network on Climate Risk and Sustainability; Bloomberg New Energy Finance Clean Energy Investment 2016 and 2017; Renewable Energy Policy Network (REN21) Renewables 2017 Global Status Report. Forecasts are based on assumptions, estimates, opinions and hypothetical models or analysis which may prove to be inaccurate or incorrect.

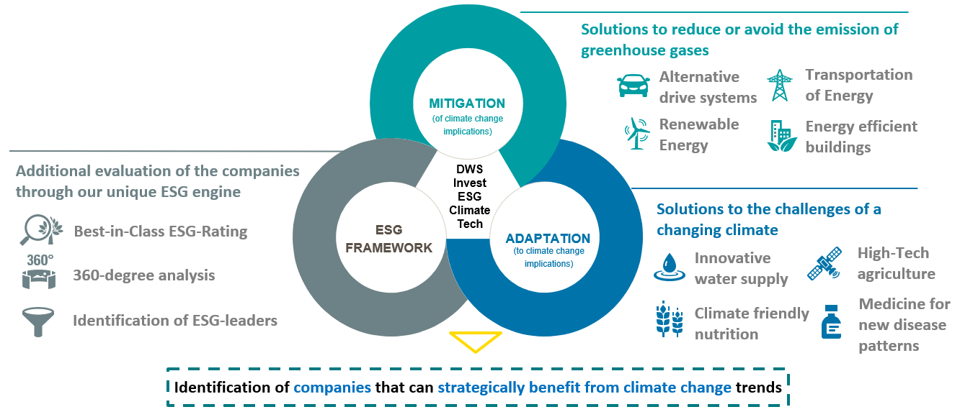

Krungsri ESG Climate Tech Fund – A (KFCLIMA-A) invests in the master fund, DWS Invest ESG Climate Tech that lays a foundation for long-term growth opportunity by investing in companies benefiting from climate change backed with solid investment strategies:

1. Active investment strategy to capture opportunities of climate change: Focusing on the company that can “mitigate” or “adapt” it business to climate change implications to drive sustainable business growth in long term

Source: DWS Investment GmbH as of Jan 2021

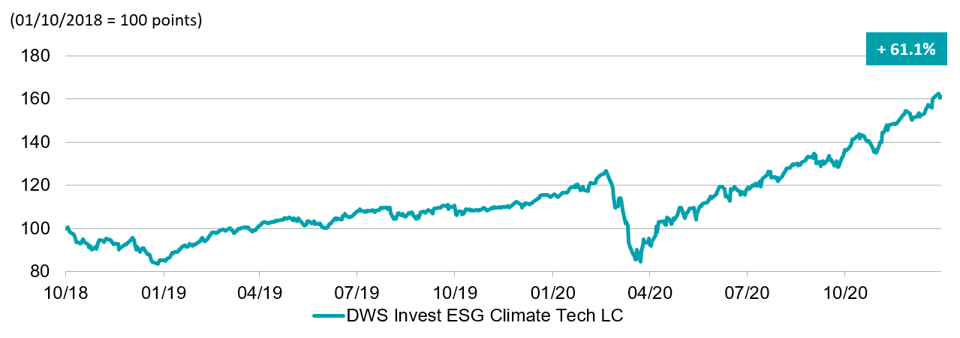

Source: DWS Investment GmbH as of Jan 2021with extensive analysis and single stock selection process proven by strong track records of performance over broader market

Source: DWS International GmbH, daily data as of 30 Dec 2020 | Calculation of performance is based on the time-weighted return and excludes front-end fees. Individual costs such as fees, commissions and other charges have not been included in this presentation and would have an adverse impact on returns if they were included. | This shows the performance of the master fund, so it is not complied to AIMC’s standard. | This shows the performance of the LC share class which is the oldest share class having EUR as a base currency, while KFCLIMA-A will invest in TFC USD share class that base currency is in USD. However, both share classes apply the same investment strategy.

3. Tilt to diversify across sectors

Source: DWS International GmbH, daily data as of 30 Dec 2020 | Calculation of performance is based on the time-weighted return and excludes front-end fees. Individual costs such as fees, commissions and other charges have not been included in this presentation and would have an adverse impact on returns if they were included. | This shows the performance of the master fund, so it is not complied to AIMC’s standard. | This shows the performance of the LC share class which is the oldest share class having EUR as a base currency, while KFCLIMA-A will invest in TFC USD share class that base currency is in USD. However, both share classes apply the same investment strategy.

3. Tilt to diversify across sectors to grasp all potential growth opportunities of climate change

Source: DWS Investment GmbH as of 30 Dec. 2020

About KFCLIMA-A

| Investment policy |

Invest in DWS Invest ESG Climate Tech, Class USD TFC (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has investment policy to predominantly invested in securities from domestic as well as foreign issuers that have an Environmental, Social and Corporate Governance (ESG) focus. |

| Risk level |

Level 6 | Hedge against currency risk upon fund manager’s discretion. Generally, The fund is hedged against foreign exchange rate risk, on average, at least 90% of foreign investment value. |

| Dealing date |

Daily (Please refer to Fund’s Non-Dealing Calendar) |

| Minimum purchase |

500 Baht |

| IPO |

8 - 16 March 2021 (After IPO transaction: 22 March 2021) |

- Please carefully study fund features, performance, and risk. Past performance is not a guarantee of future results

- The fund may enter into a currency swap within discretion of fund manager which may incur exchange rate risk and investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

Back