Promotions/Fund Highlight

KF-SMCAPD ... Active Portfolio with Small-Cap Huge-Potential Stocks

Allow you to access the active portfolio of small-cap but huge-potential stocks with Krungsri Global Small-Mid Cap Equity Dividend Fund (KF-SMCAPD) through the Morningstar 5-star rated Master Fund, Goldman Sachs Global Small Cap CORE Equity Portfolio Class I Shares (Acc.)* which drives investment with the advantage of in-depth data to the creation of an actively managed portfolio that is outstanding and differentiated.

*Effective since 18 Sep’24. | Source: Goldman Sachs Asset Management as of 30 Jun’24. | The Morningstar rating is not in accordance with the performance measurement standard prescribed by AIMC.

Highlights of the Master Fund: Goldman Sachs Global Small Cap CORE Equity Portfolio

1. Create a superior opportunity to receive return with the advantage of in-depth data: A compilation of data from diverse sources and high-level analytical and data processing techniques from the initial stage of raw data management such as the use of Machine Learning algorithms generate diverse investment views, leading to the creation of an actively managed portfolio that is outstanding and differentiated.

Source: Goldman Sachs Asset Management as of 30 Jun'24.

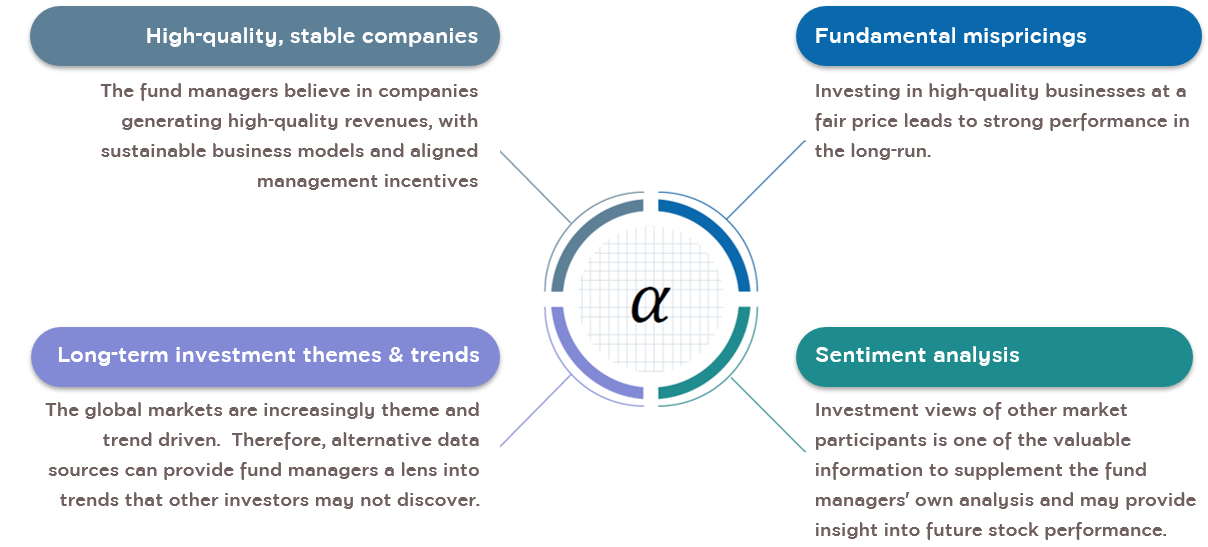

2. The investment process that involves stock selection based on the following important factors:

- Businesses with high quality and stability: The Fund will identify companies with the potential to generate profit that is higher than the market forecast.

- Fundamental mispricing: The Fund will use a combination of indicators to assess the intrinsic value of the business.

- Long-term investment trend and theme: The Fund will identify the investment theme that is overlooked by the market and select the companies with the opportunities to take advantage of such theme for investing.

- Analysis of market sentiments: The Fund will monitor the investment views of major market players toward the companies in the investment universe.

3. Taking into consideration the ESG factors in portfolio allocation.

Source: Goldman Sachs Asset Management as of 30 Jun’24.

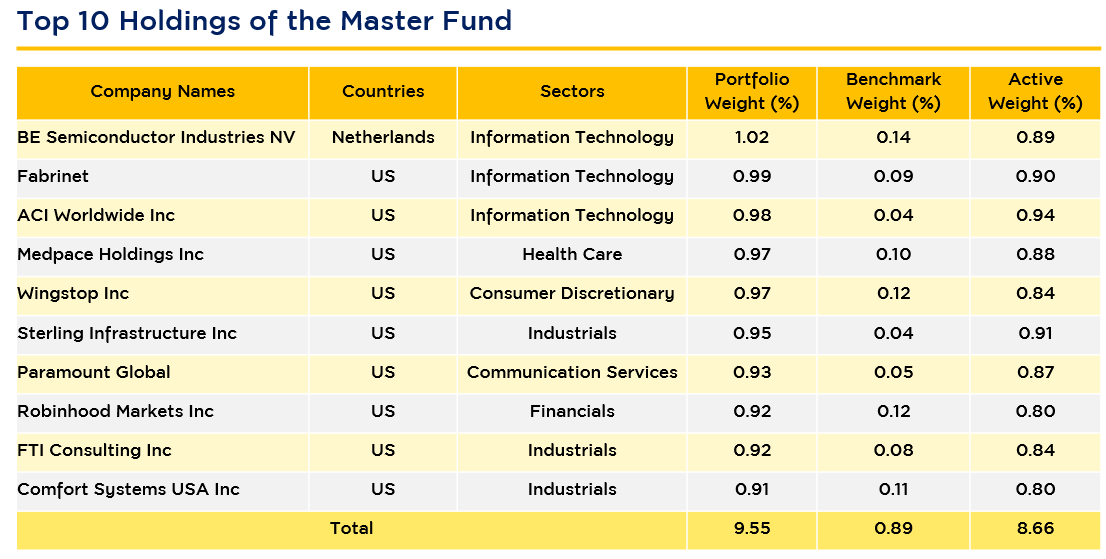

Portfolio of the Master Fund

The fund has investments in many countries around the world and diversifies the portfolio weights across many industries. Currently, it has the largest portfolio weight in the US and invests in other countries in both Asia and Europe. It has outweighed investments in the industrials, consumer discretionary and healthcare sector.

Source: Goldman Sachs Asset Management as of 30 Jun’24. |The above information is for illustrative purposes only and is not a guarantee for the future results of the fund. | The classification of industry is based on Global Industry Classification Standard.

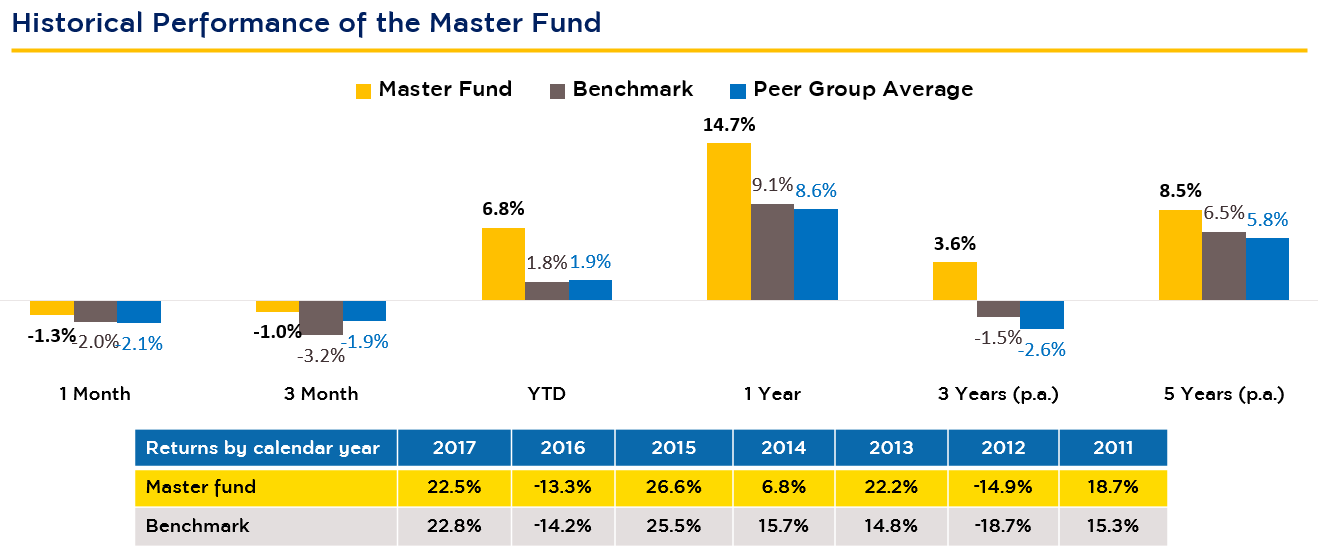

Performance of the Master Fund

The Master Fund has a track record of outstanding long-term performance that beats the benchmark and industrial average.

Source: Goldman Sachs Asset Management as of 30 Jun’24. | The benchmark is S&P Developed SmallCap Index. | Peer group average is based on Morningstar Global Small/Mid-Cap Equity. | The return displayed is the net return after deducting related fees. | Dividends are included in the return. | The performance displayed is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standard prescribed by AIMC.

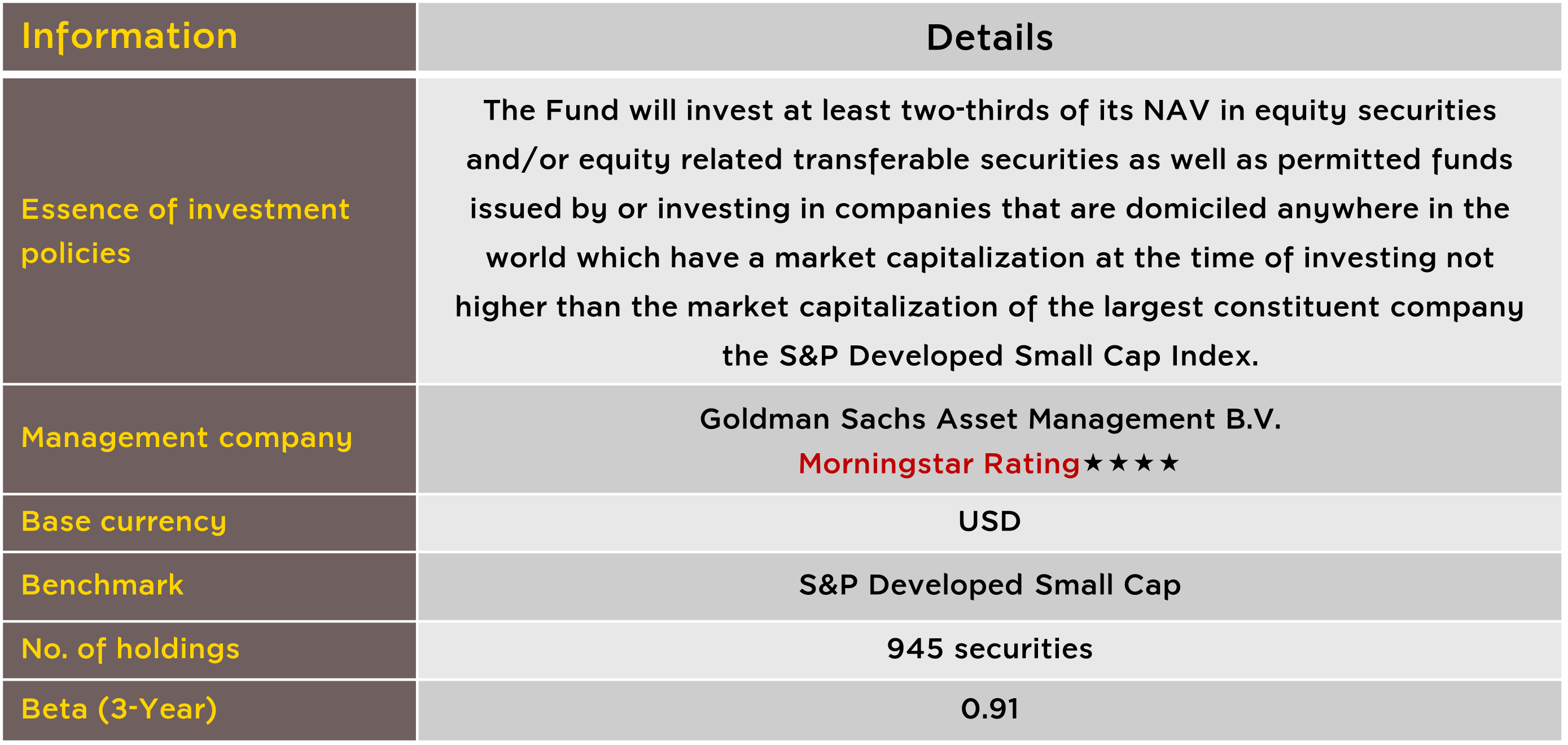

Summary of the Master Fund: Goldman Sachs Global Small Cap CORE Equity Portfolio

Source: Goldman Sachs Asset Management as of 30 Jun’24. The rating of Morningstar has no association with the performance assessment of AIMC in any respect.

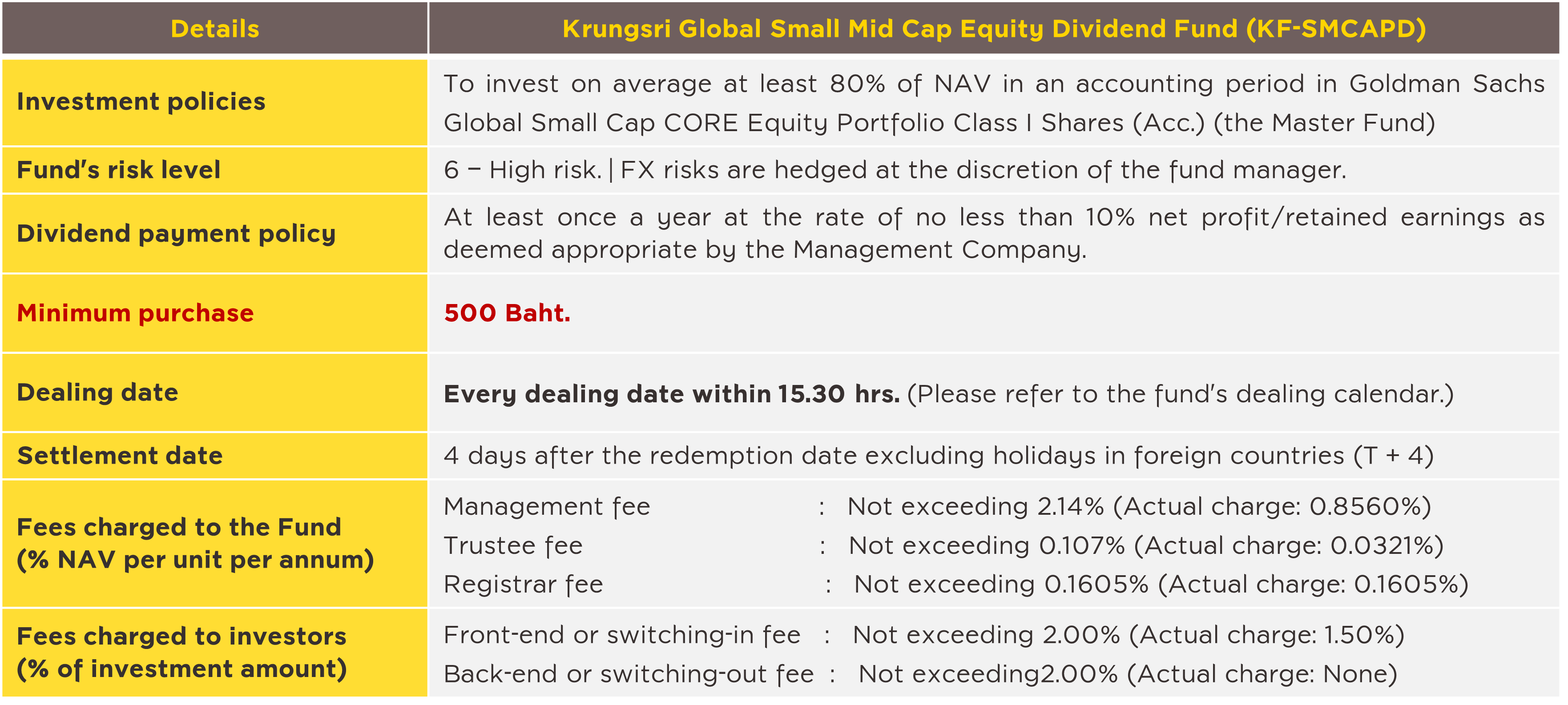

Summary of Krungsri's Fund: KF-SMCAPD

Disclaimers

Disclaimers

- This document is prepared based on the information obtained from reliable sources at the time of the presentation. However, the Management Company does not provide any warranty of the accuracy, reliability and completeness of all information. The Management Company reserves the right to make changes to all information without any prior notice.

- Since the fund is hedged against foreign exchange risk upon the fund managers' discretion, it is subject to a foreign exchange risk that may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

- Investors should understand fund features, conditions of returns, and risk, and study tax benefits from the investment manual before making an investment decision. Past performance is no guarantee of future results.

For more information or request for fund prospectus, please contact:

Krungsri Asset Management Company Limited. Tel 02-657-5757 press 2 | E-mail: krungsriasset.mktg@krungsri.com

For KF-SMCAPD details, click.

Back