News/Announcement

Green up your portfolio to harvest new opportunities with climate change

09 March 2021

Krungsri Asset Management Co., Ltd. (“the Company”) has recently launched a new investment theme for growing portfolios in the time of global warming and climate change agendas under the government regulatory solutions to environmental issues and private sector-led coalitions, resulting in the huge investment and new problem-solving innovations that have made the green investing a new decade’s investment theme investors must consider for their portfolios, particularly in the early stage of growth. In this opportunity, the Company has also launched a new fund, Krungsri ESG Climate Tech Fund – Accumulation (KFCLIMA-A) investing in the master fund, DWS Invest ESG Climate Tech Fund, a global fund specializing in the green industry with outstanding records.

In a recent webinar, Mr. Tim Bachmann, Portfolio Manager for DWS Invest ESG Climate Tech Fund and Mr. Kiattisak Preecha-anusorn - Vice President for Alternative Investment at Krungsri Asset Management have jointly shared information involving investment in the green industry – the waves of investment and businesses in the new global era. Both has also explained drivers for growth, investment opportunities and attractiveness, stock selection strategies, investment portfolio and past records.

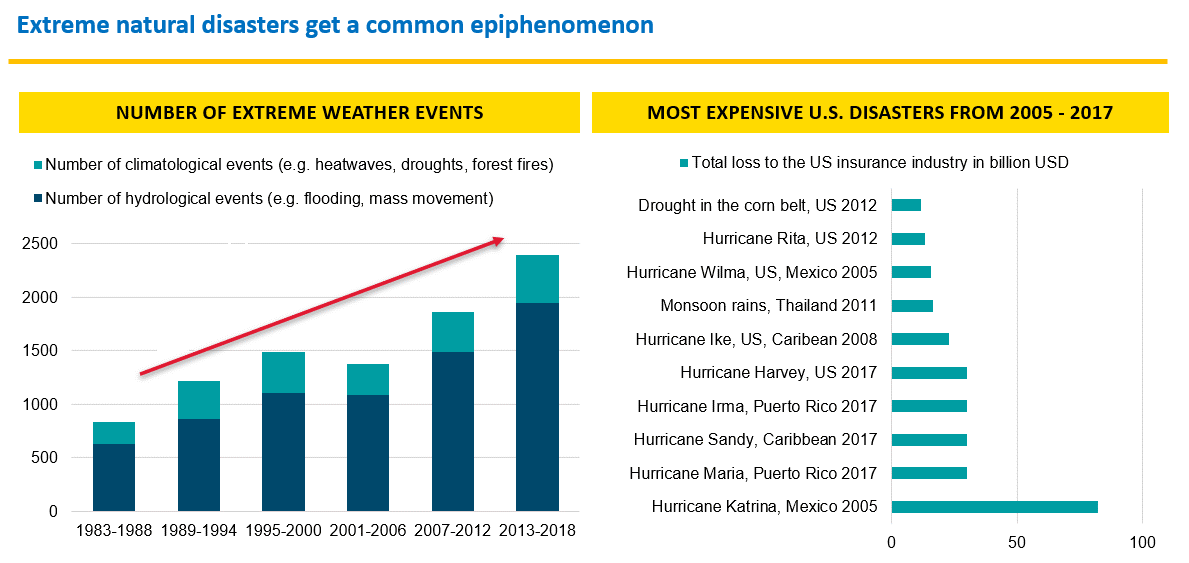

Mr. Kiattisak said that the global warming and climate change remain the long-discussed issues. However, those have been addressed for campaigns and cooperation without the actual materialization. Until the past decade, the effects have become a number of natural disasters that have increased from 1,500 times to 2,500 times per year. The level of severity has also risen for natural disasters spanning from drought, forest fire, flood, earthquake to heat waves. Given these, a government in each country has realized and turned to pay attention seriously.

Sources: Munich RE (2019); Swiss RE (2017); NOAA/NCEI (2018)

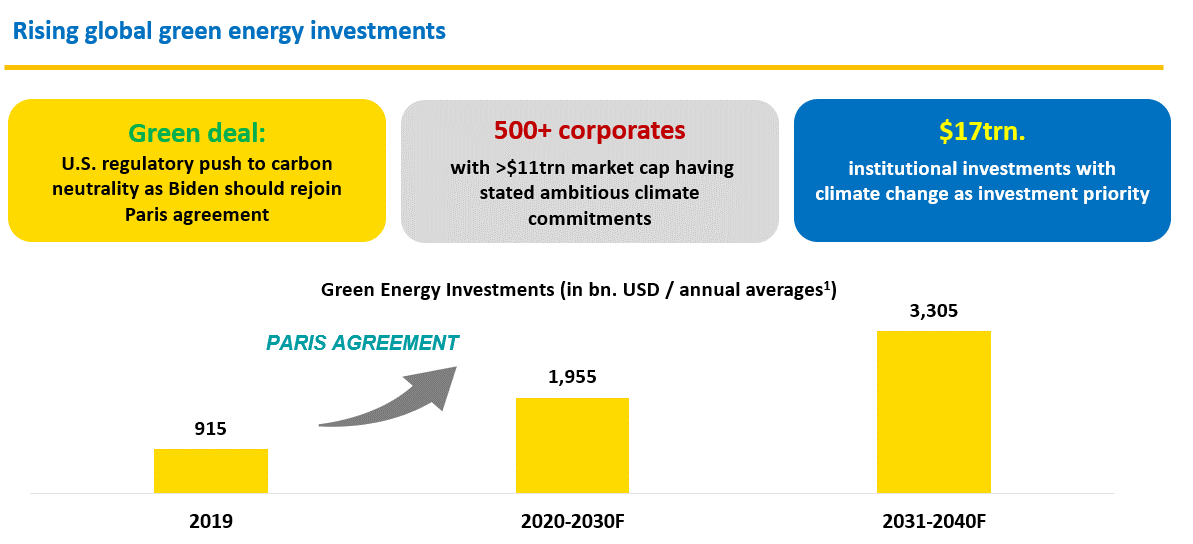

In the past two years, governments in several countries particularly the United States and those in the Europe have issued policies and regulations intending to solve the environmental problems more discreetly. For example, the “European Green Deal” has been launched by European countries, targeting to reduce carbon dioxide to zero within 2050. US President Joe Biden has moved to reinstate the United States to the Paris climate agreement for environmental cooperation. Oil producing giant Saudi Arabi also plans to establish the world’s largest green hydrogen plant. Some countries have exploited the issue of “Climate War” as a barrier to trade, forcing trading partner countries or producers to operate their businesses in line with the Environmental, Social and Governance (ESG) criteria for sustainability. These imply that every country is in the adjustment process, while enlarging its investment for environmental conservation.

Mr. Bachmann said that given rules and policy requirements by the state being prepared for investment budget, it is a good opportunity for investment as budget will be poured into the green sector. Investment budget especially for clean energy is expected to increase from 900 billion US dollar in 2019 to over 3,000 billion US dollar in 2030 - 2040. In Europe, a budget is estimated to be as high as 1 trillion euro for the green development policy.

Meanwhile, companies in other sectors are also required to shift their operations to be in line with the environmental rules. Over 500 private companies have stated ambitious climate commitments with a combined budget of no less than 11 trillion. Besides, the main investment target of institutions has also been centered in the climate change with an estimated amount of 17 trillion US dollar. All of these are the factors for growth and chance for investment in businesses designed to avert catastrophic of the global warming.

In the past two years, governments in several countries particularly the United States and those in the Europe have issued policies and regulations intending to solve the environmental problems more discreetly. For example, the “European Green Deal” has been launched by European countries, targeting to reduce carbon dioxide to zero within 2050. US President Joe Biden has moved to reinstate the United States to the Paris climate agreement for environmental cooperation. Oil producing giant Saudi Arabi also plans to establish the world’s largest green hydrogen plant. Some countries have exploited the issue of “Climate War” as a barrier to trade, forcing trading partner countries or producers to operate their businesses in line with the Environmental, Social and Governance (ESG) criteria for sustainability. These imply that every country is in the adjustment process, while enlarging its investment for environmental conservation.

Mr. Bachmann said that given rules and policy requirements by the state being prepared for investment budget, it is a good opportunity for investment as budget will be poured into the green sector. Investment budget especially for clean energy is expected to increase from 900 billion US dollar in 2019 to over 3,000 billion US dollar in 2030 - 2040. In Europe, a budget is estimated to be as high as 1 trillion euro for the green development policy.

Meanwhile, companies in other sectors are also required to shift their operations to be in line with the environmental rules. Over 500 private companies have stated ambitious climate commitments with a combined budget of no less than 11 trillion. Besides, the main investment target of institutions has also been centered in the climate change with an estimated amount of 17 trillion US dollar. All of these are the factors for growth and chance for investment in businesses designed to avert catastrophic of the global warming.

Sources: International Energy Agency (2020), Bloomberg Finance L.P., DWS Investment GmbH as of Nov 2021 - Green Energy Investments include capital spending on renewable energy generation technologies, investments into electric grid and storage, energy efficiency improvement projects across all end-use sectors and end-use applications for green electricity | Forecasts are not a reliable indicator of future returns.

In the past few years, the commitment to alleviate the global warming has positively affected the green innovation and technology sector continuously. In particular, firms with technologies to reduce carbon dioxide emission and businesses benefiting from the climate change have recorded double-digit growth rates*. Those in clean, alternative, solar, hydro and wind energy sectors posted a 27% growth, while transportation sector (electric vehicles, hybrid vehicles) registered a 22% increase. The agricultural and husbandry grew 16%. Insulation, heating system and ventilation system annually grew 11% on average. (*Sources: International Energy Agency (2020), Bloomberg Finance L.P., DWS Investment GmbH as of Nov 20 | Consensus estimates / Forecasts are not a reliable indicator of future returns. Forecasts are based on assumptions, estimates, opinions and hypothetical models or analysis which may prove to be incorrect.)

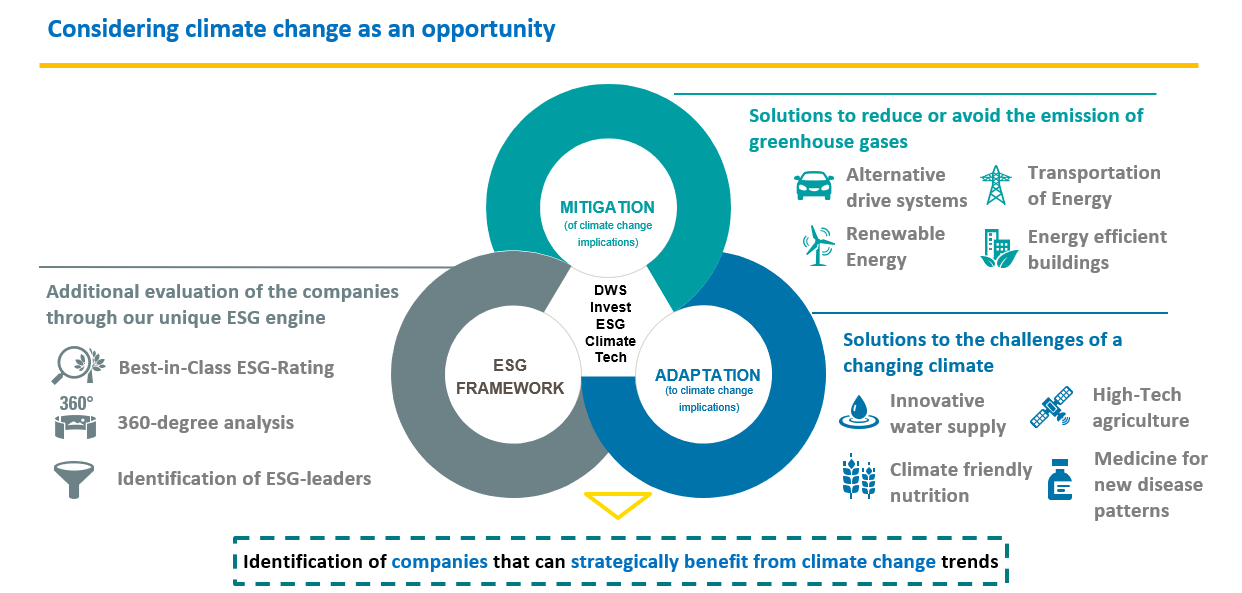

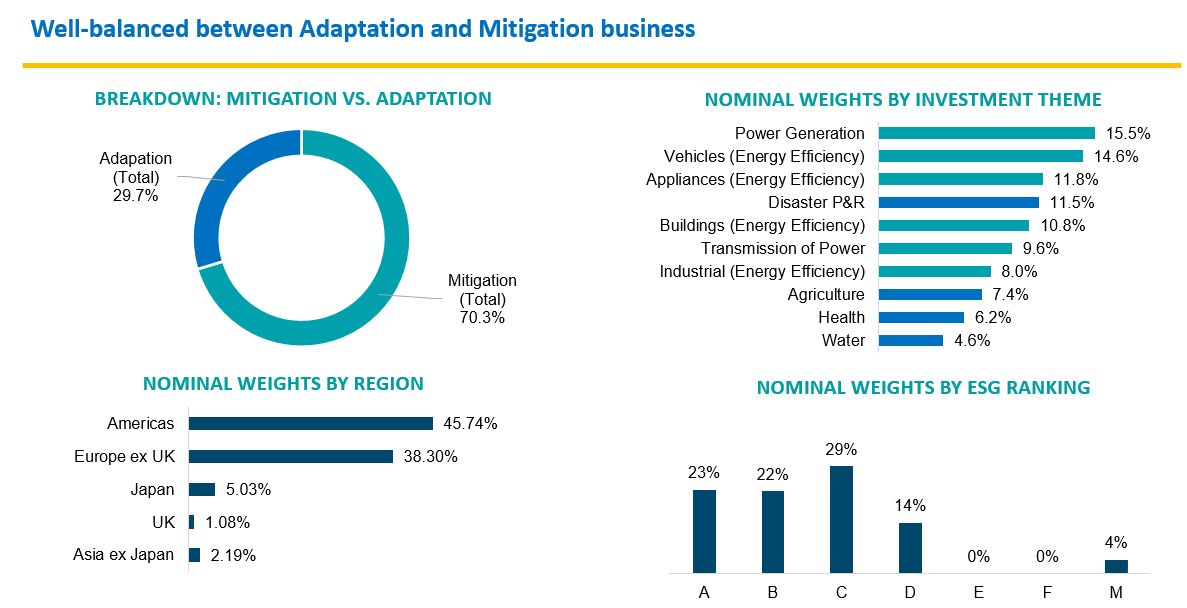

Krungsri Asset Management selects DWS Invest ESG Climate Tech Fund due to its proper risk mitigation strategy, while its investment portfolio consists of 50 - 80 companies – large, medium and small sizes, around the world. These have been screened and selected as the best in their industries. Those picked must be in accordance with the fund’s two investment themes. Firstly, about 70% of its investment portfolio are companies offering products or services responding to the environmental impacts and promote energy efficiency such as renewable/clean energy, electric vehicles, and energy-saving buildings. The remaining 30% are those investing in businesses that are adapted themselves to the climate change such as innovation in water management, smart farming, and environmentally friendly food nutrients. All companies are also required to follow the ESG principles with a strong financial status and a chance to win in their industries that will gain from the climate change. Besides, the fund will also grow its portfolio together with risk mitigation, investing in cyclical plays (IT and construction materials) for better return than that of markets, and defensive stocks (consumer products, healthcare and real estate) for hedging against bearish markets. To mitigate its risks, the fund normally invests no more than 4% of its portfolio in each company. Most of the investment is focused on countries with clean energy like the United States and those in the Europe.

In the past few years, the commitment to alleviate the global warming has positively affected the green innovation and technology sector continuously. In particular, firms with technologies to reduce carbon dioxide emission and businesses benefiting from the climate change have recorded double-digit growth rates*. Those in clean, alternative, solar, hydro and wind energy sectors posted a 27% growth, while transportation sector (electric vehicles, hybrid vehicles) registered a 22% increase. The agricultural and husbandry grew 16%. Insulation, heating system and ventilation system annually grew 11% on average. (*Sources: International Energy Agency (2020), Bloomberg Finance L.P., DWS Investment GmbH as of Nov 20 | Consensus estimates / Forecasts are not a reliable indicator of future returns. Forecasts are based on assumptions, estimates, opinions and hypothetical models or analysis which may prove to be incorrect.)

Krungsri Asset Management selects DWS Invest ESG Climate Tech Fund due to its proper risk mitigation strategy, while its investment portfolio consists of 50 - 80 companies – large, medium and small sizes, around the world. These have been screened and selected as the best in their industries. Those picked must be in accordance with the fund’s two investment themes. Firstly, about 70% of its investment portfolio are companies offering products or services responding to the environmental impacts and promote energy efficiency such as renewable/clean energy, electric vehicles, and energy-saving buildings. The remaining 30% are those investing in businesses that are adapted themselves to the climate change such as innovation in water management, smart farming, and environmentally friendly food nutrients. All companies are also required to follow the ESG principles with a strong financial status and a chance to win in their industries that will gain from the climate change. Besides, the fund will also grow its portfolio together with risk mitigation, investing in cyclical plays (IT and construction materials) for better return than that of markets, and defensive stocks (consumer products, healthcare and real estate) for hedging against bearish markets. To mitigate its risks, the fund normally invests no more than 4% of its portfolio in each company. Most of the investment is focused on countries with clean energy like the United States and those in the Europe.

Source: DWS Investment GmbH as of Jan 21.

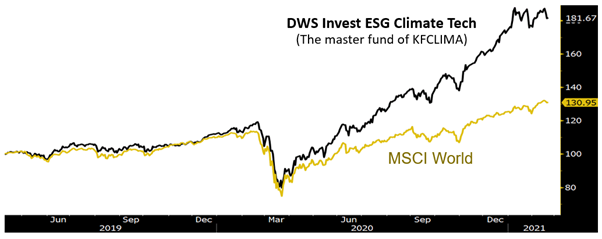

From its establishment in April 2019, DWS Invest ESG Climate Tech has booked outstanding returns. Even though the fund has no official benchmark, but if comparing with MSCI World, the fund’s return stands above the index’s relatively highly. Earlier even when stock markets made global corrections and shifted groups of investment, the fund has still provided outstanding returns after the energy and the financial. The fund is, thus, regarded as the forefront of the industry.

Source: Bloomberg as of 21 Feb. 2021 | This shows the performance of the master fund, so it is not complied to AIMC’s standard.

Mr. Kiattisak said that the climate change theme is the new trend which has emerged only one to two years, marking the beginning state of the growth that will likely highly grow from now to the medium to long term. The key drivers for this trend involve governments’ support policies, extremely lower costs of clean technology, and pressure from the society and investors on businesses to invest for tackling environmental impacts. Now comes the opportunity and the right timing to invest. The fund’s valuation is not much expensive with the price to earnings ratio of 25 times. Thus, this is the investment theme in which investors must consider for their portfolio. About 10 - 20% of portfolio should be put into this theme to grow together with the waves of the global warming reduction and climate chance – the trend for another decade.

KFCLIMA-A will hedge against currency risk upon fund manager’s discretion, while the fund will generally enter into a forward contract to hedge against FX risk on average of 90% of the foreign investment value. IPO will be offered during 8 – 16 March 2021 with a minimum purchase only at 500 Baht. Interested investors can purchase fund units at any branch of Bank of Ayudhya or selling agents, and through any transaction channel of Krungsri Asset Management (@ccess Online and @ccess Mobile) on every business day.

Disclaimer

KFCLIMA-A will hedge against currency risk upon fund manager’s discretion, while the fund will generally enter into a forward contract to hedge against FX risk on average of 90% of the foreign investment value. IPO will be offered during 8 – 16 March 2021 with a minimum purchase only at 500 Baht. Interested investors can purchase fund units at any branch of Bank of Ayudhya or selling agents, and through any transaction channel of Krungsri Asset Management (@ccess Online and @ccess Mobile) on every business day.

Disclaimer

- This document is accurate at the time of publication but does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without notice.

- KFCLIMA-A invests 80% of NAV, in average of fund accounting year, in the Master Fund named DWS Invest ESG Climate Tech, Class USD TFC. The master fund aims to invest in equities and/or other securities of global companies, that are primarily active in business areas suited to restricting or reducing climate change and relevant effects, which offer products, services and solutions helping to lower emissions by generating clean energy, transmit energy efficiently, including companies that are active in health, water, agriculture or disaster prevention as well as companies that have a focus on sustainable development according to the ESG (environmental, social, and corporate governance) principles.

- KFCLIMA-A has risk level at 6 - high risk. The fund may enter into a currency swap within discretion of fund manager which may incur exchange rate risk and investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

For more information on funds, please contact:

Krungsri Asset Management Co. Ltd. Tel. 02-657-5757 or Bank of Ayudhya PCL.

For KFCLIMA-A details, click here

To download Adobe Acrobat Reader Click Here free of charge.