News/Announcement

Seize a Chance with China’s A Share after the COVID-19 Shocks... Turn the Crisis into the Opportunity

06 June 2020

Krungsri Asset Management Company Limited held a webinar on “Seize a Chance with China’s A Share after the COVID-19 Shocks...Turn the Crisis into the Opportunity,” believing China’s economy to recover after the COVID-19 crisis eases. The New China will be the promising stock-investment theme for the highest return in the medium to long term, thanks to low valuations and chance for high returns, while global interest rates remain low and global economy is registering a sluggish growth. In the meantime, Krungsri Asset Management expressed its confidence in UBS (Lux) Investment SICAV - China A Opportunity Fund, the master fund of Krungsri China A Shares Equity Fund-A (KFACHINA-A) that has outperformed the market during the COVID-19 crisis.

At the webinar, Ms. Vivian Ng, Equity Specialist from UBS (Lux) Investment SICAV - China A Opportunity Fund and Mr. Kiattisak Preecha-Anusorn, Vice President for Alternative Investment Department at Krungsri Asset Management were invited to draw out the overall outlook on China’s recovery after the COVID-19 crisis, direction for expansion, opportunities and risks of A Share, while elaborating stock selection strategy and risk management the fund has employed to outperform the market. Explanation on an investment portfolio for robust returns in the long term was also included.

Mr. Kiattisak said that the COVID-19 shocks dragged down China’s stock market by 15%. Now, the market has already bounced back by about 10%. The Chinese economy is believed to have bottomed out with swift recovery due to the state restrictions and people’s cooperation. However, the market direction is still unpredictable in the short term as the public debt remains high and the social distancing measures are still going on. However, technology and innovation will play increasing roles. In the long-term, the market impact will be very small as more people will turn from offline to online. The country’s adjustment from globalization to domestic consumption will also be more focused.

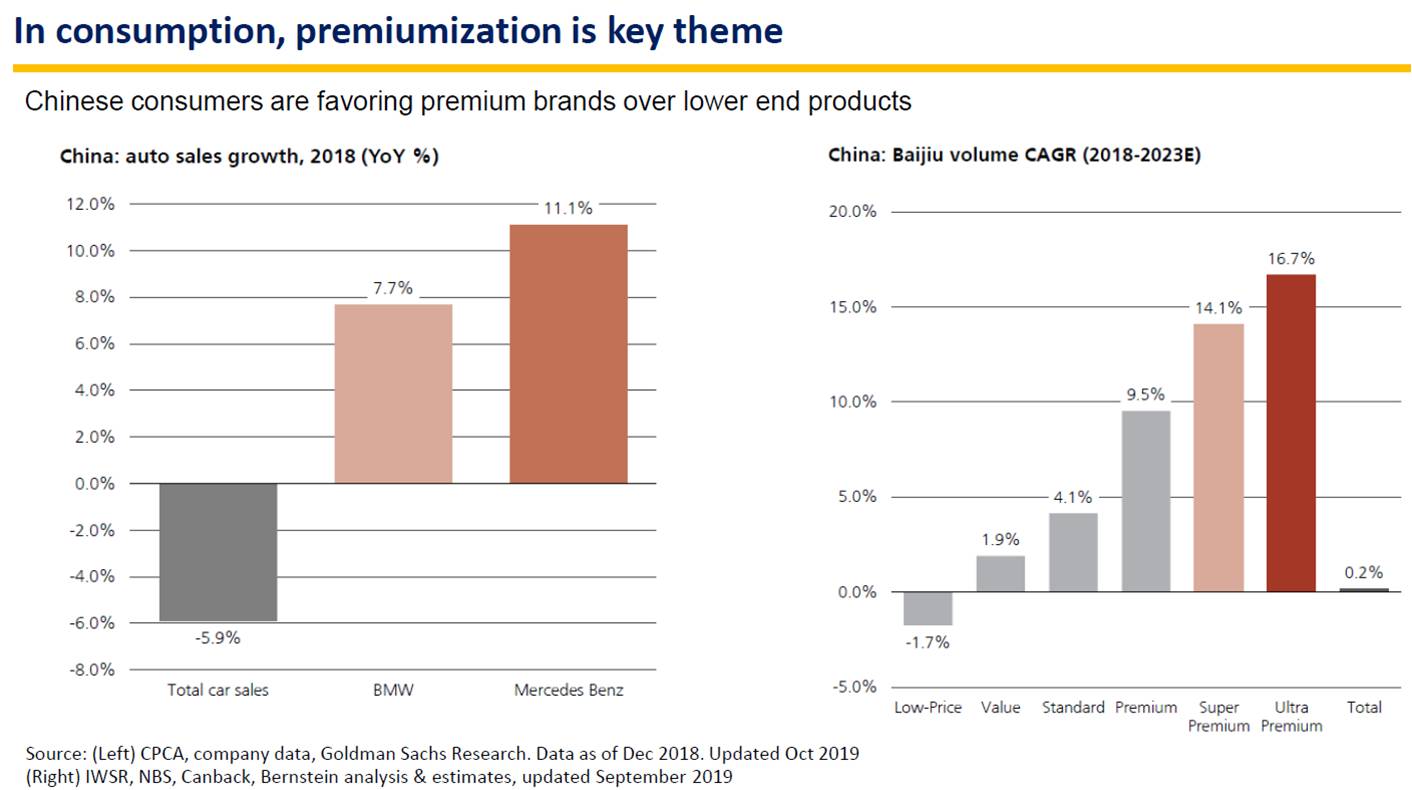

Ms. Ng pointed out four long-term structural trends in the New China economy which include consuming, urbanizing, innovating and automating, as well as aging society. Two important drivers are expected to push for the rapid economic growth. One driver is higher preferences in consumption of premium goods and services and the other is a greater role of technologies. During 2009-2019, a large amount of over 300 billion US dollar has been invested in research and development. Innovative products and services have sprung up and have been patented. For example, innovation in home appliances, financial or healthcare services that serve the needs of new-Gen consumers. These are the factors that will drive the New China’s expansion.

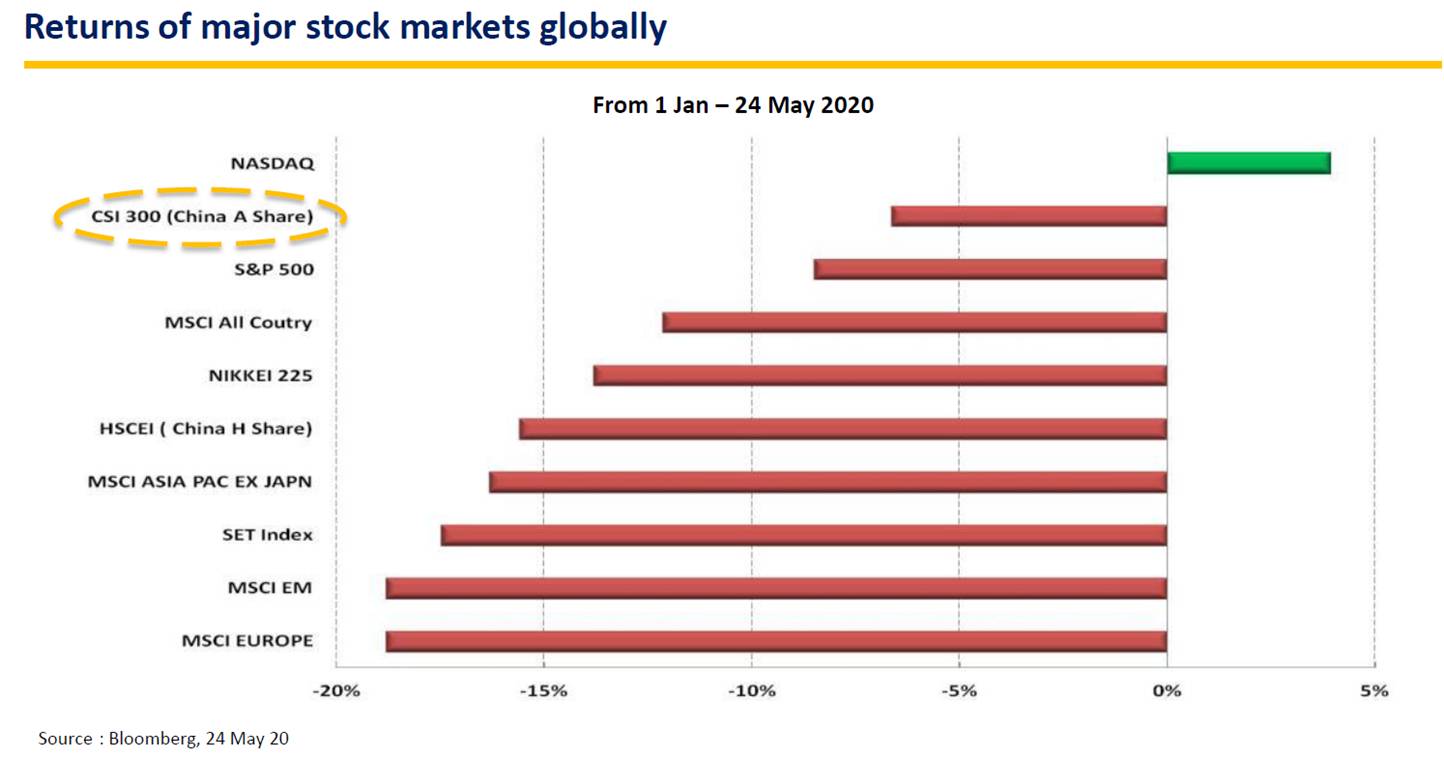

China’s economic growth has also been reflected in the A-Share market. Since its inception in 2013, the UBS (Lux) Investment SICAV - China A Opportunity Fund (The master fund) grew 13.8%, outperforming MSCI World of 4.3% and MSCI China of 3.5%. Now, the China’s A Share market has rebounded faster than any other stock markets, aside from Nasdaq. Another interesting feature of A Share is that the valuation is still low with the P/E ratio of only 12.4 times, comparing to other markets which have an average P/E ratio of 20 times. Therefore, it is attractive for medium- to long-term investment.

.aspx)

Apart from the New China’s growth, Ms. Ng explained that the investment strategy plays a part to help the fund outperform the market. The fund selects businesses that go in the New China’s upcoming trends and are industry leaders. Such strategy allows the fund to record its outstanding performance, particularly during the COVID-19 crisis. Then, the market saw a sharp drop of nearly 20%, while the fund witnessed a fall of only 5-10%.

Its top-5 stocks remain in the positive territory even though their profit levels are less during the crisis. The fund has also turned a crisis into an opportunity, by topping up sound-fundamental stocks with long-term growth potential that gain from the COVID-19 shocks into its portfolio. Such stocks are tech giant and mobile game leader Tencent Holdings, online learning platform TAL Education, and the leader in premium liquor market Kweichow Moutai whose stock prices fell during the crisis and have rebounded sharply thereafter.

Now, the fund weighs its investment in consumption and premiumization (Kweichow Moutai - China’s top white liquor brewer), healthcare (Jiangsu Hengrui - leader in China’s drug making with a possibility to be one of the world’s largest market capitalization firms), insurance (Ping An Insurance - life assurance with large tech investment), and financial services (China Merchants Bank).

Source: UBS Asset Management as of 30 Apr 2020. Photos from companies' website. Ping An's photo from Forbes.com

In regard to the US-China trade war which could bring about tariffs barriers to Chinese imports, Ms. Ng said that China’s stock markets will not be highly affected as they depend on domestic consumption rather than the US market. There could not be impacts from tariffs barriers. If the U.S. raises tariffs on Chinese imports, the consumers will be impacted. Therefore, such policy must be set with caution.

Mr. Kiattisak concluded that as the global economy is still growing slowly and interest rates will likely stay low for a long time, investors should invest in stocks but should look for a strong investment theme. New China is now the promising theme for investors. The UBS (Lux) Investment SICAV - China A Opportunity Fund was established since late 2013. The fund has outperformed the market continuously . According to the analyst consensus, the estimated EPS growth of the stocks in the fund is currently average around 15% It is thus believed that as the Covid-19 crisis eases, the stocks in which the fund has invested can bounce back rapidly and has the potential to generate a long-term return to investors.

Those who are interested in investing in China’s A Share market can do it through KFACHINA-A which are traded at every working day. Available channels range from Krungsri Asset Management head office, any branch of Bank of Ayudhya, selling agents, and online channels that are @access Mobile and @ccess Online Service system.

For more fund details, click KFACHINA-A

Disclaimer

- This document is produced for general information based on the trustworthy source of information, but the Management Company does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute a judgment as of the time of publication. All information, opinions and estimates are subject to change without noti

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

- KACHINA-A invests not less than 80% of NAV in average of fund accounting year in the foreign investment fund titled UBS (Lux) Investment SICAV - China A Opportunity (USD) (Class P - acc) (master fund). | The fund has risk level at 6 – high risk.

- KFACHINA-A may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal.

- KFACHINA-A may enter into a currency swap within discretion of fund manager which may incur transaction costs. The increased costs will reduce overall return. In absence of a currency swap, investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

For more information or request for fund prospectus, please contact:

Krungsri Asset Management Company Limited

Tel 0 2657 5757 or Bank of Ayudhya PCL. / Selling agents

To download Adobe Acrobat Reader Click Here free of charge.