Krungsri The One … Paving the Way to Your Goals

Krungsri Asset Management Co., Ltd (Krungsri Asset Management) recently organized a special seminar on "Krungsri-style 3 Best Combined Portfolios to Achieve Every Goal", taking an opportunity to introduce "Krungsri The One", a fund series being fostered through the synergy between the Krungsri Group (Bank of Ayudhya, Krungsri Asset Management, and Krungsri Securities) and investment partner, joining hands to create the three fund styles according to varying return targets and risk levels. The funds include Krungsri The One Mild (KF1Mild), Krungsri The One Mean (KF1MEAN), and Krungsri The One Max (KF1MAX). Each fund will represent the portfolio of Thailand’s best-in-class funds, ranging from fixed income, domestic equities, global equities, and alternative assets together with portfolio management to best suit varying market conditions.

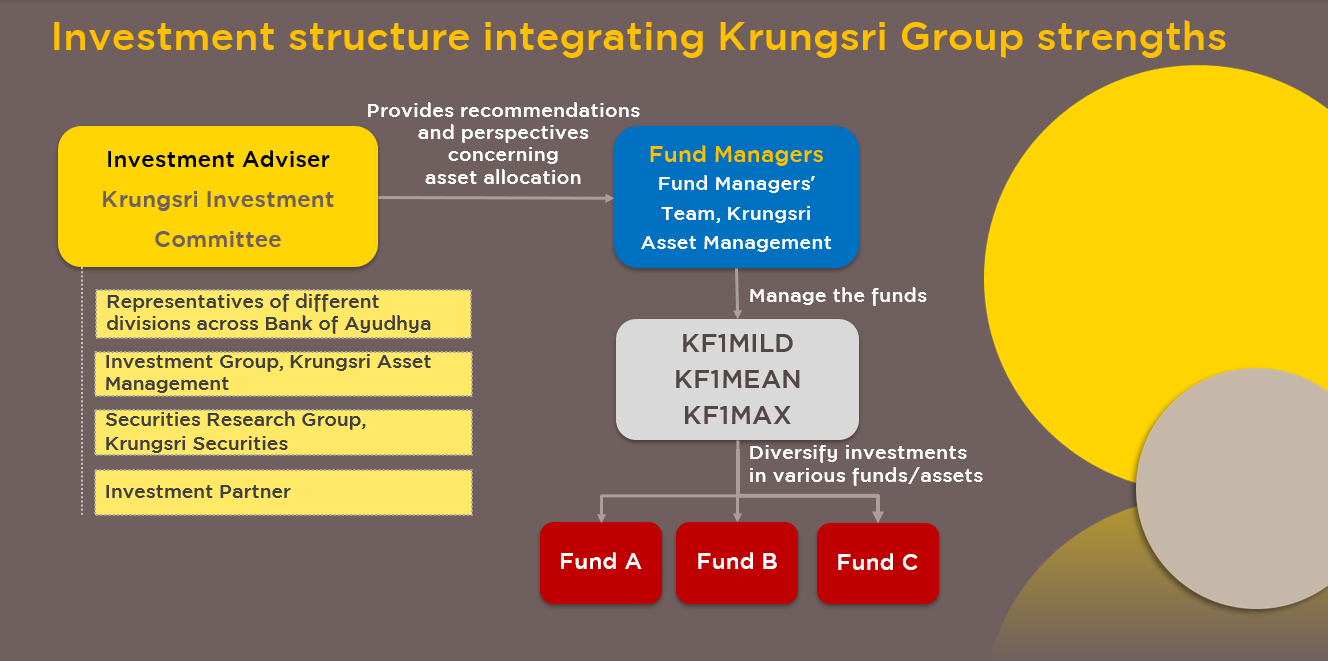

Mr. Kiattisak Preecha-anusorn, Vice President, Alternative Investment, Krungsri Asset Management, said that “Krungsri The One” funds will be an alternative investment solution for investors who lack the time to actively manage their portfolio in the midst of unpredictable market volatility which requires constant monitoring. In this respect, investors can choose only one fund as core fund based on their risk level. All three 3 differently catered styles of Krungsri The One portfolio can truly answer investors since they no longer have to manage their portfolios on their own thanks to the team of investment experts keeping track of management and allocation of the portfolio. The team of investment experts include (1) investment advisors to determine the investment strategy and directions, (2) team of experienced fund managers being responsible for selecting the funds that meet the established criteria, making investment decisions, and adjusting the portfolio in response to market conditions. With this expert management in place, investors can benefit from higher returns over the long term.

Mr. Win Phromphaet, Krungsri Executive Vice President, Head of High Net-Worth Division, Bank of Ayudhya Public Company Limited said that, in terms of Krungsri The One funds' advisory teams, we have the so-called "One Krungsri Investment Team”, a team of six high-ranking executives from Krungsri Group who are specialists in various areas of investment, including economics, finance, research, and alternative assets, including Krungsri Research team acting as the funds’ advisors, working with the fund managers’ team at Krungsri Asset Management. The advisory team is responsible for determining the Strategic Asset Allocation, which serves as a long-term investment guideline that is reviewed on an annual basis. They also provide a Tactical Asset Allocation perspective for short-term monthly portfolio adjustments. In addition, the advisory team also establishes criteria for fund selection through a focus specifically on funds that have demonstrated good returns and have received at least 3-star ratings from Morningstar and have a high ESG (Environmental, Social, and Governance) score. Such fund selection criteria thus help ensure that the portfolio contains only the best-in-class assets. The team also constantly monitors the portfolio and reviews the investment strategy to maximize benefits for investors on a regular basis.

Mr. Kiattisak added that, "Krungsri The One" strength is not about portfolio management by the high-ranking executives,

the funds also offer the broad investment framework, providing an access to a wide range of investment opportunities globally, including stocks, fixed income, money markets, and alternative assets such as gold or real estate investment trusts (REITs). Besides, Krungsri The One funds lied not only in investing in Krungsri Asset Management funds, but also the ones of other asset management companies. In this respect, the advisory team has carefully evaluated over 300 funds available in the market and selected only the 10 to15 best-in-class assets to be included in the Krungsri The One’s portfolio. The allocation of investments will be adjusted based on the portfolio’s level of risk and the fund adopts an active portfolio management strategy, allowing it to respond to market conditions in a timely manner.

Remark: At the initial stage, the Fund Managers may consider investing in the funds managed by Krungsri Asset Management as a priority for the purpose of efficient portfolio management.

Talking about the overall economic outlook in 2023, Krungsri Asset Management opines that the global economy is expected to see slower growth with the US estimated growth by only 1% and Europe by 0.5% due to economic recession that is expected to cause global stock investment to remain volatile, along with high inflation rates and ongoing international political risks. However, given the significant drop in current valuations of global markets that reduces downside risk, while that the market has already absorbed a lot of this news, it is possible that global stock markets may recover faster than expected. As such, funds must be prepared to make appropriate adjustments to their investment strategies. As for Asia, the region is expected to recover better, particularly China and Thailand, which is expected to see overall economic growth reaching 3.6% driven by the growth of the tourism sector, investments, and recovering consumption.

Source: Krungsri Research, Data as of 23 Nov 2022

As for the recommended portfolio strategy in light of the current economic outlook, Krungsri Asset Management has an overweight view on global fixed income and the Thai equity. This is because the attractive returns and price of US bond yield. However, the funds will be selective in their investments, focusing only on investment-grade fixed income securities and limiting exposure to high-yield and non-rated debt securities to no more than 60% of the portfolio. Regarding the Thai stock market, Krungsri Asset Management views the country's reopening as a positive factor for growth in the tourism and domestic consumption sectors. However, there is also a risk of currency appreciation that may dampen exports. The funds intend to seize opportunities from market corrections,

while Thai bonds expect stable returns and will underweight money market investments. Thus, now is seems to be a good time to invest as global fixed income markets are currently offering good returns, while the global stock markets are currently traded at an attractive valuation.

In terms of framework of portfolio weight and target returns of Krungsri The One funds, they vary according to asset allocation strategy through various asset types.

Source: Krungsri Asset Management as of 26 Jan 23. Remark: The above information is just an investment framework which can be changed and divert from the actual investment portfolio.

During during the IPO period (13 – 20 February 2023), Krungsri Asset Management has also offered a discount rate of the Front-end Fee charge.

For fund details, click: KF1MILD-A | KF1MEAN-A | KF1MAX-A

Disclaimers

- This document is prepared based on information obtained from reliable sources at the time of presentation, but the Management Company does not provide any warranty of the accuracy, reliability, and completeness of all information. The Management Company reserves the right to make changes to all information without prior notice.

- The funds are hedged against foreign exchange risk at the discretion of the fund manager and is therefore subject to exchange rate risk which may result in losses or gains on foreign exchange or cause investors to receive lower return than the amount initially invested.

- Should study fund features, conditions of returns, and risks before making investment decision. Past performance is not a guarantee of future results.

For fund inquiries/ prospectus, please contact:

Krungsri Asset Management Co., Ltd. Tel. 02-657-5757 or our Selling Agents

Back