Promotions/Fund Highlight

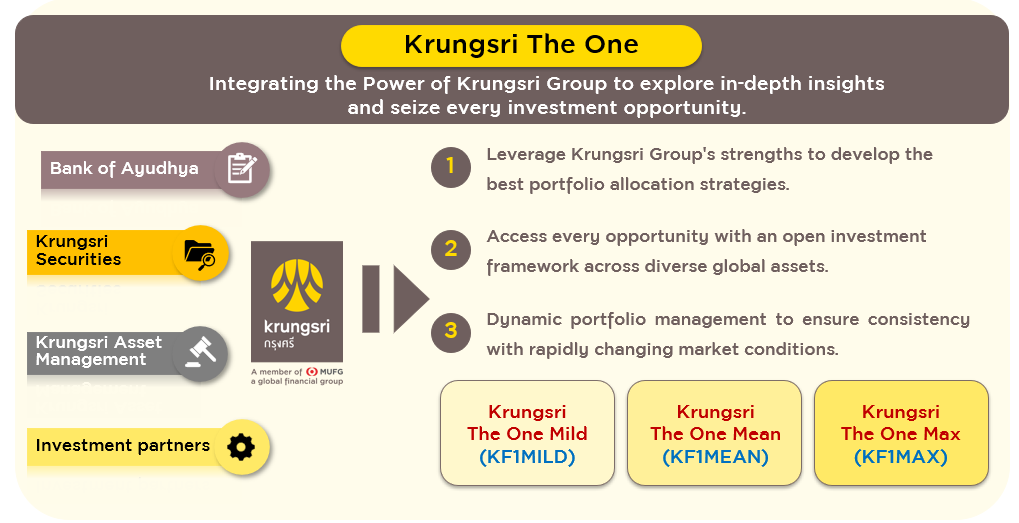

Krungsri The One ...Foster Synergy within Krungsri Group to Seize all Best-in-class Opportunities

Minimum purchase 500 Baht.

Under Krungsri Group synergies, Krungsri The One has established the investment strategies and select the comprehensively best-in-class funds in Thailand, ranging from fixed income funds, domestic equities, global equities, and alternative assets. This integrated synergy has finally been executed in the best combined portfolio strategies based on risk levels being executed in three funds, KF1MILD/ KF1MEAN/ KF1MAX, tailored with active portfolio rebalancing according to rapidly changing market conditions.

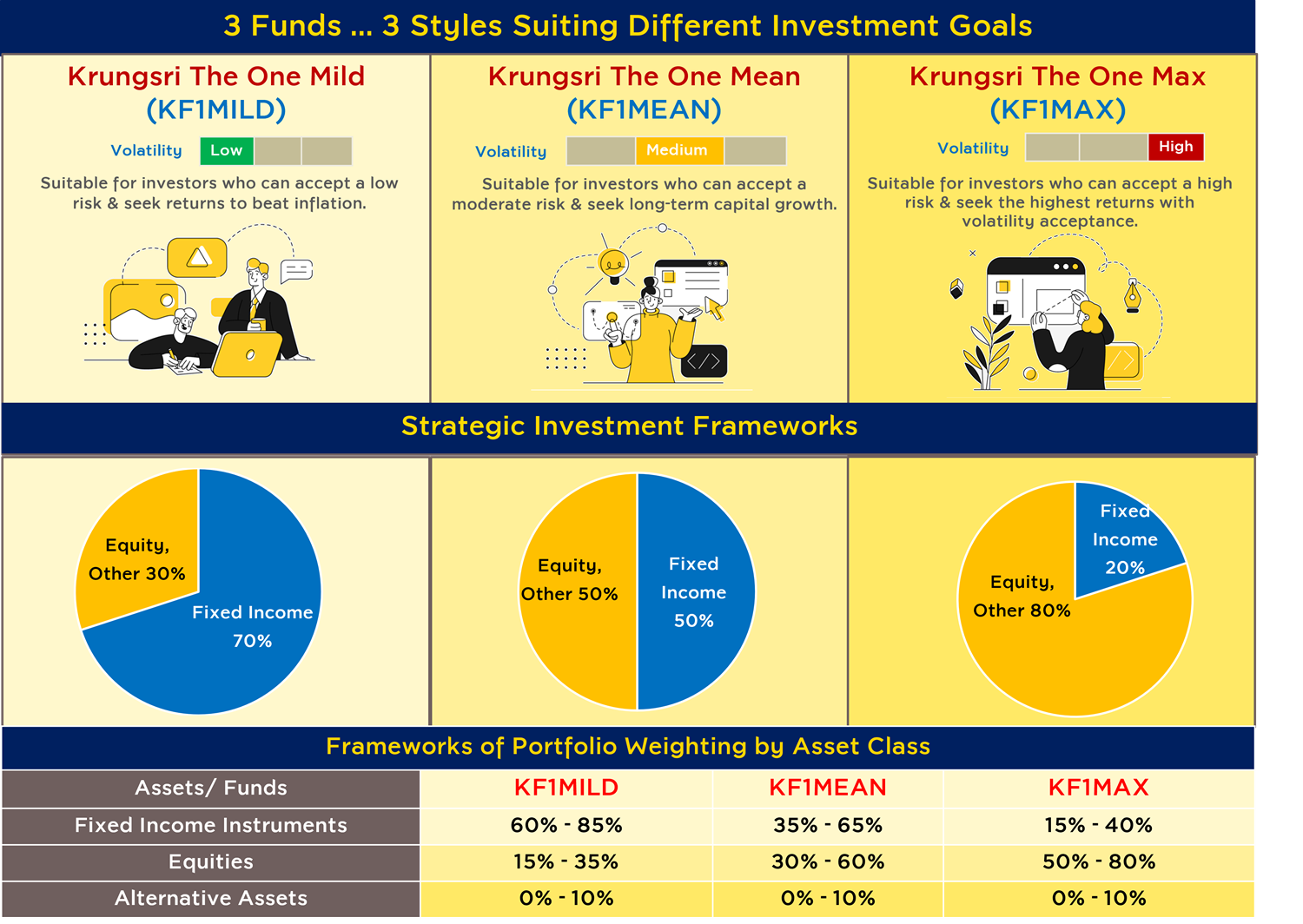

Krungsri The One Funds Series

Source: Krungsri Asset Management as of 31 Aug'24. Note: The above information is only an investment framework which is subject to change and is different from the actual investment portfolio.

1. Investment Framework

Using the multi-asset Investing and asset allocation strategies as follows:

- Money market funds to maintain the funds’ liquidity.

- Domestic and foreign equity funds* to generate returns and growth potential (*Dividend, index funds, growth, small cap, regional/national, sectoral, and thematic ones).

- Domestic and foreign fixed income funds to enhance stability and the opportunity to generate excess returns.

- Alternative investment funds to diversify risks and increase investment alternatives.

Source: Krungsri Asset Management as of 31 Aug'24 | Remark: The above information is just an investment framework which can be changed and divert from the actual investment portfolio.

2. Asset Allocation Strategies through a Comprehensive Range of Mutual Funds

- KF1MILD: Primarily invest in fixed income instruments with a slight proportion in other assets for an opportunity to generate returns capable to beat inflation.

- KF1MEAN: Investment diversified in fixed income instruments and risky assets at similar proportion most the of the time to create balance between returns and risk.

- KF1MAX: Primarily invest in equities to focus driving growth but still maintain proportion in fixed income instruments for an opportunity to generate returns together with risk management.

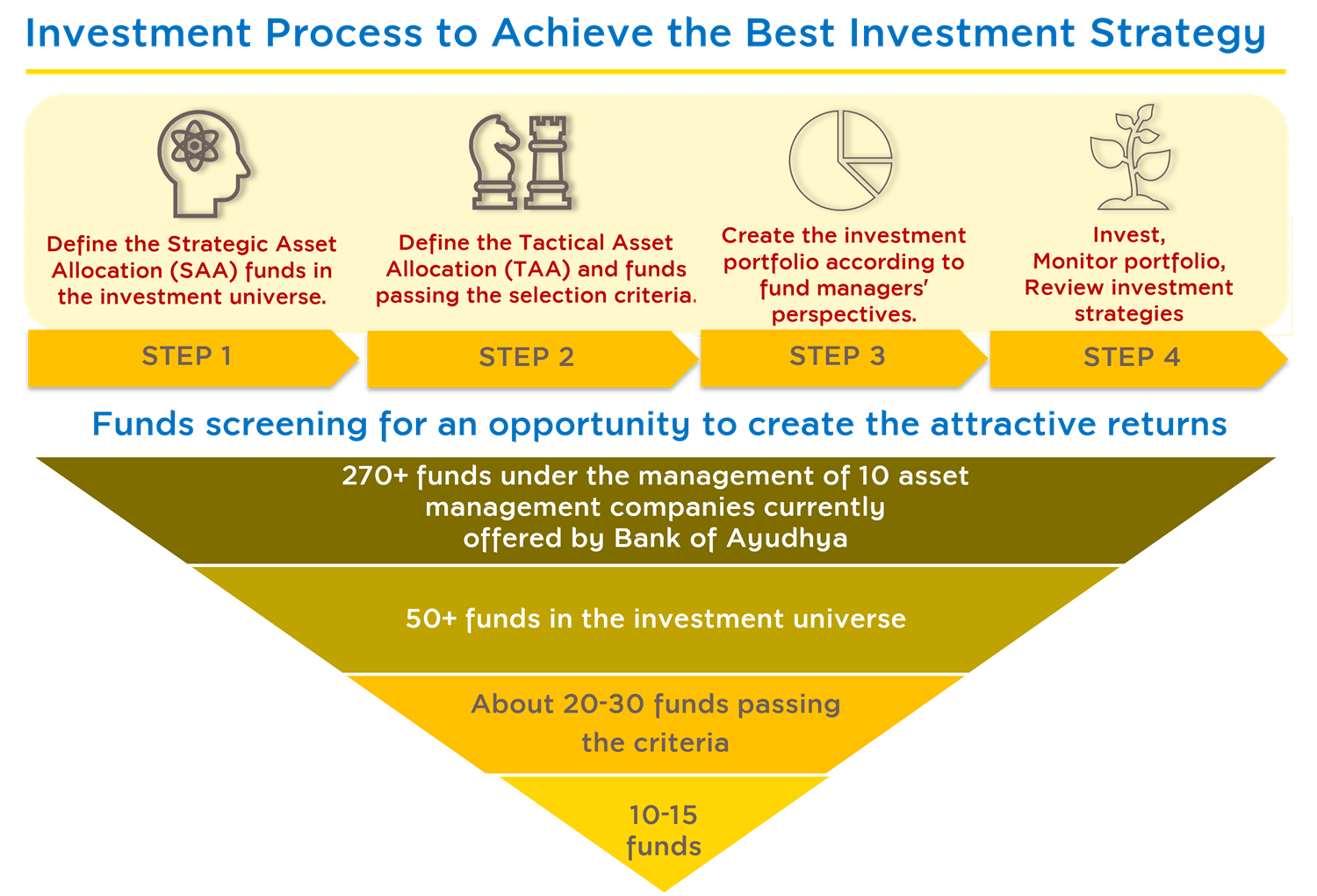

3. Investment Process

Source: Krungsri Asset Management as of 31 Aug'24 | Remark: The above information is just an investment framework which can be changed and divert from the actual investment portfolio. At the initial stage, the Fund Managers may consider investing in the funds managed by Krungsri Asset Management as a priority for the purpose of efficient portfolio management.

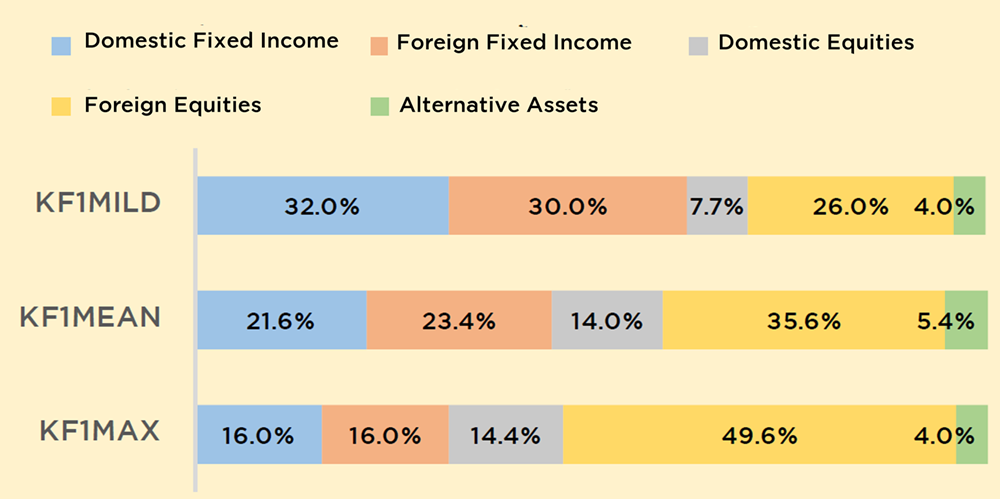

Current Porfolio of the Funds

Source: Krungsri Asset Management as of 30 Dec 24. Note: The fund has less than 100% investment due to cash holdings.

Fund information: Krungsri The One

The fund is divided into two share classes, Accumulation (-A) and Institutional Investor (-I) and also offered tax-saving funds. (Please click at fund codes for full fund details.).

For fund inquiries/ prospectus, please contact:

Krungsri Asset Management Co., Ltd. Tel. 02-657-5757 or our Selling Agents

- RMF is the fund promoting long-term investment for retirement. | Investors will not be eligible for tax benefits in an absence of compliance with investment conditions.

- Should study fund features, conditions of returns, and risks before making investment decision. Past performance is not a guarantee of future results.

- The funds are hedged against foreign exchange risk at the discretion of the fund manager and is therefore subject to exchange rate risk which may result in losses or gains on foreign exchange or cause investors to receive lower return than the amount initially invested.

- This document is prepared based on information obtained from reliable sources at the time of presentation, but the Management Company does not provide any warranty of the accuracy, reliability, and completeness of all information. The Management Company reserves the right to make changes to all information without prior notice.

Back