Promotions/Fund Highlight

KF-EMXCN: Ignite Growth with Emerging Markets Energy.

IPO: 21 – 28 April 2025.

Emerging Markets excluding China are among the high-potential growth markets, supported by favorable macroeconomic factors and relatively attractive stock valuations, underpinned by strong fundamentals. Although these markets face pressure from global trade tensions like other equity markets, they still show promising long-term growth potential.

Seize this great opportunity now with Krungsri Emerging Markets ex-China Equity Fund (KF-EMXCN)

IPO: 21 – 28 April 2025. | Minimum purchase 500 Baht.

Fund Highlights

- Increase flexibility in portfolio allocation beyond the Chinese stock market, helping to diversify risk and reduce volatility associated with Chinese equities

- Access growth potential from Emerging Markets excluding China, especially countries with large and growing populations that drive consumption, and those that serve as key manufacturing hubs in major global industries.

- Capture potential excess returns through active investment in the master fund, RBC Emerging Markets ex-China Equity Fund, which employs a strategy focused on identifying long-term growth themes. The fund targets high-quality companies that primarily operate domestically and have a strong track record of performance.

A Deep Dive into the Potential of Emerging Markets ex China

- Potential to generate strong returns during periods when the Chinese stock market is under pressure.

Source: Morningstar as of 31 Jan 2025.

- Emerging markets ex-China GDP is expected to grow strongly.

Source: RBC GAM, National Statistics, IMF Forecasts as of Oct 2024.

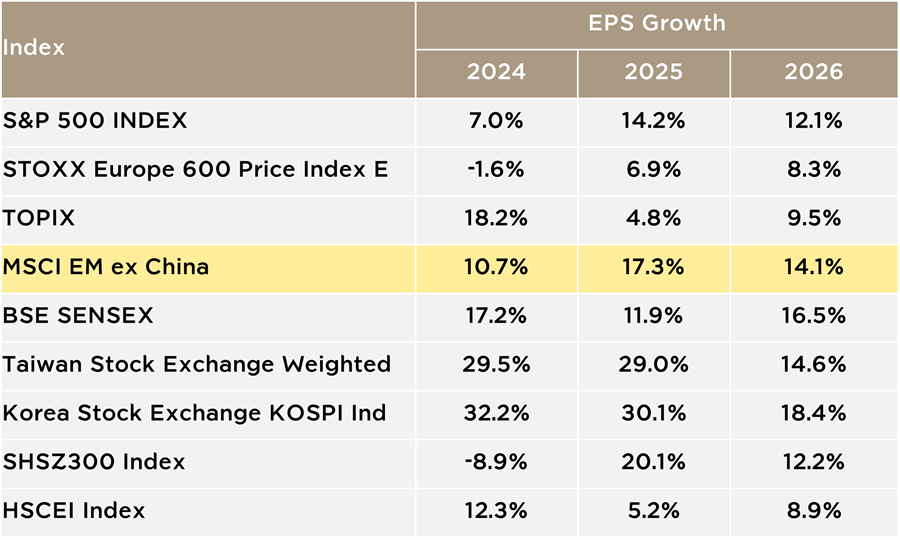

- The Emerging Markets ex-China index shows strong projected EPS growth, yet its prices have increased less than other markets, despite the solid earnings growth.

Source: Bloomberg as of 26 Feb 2025.

- Three High-Potential Countries Driving the Market

- India: Country with the highest GDP growth in the next 10 years (Source: www.visualcapitalist.com/real-gdp-growth-projections-over-10-years as of Sep 2023 and an article “The Great Powers Index: 2024” by Ray Dalio’s Great Powers Index 2024.)

- Taiwan: A leader in AI-related infrastructure

- South Korea: The largest producer of high-bandwidth memory (HBM), benefiting from DeepSeek. (Source: thebusinessresearchcompany.com as of Jan 2025 and CLSA as of 18 Feb 2025

Strategy of the Master Fund: RBC Emerging Markets ex-China Equity

Investment process for identifying the securities with opportunity to create value added sustainably.

Source: RBC Global Asset Management

Source: RBC Global Asset Management, Axioma, Barra as of 28 Feb’25.

Top 10 Holdings of the Master Fund

Sources: RBC Global Asset Management, MSCI as of 28 Feb 2025. | The performance is shown as the return differential versus the benchmark index, annualized and expressed in USD. | The performance data shown is the performance of the Master Fund that is not in accordance with the mutual fund performance measurement standards of the Association of Investment Management Companies (AIMC).

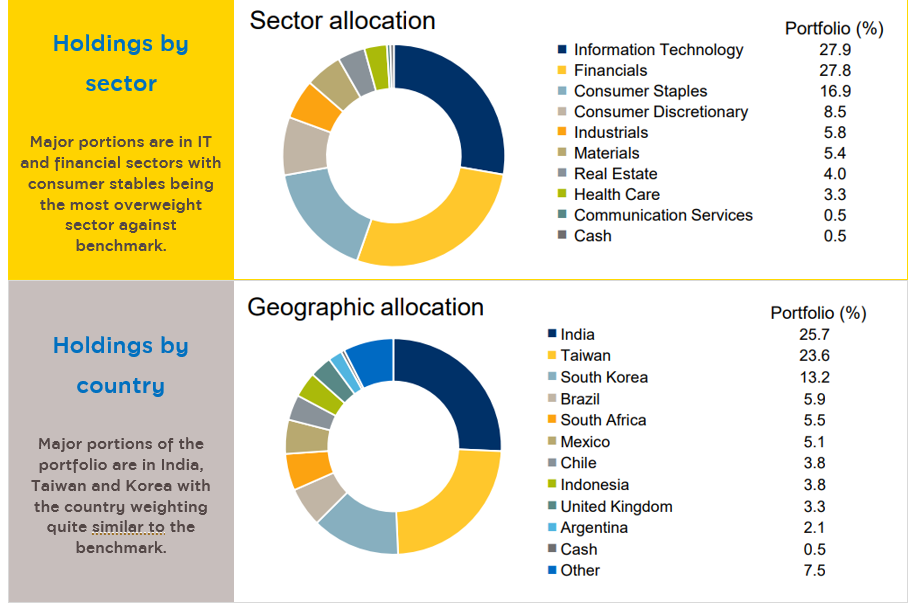

Current Portfolio of the Master Fund

Sources: RBC Global Asset Management, MSCI as of 28 Feb 2025. | The performance is shown as the return differential versus the benchmark index, annualized and expressed in USD. | The performance data shown is the performance of the Master Fund that is not in accordance with the mutual fund performance measurement standards of the Association of Investment Management Companies (AIMC).

Current Portfolio of the Master Fund

Source: RBC Global Asset Management, MSCI as of 28 Feb 2025. | The fund's benchmark index is the MSCI EM Ex China Net Index (USD). | The total figures may not add up to 100 due to rounding.

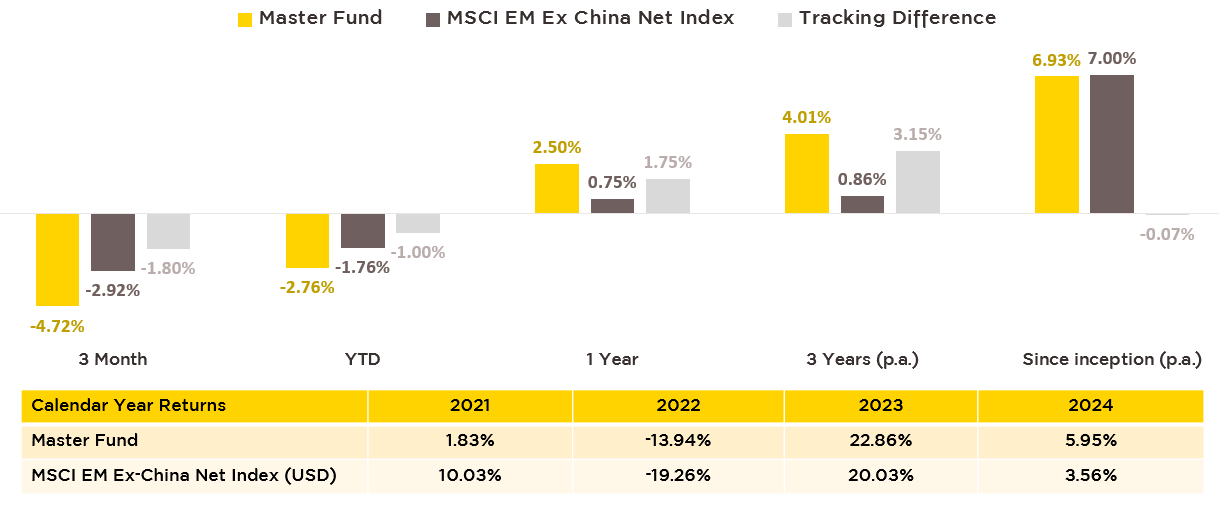

Performance of the Master Fund

- An active investment strategy that can outperform the benchmark index.

Sources: RBC Global Asset Management, MSCI as of 28 Feb 2025. | The fund’s launch date is 5 Oct 2020. | The performance data shown is the net returns after deduction of management fee where dividends are included in the calculation of returns. | The performance data shown is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of the Association of Investment Management Companies (AIMC).

Sources: RBC Global Asset Management, MSCI as of 28 Feb 2025. | The fund’s launch date is 5 Oct 2020. | The performance data shown is the net returns after deduction of management fee where dividends are included in the calculation of returns. | The performance data shown is the performance of the Master Fund which is not in accordance with the mutual fund performance measurement standards of the Association of Investment Management Companies (AIMC).

- The historical performance of the master fund compared to the overall Emerging Markets and individual countries.

Source: Morningstar as of 21 Feb 2025, which is the average performance over the past 3 years. | The performance shown reflects that of the master fund and does not comply with the performance measurement standards of mutual funds set by the Association of Investment Management Company (AIMC).

Details of the Fund: KF-EMXCN

Source: Morningstar as of 21 Feb 2025, which is the average performance over the past 3 years. | The performance shown reflects that of the master fund and does not comply with the performance measurement standards of mutual funds set by the Association of Investment Management Company (AIMC).

Details of the Fund: KF-EMXCN

The Fund offers two share classes of investment units as follows:

- Accumulation Class: KF-EMXCN-A (Krungsri Emerging Markets ex China Equity Fund-A)

- Institutional Class: KF-EMXCN-I (Krungsri Emerging Markets ex China Equity Fund-I)

Disclaimers

Disclaimers

- This document is prepared based on the information compiled from various reliable sources as of the date of publication. However, Krungsri Asset Management cannot guarantee the accuracy, reliability, and completeness of all information. The Company reserves the right to change the information without any prior notice.

- KF-EMXCN is hedged against foreign exchange risk at the Fund Manager’s discretion. Hence, it is subject to foreign exchange risk which may cause investors to lose money or gain from foreign exchange fluctuation / or receive a lower return than the initial investment amount.

- Investors should understand the fund features, conditions of returns and risks before making an investment decision. Past performance is not a guarantee of future results.

To inquire about fund’s more details/ request for prospectus, please contact Krungsri Asset Management Co., Ltd. at Tel. 0 2657 5757 | Email: krungsriasset.clientservice@krungsri.com

For details of KF-EMXCN-A, click

For details of KF-EMXCN-I, click

Back