News/Announcement

Investing in the Next Gen Infrastructure Funds to Power your Portfolio

18 February 2021

Krungsri Asset Management recommends investing in the new gen infrastructure stocks for future growth through KFINFRA-A fund.

Krungsri Asset Management reveals KFINFRA-A, investing in high-quality infrastructure stocks that will grow to cope with shifts to the future world being driven by innovations, new communication technologies and environmental concepts. The fund’s IPO is scheduled during 15 - 23 February.

KFINFRA-A will make the investment through Credit Suisse (Lux) Infrastructure Equity Fund, which has received a 5-star Morningstar rating* for investment in global infrastructure assets. The 5-star rated fund has proven itself, outperforming the market with its active strategy and yielding a higher return than global stock markets amid the crisis of the COVID-19 pandemic. (*Source: Morningstar rating from Morningstar as of Dec20. The above rankings are not relevant to the AIMC.)

In a recent webinar, Mr. Stefan Lutz, Director and Product Specialist from Credit Suisse Asset Management together with Mr. Kiattisak Preecha-anusorn, Vice President for Alternative Investment at Krungsri Asset Management provided information involving the new concept of investment in infrastructure-related assets, growth factors, risks and opportunities, investment strategies, asset selection and past performance.

Mr. Kiattisak said that the Next Generation Infrastructures are the new investment theme which becomes popular among investors and differs from the traditional infrastructure asset investments that have focused on large-scale enterprises with a large amount of cash flow, stability and resilience to economies. However, these large-sized enterprises usually stage a slow growth. Meanwhile, investing in the new generation infrastructures is intriguing from its growth capacity thanks to its focus on assets that are in the development process and growing with the new changing world, shifting itself into the urbanization and digitalization, being driven by communication technologies - 5G, Internet of Things (IoT), as well as green innovations such as renewable energy, electric vehicles. Both concepts will lay down key foundations to drive the future world from now onward.

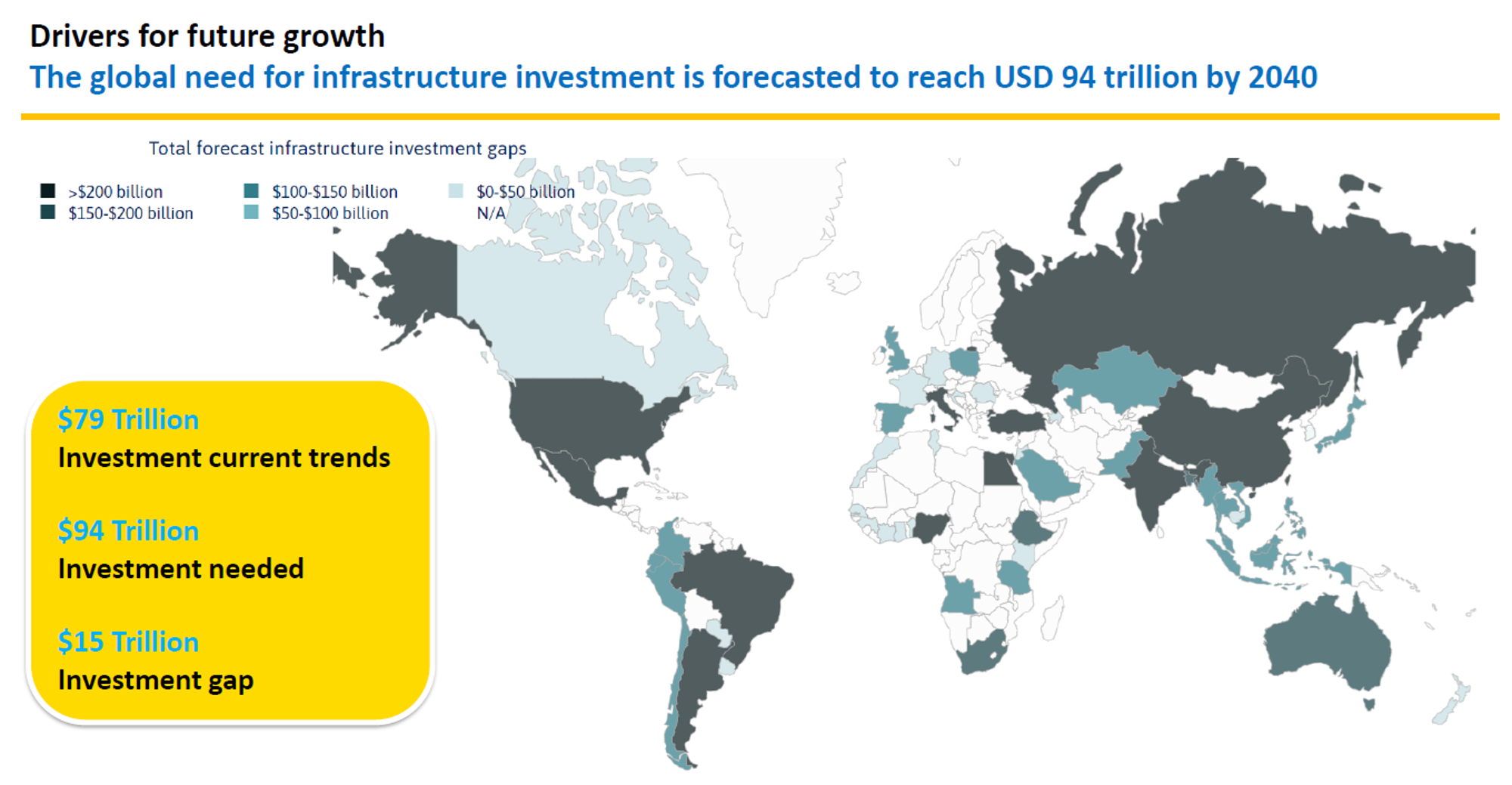

According to Mr. Lutz, the factors that will accelerate investment in the new generation infrastructures will come from the state policy. Currently, governments in several countries including the United States, those in the Europe and Asia, have set out policies and poured their budget for development of infrastructure particularly those concerning the environment. Examples are US President Joe Biden’s environmental policy, China’s zero carbon policy which constitutes the country’s national strategy in the next five years, and many more of the European countries. Global infrastructure development budget combined for the next 20 years is expected to reach 94 trillion US dollar, up from the current amount of 79 trillion US dollar. It is seen that a colossal amount of money is expected in this industry and that is a chance for investment.

KFINFRA-A will make the investment through Credit Suisse (Lux) Infrastructure Equity Fund, which has received a 5-star Morningstar rating* for investment in global infrastructure assets. The 5-star rated fund has proven itself, outperforming the market with its active strategy and yielding a higher return than global stock markets amid the crisis of the COVID-19 pandemic. (*Source: Morningstar rating from Morningstar as of Dec20. The above rankings are not relevant to the AIMC.)

In a recent webinar, Mr. Stefan Lutz, Director and Product Specialist from Credit Suisse Asset Management together with Mr. Kiattisak Preecha-anusorn, Vice President for Alternative Investment at Krungsri Asset Management provided information involving the new concept of investment in infrastructure-related assets, growth factors, risks and opportunities, investment strategies, asset selection and past performance.

Mr. Kiattisak said that the Next Generation Infrastructures are the new investment theme which becomes popular among investors and differs from the traditional infrastructure asset investments that have focused on large-scale enterprises with a large amount of cash flow, stability and resilience to economies. However, these large-sized enterprises usually stage a slow growth. Meanwhile, investing in the new generation infrastructures is intriguing from its growth capacity thanks to its focus on assets that are in the development process and growing with the new changing world, shifting itself into the urbanization and digitalization, being driven by communication technologies - 5G, Internet of Things (IoT), as well as green innovations such as renewable energy, electric vehicles. Both concepts will lay down key foundations to drive the future world from now onward.

According to Mr. Lutz, the factors that will accelerate investment in the new generation infrastructures will come from the state policy. Currently, governments in several countries including the United States, those in the Europe and Asia, have set out policies and poured their budget for development of infrastructure particularly those concerning the environment. Examples are US President Joe Biden’s environmental policy, China’s zero carbon policy which constitutes the country’s national strategy in the next five years, and many more of the European countries. Global infrastructure development budget combined for the next 20 years is expected to reach 94 trillion US dollar, up from the current amount of 79 trillion US dollar. It is seen that a colossal amount of money is expected in this industry and that is a chance for investment.

Source: Global infrastructure hub, Dec 20

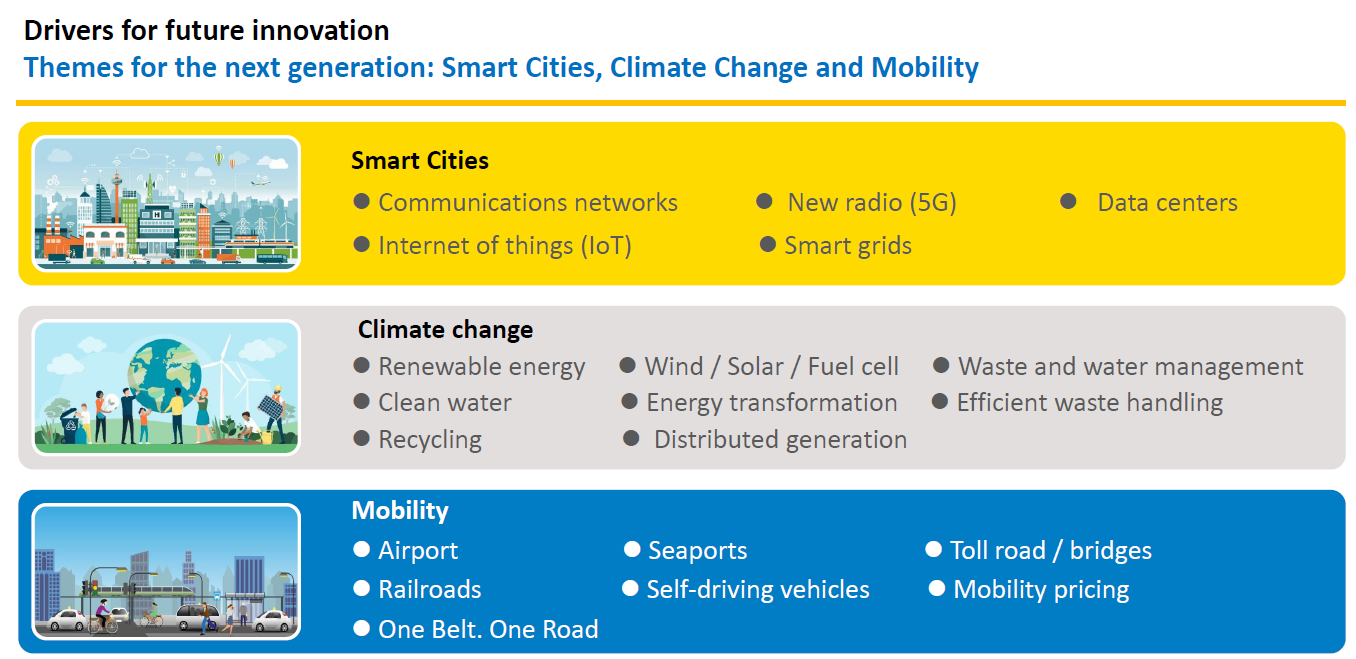

Credit Suisse (Lux) Infrastructure Equity Fund has three key investment themes:

1) Smart Cities development: It is forecast that, in 2050, about 70% of total population in the world will live in cities with 10-fold increase from now in need for information and electronics equipment. Therefore, the fund will invest in enterprises related to the communications- and telecommunications infrastructure such as 5G towers, Internet of Things (IoT), data centers, etc.

2) Climate Change: The fund will invest in renewable energy – wind and solar, water and waste management, and recycling

3) Mobility: This extends from airports, railways, ports, other utilities, and those involving China’s One Belt, One Road initiative that connects Asian region’s transportation networks.

1) Smart Cities development: It is forecast that, in 2050, about 70% of total population in the world will live in cities with 10-fold increase from now in need for information and electronics equipment. Therefore, the fund will invest in enterprises related to the communications- and telecommunications infrastructure such as 5G towers, Internet of Things (IoT), data centers, etc.

2) Climate Change: The fund will invest in renewable energy – wind and solar, water and waste management, and recycling

3) Mobility: This extends from airports, railways, ports, other utilities, and those involving China’s One Belt, One Road initiative that connects Asian region’s transportation networks.

Source: Credit Suisse, Q3 2020

Mr. Kiattisak said that these investment themes have balanced the fund’s investment portfolio in terms of growth, while mitigating risks by holding the safe-haven traditional infrastructure assets with high stability and chance for recovery after the COVID-19 crisis, such as transport and mobility infrastructures. The master fund nearly equally weighs both types of assets.

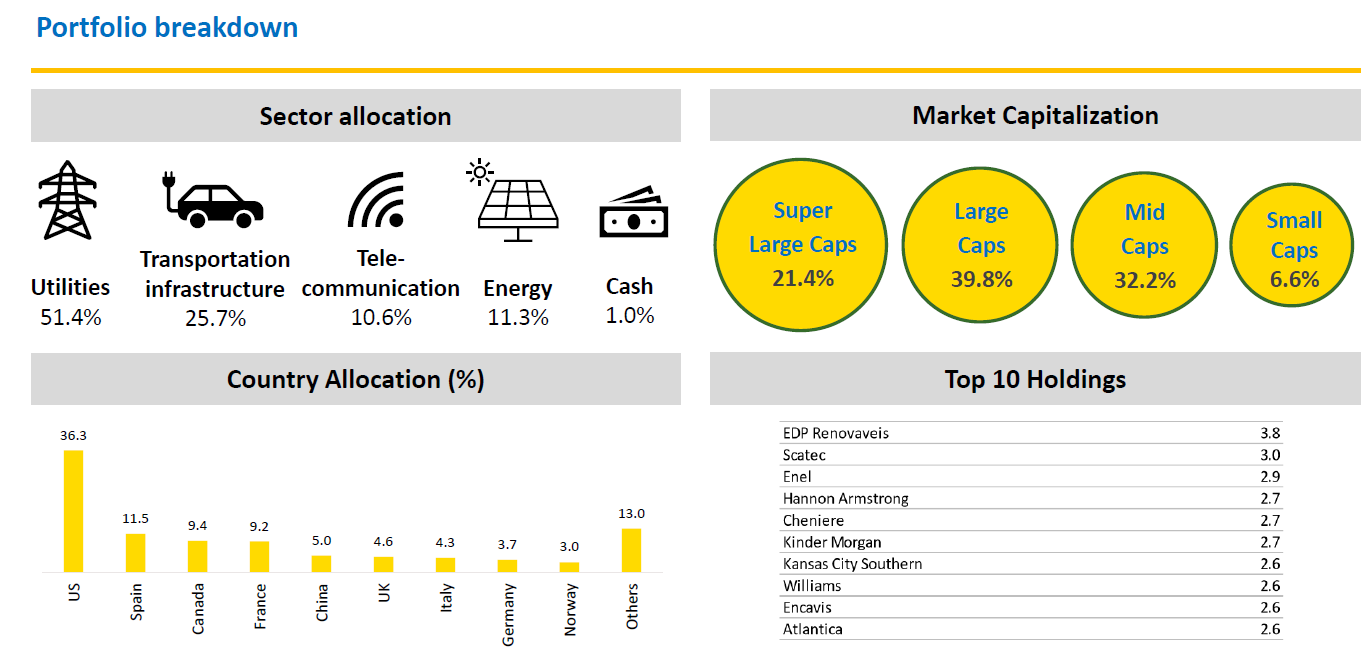

The fund’s management strategy goes to selection of individual stocks, based on the bottom-up approach, in tandem with the top-down approach, allocating its investment in all regions across the world. Meanwhile, the fund still focuses on developed countries with about 80% of its total portfolios in the United States and the European countries and the remaining 20% in emerging-market countries including China. Its asset allocation generally follows its investment themes.

Presently, the fund’s investment portfolio is allocated into several sectors: utilities, telecommunications, transportation and logistics, and renewable energy. The fund’s top holdings include American Tower Corp. - a global provider of wireless communications towers, Cellnex – the Europe’s largest telecommunications tower provider, Guangdong Investment – China’s big provider of water, energy and power, and Nextera – the world’s largest solar and wind energy.

Source: Credit Suisse as of 31 Dec 20. Market Cap definition: Super Large Caps: >CHF 60 bn, Large Caps: > CHF 10 bn < CHF 60 bn, Mid Caps: > CHF 2.5 bn < CHF 10 bn, Small Caps < CHF 2.5 bn

In addition, Credit Suisse has its strength in its active portfolio management strategy, always rebalancing its investment portfolio to cope with each particular situation. Given its investment concept and active portfolio management, the fund yields about 22% in return, above global stock markets’ average return that is about 16%. Risks to the fund’s returns exist with state policies and rises in interest rates. And it is difficult to see such risks to arise during this time of the pandemic.

Source: Credit Suisse as of 31 Dec. 2020 (performance of retail share class, while KFINFRA-A will invest in IB USD share class

In the current situation, Credit Suisse expects the economic recovery to happen after the COVID-19 vaccine development and it could be investment opportunities in the transportation and logistics infrastructure again. Currently, this sector price remains cheap, compared to other industries. Thus, it is a good chance for investment.

Mr. Kiattisak said that infra asset is still not expensive with a current P/E of 10-13 times. Thus, there remains much chance for growth and good return in the medium to longer term.

KFINFRA-A fully hedges against foreign exchange rate risk. Fund's IPO is scheduled during 15 - 23 Feb. 2021 with a minimum purchase only at 500 Baht. Interested investors can invest through Bank of Ayudhya, our Selling Agents and online channels of Krungsri Asset Management (@ccess Online Service/ @ccess Mobile).

Disclaimer

- Krungsri Asset Management Co., Ltd. (“The Management Company”) believes the information contained in this document is accurate at the time of publication but does not provide any warranty of its accuracy. Similarly, any opinions or estimates included herein constitute

- KFINFRA-A invests in Credit Suisse (Lux) Infrastructure Equity Fund, Class IB USD (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has investment policy to invest at least two-thirds of the net assets in securities issued by companies active in the infrastructure sector worldwide (including emerging markets)

- KFINFRA-A will enter into a forward contract to fully hedge against the exchange rate risk, in which case, it may incur costs for risk hedging transaction and the increased costs may reduce overall return. | Risk level 6: High risk.

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

For more information on funds, please contact:

Krungsri Asset Management Co. Ltd. Tel. 02-657-5757 or Bank of Ayudhya PCL.

For KFINFRA-A details, click here

To download Adobe Acrobat Reader Click Here free of charge.