23 April 2018 -- Krungsri Asset Management Co., Ltd (Krungsri Asset Management) held a seminar on “Vietnam…Time of the New Asian Tiger” to talk about attractive investment in the Vietnamese market and introduced “Krungsri Vietnam Equity Fund - Accumulation (KFVIET-A)*. KFVIET-A focuses investment in top quality high-growth stocks with good corporate governance in Vietnam – the market with population of over 93 million which witnesses one of the high GDP growth countries in the world.

*Since fund's investments are concentrated in the securities of a particular issuer, investors may suffer significant loss in the value of their investment.

Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance. Investors should seek advice before making an investment decision.

Mr. Isaac Thong, Fund Manager of JP Morgan Asset Management, and Mr. Kiattisak Preecha-anusorn, Vice President of Alternative Investment Department at Krungsri Asset Management, were invited to explain the economic and investment situations, market reform policy, future growth potential, detailed information in which KFVIET-A invests with strengths, strategies, challenges, risks and opportunities to gain profits from the growth of Vietnamese stock market.

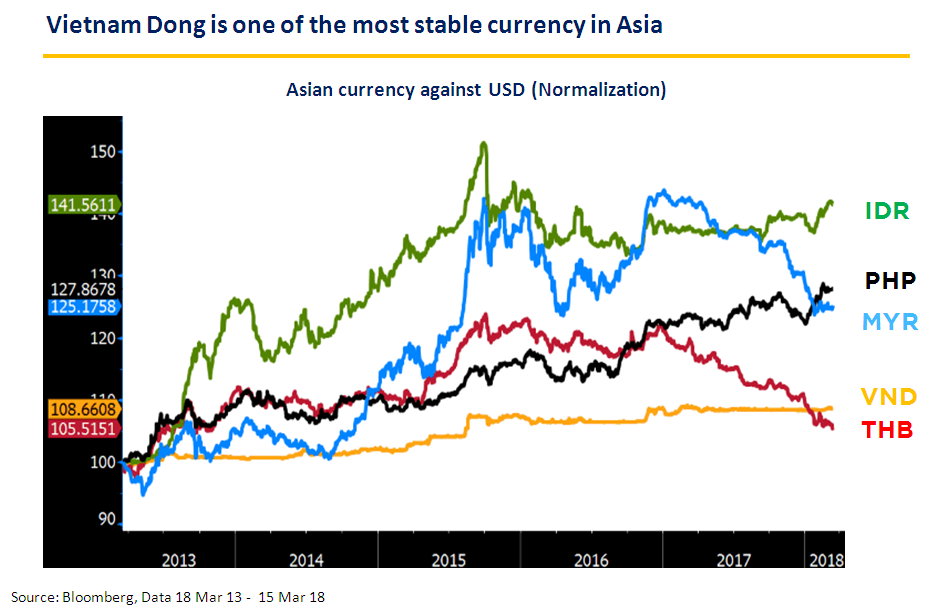

Mr. Kiattisak said that Vietnam has become an attractive investment destination, given it as one among high-growth countries in the world. Vietnam registers an average increase of 6% per annum in its gross domestic product (GDP) and tends to maintain the growth rate in the long term in light of various government policies to foster the country’s economic expansion. Simultaneously, there have been less risks. Vietnam’s inflation was down from over 20% in 2008 to 3-5% at present, while the country is facing less trade deficit with more currency stability. In the past five years, among currencies in ASEAN, Vietnamese currency has stabilized most, given its link to the US dollar.

Vietnamese growth has been attributable to two main factors: the foreign direct investment and the rise in consumption. The government’s market reform policy and the investment promotion policy especially in production of hi-tech premium products like IT, gadgets and computer equipment will transform Vietnam into a major manufacturing base. Aside from that, low wages, high quality labor force and free trade agreements that Vietnam has made with several countries such as Japan, Korea and European Union will be the key factors to attract foreign investment. Currently, FDI is very high, accounting for 7% of Vietnam’s GDP. In the meantime, consumption is also rising enormously as a result of higher income and urbanization. Several leading retail companies from Thailand have even made their investments in Vietnam, reflecting their confidence in the growth potential of the Vietnamese market.

Mr. Thong added that investors’ concern on investment in Vietnam has eased due to the government’s improved management, stricter conditions for credit extension and more foreign exchange control for currency stability. In the meantime, the country’s foreign reserves have been increasing.

In regard to the capital-market reform, Mr. Thong said Vietnam has the potential to double the market growth due to the privatization scheme, allowing several large-scale state enterprises to expand their investments in the stock market continuously. If the country follows the plan, state enterprises’ shares are expected to account for 20% of Vietnamese exchange’s market. Aside from privatization, the divestment of State Capital Investment Corporation (SCIC) together with the rule relaxation on foreign holding in listed companies will help boost market liquidity. JP Morgan Asset Management cited that in 2015, there were only five stocks traded with over 3 million US dollar. At present, there are more than 20 companies are traded in the exchange with the daily trading turnover of over 3 million US dollar. The market capitalization has increased from 4.5 billion US dollar in 2014 to 12 billion US dollar in the 2017. Besides, the Vietnamese government highly intends to implement the capital-market reform which, in another way, will help Vietnamese stocks to be included in MSCI Emerging Market. Therefore, there’s high opportunity for the Vietnamese stock exchange to double its growth with more attractiveness for investment.

KFVIET-A is a fund of funds with the active investment strategy. The fund primarily makes investment in the foreign investment fund titled JP Morgan Vietnam Opportunities managed by J.P. Morgan Asset Management with experience of more than 10 years of investment in Vietnam. This fund emphasizes investment in quality stocks which are industry winners with good corporate governance in high-growth sectors such as finance, banking, consumer staples and real estate. About 70% of the fund’s portfolio will be for long-term investment and the remaining 30% will be short- and medium-term investment. Among the major stocks which the fund has in its portfolio include Hua Phat Group, the largest steel group with gains from Vietnamese infrastructure development; Vietman Dairy Products Corp, a leading consumer staples producer, and property giant Vingroup Joint Stock Company. Since the fund’s inception in 2006, JP Morgan Vietnam Opportunities has had good performance record with satisfactory return. KFVIET-A will invest no more than 79% of its net asset value (NAV) in JP Morgan Vietnam Opportunities Fund. Since its inception in 2006, the fund has had good performance record with satisfactory return. The fund’s risk level is 6 (high risk).

The remaining investment of KFVIET-A fund will be made in international exchange-traded funds (ETFs) whose policy is to invest in listed companies in Vietnam. These ETFs range from the fund with the most satisfactory performance Xtrackers FTSE Vietnam Swap UCITS ETF managed by Deutsch Asset Management to high-liquidity ETF traded in New York exchange VanEck Vectors Vietnam ETF managed by VanEck Vectors ETF Trust. KFVIET-A will invest 15% of its NAV each in both funds to boost its liquidity. The fund, which will be linked to the US dollar, will be fully hedged against foreign exchange risk.

KFVIET’s strength lies in its portfolio allocation and its units can be traded every trading day. Its annual fee is low at 0.8025%. Investors can make the initial investment of only 2,000 baht.

Disclaimer

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

- Krungsri Vietnam Equity Fund - Accumulation (“The fund”) Invest in the investment units of foreign equity funds and/or foreign equity ETFs which have investment policy to invest in equity securities of companies registered in Vietnam or companies with business operations in Vietnam or companies with revenues from operations in Vietnam, on average in an accounting year, of not less than 80% of fund’s NAV, therefore the Fund may have risks from economic and/or political and/or social changes in the country where the master fund invested in.

- The fund may invest in non-investment grade or unrated debt securities, so investors may be exposed to risk which result in loss of investment return and principal.

- This fund will concentrate its investments in Vietnam, investor should consider diversifying risk of overall portfolio.

- The fund may enter into a currency swap within discretion of fund manager which may incur transaction costs. The increased costs will reduce overall return. In absence of a currency swap, investors may lose or gain from foreign exchange or receive lower return than the amount initially invested.

- The fund and/or master fund may invest in or make available a forward contract to enhance efficiency in investment management. This means the fund may contain higher risks than other funds and therefore the fund is suitable for investors who prefer higher return with higher risk tolerance than general investors. Investors should make investment only when they understand the risks of the contract by considering their investment experience, investment objectives and financial status.

For more details or to request for the Fund Prospectus, please contact:

Krungsri Asset Management Co., Ltd.

1st -2nd Zone A, 12th Floor, Ploenchit Tower 898, Ploenchit Road, Lumpini,

Pathumwan, Bangkok 10330

Tel: 662-657-5757 | Fax: 662-657-5777

E-mail: krungsriasset.mktg@krungsri.com | Website: www.krungsriasset.com