Fund Type

Mixed Fund

Dividend Policy

None

Inception Date

27 July 2017

Investment Policy

The Fund will invest in fixed onshore and/or offshore, listed stock, stock during IPO pending listing on the stock exchanges, as well as property units or infra units. The Fund may invest no more than 100 per cent of its NAV in units of mutual funds under management of the Management Company in accordance with the criteria and conditions prescribed by the SEC. For the remaining investment or seek investment returns by other means, onshore and offshore, as stipulated or approved by the Office of the SEC. (please see details in prospectus summary)

Fund Manager

Porntipa Nungnamjai, Thalit Choktippattana

Asset Allocation

23.99%

Instruments issued by Sovereign or Supra-national organization

3.61%

Fixed Income Instruments issued by Bank of Thailand

4.44%

Deposits and Fixed Income Instruments issued by Financial Institutions

50.68%

Fixed Income Instruments Issued by Corporates

0.76%

Other Assets

-0.18%

Other Liabilities

16.70%

Equity and Unit Trusts

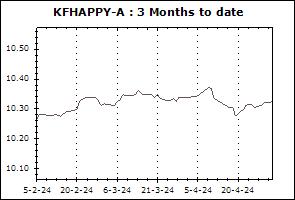

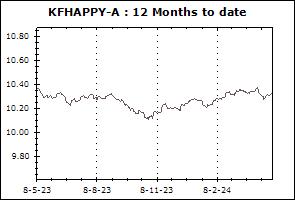

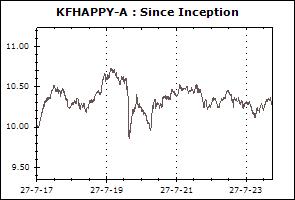

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every dealing date of the fund by 15.30 hrs.

Proceeds Payment Period: 3 business days after the execution (T+3)

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Sep 2025)

| Instruments issued by Sovereign or Supra-national organization | 24.11% |

| Fixed Income Instruments issued by Bank of Thailand | 2.70% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 5.68% |

| Fixed Income Instruments Issued by Corporates | 49.40% |

| Equity and Unit Trusts | 18.06% |

| Other Assets | 1.47% |

| Other Liabilities | -1.42% |

Top Five Issuers/Guarantors

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| The Guaranteed Debentures of Frasers Property Holdings (Thailand) Co.,Ltd. No.1/2561 Series 3 Due B.E.2571 | - | 8.00% |

| Debentures of Golden Ventures Leasehold Real Estate Investment Trust (GVREIT) No.1/2561 Due B.E.2570 | A- | 7.62% |

| TLOAN65/12/5.95Y | - | 4.93% |

| DEBENTURES OF MUANGTHAI CAPITAL PUBLIC COMPANY LIMITED NO. 3/2568 TRANCHE 1 DUE B.E. 2572 | A- | 3.57% |

| Goverment Housing Bank | AAA | 3.53% |

Mixed Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Flexible Fund (KFFLEX) | +12.87% | +3.49% | -9.75% | -15.30% | -7.00% | -1.90% | -1.81% | +2.95% | 97 |

| Standard Deviation of Fund | +14.52% | +17.33% | +16.78% | +15.80% | +12.97% | +12.89% | +13.76% | +17.98% | |

| Krungsri Flexible Dividend Fund (KFFLEX-D) | +13.28% | +4.31% | -8.50% | -14.12% | -6.47% | -1.61% | -1.60% | +5.81% | 782 |

| Standard Deviation of Fund | +14.62% | +16.80% | +16.32% | +15.40% | +12.77% | +12.70% | +13.62% | +17.85% | |

| Benchmark(2) | +9.59% | +8.20% | -0.24% | -0.80% | +0.68% | +2.72% | +2.58% | N/A | |

| Standard Deviation of Benchmark | +5.87% | +6.98% | +6.94% | +6.45% | +5.39% | +5.50% | +6.39% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Star Multiple Fund (KFSMUL) | +0.75% | +2.06% | +3.31% | +4.42% | +3.19% | +2.11% | +2.05% | +2.81% | 1,698 |

| Benchmark(4) | +0.70% | +1.62% | +2.67% | +3.38% | +2.31% | +1.17% | +1.91% | +5.12% | |

| Standard Deviation of Fund | +1.18% | +1.00% | +0.93% | +0.88% | +0.67% | +0.71% | +0.76% | +3.35% | |

| Standard Deviation of Benchmark | +0.52% | +0.49% | +0.47% | +0.44% | +0.42% | +0.49% | +2.02% | +8.77% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Happy Life Fund-A (KFHAPPY-A) | +2.78% | +3.06% | +2.57% | +2.32% | +1.97% | +1.61% | N/A | +1.03% | 529 |

| Benchmark(5) | +4.02% | +3.47% | +0.42% | +0.26% | +0.80% | +1.75% | N/A | +1.24% | |

| Standard Deviation of Fund | +2.37% | +2.81% | +2.74% | +2.63% | +2.16% | +2.26% | N/A | +2.58% | |

| Standard Deviation of Benchmark | +2.67% | +3.13% | +3.04% | +2.79% | +2.20% | +2.24% | N/A | +2.47% | |

| Krungsri Good Life Fund (KFGOOD) | +4.85% | +3.65% | +0.70% | -0.87% | +0.20% | +1.21% | N/A | -0.66% | 327 |

| Benchmark(6) | +7.52% | +5.80% | -1.05% | -1.90% | -0.32% | +2.29% | N/A | +0.46% | |

| Standard Deviation of Fund | +4.78% | +5.89% | +5.83% | +5.55% | +4.53% | +4.69% | N/A | +5.13% | |

| Standard Deviation of Benchmark | +4.65% | +5.48% | +5.43% | +5.04% | +4.18% | +4.28% | N/A | +4.82% | |

| Krungsri Super Life Fund (KFSUPER) | +7.46% | +4.69% | -1.09% | -4.01% | -1.88% | +0.48% | N/A | -3.28% | 118 |

| Benchmark(7) | +11.02% | +8.13% | -2.51% | -4.07% | -1.47% | +2.83% | N/A | +0.24% | |

| Standard Deviation of Fund | +8.00% | +9.77% | +9.66% | +9.11% | +7.40% | +7.56% | N/A | +8.84% | |

| Standard Deviation of Benchmark | +7.23% | +8.59% | +8.47% | +7.82% | +6.37% | +6.48% | N/A | +7.56% | |

| Krungsri Yenjai Fund-A (KFYENJAI-A) | +1.10% | +1.97% | +1.94% | +2.27% | +1.86% | N/A | N/A | +1.70% | 6,210 |

| Benchmark(8) | +1.60% | +2.65% | +2.36% | +2.69% | +1.96% | N/A | N/A | +1.87% | |

| Standard Deviation of Fund | +0.94% | +1.02% | +1.06% | +1.06% | +1.02% | N/A | N/A | +1.01% | |

| Standard Deviation of Benchmark | +0.73% | +1.05% | +1.01% | +0.96% | +0.79% | N/A | N/A | +0.79% | |

| Krungsri The One Mild Fund-A (KF1MILD-A) | +2.99% | +4.34% | +3.90% | +2.30% | N/A | N/A | N/A | +2.54% | 254 |

| Benchmark(9) | +4.57% | +6.21% | +5.15% | +5.15% | N/A | N/A | N/A | +4.73% | |

| Standard Deviation of Fund | +2.36% | +4.42% | +4.18% | +3.98% | N/A | N/A | N/A | +3.48% | |

| Standard Deviation of Benchmark | +2.79% | +4.03% | +3.83% | +3.50% | N/A | N/A | N/A | +2.91% | |

| Krungsri The One Mild Fund-I (KF1MILD-I) | +2.99% | +4.34% | +3.90% | +2.30% | N/A | N/A | N/A | +2.64% | 105 |

| Benchmark(9) | +4.57% | +6.21% | +5.15% | +5.15% | N/A | N/A | N/A | +4.80% | |

| Standard Deviation of Fund | +2.36% | +4.42% | +4.18% | +3.98% | N/A | N/A | N/A | +3.53% | |

| Standard Deviation of Benchmark | +2.79% | +4.03% | +3.83% | +3.50% | N/A | N/A | N/A | +2.93% | |

| Krungsri The One Mean Fund-A (KF1MEAN-A) | +3.93% | +5.48% | +3.27% | +0.85% | N/A | N/A | N/A | +1.48% | 74 |

| Benchmark(10) | +7.22% | +9.25% | +5.96% | +5.10% | N/A | N/A | N/A | +5.65% | |

| Standard Deviation of Fund | +3.38% | +6.68% | +6.35% | +5.90% | N/A | N/A | N/A | +5.16% | |

| Standard Deviation of Benchmark | +4.76% | +7.14% | +6.77% | +6.16% | N/A | N/A | N/A | +5.11% | |

| Krungsri The One Mean Fund-I (KF1MEAN-I) | +3.93% | +5.48% | +3.28% | +0.85% | N/A | N/A | N/A | +1.55% | 173 |

| Benchmark(10) | +7.22% | +9.25% | +5.96% | +5.10% | N/A | N/A | N/A | +5.78% | |

| Standard Deviation of Fund | +3.38% | +6.68% | +6.35% | +5.90% | N/A | N/A | N/A | +5.21% | |

| Standard Deviation of Benchmark | +4.76% | +7.14% | +6.77% | +6.16% | N/A | N/A | N/A | +5.15% | |

| Krungsri The One Max Fund-A (KF1MAX-A) | +4.86% | +7.54% | +4.44% | +1.67% | N/A | N/A | N/A | +1.78% | 44 |

| Benchmark(11) | +10.15% | +14.08% | +8.89% | +7.72% | N/A | N/A | N/A | +9.04% | |

| Standard Deviation of Fund | +4.56% | +8.91% | +8.44% | +7.75% | N/A | N/A | N/A | +6.89% | |

| Standard Deviation of Benchmark | +6.98% | +11.27% | +10.68% | +9.68% | N/A | N/A | N/A | +8.02% | |

| Krungsri The One Max Fund-I (KF1MAX-I) | +4.86% | +7.54% | +4.44% | +1.67% | N/A | N/A | N/A | +1.86% | 202 |

| Benchmark(11) | +10.15% | +14.08% | +8.89% | +7.72% | N/A | N/A | N/A | +9.35% | |

| Standard Deviation of Fund | +4.56% | +8.91% | +8.44% | +7.75% | N/A | N/A | N/A | +6.93% | |

| Standard Deviation of Benchmark | +6.98% | +11.27% | +10.68% | +9.68% | N/A | N/A | N/A | +8.07% | |

Remark