Krungsri Finnoventure PE Y2033 Fund-Not for Retail Investors (KFFVPE-UI)

Information as of Feb 27, 2026

Fund Type

Alternative Fund primarily investing in Private Equity Trust (PE Trust) for Institutional and Ultra High Net Worth Investors Only (High Risk or Complex Fund)

Dividend Policy

Done

Inception Date

24 December 2021

Investment Policy

Invest mainly in private equity units without investment limit and may invest up to 100% of its NAV in private equity units through the investment in a PE Trust named Finnoventure Private Equity Trust I created to mobilize funds from a limited number of investors whose qualifications meet the relevant eligibility criteria to invest in the form of venture capital (VC) in the startup businesses of domestic and overseas non-listed private companies. Such startups shall be tech companies applying advanced technology and innovation in the operations of specific sectors such as financial tech, e-commerce, and automotive, etc. Such PE Trust is created under the Trust for Transactions in Capital Market Act, B.E. 2550 (2007) with MFC Asset Management Public Company Limited (“MFC”) acting as the Trustee, responsible for the management of the PE Trust, and Krungsri Finnovate Company Limited (“Krungsri Finnovate”) acting as the Trust Manager, responsible for overseeing investment of the PE Trust. (Please study more details in Fund Prospectus)

Fund Manager

Thalit Choktippattana, Satit Buachoo

Asset Allocation

-

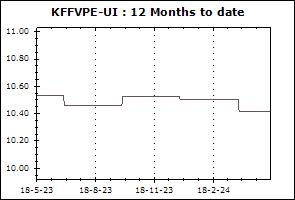

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 1,000,000

Proceeds Payment Period: This Fund does not permit regular redemption during the project life. The Management Company will process the redemption of investment units by automatically switching in full all Investment units to KFCASH-A (“the Destination Fund”) on the business day preceding the expiration of the project life. Unitholders will obtain the investment units of the Destination Fund after automatic switching on the next business day and will be able to redeem or switch-out the investment units in accordance with the conditions stipulated in the prospectus of the Destination Fund.

Fund Subscription Period: During IPO only: 16 - 22 December 2021

Fund Redemption Period: This Fund does not permit regular redemption during the project life.

Transaction Channel: Krungsri Asset Management,AGENT

Asset Allocation (27 Feb 2026)

| Fixed Income Instruments issued by Bank of Thailand | 1.86% |

| Equity and Unit Trusts | 97.26% |

| Other Assets | 0.98% |

| Other Liabilities | -0.10% |

Alternative Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Finnoventure PE Y2033 Fund-Not for Retail Investors (KFFVPE-UI)(4) | +3.04% | +2.20% | +0.61% | +0.61% | +1.62% | N/A | N/A | +2.69% | |

Remark