Krungsri Financial Focus Dividend Fund (KFFIN-D)

Old Name: Primavest Equity Dividend Fund (PEF), KRUNGSRI Dynamic Dividend Fund 2 (KFDNM-D2)

Information as of Nov 28, 2025

Fund Type

Equity Fund

Dividend Policy

At least once a year at the minimum 90% of net profit and/or accrued profit In the event that the dividend payment is less than 0.25 baht per unit, the Fund reserves the right not to pay. For further detail pertaining to dividend payment, please study Fund Prospectus and Fund Project and Commitment.

Objective

To create return from equities in Finanace & Securities and/or Banking sectors.

Inception Date

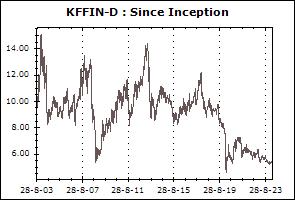

28 August 2003

Investment Policy

To invest at least 80% of its net asset value on average in listed stocks and in Finance & Securities and Banking sectors.

Fund Manager

Thalit Choktippattana, Sawinee Sooksiwong

Asset Allocation

-

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every dealing date of the fund by 15.30 hrs.

Proceeds Payment Period: 3 business days after the execution (T+3)

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (28 Nov 2025)

| Banking | 67.99% |

| Finance & Securities | 17.24% |

| Information & Communication Technology | 4.06% |

| Health Care Services | 3.28% |

| Insurance | 2.05% |

Top Five Holdings (28 Nov 2025)

| Krung Thai Bank Plc. | 9.64% |

| SCB X Plc. | 9.53% |

| Tisco Financial Group Plc. | 9.12% |

| Thanachart Capital Plc. | 8.94% |

| TMBThanachart Bank Plc. | 8.90% |

Dividend Payment History (Last 10 times or last 5 years)

(Note : Paid 21 times, totalling 20.3800 Baht.)

(Note : Paid 21 times, totalling 20.3800 Baht.)

| 20 Feb 2025 | 0.5500 Bt./unit |

| 27 Jan 2023 | 0.3400 Bt./unit |

| 27 Jan 2022 | 0.4500 Bt./unit |

| 29 Jul 2021 | 0.9500 Bt./unit |

| 27 Jan 2021 | 0.7500 Bt./unit |

| 30 Jul 2019 | 0.6600 Bt./unit |

| 29 Jan 2018 | 1.3200 Bt./unit |

| 27 Jul 2017 | 0.9000 Bt./unit |

| 27 Jan 2017 | 1.2500 Bt./unit |

| 29 Jul 2016 | 0.9000 Bt./unit |

Equity Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Stock Fund (KFSDIV) | -0.96% | +3.60% | -10.00% | -11.74% | -8.42% | -4.18% | -2.44% | +4.77% | 6,300 |

| Standard Deviation of Fund | +11.12% | +15.31% | +16.89% | +16.79% | +13.44% | +13.07% | +14.80% | +15.46% | |

| Krungsri Value Stock Fund-A (KFVALUE-A) | -1.03% | +3.65% | -9.72% | -11.47% | -8.22% | -4.08% | -2.32% | +3.81% | 523 |

| Standard Deviation of Fund | +11.07% | +15.24% | +16.73% | +16.63% | +13.32% | +12.99% | +14.74% | +17.73% | |

| Krungsri Value Stock Fund-I (KFVALUE-I) | -1.02% | +3.65% | -9.71% | -11.47% | -8.22% | N/A | N/A | -7.85% | 0 |

| Standard Deviation of Fund | +11.07% | +15.24% | +16.73% | +16.62% | +13.32% | N/A | N/A | +13.29% | |

| Krungsri Star Equity Dividend Fund (KFSEQ-D) | +0.44% | +4.13% | -11.69% | -13.90% | -9.35% | -2.72% | -2.03% | +6.81% | 767 |

| Standard Deviation of Fund | +11.50% | +15.86% | +17.82% | +17.73% | +13.98% | +13.19% | +15.20% | +21.71% | |

| Krungsri Star Equity Fund (KFSEQ) | +0.36% | +3.98% | -11.70% | -13.94% | -9.36% | -2.76% | -2.09% | +2.82% | 682 |

| Standard Deviation of Fund | +11.38% | +15.58% | +17.62% | +17.54% | +13.86% | +13.12% | +15.12% | +19.04% | |

| Krungsri Dynamic Dividend Fund (KFDNM-D) | -4.30% | -4.30% | -23.00% | -24.58% | -11.01% | -0.41% | +1.66% | +4.67% | 307 |

| Standard Deviation of Fund | +14.96% | +18.43% | +19.63% | +19.32% | +14.98% | +14.43% | +16.27% | +19.20% | |

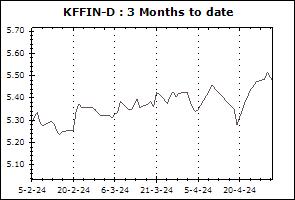

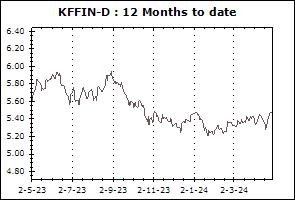

| Krungsri Financial Focus Dividend Fund (KFFIN-D) | +3.77% | +10.59% | +5.70% | +7.21% | +1.59% | +6.63% | +4.92% | +7.28% | 1,585 |

| Standard Deviation of Fund | +9.88% | +12.00% | +13.85% | +13.68% | +12.73% | +13.88% | +16.88% | +20.89% | |

| Krungsri Dynamic Fund (KFDYNAMIC) | -4.33% | -4.38% | -23.24% | -24.82% | -11.17% | -0.55% | +1.65% | +4.78% | 745 |

| Standard Deviation of Fund | +15.09% | +18.47% | +19.74% | +19.43% | +15.15% | +14.57% | +16.33% | +19.57% | |

| Krungsri Growth Equity Fund-A (KFGROWTH-A) | +0.39% | +3.85% | -11.53% | -13.72% | -9.40% | -2.85% | N/A | -7.72% | 10 |

| Standard Deviation of Fund | +11.49% | +15.56% | +17.34% | +17.29% | +13.84% | +13.06% | N/A | +15.71% | |

| Krungsri Growth Equity Fund-D (KFGROWTH-D) | +0.39% | +3.84% | -11.53% | -13.72% | -9.40% | -2.85% | -1.97% | +4.82% | 359 |

| Standard Deviation of Fund | +11.49% | +15.56% | +17.35% | +17.30% | +13.84% | +13.06% | +15.07% | +19.05% | |

| Krungsri Enhanced SET50 Fund-A (KFENS50-A) | +1.26% | +10.30% | -7.29% | -8.64% | -4.77% | -0.54% | +1.93% | +4.43% | 1,933 |

| Standard Deviation of Fund | +14.13% | +18.09% | +20.31% | +19.86% | +15.23% | +14.68% | +16.77% | +20.47% | |

| Krungsri Thai Small-Mid Cap Equity Fund (KFTHAISM) | -1.71% | +1.21% | -19.90% | -21.51% | -16.36% | -2.88% | N/A | -1.74% | 121 |

| Standard Deviation of Fund | +11.97% | +16.05% | +18.59% | +18.20% | +14.84% | +14.80% | N/A | +15.83% | |

| Krungsri Thai All Stars Equity Fund-D (KFTSTAR-D) | -0.59% | +3.35% | -5.97% | -8.56% | -7.84% | -2.34% | N/A | -4.75% | 514 |

| Standard Deviation of Fund | +10.10% | +13.95% | +16.42% | +16.20% | +13.55% | +13.19% | N/A | +14.98% | |

| Krungsri Thai All Stars Equity Fund-A (KFTSTAR-A) | -0.59% | +3.35% | -5.97% | -8.55% | -7.84% | -2.34% | N/A | -6.82% | 449 |

| Standard Deviation of Fund | +10.10% | +13.95% | +16.42% | +16.20% | +13.55% | +13.18% | N/A | +15.37% | |

| Krungsri Thai Equity CG Fund (KFTHAICG) | +1.00% | +4.50% | -6.01% | -7.83% | -5.70% | +0.28% | N/A | -1.84% | 55 |

| Standard Deviation of Fund | +10.59% | +14.35% | +16.69% | +16.56% | +13.53% | +12.88% | N/A | +14.91% | |

| Krungsri SET100 Fund-A (KFS100-A) | +2.23% | +11.36% | -6.44% | -7.71% | -4.51% | +0.11% | N/A | +1.57% | 172 |

| Standard Deviation of Fund | +13.84% | +17.58% | +19.75% | +19.34% | +14.81% | +14.20% | N/A | +14.74% | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.99% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.37% | N/A | N/A | N/A | N/A | |

| Krungsri SET100 Fund-I (KFS100-I) | +2.66% | +11.83% | -6.04% | -7.32% | N/A | N/A | N/A | -2.73% | 0 |

| Standard Deviation of Fund | +14.28% | +17.76% | +19.84% | +19.42% | N/A | N/A | N/A | +15.45% | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.08% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | +0.03% | N/A | N/A | N/A | N/A | |

| Krungsri SET50 LTF-A (KFLTF50-A) | +2.35% | +10.97% | -6.14% | -7.41% | -3.82% | +0.38% | N/A | +3.17% | 8 |

| Standard Deviation of Fund | +13.58% | +17.33% | +19.81% | +19.40% | +14.83% | +14.34% | N/A | +14.95% | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.91% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.93% | N/A | N/A | N/A | N/A | |

| Krungsri Dividend Stock LTF 70/30-D (KFLTFD70-D) | +0.36% | +4.92% | -6.84% | -8.39% | -5.47% | -2.47% | N/A | -0.78% | 4 |

| Standard Deviation of Fund | +8.60% | +11.23% | +12.37% | +12.21% | +9.78% | +9.39% | N/A | +9.63% | |

| Krungsri Dividend Stock LTF-D (KFLTFDIV-D) | +0.21% | +6.26% | -10.53% | -12.58% | -8.13% | -4.02% | N/A | -1.76% | 6 |

| Standard Deviation of Fund | +12.24% | +15.83% | +17.55% | +17.32% | +13.91% | +13.39% | N/A | +13.75% | |

| Krungsri Equity LTF-A (KFLTFEQ-A) | +0.57% | +4.17% | -12.36% | -14.58% | -9.60% | -2.76% | N/A | -0.98% | 0 |

| Standard Deviation of Fund | +11.86% | +16.33% | +18.13% | +18.02% | +14.13% | +13.29% | N/A | +13.41% | |

| SET TRI | +2.38% | +10.85% | -6.33% | -8.07% | -5.12% | +0.98% | +2.46% | N/A | |

| Standard Deviation of Benchmark | +13.51% | +16.47% | +18.16% | +17.80% | +13.81% | +13.38% | +14.92% | N/A | |

| SET50 TRI | +2.66% | +11.77% | -5.29% | -6.48% | -2.88% | +1.12% | +2.56% | N/A | |

| Standard Deviation of Benchmark | +13.61% | +17.40% | +19.78% | +19.38% | +14.88% | +14.37% | +16.73% | N/A | |

| SET100 TRI | +2.56% | +12.02% | -6.17% | -7.34% | -4.40% | +0.33% | +2.18% | N/A | |

| Standard Deviation of Benchmark | +13.81% | +17.64% | +19.80% | +19.38% | +14.91% | +14.30% | +16.51% | N/A | |

Remark