Fund Type

Equity Fund

Dividend Policy

None

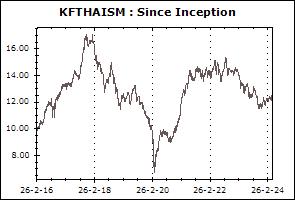

Inception Date

26 February 2016

Investment Policy

The Fund will invest no less than 80% of NAV in equity of companies listed in The Stock Exchange of Thailand and/or the Market for Alternative Investment (MAI) of good fundamental and/or growth in small and medium-sized enterprises. (please see details in prospectus summary)

Fund Manager

Thalit Choktippattana

Asset Allocation

-

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every dealing date of the fund by 15.30 hrs.

Proceeds Payment Period: 3 business days after the execution (T+3)

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Top Five Sectors (28 Nov 2025)

| Energy & Utilities | 12.30% |

| Finance & Securities | 9.19% |

| Health Care Services | 8.90% |

| Commerce | 8.49% |

| Transportation & Logistics | 8.42% |

Top Five Holdings (28 Nov 2025)

| Thanachart Capital Plc. | 5.64% |

| MBK Plc. | 5.30% |

| Bangkok Airways Plc. | 3.78% |

| Mega Lifesciences Plc. | 3.48% |

| Central Plaza Hotel Plc. | 3.32% |

Equity Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Dividend Stock Fund (KFSDIV) | -0.96% | +3.60% | -10.00% | -11.74% | -8.42% | -4.18% | -2.44% | +4.77% | 6,300 |

| Standard Deviation of Fund | +11.12% | +15.31% | +16.89% | +16.79% | +13.44% | +13.07% | +14.80% | +15.46% | |

| Krungsri Value Stock Fund-A (KFVALUE-A) | -1.03% | +3.65% | -9.72% | -11.47% | -8.22% | -4.08% | -2.32% | +3.81% | 523 |

| Standard Deviation of Fund | +11.07% | +15.24% | +16.73% | +16.63% | +13.32% | +12.99% | +14.74% | +17.73% | |

| Krungsri Value Stock Fund-I (KFVALUE-I) | -1.02% | +3.65% | -9.71% | -11.47% | -8.22% | N/A | N/A | -7.85% | 0 |

| Standard Deviation of Fund | +11.07% | +15.24% | +16.73% | +16.62% | +13.32% | N/A | N/A | +13.29% | |

| Krungsri Star Equity Dividend Fund (KFSEQ-D) | +0.44% | +4.13% | -11.69% | -13.90% | -9.35% | -2.72% | -2.03% | +6.81% | 767 |

| Standard Deviation of Fund | +11.50% | +15.86% | +17.82% | +17.73% | +13.98% | +13.19% | +15.20% | +21.71% | |

| Krungsri Star Equity Fund (KFSEQ) | +0.36% | +3.98% | -11.70% | -13.94% | -9.36% | -2.76% | -2.09% | +2.82% | 682 |

| Standard Deviation of Fund | +11.38% | +15.58% | +17.62% | +17.54% | +13.86% | +13.12% | +15.12% | +19.04% | |

| Krungsri Dynamic Dividend Fund (KFDNM-D) | -4.30% | -4.30% | -23.00% | -24.58% | -11.01% | -0.41% | +1.66% | +4.67% | 307 |

| Standard Deviation of Fund | +14.96% | +18.43% | +19.63% | +19.32% | +14.98% | +14.43% | +16.27% | +19.20% | |

| Krungsri Financial Focus Dividend Fund (KFFIN-D) | +3.77% | +10.59% | +5.70% | +7.21% | +1.59% | +6.63% | +4.92% | +7.28% | 1,585 |

| Standard Deviation of Fund | +9.88% | +12.00% | +13.85% | +13.68% | +12.73% | +13.88% | +16.88% | +20.89% | |

| Krungsri Dynamic Fund (KFDYNAMIC) | -4.33% | -4.38% | -23.24% | -24.82% | -11.17% | -0.55% | +1.65% | +4.78% | 745 |

| Standard Deviation of Fund | +15.09% | +18.47% | +19.74% | +19.43% | +15.15% | +14.57% | +16.33% | +19.57% | |

| Krungsri Growth Equity Fund-A (KFGROWTH-A) | +0.39% | +3.85% | -11.53% | -13.72% | -9.40% | -2.85% | N/A | -7.72% | 10 |

| Standard Deviation of Fund | +11.49% | +15.56% | +17.34% | +17.29% | +13.84% | +13.06% | N/A | +15.71% | |

| Krungsri Growth Equity Fund-D (KFGROWTH-D) | +0.39% | +3.84% | -11.53% | -13.72% | -9.40% | -2.85% | -1.97% | +4.82% | 359 |

| Standard Deviation of Fund | +11.49% | +15.56% | +17.35% | +17.30% | +13.84% | +13.06% | +15.07% | +19.05% | |

| Krungsri Enhanced SET50 Fund-A (KFENS50-A) | +1.26% | +10.30% | -7.29% | -8.64% | -4.77% | -0.54% | +1.93% | +4.43% | 1,933 |

| Standard Deviation of Fund | +14.13% | +18.09% | +20.31% | +19.86% | +15.23% | +14.68% | +16.77% | +20.47% | |

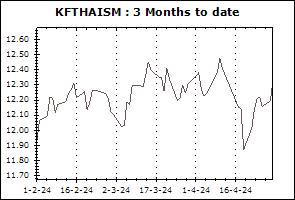

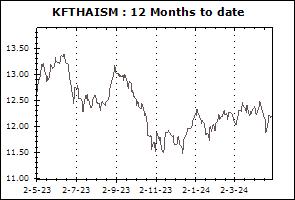

| Krungsri Thai Small-Mid Cap Equity Fund (KFTHAISM) | -1.71% | +1.21% | -19.90% | -21.51% | -16.36% | -2.88% | N/A | -1.74% | 121 |

| Standard Deviation of Fund | +11.97% | +16.05% | +18.59% | +18.20% | +14.84% | +14.80% | N/A | +15.83% | |

| Krungsri Thai All Stars Equity Fund-D (KFTSTAR-D) | -0.59% | +3.35% | -5.97% | -8.56% | -7.84% | -2.34% | N/A | -4.75% | 514 |

| Standard Deviation of Fund | +10.10% | +13.95% | +16.42% | +16.20% | +13.55% | +13.19% | N/A | +14.98% | |

| Krungsri Thai All Stars Equity Fund-A (KFTSTAR-A) | -0.59% | +3.35% | -5.97% | -8.55% | -7.84% | -2.34% | N/A | -6.82% | 449 |

| Standard Deviation of Fund | +10.10% | +13.95% | +16.42% | +16.20% | +13.55% | +13.18% | N/A | +15.37% | |

| Krungsri Thai Equity CG Fund (KFTHAICG) | +1.00% | +4.50% | -6.01% | -7.83% | -5.70% | +0.28% | N/A | -1.84% | 55 |

| Standard Deviation of Fund | +10.59% | +14.35% | +16.69% | +16.56% | +13.53% | +12.88% | N/A | +14.91% | |

| Krungsri SET100 Fund-A (KFS100-A) | +2.23% | +11.36% | -6.44% | -7.71% | -4.51% | +0.11% | N/A | +1.57% | 172 |

| Standard Deviation of Fund | +13.84% | +17.58% | +19.75% | +19.34% | +14.81% | +14.20% | N/A | +14.74% | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.99% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.37% | N/A | N/A | N/A | N/A | |

| Krungsri SET100 Fund-I (KFS100-I) | +2.66% | +11.83% | -6.04% | -7.32% | N/A | N/A | N/A | -2.73% | 0 |

| Standard Deviation of Fund | +14.28% | +17.76% | +19.84% | +19.42% | N/A | N/A | N/A | +15.45% | |

| Tracking Error (TE) | N/A | N/A | N/A | +2.08% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | +0.03% | N/A | N/A | N/A | N/A | |

| Krungsri SET50 LTF-A (KFLTF50-A) | +2.35% | +10.97% | -6.14% | -7.41% | -3.82% | +0.38% | N/A | +3.17% | 8 |

| Standard Deviation of Fund | +13.58% | +17.33% | +19.81% | +19.40% | +14.83% | +14.34% | N/A | +14.95% | |

| Tracking Error (TE) | N/A | N/A | N/A | +1.91% | N/A | N/A | N/A | N/A | |

| Tracking Difference (TD) | N/A | N/A | N/A | -0.93% | N/A | N/A | N/A | N/A | |

| Krungsri Dividend Stock LTF 70/30-D (KFLTFD70-D) | +0.36% | +4.92% | -6.84% | -8.39% | -5.47% | -2.47% | N/A | -0.78% | 4 |

| Standard Deviation of Fund | +8.60% | +11.23% | +12.37% | +12.21% | +9.78% | +9.39% | N/A | +9.63% | |

| Krungsri Dividend Stock LTF-D (KFLTFDIV-D) | +0.21% | +6.26% | -10.53% | -12.58% | -8.13% | -4.02% | N/A | -1.76% | 6 |

| Standard Deviation of Fund | +12.24% | +15.83% | +17.55% | +17.32% | +13.91% | +13.39% | N/A | +13.75% | |

| Krungsri Equity LTF-A (KFLTFEQ-A) | +0.57% | +4.17% | -12.36% | -14.58% | -9.60% | -2.76% | N/A | -0.98% | 0 |

| Standard Deviation of Fund | +11.86% | +16.33% | +18.13% | +18.02% | +14.13% | +13.29% | N/A | +13.41% | |

| SET TRI | +2.38% | +10.85% | -6.33% | -8.07% | -5.12% | +0.98% | +2.46% | N/A | |

| Standard Deviation of Benchmark | +13.51% | +16.47% | +18.16% | +17.80% | +13.81% | +13.38% | +14.92% | N/A | |

| SET50 TRI | +2.66% | +11.77% | -5.29% | -6.48% | -2.88% | +1.12% | +2.56% | N/A | |

| Standard Deviation of Benchmark | +13.61% | +17.40% | +19.78% | +19.38% | +14.88% | +14.37% | +16.73% | N/A | |

| SET100 TRI | +2.56% | +12.02% | -6.17% | -7.34% | -4.40% | +0.33% | +2.18% | N/A | |

| Standard Deviation of Benchmark | +13.81% | +17.64% | +19.80% | +19.38% | +14.91% | +14.30% | +16.51% | N/A | |

Remark