Fund Type

Fixed Income Fund cross Investing Fund

Dividend Policy

None

Inception Date

27 November 2019

Investment Policy

Invest both onshore and offshore in debt instruments and/or deposits or deposits equivalent issued, certified, avalized, or repayment guaranteed by the government, a state enterprise, a financial institution, and/or private entity, where such instruments are designated as investment grade in either the issue rating category or the issuer rating category. The fund may invest in non-investment grade debt securities or unrated securities. The Fund may invest in aggregate of no more than 20% of its NAV in fixed-income instruments of non-investment grade or unrated securities and may also invest in structured note. The Fund may invest no more than 100% of its NAV in units of mutual funds under management of the Management Company in accordance with the criteria and conditions prescribed by the SEC.

Fund Manager

Theerapab Chirasakyakul, Porntipa Nungnamjai

Asset Allocation

44.38%

Instruments issued by Sovereign or Supra-national organization

33.98%

Fixed Income Instruments issued by Bank of Thailand

0.71%

Deposits and Fixed Income Instruments issued by Financial Institutions

19.15%

Fixed Income Instruments Issued by Corporates

7.71%

Other Assets

-5.94%

Other Liabilities

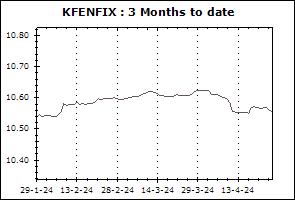

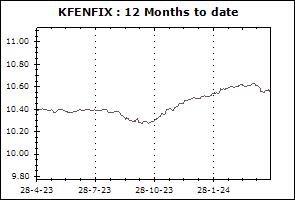

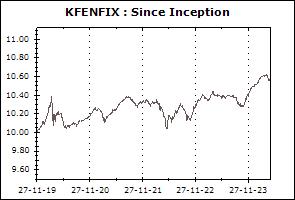

Return Chart

NAV Movement

- 3 Months

- 12 Months

- Since inception

Transaction Details

Minimum Purchase Amount (Baht): 500

Minimum Redemption Amount (Unit): 500 Baht or 50 units

Transaction Period: Every dealing date of the fund by 15.30 hrs.

Proceeds Payment Period: 2 business days after the execution (T+2)

Fund Redemption Period: Every dealing date of the fund by 15.30 hrs.

Transaction Channel: Krungsri Asset Management,Online Service,AGENT

Asset Allocation (30 Sep 2025)

| Instruments issued by Sovereign or Supra-national organization | 49.22% |

| Fixed Income Instruments issued by Bank of Thailand | 17.88% |

| Deposits and Fixed Income Instruments issued by Financial Institutions | 1.73% |

| Fixed Income Instruments Issued by Corporates | 28.95% |

| Foreign CIS - Fixed income | 2.51% |

| Other Assets | 1.28% |

| Other Liabilities | -1.57% |

Top Five Issuers/Guarantors (30 Sep 2025)

| Government | 49.22% |

| Bank of Thailand | 17.88% |

| Supalai Plc. | 3.12% |

| Thai Beverage Plc. | 2.86% |

| Bangchak Corporation Plc. | 2.59% |

Top Five Securities

| Security Code | Issue / Issuer Rating | % of NAV |

|---|---|---|

| Sustainability-Linked Bond FY. B.E. 2568 | - | 5.95% |

| TLOAN65/1/20.84Y | - | 5.93% |

| Debt Management Government Bond FY. B.E. 2567 No. 16 | - | 5.43% |

| Bank of Thailand Bond 12/FRB182/2025 | - | 4.84% |

| Government Bond FY. B.E. 2568 No. 4 | - | 4.57% |

Fixed Income Funds

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Medium Term Fixed Income Fund (KFMTFI) | +0.69% | +2.05% | +3.26% | +4.30% | +3.11% | +2.11% | +1.94% | +2.59% | 2,708 |

| Standard Deviation of Fund | +1.19% | +1.00% | +0.93% | +0.85% | +0.65% | +0.69% | +0.63% | +0.67% | |

| Krungsri Medium Term Fixed Income Dividend Fund (KFMTFI-D) | +0.75% | +2.10% | +3.27% | +4.31% | +3.12% | +2.01% | +1.90% | +2.96% | 647 |

| Standard Deviation of Fund | +1.17% | +0.99% | +0.92% | +0.85% | +0.66% | +0.67% | +0.66% | +0.93% | |

| Benchmark(1) | +0.48% | +1.07% | +1.75% | +2.27% | +1.75% | +1.02% | +2.24% | N/A | |

| Standard Deviation of Benchmark | +0.26% | +0.25% | +0.24% | +0.22% | +0.21% | +0.25% | +0.80% | N/A | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Star Plus Fund-A (KFSPLUS-A) | +0.33% | +0.72% | +1.18% | +1.69% | +1.68% | +1.17% | +1.26% | +2.97% | 56,430 |

| Benchmark(3) | +0.28% | +0.62% | +0.99% | +1.41% | +1.34% | +0.96% | +1.06% | +2.20% | |

| Standard Deviation of Fund | +0.05% | +0.06% | +0.06% | +0.06% | +0.07% | +0.07% | +0.06% | +0.84% | |

| Standard Deviation of Benchmark | +0.01% | +0.02% | +0.02% | +0.02% | +0.03% | +0.03% | +0.03% | +0.10% | |

| Krungsri Star Plus Fund-I (KFSPLUS-I) | +0.33% | +0.72% | +1.18% | +1.68% | N/A | N/A | N/A | +1.74% | 0 |

| Benchmark(3) | +0.28% | +0.62% | +0.99% | +1.41% | N/A | N/A | N/A | +1.37% | |

| Standard Deviation of Fund | +0.05% | +0.06% | +0.06% | +0.06% | N/A | N/A | N/A | +0.07% | |

| Standard Deviation of Benchmark | +0.01% | +0.02% | +0.02% | +0.02% | N/A | N/A | N/A | +0.03% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Smart Fixed Income Fund-A (KFSMART-A) | +0.46% | +0.98% | +1.57% | +2.26% | +2.10% | +1.53% | N/A | +1.53% | 102,132 |

| Benchmark(4) | +0.41% | +0.88% | +1.38% | +1.96% | +1.92% | +1.39% | N/A | +1.43% | |

| Standard Deviation of Fund | +0.12% | +0.12% | +0.11% | +0.11% | +0.13% | +0.15% | N/A | +0.14% | |

| Standard Deviation of Benchmark | +0.07% | +0.08% | +0.08% | +0.08% | +0.09% | +0.08% | N/A | +0.08% | |

| Krungsri Smart Fixed Income Fund-I (KFSMART-I) | +0.46% | +0.98% | +1.57% | +2.26% | N/A | N/A | N/A | +2.11% | 179 |

| Benchmark(4) | +0.41% | +0.88% | +1.38% | +1.96% | N/A | N/A | N/A | +1.97% | |

| Standard Deviation of Fund | +0.12% | +0.12% | +0.11% | +0.11% | N/A | N/A | N/A | +0.12% | |

| Standard Deviation of Benchmark | +0.07% | +0.08% | +0.08% | +0.08% | N/A | N/A | N/A | +0.09% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Active Fixed Income Fund-A (KFAFIX-A) | +0.72% | +2.15% | +3.46% | +4.61% | +3.50% | +2.37% | N/A | +2.38% | 67,032 |

| Benchmark(5) | +0.90% | +2.19% | +3.47% | +4.41% | +3.35% | +1.82% | N/A | +2.15% | |

| Standard Deviation of Fund | +1.10% | +0.98% | +0.91% | +0.84% | +0.68% | +0.80% | N/A | +0.86% | |

| Standard Deviation of Benchmark | +0.86% | +0.82% | +0.76% | +0.72% | +0.78% | +0.94% | N/A | +0.91% | |

| Krungsri Active Fixed Income Fund-C (KFAFIX-C) | +0.76% | +2.23% | +3.58% | +4.78% | +3.67% | N/A | N/A | +2.49% | 250 |

| Benchmark(5) | +0.90% | +2.19% | +3.47% | +4.41% | +3.35% | N/A | N/A | +1.91% | |

| Standard Deviation of Fund | +1.10% | +0.98% | +0.91% | +0.84% | +0.68% | N/A | N/A | +0.79% | |

| Standard Deviation of Benchmark | +0.86% | +0.82% | +0.76% | +0.72% | +0.78% | N/A | N/A | +0.97% | |

| Krungsri Active Fixed Income Fund-I (KFAFIX-I) | +0.72% | +2.15% | +3.45% | +4.61% | N/A | N/A | N/A | +3.36% | 160 |

| Benchmark(5) | +0.90% | +2.19% | +3.47% | +4.41% | N/A | N/A | N/A | +3.09% | |

| Standard Deviation of Fund | +1.10% | +0.98% | +0.91% | +0.84% | N/A | N/A | N/A | +0.66% | |

| Standard Deviation of Benchmark | +0.86% | +0.82% | +0.76% | +0.72% | N/A | N/A | N/A | +0.73% | |

| Fund | Historical Returns | Fund Size (mil) | |||||||

| % Cumulative Return | % Annualized Return | Since Inception | |||||||

| 3 Months | 6 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | |||

| Krungsri Enhanced Active Fixed Income Fund (KFENFIX) | +1.21% | +3.44% | +5.17% | +6.34% | +4.22% | +2.57% | N/A | +2.41% | 10,380 |

| Benchmark(6) | +1.05% | +2.63% | +4.14% | +5.20% | +3.79% | +1.83% | N/A | +1.98% | |

| Standard Deviation of Fund | +2.41% | +2.05% | +1.82% | +1.64% | +1.31% | +1.40% | N/A | +1.63% | |

| Standard Deviation of Benchmark | +0.93% | +0.89% | +0.83% | +0.79% | +0.85% | +1.03% | N/A | +1.27% | |

Remark