Plan Your Investment

Building a more sustainable tomorrow through ESG stocks investing

17 August 2021 - Krungsri Asset Management Company Limited (KSAM) held an online seminar on “Investing for a More Sustainable Tomorrow,” inviting investors to seize an opportunity to invest in global stocks with sound fundamentals and innovations that solve impacts on quality of life and the environment, social and governance (ESG). KSAM also took this opportunity to launch its Krungsri Equity Sustainable Global Growth Fund (KFESG) which has the master fund specializing in ESG stocks investing with a focus on three ESG themes for good return potential in the long term.

At the seminar, KSAM had invited Mr. David Wong, Senior Investment Strategist, AllianceBernsteinHong Kong Ltd., who has been the fund manager for AB Sustainable Global Thematic Portfolio, KFESG’s master fund, and Mr. Kiattisak Preecha-anusorn, Vice President for Alternative Investment at KSAM to explain the ESG practices and sustainability, while opportunity for ESG investing, potential and factors for growth, stock selection strategy, current investment portfolio, past record of returns and expectations were also addressed.

Mr. Kiattisak said that KFESG was the fund that meets the needs to solve the difficulties people around the world have confronted. These difficulties extended from the pandemic, healthcare challenges, social and environmental problems, poverty, disparity to others, and a lot more. Meanwhile, amid the crises, this was the opportunity for business with innovative solutions in easing these problems as well as for the investment opportunity.

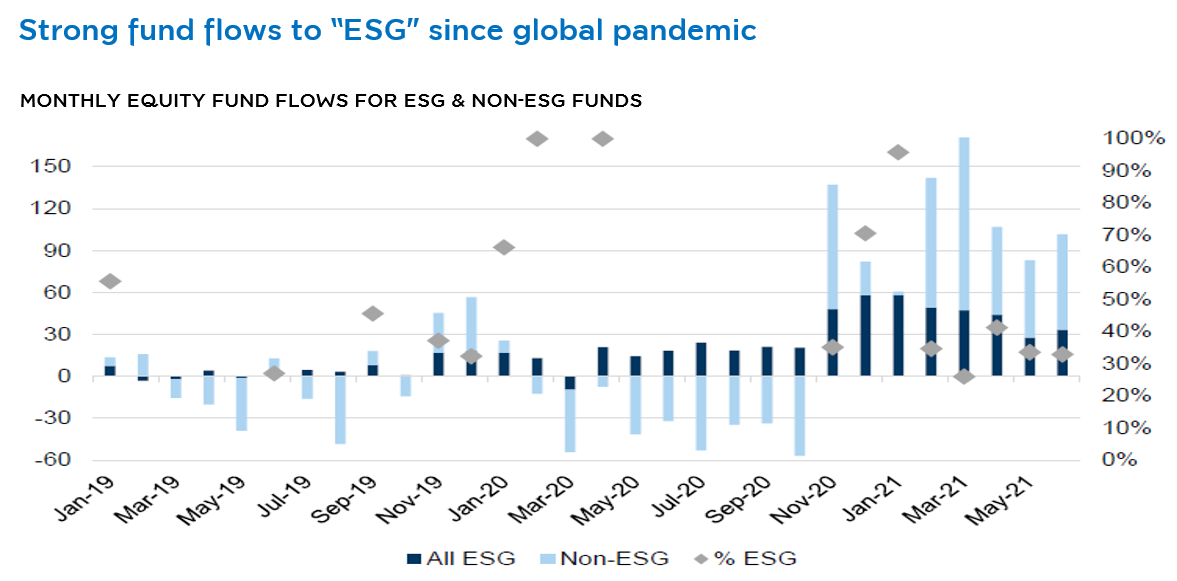

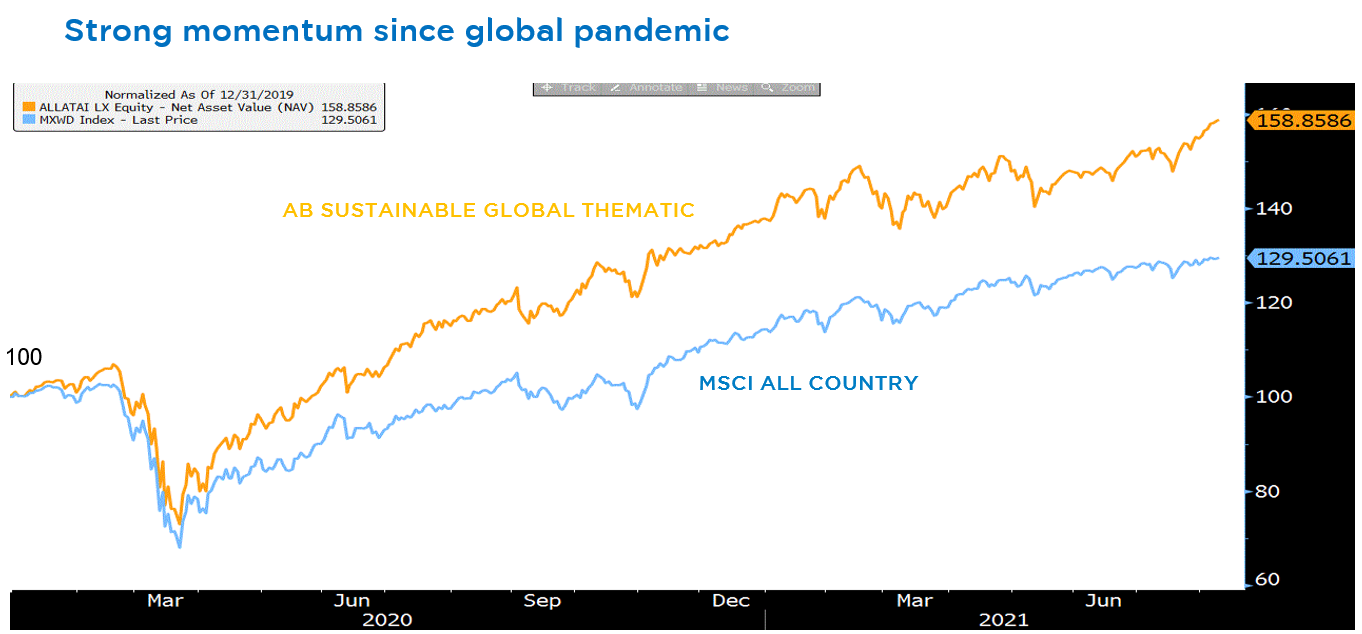

From the Coronavirus pandemic in the second quarter of 2020 onward, ESG businesses with innovation gained interest from investors consistently, prompting their higher growth. Since the pandemic spread, the master fund has yielded a return up to 58% supported by the Covid-19 pandemic which has prompted investors to put more emphasis on ESG. In 2021, the master fund was capable to yield a return of more than 15%, higher than that of 13% by global equity funds. And, since the capital continued to pour into ESG stocks continuously, this was the right time for the ESG investing to diversify investment amid market volatility. Source: Bloomberg 11 Aug. 2021

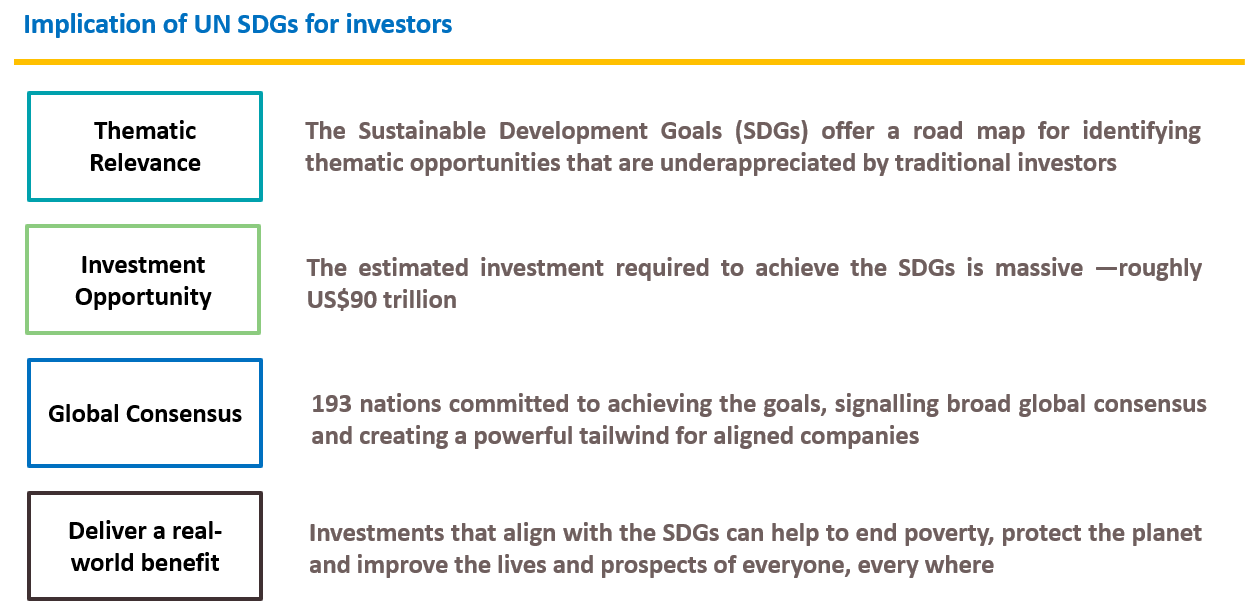

Aside from the Covid-19 crisis as the factor to accelerate growth of ESG stocks, another key factor for their long-term growth was the United Nations (UN) invitation to193 member countries for an agreement on the Sustainable Development Goals (SDGs), while asking them to help eliminate problems. About 17 goals were set to solve the environmental and social problems and used as the operational framework for the public and private sectors across the world. A colossal amount of about 90 trillion US dollar was expected to finance investment to achieve the sustainable development goals within 2030. Therefore, ESG-focused business sectors were expected to gain from that amount of investment.

Source: https://sdgs.un.org/goals and AB as of June 2021

Source: https://sdgs.un.org/goals and AB as of June 2021Mr. Kiattisak added that the sustainable development goals provided the opportunity to invest in three themes of related businesses including climate, health, and empowerment. All these three themes brought about focused innovations that are climate, the clean energy, raw material sourcing, recycle and sustainable transportation. In the health theme, it was the opportunity for businesses focusing on an access into healthcare and medical services, medical treatment, safety of food and water, and innovations for development of quality of life. Lastly, the empowerment theme gave the chance for education-related businesses, recruitment services, financial stability, ICT and sustainable infrastructure, etc.

Mr. David Wong said that AB Sustainable Global Thematic Portfolio Fund was the global fund with specialization in businesses that brought positive impacts to the environment and society. Its target was to generate a return at a higher rate than that of the global equity index. The fund applied the ESG as the guideline and a part of its investment process.

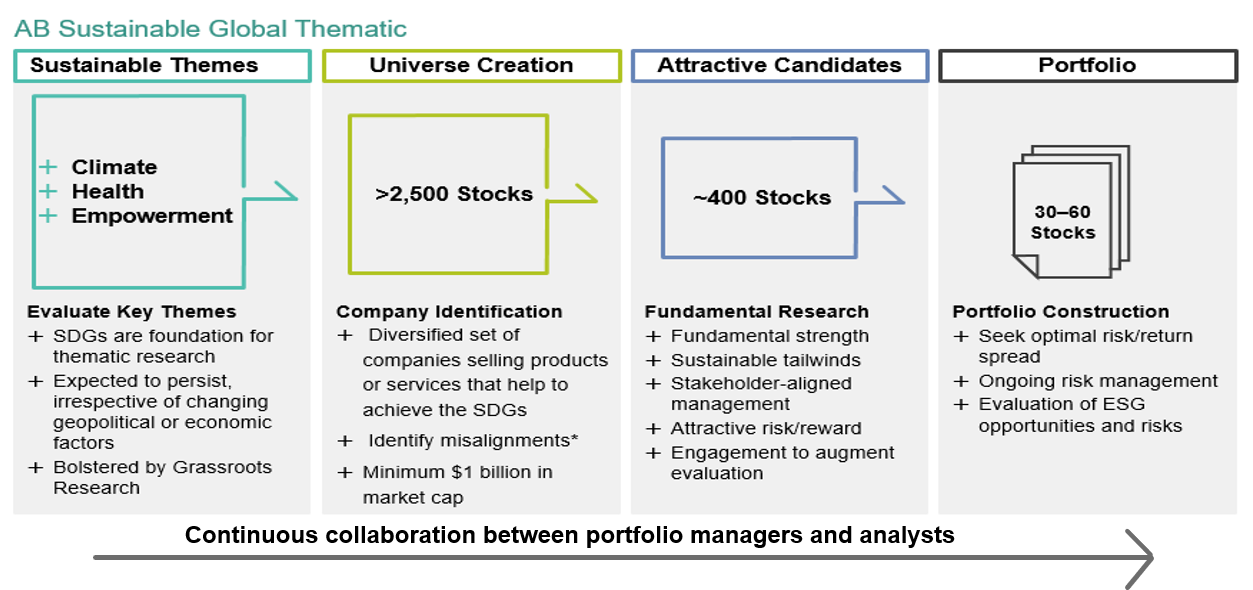

In a broad aspect. The fund reviewed how businesses were involved with the sustainable development and goals and, later, classified more than 140 business categories of products and services from more than 2,500 companies worldwide.

After that, the fund set its criteria to review and analyze each stock at all sides and all details, starting from fundamentals, overall picture of businesses, ESG business operations, good corporate governance, management’s attention on all stakeholders, environmental management, competitors to competitiveness. Besides, financial statements were also reviewed. These ESG-focused companies were required to stage robust operational performance, strong financial health and consistent profit growth with competitive advantages for stable growth. Importantly, price valuations must be reasonable and proper with low risks compared to returns. Given intensive selection procedures, the fund had about 400 potential firms and selected 30-60 medium-sized ones with the best quality and high growth potential into its investment portfolio. These selected firms were in three themes of ESG and sustainability.

Source: AB as of Jun 21 | *Companies selling products or services that don’t contribute to the achievement of the SDGs are excluded. This includes alcohol, coal, gambling, pornography, prisons, tobacco, weapons

Source: AB as of Jun 21 | *Companies selling products or services that don’t contribute to the achievement of the SDGs are excluded. This includes alcohol, coal, gambling, pornography, prisons, tobacco, weaponsTop picks in the master fund’s portfolio were Labcorp allowing people to gain better access into medical services. Labcorp’s growth was 23% per year and recorded the highest market share in the United States, while SVB Financial Corp provided financial services and consulting services for startups in Silicon Valley with an average growth of about 28% per year. Also, Waste Management operated waste treatment with advanced technology for recycling and environmental sustainability. Its annual growth was 8% and was expected to be higher.

AB Sustainable Global Thematic Portfolio diversified its investment properly, not overweighing any stock unreasonably. The fund weighed in technology-focused businesses the most. By region, the fund invests 93.7% of its investment portfolio in developed countries with the highest of 61.9% in the US. About 6.3% was in emerging-market countries who generated about 17% of its revenue. (Source: Company report and AB as of Jun 21)

Mr. David Wong said that the fund will seek the securities that have a potential to generate IRR of about 12 - 15%, believing the ESG investing to bring a sustainable growth for businesses and consistent long-term return for investors.

Mr. Kiattisak added that KFESG was different from previously-launched KFCLIMA which emphasized climate-focused businesses. For KFESG, it concentrates on innovations that can benefit more diverse aspects. In the long term, the ESG is the mega trend for business to grow. And in the short to medium term, it was a good opportunity to invest due to continuous flow of capital into this kind of fund. But this fund was not considered as overheating and that prompted the fund to outperform the stock markets.

KFESG’s IPO is scheduled during 16 - 24 August 2021 with required minimum purchase amount at 500 Baht only. Interested investors can purchase fund units at any branch of Bank of Ayudhya or selling agents, and Krungsri Asset Management (via @ccess Online and @ccess Mobile). Investors can also enjoy a special promotion during fund’s IPO where every 100,000 Baht investment amount in KFESG-A will give KFESG-A units valued 100 Baht. (Terms and conditions as specified by KSAM)

For Fund Info/Promotion, click hereInvestment policy & disclaimers

- KFESG is divided into two share classes: Krungsri Equity Sustainable Global Growth Fund – Accumulation Class (KFESG-A) and Krungsri Equity Sustainable Global Growth Fund – Institutional Investor Class (KFESG-I)

- Both share-class funds invest in the foreign investment fund titled AB Sustainable Global Thematic Portfolio, Class S1 USD (The master fund), on average in an accounting year, of not less than 80% of fund’s NAV. The master fund has the policy to invest in global equity securities of companies that have a focus on the ESG (environmental, social, and corporate governance) principles which are the most attractive securities fitting into sustainable investment themes.

- The fund has risk level at 6 – High risk | Fully hedge against foreign exchange rate risk (Hedge against the exchange rate risk at a particular time for the value of at least 90% of the foreign investment value) in which case, it may incur costs for risk hedging transaction and the increased costs may reduce overall return.

- Please study fund features, performance, and risk before investing. Past performance is not an indicative of future performance.

For more information on fund, please contact

Krungsri Asset Management Co., Ltd. Tel. 02-657-5757 or any branch of Bank of Ayudhya