News/Announcement

Promotions/Fund Highlight

KFUSINDFX/ KFUSINDFXRMF … Opportunities to grow with S&P 500.

IPO 3 – 10 September 2024.

- Krungsri US Equity Index FX Fund (KFUSINDFX)

- Krungsri US Equity Index FX RMF (KFUSINDFXRMF)

Funds’ IPO: 3 – 10 September 2024. | Minimum purchase: 500 Baht.

In this regard, you can use Krungsri's participating credit cards to purchase KFUSINDFXRMF that will also allow you to enjoy tax deduction privilege and special promotion by receiving KFCASH-A units valued at 100 Baht for every 50,000 Baht investment in participating Krungsri funds in SSF/ RMF/ Thai ESG categories. (When investing according to terms and conditions only, while the purchased units through a credit card is not eligible for participating in the promotional campaign of the credit card./ Please study more details at below button*)

Factors impacting the US stock market.

1. Market plunged sharply, providing an opportunity for investment.

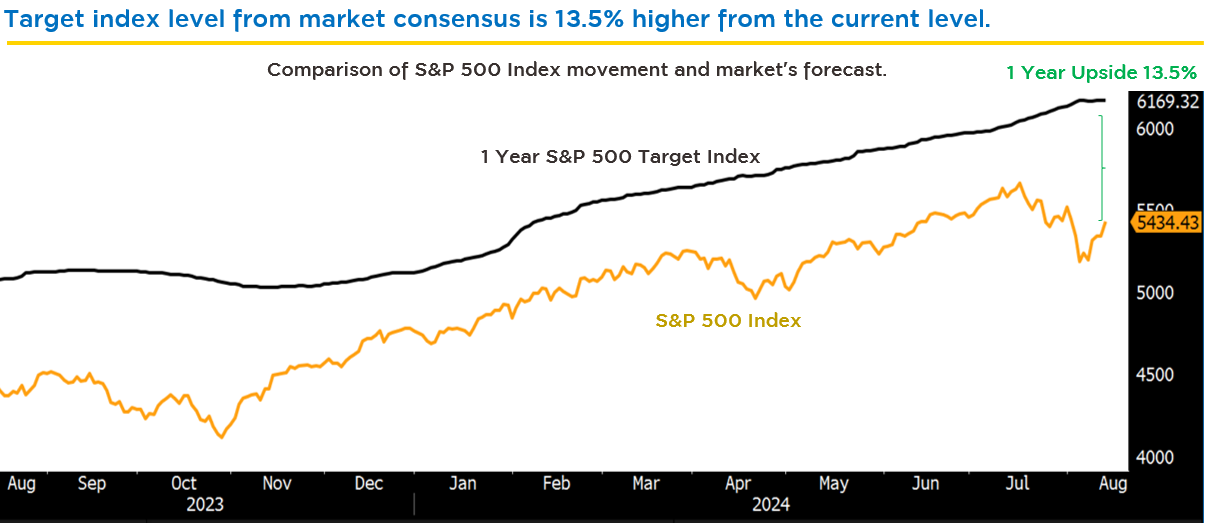

- In early August, the S&P 500 Index fell 8% from its highest level on sector rotation, US recession fears and JPY carry trade unwind. | Source: Bloomberg as of 14 Aug 2024.

- The S&P 500 Index has usually delivered good returns in the past after dropping more than 5%. This is deemed as a good turning point for recovery. (Source: Goldman Sachs Global Investment Research as of 5 Aug 2024.)

- Easing inflation supports market predictions that the Fed will begin cutting interest rate in September with a total of 1% cuts expected for this year. (Source: Bloomberg as of Jul 2024 and as of 14 Aug 2024.)

- Returns of the S&P 500 Index are driven mainly by the Magnificent 7 stocks while earnings growth in other sectors have not risen much. (Sources: Citi Research, Bloomberg, as of 14 Jun 2024.)

- AI stocks have not in a bubble yet and there are still many opportunities in the stocks that benefit from AI. (Source: FactSet, Goldman Sachs Global Investment Research as of 10 Jul 2024.)

Source: Bloomberg as of 14 Aug. 2024 | The above information demonstrates the market consensus on S&P500 index movement that does not guarantee the actual returns and the return the fund can generate.

Why must invest in KFUSINDFX / KFUSINDFXRMF ?

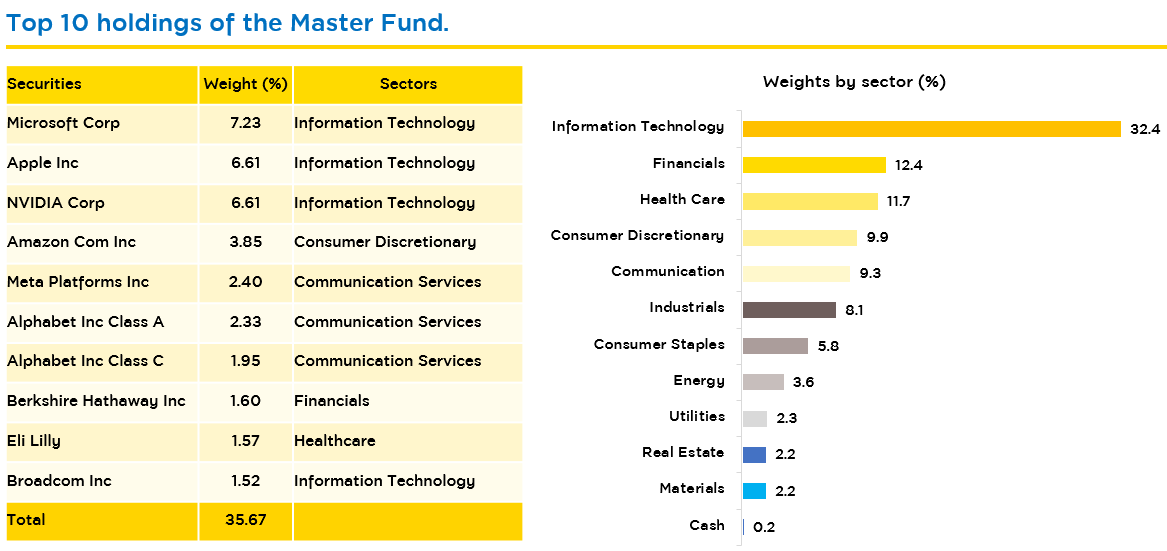

The funds invest in the master fund, “iShares Core S&P 500 ETF” that can access the top 500 US companies in one fund and has competitive interest fee with an aim to create an opportunity to replicate the return of S&P 500 Index, which is one of the world’s major indexes.

Source: Fact sheet, iShares by Blackrock as of 30 Jun. 2024.

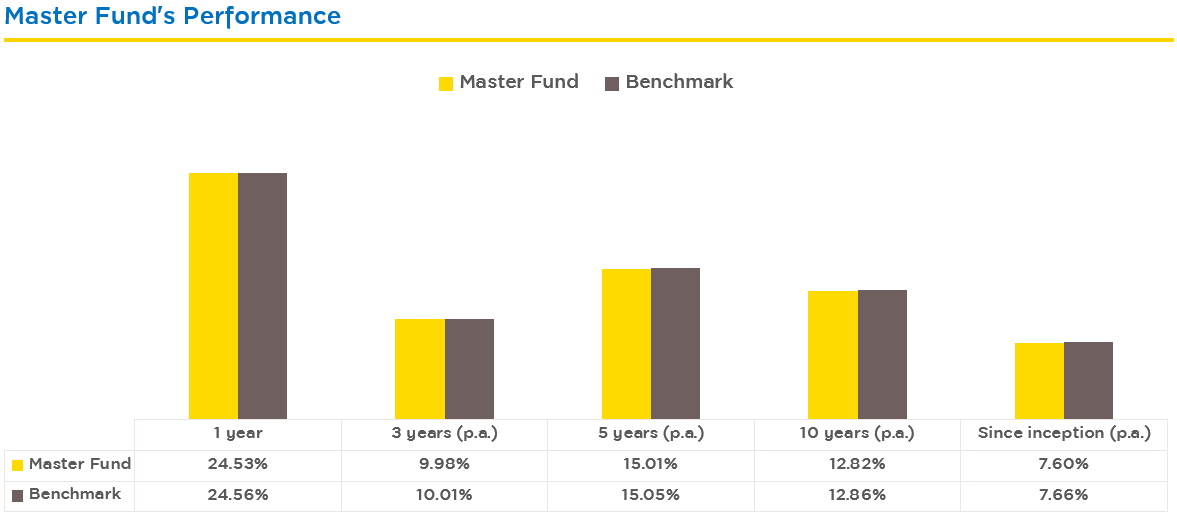

Source: Fact sheet, iShares by Blackrock as of 30 Jun. 2024 | Fund inception is 15 May 2000. | Performance of the master fund referred to the NAV price. The above information is the performance of the master fund, which does not comply with the AIMC measurement standards.

Source: Fact sheet, iShares by Blackrock as of 30 Jun. 2024 | Fund inception is 15 May 2000. | Performance of the master fund referred to the NAV price. The above information is the performance of the master fund, which does not comply with the AIMC measurement standards.3 Options for opportunity to grow with leading US stock index.

3 Options for opportunity to grow with leading US stock index.

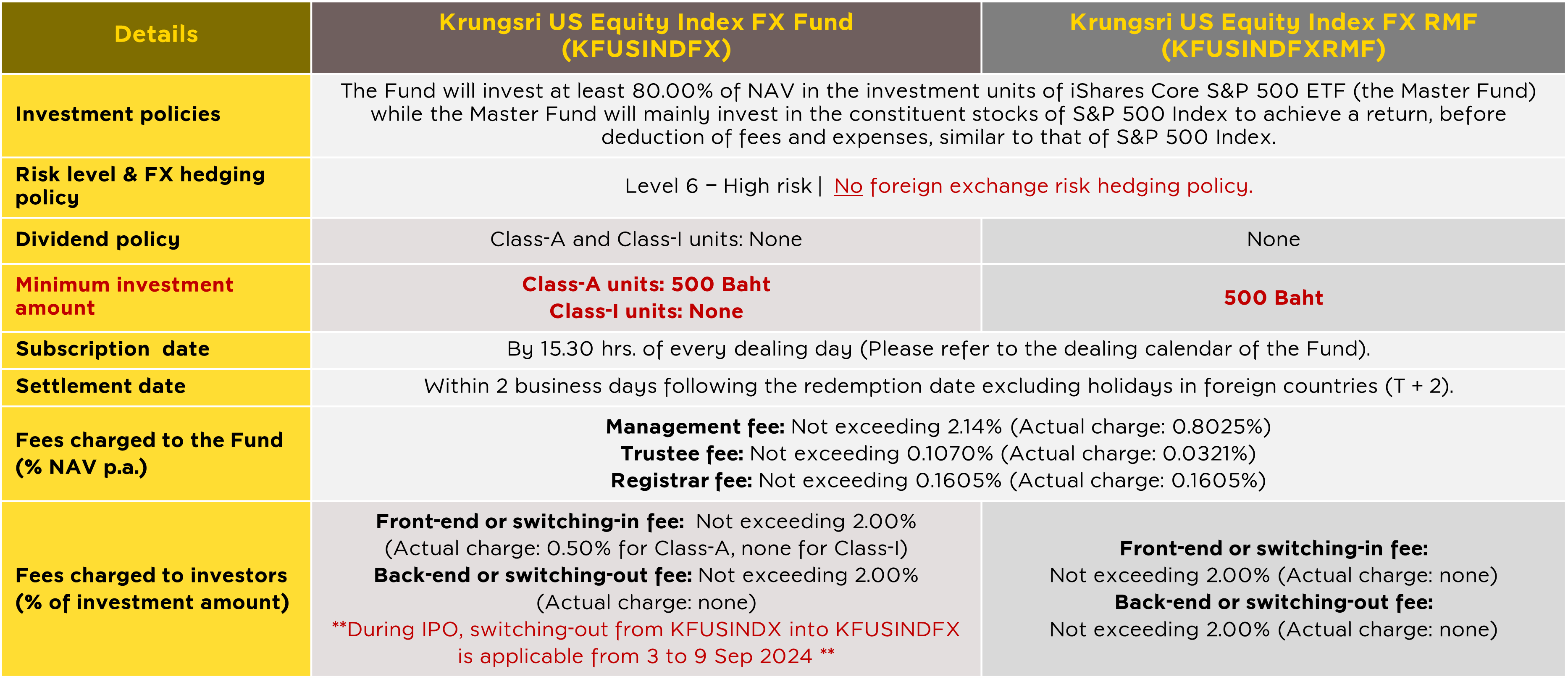

Funds’ information: KFUSINDFX / KFUSINDFXRMF

KFUSINDFX has two types of share class: Accumulation (-A) and Institutional Investor (-I).

- RMF is the fund promoting long-term investment for retirement. | Investors will not be eligible for tax benefits in the absence of compliance with investment conditions.

- Should understand fund features, conditions of returns, and risk, and study tax benefits from the investment manual before making an investment decision. Past performance is no guarantee of future results.

- This document is prepared based on the information obtained from reliable sources at the time of the presentation. However, the Management Company does not provide any warranty of the accuracy, reliability and completeness of all information. The Management Company reserves the right to make changes to all information without any prior notice.

- These Funds are not hedged against foreign exchange risk. Thus, they are subject to high foreign exchange risk which may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount.

Krungsri Asset Management Company Limited. Tel 02-657-5757

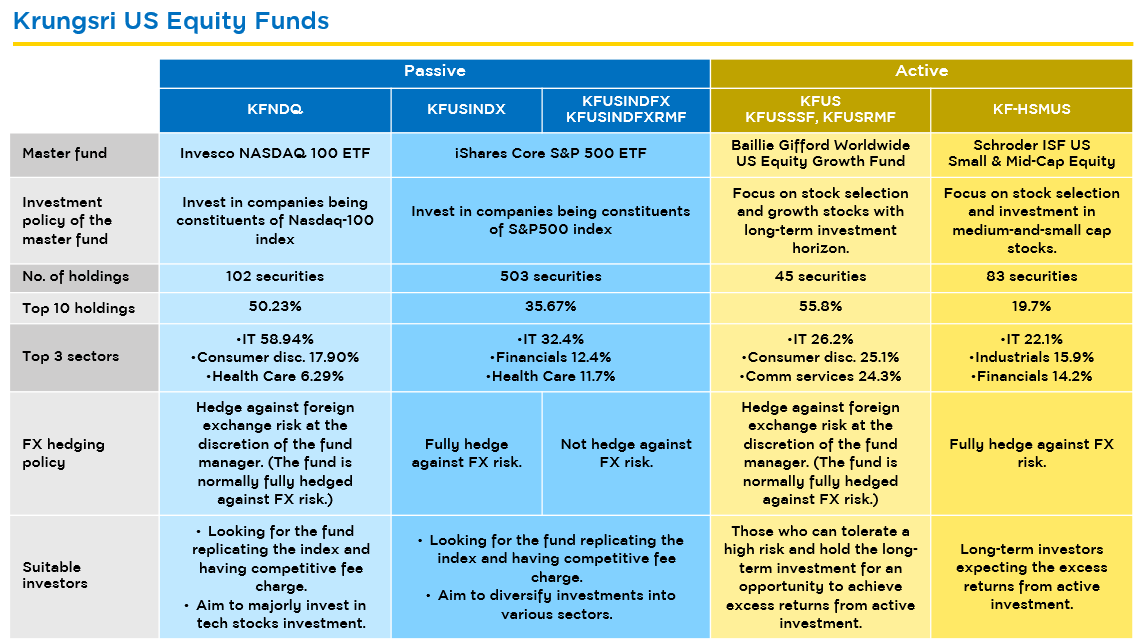

Comparison of Krungsri US equity funds

Source: Master fund’s fact sheet and Krungsri Asset Management as 30 Jun. 2024. | The funds that do not hedge against foreign exchange risk or are hedged upon fund managers’ discretion are subject to foreign exchange risk which may cause investors to lose money or gain from foreign exchange fluctuation/ or receive a lower return than the initial investment amount. | SSF is the fund to promote savings. | RMF is the fund promoting long-term investment for retirement. Investors will not be eligible for tax benefits in an absence of compliance with investment conditions.

For funds details, click: KFNDQ-A | KF-HSMUS | KFUS-A | KFUSINDX-A | KFUSSSF | KFUSRMF